INTRODUCTION TO REINSURANCE EXPERIENCE AND EXPOSURE RATING SUMMARY AND RECONCILIATION OF ESTIMATES

advertisement

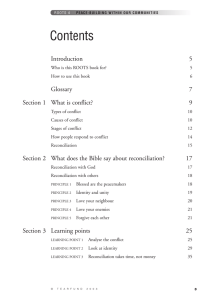

INTRODUCTION TO REINSURANCE EXPERIENCE AND EXPOSURE RATING SUMMARY AND RECONCILIATION OF ESTIMATES MICHAEL E. ANGELINA - TOWERS PERRIN CAS RATEMAKING SEMINAR MARCH 11, 2004 PHILADELPHIA, PA KEY ASSUMPTIONS You are the underwriter/actuary of the assumed reinsurance division, what should you be thinking about: Hazard group selection Loss ratios Expense loadings Claim frequencies Tail factors Layer severities Credibility of experience Results of u/w audit 2 Reconciliation of Estimates Goal - determination of a final estimate Recap of results Exposure Estimate Classical Burning Cost Freq/Severity-Industry Experience Estimate Expected Counts 2.3 1.09 0.85 0.96 Ultimate Loss & ALAE 82.1 68.4 69.5 67.7 Excess Severity 28.0 15.9 12.3 14.2 Wide range of results between experience and exposure Severity relatively flat Variation in expected counts/losses 3 Experience Rating - Frequency Based Method Projected # of Claims for Rating Year (1) (2) Accident Year Detrended Data Limit 6.0% 1999 2000 2001 2002 2003 74,726 79,209 83,962 89,000 94,340 Total All yrs Total 99-02 Rate Year 2004 (3) Actual #> Detrended Data Limit Frequency Trend @ 2% (5) Claim Count Dev't Factors 4.0 7.0 2.0 9.0 2.0 1.104 1.082 1.061 1.040 1.020 1.125 1.238 1.671 2.506 6.265 24.0 22.0 100,000 (4) (6) (7) Adjustment for Growth in Premium Projected # of Claims >Data Limit [3x4x5x6] 2.960 2.162 1.684 1.509 1.270 14.7 20.3 6.0 35.4 16.2 92.6 76.3 20.00 4 RECAP OF ESTIMATES Ultimate Losses 4,000 Dollars (000s) 3,000 2,000 1,000 0 1999 Reported 2000 2001 Indicated Ultimate Losses 2002 Exposure 2003 Burning Cost Experience 5 RECAP OF ESTIMATES Expected Counts > $100k 40 35 Dollars (000s) 30 25 20 15 10 5 0 1999 Reported 2000 2001 Indicated Ultimate Losses 2002 Exposure 2003 Burning Cost Experience 6 Reconciliation of Estimates Which method yields best estimate? Experience estimates Test at lower layers Results for frequency/severity and burning cost should be consistent Considerations credibility of data - 40 XS claims? loss development factors - reflecting claim audit? load for ALAE (explicit/implicit?) adjust for claim impact of premium growth - deterioration in U/W? account for change in policy limits? 7 Reconciliation of Estimates Which method yields best estimate (con’t) Exposure estimates Allocation of premium consistent with company’s Historical comparison of XS premium to losses suggest different loss ratio for layer? Considerations appropriateness of size of loss curve test with claim emergence at different attachment points calculate implied claim counts to company experience compare industry curve to company fitted curve fitting curve is not trivial (development on individual claims) adequacy of loss ratio reflect claim audit findings adjust for implication on growing business account for differences in excess layer vs. primary layer 8 1.3 1.2 1.1 1.0 0.9 0 2, 00 0 1, 50 0 1, 00 75 0 50 0 45 0 40 0 35 0 30 0 25 0 20 0 15 0 0.8 10 0 Limited Average Severity Reconciliation of Estimates Policy Limit Ind-M L Ind-M Act 9 Reconciliation of Estimates Expected Claim Counts 60 50 40 30 20 10 0 50 75 100 150 200 > 250 Attachment Point Exposure F/ S - Industry F/ S - Company Actual 10 Audience Underwriting Recap of Results Ultimate Exp Counts ALAE Implied Loss & ALAE >100k Load XS L/R Exposure 2.30 28.0 21% 62.1% Burning Cost 1.09 15.9 8.5% 31.8% Frequency/Severity 0.85 12.3 7.5% 24.6% 1.00 14.0 8.0% 29.1% (Industry) Experience * assumes premium allocated to layer is 3,717 (from exposure method) 11 Reconciliation of Estimates Goal - Sensitivity test indications Experience Indications (burning cost) Selected 1,000 Alter Selection 1,200 ALAE Differences 111 Revised Selection 1,311 2.5% BF: 2 recent yrs 18% vs 8% 3.3% Experience Indications (frequency / severity) Selected 851 2.4% Alter Selection 1,080 Different weights ALAE Differences 105 18% vs 7.5% Revised Selection 1,185 3.0% Final Selection 1,250 3.1% 12 Reconciliation of Estimates Goal - Move expected ultimates to similar base Exposure Indications Selected 2,304 Alter Selection 1,593 ALAE Differences (40) Revised Selection 1,553 5.8% higher % Table 1 18% vs 21% 3.9% Experience Indications (Selected) Revised Selection 1,250 3.1% implied loss ratio for layer Final Selection 1,450 implied loss ratio for layer 34.4% 3.625% 39% 13 Reconciliation of Estimates Scenario Testing Move away from point estimate of methods and look at a range of possible outcomes Exposure size of loss table/loss ratio what assumptions would get result to experience rate 20% loss ratio, lower hazard curve, less ALAE loading, combination of all three Experience LDF’s, claim counts, size of loss curve (industry or company) what assumptions get result to exposure rate 54 claims above 50k, heavier tail factor (1.238 @ 60 months to 2.2) Assign weights to various outcomes and determine a new expected loss estimate Credibility 14 Reconciliation of Estimates Leads to stochastic applications Need to assign probabilities to various assumptions/scenarios Think about independence of variable Address parameter/process risk Results in better pricing for AAD considerations, swing plans, stop loss treaties, etc. 15