2015 LOCAL GOVERNMENT AGENCY FEDERAL AWARD COMPLIANCE CONTROL RECORD

LOCAL GOVERNMENT AGENCY

FEDERAL AWARD COMPLIANCE CONTROL RECORD 1

NAME OF CLIENT:

YEAR ENDED: 2015

FEDERAL AWARD NAME: Twenty-First Century Community Learning Centers

CFDA#: # 84.287

NOTE:

AOS wrote this FACCR for programs that pass through the Ohio Department of Education, and the

USDE crosscutting requirements apply to, but does not include ARRA requirements, and the new

Uniform Guidance does not apply. o You must document in your w/p’s how the determination was made that this major program fell under the old OMB Circulars (A-87 & A-102), as opposed to the new Uniform Grants

Guidance.

Updated in September 2015 for edits to MOE tests in Section G.

Update yellow highlighted items based on specific program/grant.

Grey highlighted information was obtained from the pass through agency, the Ohio Department of Education.

Orange highlighted text is additional information from AOS Center for Audit Excellence (CFAE)

Prepared by AA

Reviewed by AM

Reviewed by SAM

Date

Date

Date

(NOTE: The above sign-off boxes are n/a to AOS audits completed in Teammate. AOS auditors should perform their sign-offs in the Teammate system.)

Updated September 2015

1 The auditor should always:

Ask the client if there have been any changes in program requirements.

Review the contracts/grant agreements for such changes or other modifications.

If changes are noted, document them in the W/P’s and consult with Center for Audit Excellence for an appropriate

FACCR modification.

Planning Federal Materiality by Compliance Requirement

(6) CFAE included the typical monetary vs. nonmonetary determinations for each compliance requirement in this program. However, auditors should tailor these assessments as appropriate based on the facts

(1) and circumstances of their entity’s operations. See further guidance below.

(2) (6) (6) (3) (4) (5) (5) (6)

Applicable per

Compl.

Suppl.

Direct & material to program / entity

Monetary or nonmonetary

If monetary, population subject to require.

Inherent risk

(IR) assess.

Final control risk (CR) assess.

Detection risk of noncompl.

Overall audit risk of noncompl.

Federal materiality by compl. requirement

Compliance Requirement

A Activities Allowed or Unallowed

B Allowable Costs/Cost Principles

C Cash Management

D Reserved

E Eligibility

F Equipment & Real Property Mgmt

G Matching, Level of Effort,

Earmark

(Yes or No)

Yes

Yes

Yes

No

No

Yes

(Yes or No) (M/N)

M

M

N

Mat. & Ear. =

M

MOE = N

M

(Dollars) (High/Low) (High/Low) (High/Low) (High/Low) typically 5% of population subject to requirement

5%

5%

5%

5%

H Period of Availability

(Performance)

I Procurement & Sus. & Debarment

J Program Income

K Reserved

L Reporting

M Subrecipient Monitoring

N Special Tests & Provisions

Participation of Private School

Children

N Special Tests & Provisions

Schoolwide Programs

Yes

No

Yes

Yes

Yes

Yes

Yes

M

N

N

N

N

5%

5%

(1) Taken from Part 2, Matrix of Compliance Requirements, of the OMB Compliance Supplement ( http://www.whitehouse.gov/omb/financial_fin_single_audit/ ). When Part 2 of the Compliance Supplement indicates that a type of compliance requirement is not applicable, the remaining assessments for the compliance requirement are not applicable.

5%

5%

5%

5%

(2) If the Supplement notes a compliance requirement as being applicable to the program in column (1), it still may not apply at a particular entity either because that entity does not have activity subject to that type of compliance requirement, or the activity could not have a material effect on a major program. If the Compliance Supplement indicates that a type of compliance requirement is applicable and the auditor determines it also is direct and material to the program at the specific entity being audited, the auditor should answer this question “Yes,” and then complete the remainder of the line to document the various risk assessments, sample sizes, and references to testing. Alternatively, if the auditor determines that a particular type of compliance requirement that normally would be applicable to a program (as per part 2 of the Compliance Supplement) is not direct and material to the program at the specific entity being audited, the auditor should answer this question “No.” Along with that response, the auditor should document the basis for the determination (for example, "Davis-Bacon Act does not apply because there were no applicable contracts for construction in the current period" or "per the Compliance Supplement, eligibility requirements only apply at the state level").

(3) Refer to the AICPA Audit Guide Government Auditing Standards and Circular A-133 Audits, chapter 10, Compliance Auditing Applicable to Major Programs, for considerations relating to assessing inherent risk of noncompliance for each direct and material type of compliance requirement. The auditor is expected to document the inherent risk assessment for each direct and material compliance requirement.

(4) Refer to the AICPA Audit Guide Government Auditing Standards and Circular A-133 Audits, chapter 9, "Internal Control Over Compliance for Major Programs," for considerations relating to assessing control risk of noncompliance for each direct and material types of compliance requirement. To determine the control risk assessment, the auditor is to document the five internal control components of the Committee of

Sponsoring Organizations of the Treadway Commission (COSO) (that is, control environment, risk assessment, control activities, information and communication, and monitoring) for each direct and material type of compliance requirement. Keep in mind that the auditor is expected to perform procedures to obtain an understanding of internal control over compliance for federal programs that is sufficient to plan the audit to support a low assessed level of control risk. If internal control over compliance for a type of compliance requirement is likely to be ineffective in preventing or detecting noncompliance, then the auditor is not required to plan and perform tests of internal control over compliance. Rather, the auditor must assess control risk at maximum, determine whether additional compliance tests are required, and report a significant deficiency (or material weakness) as part of the audit findings. The control risk assessment is based upon the auditor's understanding of controls, which would be documented outside of this template.

Auditors may use the practice aid, Controls Overview Document, to support their control assessment. The Controls Overview Document assists the auditor in documenting the elements of COSO, identifying key controls, testing of those controls, and concluding on control risk. The practice aid is available in either a checklist or narrative format.

(5) Audit risk of noncompliance is defined in Statement on Auditing Standards No. 117, Compliance Audits (AICPA, Professional Standards, vol. 1, AU sec. 801 / AU-C 935), as the risk that the auditor expresses an inappropriate opinion on the entity's compliance when material noncompliance exists. Audit risk of noncompliance is a function of the risks of material noncompliance and detection risk of noncompliance.

(6) CFAE included the typical monetary vs. nonmonetary determinations for each compliance requirement in this program. However, auditors should tailor these assessments as appropriate based on the facts and circumstances of their entity’s operations. AICPA A-133 Guide 10.49 states t he auditor's tests of compliance with compliance requirements may disclose instances of noncompliance. Circular A-133 refers to these instances of noncompliance, among other matters, as “findings.” Such findings may be of a monetary nature and involve questioned costs or may be nonmonetary and not result in questioned costs. AU

801 / AU-C 935.13 & .A7 require auditors to establish and document two materiality levels: (1) a materiality level for the program as a whole. The column above documents quantitative materiality at the

PROGRAM LEVEL for each major program; and (2) a second materiality level for the each of the applicable 12 compliance requirement listed in A-133 § .320(b)(2)(xii).

Note:

a. If the compliance requirement is of a monetary nature, and b. The requirement applies to the

total

population of program expenditure,

Then the compliance materiality amount for the program also equals materiality for the requirement. For example, the population for allowable costs and cost principles will usually equal the total Federal expenditures for the major program as a whole. Conversely, the population for some monetary compliance requirements may be less than the total Federal expenditures. Auditors must carefully determine the population subject to the compliance requirement to properly assess Federal materiality. Auditors should also consider the qualitative aspects of materiality. For example, in some cases, noncompliance and internal control deficiencies that might otherwise be immaterial could be significant to the major program because they involve fraud, abuse, or illegal acts. Auditors should document PROGRAM LEVEL materiality in the Record of Single Audit Risk (RSAR).

(Source: AOS CFAE)

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 3/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

The A-102 Common Rule

A-102 Common Rule applies to State & Local Governments; A-110 (2 CFR Part 215) applies to Universities & Non-Profit

Organizations.

Use the following convention to refer to the federal agency codification of the A-102 Common Rule: (A-102 Common

Rule: §___.36). Auditors should replace the “§___” with the applicable numeric reference.

Appendix II of the OMB Compliance Supplement identifies each agency’s codification of the A-102

Common Rule. If a citation is warranted, auditors should look up where the federal awarding agency codified the A-102 Common Rule. For example, a Cash Management citation for a U.S. Department of

Education grant would cite 34 CFR 80.21 (34 CFR 80 coming from Appendix II of the OMB Compliance

Supplement, and .21 coming from Section C below, Source of Governing Requirements for A-102 Common

Rule entities. There are other “sources of governing requirements” noted in each section as well, this is just an explanation for the A-102 Common Rule references.

Appendix I of the OMB Compliance Supplement includes a list of programs excluded from the requirements of the A-102

Common Rule.

(Source: AOS CFAE)

Conclusion

The opinion on this major program should be:

Unqualified:

Qualified (describe):

Adverse (describe):

Disclaimer (describe):

Cross-reference to significant compliance requirements obtained from reviewing the grant agreement; terms and conditions; etc. , if any, added to and documented within the FACCR by auditor (Note: Audit staff should document these items within the appropriate FACCR section for the 12 compliance requirements. Likewise, auditors should indicate below if there were no additional significant compliance requirements to be added to the FACCR.):

Cross-reference to internal control matters (significant deficiencies or material weaknesses), if any, documented in the FACCR:

Cross-reference to questioned costs and matter of noncompliance, if any, documented in this FACCR:

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 4/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

Cross-reference to any Management Letter items and explain why not included in the A-133 Report:

Per paragraph 13.38 of the AICPA Audit Guide,

Government Auditing Standards and Circular A-133 Audits

following are required to be reported as audit findings in the federal awards section of the schedule of findings and questioned costs :

Significant deficiencies or material weaknesses in internal control over major programs

, the

Material noncompliance with the laws, regulations, and provisions of contracts and grant agreements related to major programs

Known questioned costs that are greater than $10,000 for a type of compliance requirement for a major program. The auditor also should report (in the schedule of findings and questioned costs) known questioned costs when likely questioned costs are greater than $10,000 for a type of compliance requirement for a major program.

Known questioned costs that are greater than $10,000 for programs that are not audited as major.

The circumstances concerning why the auditor's report on compliance for major programs is other than an unmodified opinion, unless such circumstances are otherwise reported as audit findings in the schedule of findings and questioned costs for federal awards (for example, a scope limitation that is not otherwise reported as a finding).

Known fraud affecting a federal award, unless such fraud is otherwise reported as an audit finding in the schedule of findings and questioned costs for federal awards.

Instances in which the results of audit follow-up procedures disclosed that the summary schedule of prior audit findings prepared by the auditee in accordance with Section 315(b) of Circular A-133 materially misrepresents the status of any prior audit finding.

Per paragraph 13.44 of the AICPA Audit Guide,

Government Auditing Standards and Circular A-133 Audits

, the schedule of findings and questioned costs should include all audit findings required to be reported under Circular A-133. A separate written communication (such as a communication sometimes referred to as a management letter) may not be used to communicate such matters to the auditee in lieu of reporting them as audit findings in accordance with Circular

A-133. See the discussion beginning at paragraph 13.33 for information on Circular A-133 requirements for the schedule of findings and questioned costs. If there are other matters that do not meet the Circular A-133 requirements for reporting but, in the auditor's judgment, warrant the attention those charged with governance, they should be communicated in writing or orally.

If such a communication is provided in writing to the auditee, there is no requirement for that communication to be referenced in the Circular A-133 report. Per table 13-2 a matter must meet the following in order to be communicated in the management letter:

Other deficiencies in internal control over compliance that are not significant deficiencies or material weaknesses required to be reported but, in the auditor's judgment, are of sufficient importance to be communicated to management.

That does not meet the criteria for reporting under Circular A-133 but, in the auditor's judgment, is of sufficient importance to communicate to management or those charged with governance

That is less than material to a major program and not otherwise required to be reported but that, in the auditor's judgment, is of sufficient importance to communicate to the auditee

Other findings or issues arising from the compliance audit that are not otherwise required to be reported but are, in the auditor's professional judgment, significant and relevant to those charged with governance.

Management Letter items and reasons why not reported in the A-133 report:

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 5/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

Performing Tests to Evaluate the Effectiveness of Controls throughout this FACCR

Auditors should consider the following when evaluating, documenting, and testing the effectiveness of controls throughout this FACCR:

As noted in paragraph 9.03 of the A-133 Guide, Circular A-133 states that the auditors should perform tests of internal controls over compliance as planned. (Paragraphs 9.27—.29 of the

AICPA Government Auditing Standards and Circular A-

133 Guide

discuss an exception related to ineffective internal control over compliance.) In addition, paragraph .08 of AU-

C section 330 states that the auditor should perform tests of controls when the auditor's risk assessment includes an expectation of the operating effectiveness of control. Testing of the operating effectiveness of controls ordinarily includes procedures such as (a) inquiries of appropriate entity personnel, including grant and contract managers; (b) the inspection of documents, reports, or electronic files indicating performance of the control; (c) the observation of the application of the specific controls; and (d) reperformance of the application of the control by the auditor. The auditor should perform such procedures regardless of whether he or she would otherwise choose to obtain evidence to support an assessment of control risk below the maximum level.

Paragraph .A24 of AU-C section 330 provides guidance related to the testing of controls. When responding to the risk assessment, the auditor may design a test of controls to be performed concurrently with a test of details on the same transactions. Although the purpose of a test of controls is different from the purpose of a test of details, both may be accomplished concurrently by performing a test of controls and a test of details on the same transaction (a dual-purpose test). For example, the auditor may examine an invoice to determine whether it has been approved and whether it provides substantive evidence of a transaction. A dual purpose test is designed and evaluated by considering each purpose of the test separately.

9 Also, when performing the tests, the auditor should consider how the outcome of the test of controls may affect the auditor's determination about the extent of substantive procedures to be performed. See chapter 11 of this guide for a discussion of the use of dual purpose samples in a compliance audit.

(Source: Paragraphs 9.31 and 9.33 of the

AICPA Government Auditing Standards and Circular A-133 Guide

)

I. Program Objectives

The objective of this program is to establish or expand community learning centers that provide students with academic enrichment opportunities along with activities designed to complement the students’ regular academic program.

Community learning centers must also offer families of these students literacy and related educational development.

Centers, which can be located in elementary or secondary schools or other similarly accessible facilities, provide a range of high-quality services to support student learning and development, including tutoring and mentoring, homework help, academic enrichment (such as hands-on science or technology programs), and community service opportunities, as well as music, arts, sports and cultural activities. At the same time, centers help working parents by providing a safe environment for students during non-school hours or periods when school is not in session.

(Source: 2015 OMB Compliance Supplement, Part 4)

II. Program Procedures

With enactment of the No Child Left Behind Act of 2001 (NCLB), the requirements for this program were modified from those previously established under the Improving America’s Schools Act (IASA). The NCLB converted the 21st Century

Community Learning Centers (CCLC) authority to a State formula grant program. In past years, the U. S. Department of

Education (ED) made competitive awards directly to local educational agencies (LEAs). Under the reauthorized authority, funds flow to States based on their share of Title I, Part A funds. States, in turn, use their allocations to make competitive awards to eligible entities. The Secretary of Education awards 21st CCLC grants through a formula grant process to States; the States then award, through a competitive process, subgrants to LEAs, community-based organizations (CBOs), other public or private entities, or consortia of two or more of such agencies, organizations, or entities.

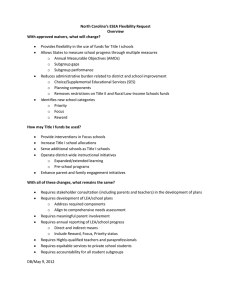

ESEA Flexibility

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 6/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

Under ESEA flexibility, a State educational agency (SEA) may request flexibility to permit an eligible entity to use funds under the 21st CCLC program to provide activities that support high-quality expanded learning time during an expanded school day, week, or year in addition to activities during non-school hours or periods when school is not in session ( before and after school or during summer recess). Under certain conditions, as established by individual States, and existing 21 st CCLC subgrantee may implement the flexibility afforded by the 21 st

i.e.

,

CCLC waiver under SEA flexibility when the scope and objectives of the project remain the same. With the exception of carrying out 21st CCLC activities during an expanded school day, week, or year, an eligible entity in a State that receives a waiver must comply with all other 21st

CCLC requirements. In other words, other provisions of the 21st CCLC program remain unchanged, including the allocation of funds to SEAs by formula, the requirement that SEAs use 95 percent of their State formula grants to make competitive subgrants, and the entities eligible to compete for those subgrants (which consist of LEAs, community-based organizations, other public or private entities, and consortia of those entities) (see page 2, paragraph 11, of

ESEA

Flexibility

(June 7, 2012)). See further information below under cross-cutting requirements. o Only new FY 13 21st CCLC applications are eligible to apply for the 21st CCLC flexibility to use 21st CCLC program funds to support expanded learning time during the school day in addition to activities during non-school hours or periods when school is not in session (i.e., before and after school or during summer recess). (Source: ESEA

Flexibility Waiver Impact on FY13 21st CCLC Applicants, February 15, 2012 https://ccip.ode.state.oh.us/documentlibrary/ViewDocument.aspx?DocumentKey=78081 )

(Source: 2015 OMB Compliance Supplement, Part 4)

US Department of Education Cross-Cutting Requirements:

The ESEA was amended January 8, 2002 by the No Child Left Behind Act of 2001 (NCLB) (Pub. L. No. 107-110).

Plans for ESEA Programs

An SEA must either develop and submit separate, program-specific individual State plans to ED for approval as provided in individual program requirements outlined in the ESEA or submit, in accordance with Section 9302 of the ESEA, a consolidated plan to ED for approval. Consolidated plans will provide a general description of the activities to be carried out with ESEA funds. Subgrants to LEAs and other eligible entities and amounts to be used for State activities are often set by law for ESEA programs. However, SEAs have discretion in using funds available for State activities.

LEAs also have the choice in many cases of submitting individual program plans or a consolidated plan to the SEA to receive program funds. SEAs with approved consolidated State plans may require LEAs to submit consolidated plans.

Unique Features of ESEA Programs That May Affect the Conduct of the Audit

Consolidation of administrative funds

(In addition to the compliance requirement described in Part A of this FACCR)

SEAs and LEAs (with SEA approval) may consolidate Federal funds received for administration under many ESEA programs, thus eliminating the need to account for these funds on a program-by-program basis. The amount from each applicable program set aside for State consolidation may not be more than the percentage, if any, authorized for State administration under that program. The amount set aside under each covered program for local consolidation may not be more than the percentage, if any, authorized for local administration under that program. Expenditures using consolidated administrative funds may be charged to the programs on a first in/first out method, in proportion to the funds provided by each program, or another reasonable manner.

ESEA programs in this Supplement to which this section applies are: Title I, Part A (84.010); MEP (84.011); CSP (84.282);

21st CCLC (84.287); Title III, Part A (84.365); MSP (84.366) (at the LEA level only); Title II, Part A (84.367); and SIG

(84.377 and 84.388).

State and local administrative funds that are consolidated (as described in III.A.1, “Activities Allowed or Unallowed –

Consolidation of Administrative Funds (SEAs and LEAs”)) should be included in the audit universe and the total

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 7/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

expenditures of the programs from which they originated for purposes of (1) determining Type A programs, and (2) completing the Schedule of Expenditures of Federal Awards (SEFA). A footnote showing, by program, amounts of administrative funds consolidated is encouraged.

Schoolwide Programs

(In addition to the compliance requirement described in Part A of this FACCR)

Eligible schools are able to use their Title I, Part A funds, in combination with other Federal, State, and local funds, in order to upgrade the entire educational program of the school and to raise academic achievement for all students.

Except for some of the specific requirements of the Title I, Part A program, Federal funds that a school consolidates in a schoolwide program are not subject to most of the statutory or regulatory requirements of the programs providing the funds as long as the schoolwide program meets the intent and purpose of those programs. The Title I, Part A requirements that apply to schoolwide programs are identified in the Title I, Part A program-specific section. If a school does not consolidate Federal funds with State and local funds in its schoolwide program, the school has flexibility with respect to its use of Title I, Part A funds, consistent with Section 1114 of ESEA (20 USC 6314), but it must comply with all statutory and regulatory requirements of the other Federal funds it uses in its schoolwide program

ESEA programs in this Supplement to which this section applies are: Title I, Part A (84.010); MEP (84.011); 21st CCLC

(84.287); Title III, Part A (84.365); MSP (84.366); Title II, Part A (84.367); and SIG (84.377 and 84.388).

This section also applies to IDEA (84.027 and 84.173) and CTE (84.048).

Since schoolwide programs are not separate Federal programs, as defined in OMB Circular A-133, expenditures of Federal funds consolidated in schoolwide programs should be included in the audit universe and the total expenditures of the programs from which they originated for purposes of (1) determining Type A programs and

(2) completing the SEFA. A footnote showing, by program, amounts consolidated in schoolwide programs is encouraged.

Transferability

(In addition to the compliance requirement described in Parts A & G of this FACCR)

SEAs and LEAs (with some limitations) may transfer funds from one or more applicable programs to one or more other applicable programs, or to Title I, Part A. Transferred funds are subject to all of the requirements, set-asides, and limitations of the programs into which they are transferred, except as modified under ESEA flexibility.

ESEA programs in this Supplement to which this section applies are: 21st CCLC (84.287

) and Title II, Part A (84.367)

.

Expenditures of funds transferred from one program to another (as described in III.A.3, “Activities Allowed or Unallowed

– Transferability (SEAs and LEAs)”) should be included in the audit universe and total expenditures of the receiving program for purposes of (1) determining Type A programs, and (2) completing the SEFA. A footnote showing amounts transferred between programs is encouraged by OMB and has been requested by ODE.

Other Information

Prima Facie Case Requirement for Audit Findings

Section 452(a)(2) of the General Education Provisions Act (20 USC 1234a(a)(2)) requires that ED officials establish a

prima facie

case when they seek recoveries of unallowable costs charged to ED programs. When the preliminary ED decision to seek recovery is based on an OMB Circular A-133 audit, upon request, auditors will need to provide ED program officials audit documentation. For this purpose, audit documentation (part of which is the auditor’s working papers) includes information the auditor is required to report and document that is not already included in the reporting package.

The requirement to establish a

prima facie

case for the recovery of funds applies to all programs administered by ED, with the exception of Impact Aid (CFDA 84.041) and programs under the Higher Education Act, i.e., the Family Federal

Education Loan Program (CFDA 84.032) and the other ED programs covered in the Student Financial Assistance Cluster in

Part 5 of the Supplement.

Waivers and Expanded Flexibility

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 8/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

Under Title IX of the ESEA, State educational agencies (SEAs), Indian tribes, local educational agencies (LEAs), and schools through their LEA may request waivers from ED of many of the statutory and regulatory requirements of programs authorized in the ESEA. In addition, some States may have been granted authority to grant waivers of Federal requirements under the Education Flexibility Partnership Act of 1999.

ESEA Flexibility

On September 23, 2011, ED invited States to request flexibility on behalf of the State, its LEAs, and its schools to better focus on improving student achievement and increasing the quality of instruction (ESEA flexibility). This voluntary opportunity provides SEAs and LEAs, in States whose requests for ESEA flexibility have been approved, with waivers of specific requirements of the ESEA in exchange for rigorous and comprehensive State-developed plans designed to improve educational outcomes for all students, close achievement gaps, increase equity, and improve the quality of instruction. States receiving ESEA flexibility before November 1, 2012, and LEAs in those States, began implementing the plans contained in their request in the 2012–2013 school year. Those waivers applied through the end of the 2013-2014 school year, and States with waivers that expired at that time could request a one-year extension of ESEA flexibility through the 2014-2015 school year. Other States received ESEA flexibility after October 31, 2012, and LEAs in those

States began implementing the plans contained in their request in the 2013–2014 school year. Those waivers generally apply through the end of the 2014-2015 school year.

Those waivers apply through the end of the 2013-2014 school year. For a list of the waivers offered, see

ESEA Flexibility

.

A list of the States that have requested waivers is available at http://www.ed.gov/esea/flexibility . [As noted at this link, Ohio’s ESEA flexibility request was approved on May 29, 2012.]

[In addition, Ohio’s ESEA 1 year extension of flexibility was granted on August 21, 2014 for the 2014-2015 school year.]

ESEA programs in this Supplement to which ESEA flexibility applies are

:

Title I, Part A (84.010); 21st CCLC (84.287);

Title II, Part A (84.367); and SIG (84.377 and 84.388).

See III.G.2.2, “Level of Effort – Supplement Not Supplant,”

III.G.3.b, “Transferability,” III.N.2, “Special Tests and Provisions – Schoolwide Programs,” and the individual program supplements for testing related to ESEA flexibility.

Auditors should ascertain from the audited SEAs and LEAs whether the SEA or the LEA or its schools are operating under

ESEA flexibility or any other approved waivers.

Any requested waivers would be reviewed/approved by the ODE waiver committee.

General and Program-Specific Cross-Cutting Requirements

The requirements in the cross-cutting section can be classified as either general or program-specific. General crosscutting requirements are those that are the same for all applicable programs but are implemented on an entity-level.

These requirements need only be tested once to cover all applicable major programs. The general cross-cutting requirements that the auditor only need test once to cover all applicable major programs are: III.G.2.1, “Level of Effort-

Maintenance of Effort (SEAs/LEAs);” III.L.3, “Special Reporting;” and, III.N, “Special Tests and Provisions” (III.N.2,

“Schoolwide Programs;” and III.N.3, “Comparability”). Program-specific cross-cutting requirements are the same for all applicable programs, but are implemented at the individual program level. These types of requirements need to be tested separately for each applicable major program. The compliance requirement in III.N.1, “Participation of Private

School Children,” may be tested on a general or program-specific basis.

In recent years, the Office of Inspector General in ED has investigated a number of significant criminal cases related to the risk of misuse of Federal funds and the lack of accountability of Federal funds in public charter schools. Auditors should be aware that, unless an applicable program statute provides otherwise, public charter schools and charter school

LEAs are subject to the requirements in this cross-cutting section to the same extent as other public schools and LEAs.

Auditors also should note that, depending upon State law, a public charter school may be its own LEA or a school that is part of a traditional LEA.

Program procedures for non-ESEA programs covered by this cross-cutting section and additional information on program procedures for the ESEA programs are set forth in the individual program sections of this Supplement.

(Source: 2015 OMB Compliance Supplement, Part 4)

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 9/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

III. Program Specific Information

State of Ohio

Application Access

The Ohio Department of Education (ODE) administers a number of federal programs under which subawards are made to

Local Educational Agencies (LEAs). ODE uses a Consolidated Application (CA), known as the Comprehensive Continuous

Improvement Plan, for several of these programs. The CA is an online form completed by the LEA and constitutes the

LEA’s application for various federal programs (certain federal programs administered by ODE are not awarded through the consolidated application).

Following is a summary of the CA contents and related access. This summary is only intended to give auditors sufficient information to get started and to provide a general understanding of available information. For answers to more specific questions, auditors should inquire of appropriate LEA or ODE personnel and review the various documents available in the document library discussed below.

Some of the information included in the CA includes:

An application status history log

A summary of federal allocations by federal program (including carryover and transfer information)

Individual program applications including: o Program specific schedules and worksheets (For example: supporting school-wide building eligibility, or documenting nonpublic school participation information) o Program budget o Program improvement plan goals and strategies (application narrative) o Additional program schedules (usually identifying which allowable activities are being proposed)

Assurances

Each LEA’s consolidated application is available on ODE’s website under the Comprehensive Continuous Improvement

Planning section (CCIP). The specific location is currently: https://ccip.ode.state.oh.us/default.aspx

. This section allows the general public to review CAs for individual LEAs (“Search Districts” option). The section also includes a document library (“Doc Library”) with access to program specific guidance and CCIP/CA general information and instructions.

Select a specific LEA from the “Search Organization’s” option. From here you can obtain:

The entire CA by selecting the Application (then Funding Application) option and selecting the type of application you wish to view. You can download the entire CA, or portions, by using the various “print” options on the screen.

Selecting a print option results in the creation of a PDF format document.

Project Cash Requests (PCR) by selecting the “PCRs” option. You can then select the desired federal program which will result in a list of PCRs for that program and their status. Select the desired PCR to view it.

Some fields are populated by ODE or by programmed calculations within the form. The LEA can only 1) enter total cash basis expenditures, 2) alter the advance amount requested (default is 10% of the total award for the month requested) and, 3) provide a justification of need explanation for any amount requested in excess of 10% of the total award or if more than 10% cash balance is on hand at the local entity.

Final Expenditure Reports are available online on the funding application’s section page of ODE’s website.

Note: As the grant application, budget, project cash requests, and final expenditure reports are readily available online, it is anticipated that LEAs may not have paper copies of certain documents. The online documents will be sufficient for audit purposes.

(Source: Ohio Department of Education Office of Federal and State Grants Management)

IV. Source of Governing Requirements (CFR, USC, grantor manual section, etc.)

This program is authorized under Title IV, Part B of the Elementary and Secondary Education Act of 1965 (ESEA), as amended by the NCLB (20 USC 7171 et seq.; Section 4201 et seq. of Pub. L. No. 107-110, 115 Stat. 1765, January 8,

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 10/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

2002).

(Source: 2015 OMB Compliance Supplement, Part 4)

Availability of Other Program Information

Information on this program can be found in Non-Regulatory Guidance on the 21st Century Learning Centers (February

2003) at: http://www.ed.gov/programs/21stcclc/guidance2003.pdf

.

Additional information regarding Expanded Learning Time in 21st CCLC programs can be found in the 21st Century

Community Learning Centers (21st CCLC) Frequently Asked Questions (FAQs) Expanded Learning Time (ELT) under the

ESEA Flexibility Optional Waiver (July 2013) at http://www2.ed.gov/programs/21stcclc/21stcclc-elt-faq.pdf

.

(Source: 2015 OMB Compliance Supplement, Part 4)

US Department of Education Cross-Cutting Requirements:

The ESEA, as reauthorized by the NCLB, is available with a hypertext index at http://www.ed.gov/policy/elsec/leg/esea02/index.html

.

An ED

Federal Register

notice, dated July 2, 2004 (69 FR 40360-40365), indicating which Federal programs may be consolidated in a schoolwide program is available at http://www.gpo.gov/fdsys/pkg/FR-2004-07-02/pdf/04-15121.pdf

.

A number of documents contain guidance applicable to the cross-cutting requirements in the OMB Supplement. They include:

[NOTE: You should copy and paste these web addresses, rather than clicking on the links.]

Guidance on the Transferability Authority

( http://www.ed.gov/programs/transferability/finalsummary04.doc

)

(June 8, 2004)

Guidance on the Rural Education Achievement

( http://www.ed.gov/policy/elsec/guid/reap03guidance.doc

)

Program (REAP) (June 2003)

State Educational Agency Procedures for Adjusting Basic, Concentration, Targeted, and Education Finance

Incentive Grant Allocations Determined by the U.S. Department of Education (May 23, 2003)

( http://www.ed.gov/programs/titleiparta/seaguidanceforadjustingallocations.doc

)

Applying the Title I and School Improvement Hold-Harmless Requirements when Allocating Funds to Newly

Opening and Significantly Expanding Charter

( http://www2.ed.gov/programs/titleiparta/legislation.html#policy )

School LEAs (September 2013)

How Does a State or Local Educational Agency Allocate Funds to Charter Schools that Are Opening for the First

Time or Significantly Expanding Their

( http://www.ed.gov/policy/elsec/guid/cschools/cguidedec2000.doc

)

Enrollment? (December 2000)

Applying the Title I and School Improvement Hold-Harmless Requirements when Allocating Funds to Newly

Opening and Significantly Expanding Charter

( http://www2.ed.gov/programs/titleiparta/legislation.html#policy )

School LEAs (September 2013)

Title I Services to Eligible Private

( http://www.ed.gov/programs/titleiparta/psguidance.doc

)

School Children (October 17, 2003)

Title IX, Part E Uniform Provisions Subpart 1—Private Schools: Equitable Services to Eligible Private School

Students, Teachers, and Other Educational

( http://www.ed.gov/policy/elsec/guid/equitableserguidance.doc

)

Personnel (March 2009)

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 11/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

Serving Preschool Children Through Title I, Part A of the Elementary and Secondary Education Act of 1965, as

Amended (April 16, 2012) ( http://www2.ed.gov/policy/elsec/guid/preschoolguidance2012.pdf

)

Title I Fiscal Issues: Maintenance of Effort; Comparability; Supplement, not Supplant; Carryover; Consolidating

Funds in Schoolwide Programs; and

( http://www.ed.gov/programs/titleiparta/fiscalguid.doc

)

Grantback Requirements (February 2008)

Designing Schoolwide Programs (March 2006) ( http://www.ed.gov/policy/elsec/guid/designingswpguid.doc

)

ESEA Flexibility Frequently Asked

( http://www2.ed.gov/policy/eseaflex/esea-flexibility-faqs.doc

)

Questions

ESEA

( http://www.ed.gov/esea/flexibility/documents/esea-flexibility.doc

)

ESEA Flexibility

Flexibility

Addendum to Frequently

( http://www2.ed.gov/policy/eseaflex/faqaddendum.doc

)

(June

Asked

(August

Questions

7,

(March

3,

5,

2012)

2012)

2013)

Letter to Chief State School Officers on Granting Administrative Flexibility for Better Measures of Success

(September 7,

( http://www2.ed.gov/policy/fund/guid/gposbul/time-and-effort-reporting.html?exp=3 )

2012)

Letter and Enclosure on Flexibility in Schoolwide Programs (September 13, 2013)

( http://www2.ed.gov/programs/titleiparta/flexswp091313.pdf

)

Non-Regulatory Guidance on Title I, Part A Waivers (July 2009) ( http://www.ed.gov/programs/titleiparta/title-iwaiver.doc

)

Guidance on School Improvement Grants Under Section 1003(g) of the Elementary and Secondary Education Act of 1965 (Revised June 29, 2010) ( http://www2.ed.gov/programs/sif/sigguidance05242010.pdf

)

Guidance on Fiscal Year 2010 School Improvement Grants Under Section 1003(g) of the Elementary and

Secondary Education Act of 1965 (March 1, 2012) ( http://www2.ed.gov/programs/sif/sigguidance03012012.doc

Two documents contain guidance applicable to the cross-cutting requirements affected by the Education Jobs Fund program (Ed Jobs). They include:

Guidance – When to Treat Expenditures of Education Jobs Funds as State or Local Funds for Purposes of the

Fiscal Requirements under Title I, Part A of the Elementary and Secondary Education Act of 1965 (November

2010) ( http://www2.ed.gov/programs/titleiparta/fiscalejfguidance.doc

)

Part B IDEA MOE Guidance for States on the Education Jobs Fund Program (May 2011)

( www2.ed.gov/policy/speced/guid/idea/idea-edjobs-guidance.pdf

).

(Source: 2015 OMB Compliance Supplement, Part 4)

Additional Guidance:

ODE Document Library: https://ccip.ode.state.oh.us/documentlibrary/default.aspx

OMB Compliance Supplements: http://www.whitehouse.gov/omb/financial_fin_single_audit/

AOS Guidance on federal sampling – Fall 2014

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 12/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

http://portal/BP/Intranet/Webinar%20Supplemental%20Materials/Fall%202014%20-%20Federal%20Sampling.pdf

V. Reporting in the Schedule of Expenditures of Federal Awards

The District should report federal receipts and disbursements for CFDA #84.287 in fund 599. At a minimum, the District should report the total fiscal year receipts and disbursements for each program. A-133.310(b)(2) requires including passthrough numbers (if any) on the Schedule. However, ODE informed us OAKS is not currently assigning pass-through numbers. Because ODE may reinstate pass-through numbers in the future, we suggest districts continue to create special cost centers in fund 599 to separately summarize amounts for each fiscal year. The Schedule should also report the following for 21 st Century Community Learning Centers:

The School District generally must spend Federal assistance within 15 months of receipt (funds must be obligated by June

30 th

CFDA number: 84.287

Grant Title: Twenty-First Century Community Learning Centers

Receipts and disbursements for each pass-through number (i.e., cost center) in Fund 599.

and spent by September 30 th ).

PROJECT DURATION - Approved grants will be funded for a five-year period contingent upon new and continued USDOE's annual appropriation to the state. Beginning if FY 14, the first year of the grant awarded will be considered implementation or “probationary year”. Additional monitoring requirements will be addressed during the year including program implementation timeline, adherence to the approved grant application, implementation of service, sustainability planning, and program effectiveness will determine the continuation of funding into subsequent years. Additionally, the first three years will be funded at 100 percent, and the fourth and fifth years will be funded at 75 percent and 50 percent, respectively.

(Source: 21 st Century CLC Request for Applications http://education.ohio.gov/getattachment/Topics/Other-

Resources/21st-Century/21st-CCLC-Archived-Event-Information/FY14-Request-for-Applications.pdf.aspx

)

As described in §___.310(b)(3) of OMB Circular A-133, auditees must complete the SEFA and include CFDA numbers provided in Federal awards/subawards and associated expenditures.

____________________________________________________________________________________

NOTE: Legacy cash reports are available to schools and their auditors to aid in preparation of the SEFA. A cross walk of

Web

‐

GAAP alternatives is located within the Web

‐

GAAP wiki, which can be accessed using the following link: http://gaapwiki.oecn.k12.oh.us/images/1/19/4502Web ‐ GAAPAlternatives.pdf. A link to the entire Web ‐ GAAP wiki is provided on our intranet page under the auditor resources tab. Keep in mind that district use of Web ‐ GAAP is not mandatory and some districts may not utilize these reports. Any SEFA format is acceptable so long as it complies with the requirements above and those of OMB Circular A-133 §_.310(b). Additionally, as the pass-through agency, ODE requires school districts to report receipts as well as expenditures on the SEFA.

(Source: AOS CFAE)

FOOTNOTE TO THE FEDERAL SCHEDULE (If any funds were carried over to the next program year):

NOTE D – TRANSFERS

The School District generally must spend Federal assistance within 15 months of receipt (funds must be obligated by June

30 th and spent by September 30 th ). However, with ODE’s approval, a District can transfer unspent Federal assistance to the succeeding year, thus allowing the School District a total of 27 months to spend the assistance. Schools can document this by using special cost centers for each year’s activity, and transferring the amounts ODE approves between the cost centers. During fiscal year 200X, the Ohio Department of Education (ODE) authorized the following transfers:

CFDA

Number Program Title

Pass-Through

Entity Number

Transfers

Out Transfers In

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 13/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

84.010 Title I Grants to Local Educational Agencies

84.010 Title I Grants to Local Educational Agencies

84.027 Special Education - Grants to States

84.027 Special Education - Grants to States

84.173 Special Education - Preschool Grants

84.173 Special Education - Preschool Grants

84.318 Education Technology State Grants

84.318 Education Technology State Grants

84.367 Improving Teacher Quality State Grant

84.367 Improving Teacher Quality State Grant

Totals

VI. Improper Payments

(or Grant Year)

C1S1-200X-1

C1S1-200X

6BSF-200X-1

6BSF-200X

PGS1-200X-1

PGS1-200X

TJS1-200X-1

TJS1-200X

TRS1-200X-1

TRS1-200X

$ 20,034

2,754

554

62

3,109

$ 27,513

$ 20,034

2,754

554

62

3,109

$ 27,513

Under OMB guidance, Public Law (Pub. L.) No. 107-300, the Improper Payments Information Act of 2002, as amended by

Pub. L. No. 111-204, the Improper Payments Elimination and Recovery Act, Executive Order 13520 on reducing improper payments, and the June 18, 2010 Presidential memorandum to enhance payment accuracy, Federal agencies are required to take actions to prevent improper payments, review Federal awards for such payments, and, as applicable, reclaim improper payments. Improper payment means:

1. Any payment that should not have been made or that was made in an incorrect amount under statutory, contractual, administrative, or other legally applicable requirements.

2.

3.

4.

Incorrect amounts are overpayments or underpayments that are made to eligible recipients (including inappropriate denials of payment or service, any payment that does not account for credit for applicable discounts, payments that are for the incorrect amount, and duplicate payments).

Any payment that was made to an ineligible recipient or for an ineligible good or service, or payments for goods or services not received (except for such payments where authorized by law).

Any payment that an agency’s review is unable to discern whether a payment was proper as a result of insufficient or lack of documentation.

Auditors should be alert to improper payments, particularly when testing the following parts - A, “Activities

Allowed or Unallowed;” B, “Allowable Costs/Cost Principles;” E, “Eligibility;” and, in some cases, N, “Special

Tests and Provisions.”

(Source: 2015 OMB Compliance Supplement, Part 3)

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 14/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

A. Activities Allowed or Unallowed

Audit Objectives

1) Obtain an understanding of internal control, assess risk, and test internal control as required by OMB Circular A-133

§___.500(c).

2) Determine whether Federal awards were expended only for allowable activities.

Compliance Requirements

Important Note: For a cost to be allowable, it must (1) be for a purpose the specific award permits and (2) fall within A-87’s (codified in 2 CFR Part 225) allowable cost guidelines. These two criteria are roughly analogous to classifying a cost by both program/function and object. That is, the grant award generally prescribes the allowable program/function while A-87 prescribes allowable object cost categories and restrictions that may apply to certain object codes of expenditures.

For example, could a government use an imaginary Homeland Security grant to pay OP&F pension costs for its police force? To determine this, the client (and we) would look to the grant agreement to see if police activities (security of persons and property function cost classification) met the program objectives. Then, the auditor would look to A-

87 to determine if pension costs (an object cost classification) are permissible. (A-87, Appendix B states they are allowable, with restrictions, so we would need to determine if the auditee met the restrictions.) Both the client and we should look at A-87 even if the grant agreement includes a budget by object code approved by the grantor agency.

(Source: AOS CFAE)

The specific requirements for activities allowed or unallowed are unique to each Federal program and are found in the laws, regulations, and the provisions of contract or grant agreements pertaining to the program.

For programs listed in the OMB Compliance Supplement, the specific requirements of the governing statutes and regulations are included in Part

4 – Agency Program Requirements or Part 5 – Clusters of Programs, as applicable. This type of compliance requirement specifies the activities that can or cannot be funded under a specific program.

Source of Governing Requirements

The requirements for activities allowed or unallowed are contained in program legislation, Federal awarding agency regulations, and the terms and conditions of the award.

(Source: 2015 OMB Compliance Supplement, Part 3)

Program Specific Requirements

Grant awards may be used to carry out a broad array of before- and after-school activities (including summer recess periods) that advance student academic achievement including: a.

Remedial education activities and academic enrichment learning programs, including providing additional assistance to students to allow the students to improve their academic achievement. b.

Mathematics and science education activities. c.

Arts and music education activities.

Entrepreneurial education programs.

Tutoring services (including those provided by senior citizen volunteers) and mentoring programs. d.

e.

f.

Programs that provide after school activities for limited English proficient students that emphasize language skills and academic achievement. g.

Recreational activities. h.

Telecommunications and technology education programs. i.

Expanded library service hours. j.

Programs that promote parental involvement and family literacy.

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 15/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

A. Activities Allowed or Unallowed k.

Programs that provide assistance to students who have been truant, suspended, or expelled to allow the students to improve their academic achievement. l.

Drug and violence prevention programs, counseling programs, and character education programs (20 USC

7175(a)). m.

If an SEA requests and is approved for a waiver of ESEA Sections 4201(b)(1)(A) and 4204(b)(2)(A) (ESEA

Flexibility), an eligible entity may use 21st CCLC funds to support expanded learning time during the school day in addition to activities during non-school hours or periods when school is not in session such as:

(1) Using the additional time to increase learning time for all students in areas of need;

(2)

(3)

(4)

Using the additional time to support a well-rounded education that includes time for academics and enrichment activities;

Providing additional time for teacher collaboration and common planning;

(5)

Partnering with one or more outside organizations, such as a nonprofit organization with demonstrated experience in improving student achievement;

Redesigning the whole school day to use time more strategically, especially in designing activities that are not “more of the same;”

(6)

(7)

Providing evidence-based activities and programs;

Personalizing instructional student supports;

(8)

(9)

Using data to inform ELT activities and practices; and

Directly aligning ELT activities to student achievement and preparation for college and careers (21 st CCLC FAQs on ELT (June 2013), pages 1-2, question 3).

Note that an eligible entity may use any one or more of these types of activities, consistent with the SEA’s approved flexibility application and consistent with the eligible entity’s 21 st CCLC application to the SEA.

(Source: 2015 OMB Compliance Supplement, Part 4)

US Department of Education Cross-Cutting Requirements:

1.

Consolidation of Administrative Funds

(SEAs/LEAs)

ESEA programs this Supplement to which this section applies are Title I, Part A (84.010); MEP (84.011); CSP

(84.282); 21st CCLC (84.287

); Title III, Part A (84.365); MSP (84.366) (at the LEA level only); Title II, Part A

(84.367); and SIG (84.377 and 84.388).

An LEA may, with the approval of its SEA, consolidate and use for the administration of one or more ESEA programs not more than the percentage, established in each program, of the total available under those programs. An LEA may use consolidated funds for the administration of the consolidated programs and for uses at the school district and school levels comparable to those authorized for the SEA. An LEA that consolidates administrative funds may not use any other funds under the programs included in the consolidation for administration (Section 9203 of ESEA (20

USC 7823)).

An SEA or LEA that consolidates administrative funds is not required to keep separate records of administrative costs for each individual program. Expenditures of consolidated administrative funds are allowable if they are for administrative costs that are allowable under any of the contributing programs (Sections 9201(c) and 9203(e) of

ESEA (20 USC 7821(c) and 7823(e))).

See Section N, “Special Tests and Provisions – Schoolwide Programs” for discussion of provisions relating to allowable activities for Schoolwide Programs.

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 16/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

A. Activities Allowed or Unallowed

See Part II, Program Procedures, for guidance on the treatment of consolidated administrative funds for purposes of

Type A program determination and presentation in the Schedule of Expenditures of Federal Awards (SEFA).

Program funds may also be used for Consolidation of Administrative Funds, Coordinated Services Projects, and

Schoolwide Programs under Title I. Also, unneeded Program Funds may be transferred to certain other federal programs. The requirements for these options and related testing guidance are included in Section G and N of this

FACCR.

NOTE: The Ohio Department of Education has not implemented consolidation of administrative funds or the coordinated services projects for its ESEA programs.

(Source: Ohio Department of Education Office of Federal and State Grants Management)

2.

Schoolwide Programs

(LEAs)

ESEA programs this Supplement to which this section applies are Title I, Part A (84.010); MEP (84.011); 21st CCLC

(84.287

); Title III, Part A (84.365); MSP (84.366); Title II, Part A (84.367); and SIG (84.377 and 84.388)

.

This section also applies to IDEA (84.027 and 84.173) and CTE (84.048).

An eligible school participating under Title I, Part A may, in consultation with its LEA, use its Title I, Part A funds, along with funds provided from the above-identified programs, to upgrade the school’s entire educational program in a schoolwide program. See “Special Tests and Provisions – Schoolwide Programs” for testing related to schoolwide programs (Section 1114 of ESEA (20 USC 6314)).

3.

See Part II, Program Procedures, for guidance on the treatment of consolidated schoolwide funds for purposes of

Type A program determination and presentation in the SEFA.

Transferability

(SEAs and LEAs)

ESEA programs in this Supplement to which this section applies are: 21st CCLC (84.287

) and Title II, Part A

(84.367)

.

Except for 21st CCLC (CFDA 84.287

), LEAs not identified for improvement or corrective action under Section 1116(c) of ESEA may also transfer up to 50 percent of the funds allocated to them from one or more of the listed applicable programs to another listed applicable program or to Title I, Part A. LEAs identified for improvement under Section

1116(c) may transfer up to 30 percent of the funds allocated to them for (a) school improvement under Section 1003 or (b) other LEA improvement activities consistent with Section 1116(c). LEAs identified for corrective action may not transfer funds (Sections 6123(a) and (b) of ESEA (20 USC 7305b(a) and (b))).

Transferred funds are subject to all of the requirements, set-asides, and limitations of the programs into which they are transferred (Section 6123(e) of ESEA (20 USC 7305b(e))).

In a State that has received ESEA flexibility [See Section II, Program Procedures, ESEA Flexibility] , an SEA or an LEA may transfer up to 100 percent of the funds available under one or more of the authorized ESEA programs among those programs and into Title I, Part A. This authority applies to all LEAs notwithstanding the limitations on such transfers and the restrictions on the use of the transferred funds in Section 6123(b)(1) of the ESEA (20 USC

7305b(b)(1)). Funds transferred under ESEA flexibility are not subject to any set-aside requirements of the programs into which they are transferred but they are subject to all of the requirements and limitations of those programs.

Moreover, an SEA is not required to notify ED, and its participating LEAs are not required to notify the SEA, prior to transferring funds (see paragraph 9 on page 2 of

ESEA Flexibility

). Note, however, that there is a limitation on the amount of Title II, Part A funds that may be transferred because of that program’s equitable services requirement

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 17/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

A. Activities Allowed or Unallowed

(see section III.G.2, “Matching, Level of Effort, Earmarking – Maintenance of Effort,” in the program supplement for

CFDA 84.367 for details).

What are some examples of ways an eligible entity might use 21st CCLC funds to provide activities

that support expanded learning time? o The 21st CCLC activities may be carried out at any point in time during an extended school day, week, or year.

For example, if an LEA lengthens its school day beyond the State minimum, the LEA or another eligible entity might use 21st CCLC funds to provide supplemental science, reading, civics, or art instruction or other supplemental academic enrichment activities to students in the morning or afternoon to allow teachers time to collaborate or plan.

Similarly, an LEA working with a community partner, might use 21st CCLC funds to extend its school week and incorporate enrichment activities, such as debate or college preparation, on either Saturday or a week day.

Using 21st CCLC funds to support expanded learning time should not be just “more of the same”; it should involve careful planning by the eligible entity to ensure that the programs or activities will be used to improve student achievement and ensure a well-rounded education that prepares students for college and careers.

(Source: ESEA Flexibility Waiver Impact on FY13 21st CCLC Applicants, February 15, 2012 https://ccip.ode.state.oh.us/documentlibrary/ViewDocument.aspx?DocumentKey=78081 )

See “Matching, Level of Effort, Earmarking – Earmarking,” for additional testing related to transferability.

See Part II, Program Procedures, for guidance on the treatment of funds transferred under this provision for purposes of Type A program determination and presentation in the SEFA.

(Source: 2015 OMB Compliance Supplement, Part 4)

Unallowable Activities:

The purchase of real property is an unallowable Federal program cost for Ohio school districts.

(Source: Ohio Department of Education Office of Federal and State Grants Management)

Ohio Revised Code 3313.24 states, in part: The board of education of each local, exempted village or city school district shall fix the compensation of its treasurer which shall be paid from the general fund of the district.

In spite of any additional duties in managing Federal or State funds, Federal and state law prohibits treasurers from receiving a supplemental contract for managing Federal or State funds . There are several Ohio statutes and the OMB Circular A-133 compliance supplement which require that position.

To ensure consistency of application, the Department considers all chief financial officers of educational entities, including but not limited to, non-profit corporations, colleges and universities to be similarly situated to treasurers of school districts. Additionally, as community schools discharge functions in a similar manner as school districts and community schools are considered local education agencies, as defined in 34 CFR parts 76 and 77, chief financial officers of community schools are treated as if they were treasurers of a traditional public school district.

(Source: http://education.ohio.gov/getattachment/Topics/Finance-and-Funding/State-Funding-For-

Schools/Career-Technical-Funding/Grants-Management-Guidance/Supplemental-Contracts.pdf.aspx

)

Additional Program Specific Requirements

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 18/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

A. Activities Allowed or Unallowed

The grant application, agreement, or policies may contain the specific requirements for activities allowed or unallowed.

(Source: )

In determining how the client ensures compliance, consider the following:

Obtain an understanding of internal control, assess risk, and test internal control as required by OMB Circular A-133

§___.500(c). Using the guidance provided in the 2013 COSO ( http://www.coso.org/IC.htm

), or GAO’s 2014 Green Book

( http://www.gao.gov/assets/670/665712.pdf

), perform procedures to obtain an understanding of internal control sufficient to plan the audit to support a low assessed level of control risk for the program. Plan the testing of internal control to support a low assessed level of control risk for Activities Allowed or Unallowed and perform the testing of internal control as planned. If internal control over some or all of the compliance requirements is likely to be ineffective, see the alternative procedures in §___.500(c)(3) of OMB Circular A-133, including assessing the control risk at the maximum and considering whether additional compliance tests and reporting are required because of ineffective internal control. For further AOS guidance on testing federal controls see http://portal/BP/Intranet/AA%20Training%20Fall%202011/FACCR%20Controls%20and%20Federal%20Update.pdf

– Fall

2011.

WP Ref. What control procedures address the compliance requirement?

Basis for the control (reports, resources, etc. providing information needed to understand requirements and prevent or identify and correct errors):

Control Procedure (description of how auditee uses the “Basis” to prevent, or identify and correct or detect errors):

Person(s) responsible for performing the control procedure (title):

Description of evidence documenting the control was applied (i.e. sampling unit):

Suggested Audit Procedures – Compliance (Substantive Tests)

Note: Consider the results of the testing of internal control in assessing the risk of noncompliance. Use this as the basis for determining the nature, timing, and extent (e.g., number of transactions to be selected) of substantive tests of compliance.

1) Identify (and document) the types of activities which are either specifically allowed or prohibited by the laws, regulations, and the provisions of contract or grant agreements pertaining to the program.

WP Ref.

2) When allowability is determined based upon summary level data (voucher summaries, etc.), perform procedures to verify that: a) Activities were allowable. b) Individual transactions were properly classified and accumulated into the activity total.

3) When allowability is determined based upon individual transactions, select a sample of transactions and perform procedures (vouch, scan, etc.) to verify that the transaction was for an allowable activity.

4) The auditor should be alert for large transfers of funds from program accounts, which may have been used to fund unallowable activities.

Audit Implications (adequacy of the system and controls, and the effect on sample size, significant deficiencies / material weaknesses, and management letter comments)

A. Results of Test of Controls: (including material weaknesses, significant deficiencies and management letter items)

B. Assessment of Control Risk:

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 19/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

A. Activities Allowed or Unallowed

C. Effect on the Nature, Timing, and Extent of Compliance (Substantive Test) including Sample Size:

D. Results of Compliance (Substantive Tests) Tests:

E. Questioned Costs: Actual __________ Projected __________

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 20/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

B. Allowable Costs / Cost Principles

Introduction

The following OMB cost principles circulars prescribe the cost accounting policies associated with the administration of

Federal awards by (1) States, local governments, and Indian tribal governments (State rules for expenditures of State funds apply for block grants authorized by the Omnibus Budget Reconciliation Act of 1981 and for other programs specified on Appendix I); (2) institutions of higher education; and (3) non-profit organizations. Federal awards administered by publicly owned hospitals and other providers of medical care are exempt from OMB’s cost principles circulars, but are subject to requirements promulgated by the sponsoring Federal agencies (e.g., the Department of

Health and Human Services’ 45 CFR part 74, Appendix E). The cost principles applicable to a non-Federal entity apply to all Federal awards received by the entity, regardless of whether the awards are received directly from the Federal

Government, or indirectly through a pass-through entity. The circulars describe selected cost items, allowable and unallowable costs, and standard methodologies for calculating indirect costs rates (e.g., methodologies used to recover facilities and administrative costs (F&A) at institutions of higher education). Federal awards include Federal programs and cost-type contracts and may be in the form of grants, contracts, and other agreements.

The three cost principles circulars are as follows:

OMB Circular A-87 OMB Circular A-87, “Cost Principles for State, Local, and Indian Tribal Governments”

(2 CFR part 225)

OMB Circular A-21, “Cost Principles for Educational Institutions.” (2 CFR part 220) - All institutions of higher education are subject to the cost principles contained in OMB Circular A-21, which incorporates the four Cost

Accounting Standards Board (CASB) Standards and the Disclosure Statement (DS-2) requirements as described in

OMB Circular A-21, sections C.10 through C.14 and Appendices A and B.

OMB Circular A-122, “Cost Principles for Non-Profit Organizations.” (2 CFR part 230) - Non-profit organizations are subject to OMB Circular A-122, except those non-profit organizations listed in OMB Circular A-122,

Appendix C that are subject to the commercial cost principles contained in the Federal Acquisition Regulation (FAR).

Also, by contract terms and conditions, some non-profit organizations may be subject to the CASB’s Standards and the Disclosure Statement (DS-1) requirements.

Although these cost principles circulars have been reissued in Title 2 of the CFR for ease of access, the OMB Circular A-

133 Compliance Supplement refers to them by the circular title and numbering. However, auditors should use the authoritative reference of 2 CFR Part 225 … when citing noncompliance.

The cost principles articulated in the three OMB cost principles circulars are, in most cases, substantially identical, but a few differences do exist. These differences are necessary because of the nature of the Federal/State/local/non-profit organizational structures, programs administered, and breadth of services offered by some grantees and not others.

Exhibit 1 of Part 3 of the OMB Circular A-133 Compliance Supplement, Selected Items of Cost (included in at the end of

Part B to this FACCR), lists the treatment of the selected cost items in the different circulars.

Note: This FACCR is designed for State and Local Governments (based on the requirements of OMB

Circular A-87). If you are performing a Single Audit for a Higher Educational Institution or a Non-

Profit Organization, you will need to update the guidance contained within this FACCR in accordance with the applicable cost principle circular.

(Source: AOS CFAE)

Important Note: For a cost to be allowable, it must (1) be for a purpose the specific award permits and (2) fall within A-87’s (codified in 2 CFR Part 225) allowable cost guidelines. These two criteria are roughly analogous to classifying a cost by both program/function and object. That is, the grant award generally prescribes the allowable program/function while A-87 prescribes allowable object cost categories and restrictions that may apply to certain object codes of expenditures.

Filename: A133 FACCR 84287 21st Century 2015 (non-ARRA non-UG) Sept15.docx CFDA # 84.287 - 21/91

* Cross-reference to the working papers where the tests of controls or compliance tests have been performed.

B. Allowable Costs / Cost Principles

For example, could a government use an imaginary Homeland Security grant to pay OP&F pension costs for its police force? To determine this, the client (and we) would look to the grant agreement to see if police activities (security of persons and property function cost classification) met the program objectives. Then, the auditor would look to A-

87 to determine if pension costs (an object cost classification) are permissible. (A-87, Appendix B states they are allowable, with restrictions, so we would need to determine if the auditee met the restrictions.) Both the client and we should look at A-87 even if the grant agreement includes a budget by object code approved by the grantor agency.

(Source: AOS CFAE)

2 CFR PART 225/OBM Circular A-87

Cost Principles for State, Local, and Indian Tribal Governments

2 CFR part 225/OBM Circular A-87 (A-87) establishes principles and standards for determining allowable direct and indirect for Federal awards. This part is organized in to the following areas of allowable costs: State/Local-Wide Central

Service Costs; State/Local Department or Agency Costs (Direct and Indirect); and State Public Assistance Agency Costs.

Cognizant Agency

A-87, Appendix A, paragraph B.6. defines “cognizant agency” as the Federal agency responsible for reviewing, negotiating, and approving cost allocation plans or indirect cost proposals developed under A-87 on behalf of all Federal agencies. OMB publishes a listing of cognizant agencies ( available at

Federal Register

, 51 FR 552, January 6, 1986). This listing is http://www.whitehouse.gov/sites/default/files/omb/assets/financial_pdf/fr-notice_cost_negotiation_010686.pdf

.

References to cognizant agency in this section should not be confused with the cognizant Federal agency for audit responsibilities, which is defined in OMB Circular A-133, Subpart D. §____.400(a).

Availability of Other Information

Additional information on cost allocation plans and indirect cost rates is found in the Department of Health and Human

Services (HHS) publications:

A Guide for State, Local, and Indian Tribal Governments (ASMB C-10); Review Guide for