Federal Awards Compliance Audit Guidance

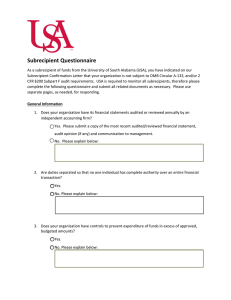

advertisement