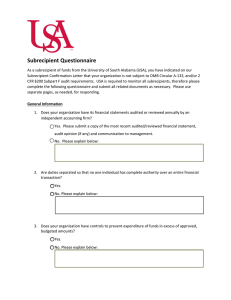

Federal Awards Compliance Audit Guidance

advertisement