AY 2014-2015 ACADEMIC PROGRAM REVIEW SELF-STUDY TEMPLATE

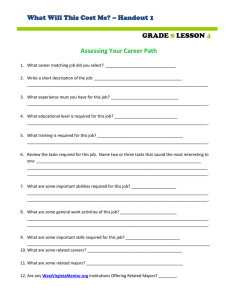

advertisement

AY 2014-2015 ACADEMIC PROGRAM REVIEW SELF-STUDY TEMPLATE Reporting School/College: Tobin College of Business Program Reviewed: Taxation MS Q Date Submitted to Department/Division Chair: Overview and Program Review Summary: Please summarize this program’s mission and its relationship to the vision and mission of St. John’s University, and the program’s School/College. Identify similar programs regionally and nationally and distinguish this program from them. In addition, summarize your findings as they relate to (1) program quality, (2) market growth potential, and (3) student learning. Also, summarize any significant changes, achievements (by faculty and students and the program itself), and plans for the future. Finally, based on the information gleaned from the data in the self-study, give an overall rating of the program’s Enrollment/Market Potential by categorizing it as one of the following: (1) Enhance; (2) Maintain; (3) Reduce support, Phase out, Consolidate, or Discontinue. (Suggested limit 1 page) STANDARD 1. The purpose of the program reflects and supports the strategic vision and mission of St. John’s University, and the program’s School/College. 1a. What evidence can you provide that demonstrates that the program embodies the Catholic, Vincentian, and metropolitan identity of St. John’s University? www.stjohns.edu/about/out-mission. (Suggested limit 1/3 page) 1b. What evidence can you provide that demonstrates that the program embodies the University’s vision. www.stjohns.edu/about/out-mission/vision-statement. (Suggested limit 1/3 page) 1c. What evidence can you provide that demonstrates that the program embodies the vision and mission of the program’s School/College? (Suggested limit 1/3 page) Standard 1. Additional comments if needed. (Suggested limit 1 page) STANDARD 2. The program attracts, retains, and graduates high quality students. 2a. Undergraduate SAT and High School Average Not Applicable 2b. Undergraduate 1st Year Retention Rate Not Applicable 2c. Undergraduate 6 Year Graduation Rate Not Applicable TCB_ACC_TAX_MS_Q Self-Study Template 1 2d. Graduate Standardized Test Scores Fall 2005 2006 2007 2008 2009 School/College Average Rate 508 511 507 522 545 Regional Comparison n.a n/a n/a n/a n/a National Comparison n/a n/a n/a n/a n/a Program Fall 2010 Taxation MS Q Fall 2011 454 Fall 2010 Peter J.Tobin Coll of Bus-Grad 540 Fall 2011 Fall 2012 530 Fall 2012 563 549 Fall 2013 471 505 Fall 2013 542 General test percentage distribution of scores within intended graduate major field that is based on the profile of GMAT candidates, 2011-12. GMAT® Degree Pursued Gender Master's in Business (MS, MSc, MA) Men: Number Mean Total Score Women: Number Mean Total Score Total: Number Mean Total Score TCB_ACC_TAX_MS_Q 2010-11 2011-12 11,339 14,307 553 12,609 552 553 17,422 557 23,948 31,729 552 555 Self-Study Template 2 2e. Please describe how the program compares with peer and aspirational institutions. (Suggested limit 1/2 page) 2f. If applicable, describe the program’s student performance over the past five years on licensure or professional certification exams relative to regional and national standards. (Suggested limit 1/4 page) 2g. Number of majors and minors enrolled over the past five years. See table below. Fall Number of Students 2006 2007 2008 2009 Majors 46 33 59 54 52 Minors 0 0 0 0 0 Total 46 33 59 54 52 MAJORS 2h. 2005 TAX MS Fall 2010 Fall 2011 Fall 2012 Fall 2013 Majors Majors Majors Majors 67 42 57 49 Number of degrees granted during the past five years. See table below. Academic Year Degrees Granted MS TCB-GR TAX TCB_ACC_TAX_MS_Q 04/05 05/06 06/07 07/08 08/09 31 30 22 52 35 Taxation MS 10/11 11/12 12/13 Degrees Conferred Degrees Conferred Degrees Conferred 4 8 8 Self-Study Template 3 Below is comparison degrees conferred data for local and national institutions based on data retrieved from the IPEDS website. This is based on the Classification of Instructional Program (CIP) Code of 52-Business, Management, Marketing, and Related Support Services. 20092010 20102011 20112012 Master's Local 4,898 National 177,684 5,532 5,719 187,213 191,571 1 Local institution include: Adelphi University, Columbia University, CUNY Queens College, Fordham University, Hofstra University, Iona College, C.W. Post University, Manhattan College, New York University, Pace University, Seton Hall University, Stony Brook University, and Wagner College. Comments : Based on the data in 2g and 2h, how do these trends compare to institutional, regional and national patterns? (Suggested limit 1/2 page) 2i. What mechanisms are in place to monitor students’ progress toward degree? And, to what extent is there a collaborative effort to provide quality advising and support services to students? (Suggested limit 1/4 page) 2j. If available, provide information on the success of graduates in this program as it relates to employment or attending graduate school. (Suggested limit 1/4 page) TCB_ACC_TAX_MS_Q Self-Study Template 4 2k. Please comment on the students’ competencies in the program. Support your response using data provided below and any other data available. (Suggested limit 1/3 page) Standard 2. Additional comments if needed: (Suggested limit 1 page) STANDARD 3. The program engages in ongoing systematic planning that is aligned with the University and School/College planning, direction, and priorities. 3a. How does your program’s strategic goal/objectives link to your School/College plan and the University’s strategic plan? http://www.stjohns.edu/about/leadership/strategic-planning 3b. What is the evidence of monitoring the external and internal environments, specifically what are the strengths, weaknesses, opportunities and threats facing the program? How were they identified? What actions have been taken in response to these findings? What characteristics of the program suggest a competitive edge against other programs regionally and nationally? 3c. What is the current and future market demand for the program? Support your response using the data provided below or any other internal or external sources to justify your response. Fastest growing occupations and occupations having the largest numerical increase in employment by level of education and training projected. TCB_ACC_TAX_MS_Q Self-Study Template 5 Change, 2010-20 Fastest Growing Occupations Percent Numeric Tax Examiners, Collectors and Preparers and Revenue Agents 7% 5,500 Accountant and Auditors 16% 190,700 Occupations having the largest numerical increase in employment Accountant and Auditors Change, 2010-20 Percent Numeric 16% 190,700 Projected Changes in Related Occupations (2010 – 2020) Changes, 2010-20 Grow faster than average - Increase 15 to 20.9% Accountant and Auditors Percent Numeric 16% 190,700 Changes, 2010-20 Grow About as Fast as Average - Increase 7 to 14.9% Tax Examiners, Collectors and Preparers and Revenue Agents Percent Numeric 7% 5,500 *For more information please visit: http://www.bls.gov/news.release/ecopro.toc.htm Standard 3. Additional comments if needed: (Suggested limit 1 page) STANDARD 4. The program provides a high quality curriculum that emphasizes and assesses student learning and engagement. 4a. Please indicate how the program curriculum is in alignment with the following three items: (Suggested limit 1/2 page for each of the three categories below) 1. Standards within the discipline 2. Curriculum integrity, coherence, academic internships, teaching excellence, teaching vibrancy, and study abroad experiences. 3. The University Core competencies 4b. The syllabi for the courses within this program incorporate the suggested elements of a syllabus – an example of which can be found at the following St. John’s University Center for Teaching and Learning link. (Suggested limit 1/3 page) http://stjohns.campusguides.com/content.php?pid=71651&sid=984766 4c. Describe the assessment model currently in place for the program and indicate the extent to which disciplinary and core knowledge, competence, and values are met, as well as findings and action plans for improvement. For reference, visit WeaveOnline – https://app.weaveonline.com//login.aspx; Digication – https://stjohns.digication.com (Suggested limit 1/2 page) TCB_ACC_TAX_MS_Q Self-Study Template 6 4d. What, if any, external validations, e.g. specialized accreditations, external awards, other validations of quality has the program received? (Suggested limit 1/3 page) Standard 4. Additional comments if needed. (Suggested limit 1 page) STANDARD 5. The program has the faculty resources required to meet its mission and goals. 5a. Below you will find the number of students enrolled as majors and minors in the program. Please complete the table by adding the number of full-time faculty assigned to the program. Then calculate the student to full-time faculty ratio. Fall 2005 # Majors/ FT Faculty FT PT Fall 2006 Total FT PT Fall 2007 Total FT PT Fall 2008 Total FT PT Fall 2009 Total FT PT Total M.S. Taxation Majors # of FTE Students 15 31 46 5 28 33 35 24 59 15 39 54 33 19 52 15.00 10.33 25.33 5.00 9.33 14.33 35.00 8.00 43.00 15.00 13.00 28.00 33.00 6.33 39.33 M.B.A. Business Taxation Majors # of FTE Students 2 4 6 0 3 3 0 3 3 0 2 2 1 2 3 2.00 1.33 3.33 0.00 1.00 1.00 0.00 1.00 1.00 0.00 0.67 0.67 1.00 0.67 1.67 Total Graduate Taxation - Queens Majors # of FTE Students 17 35 52 5 31 36 35 27 62 15 41 56 34 21 55 17.00 11.67 28.67 5.00 10.33 15.33 35.00 9.00 44.00 15.00 13.67 28.67 34.00 7.00 41.00 # of FTE Faculty assigned to the program** 2.58 3.50 3.75 2.58 3.17 FTE Student/ FTE Faculty Ratio*** 11.11 4.38 11.73 11.11 12.93 TCB_ACC_TAX_MS_Q Self-Study Template 7 Fall 2010 Fall 2011 Fall 2013 F P Total F P Total F P Total F P Total Majors Majors Majors Majors Majors Majors Majors Majors Majors Majors Majors Majors MAJORS 46 21 67 27 Fall 2010 Total Fall 2012 FTE MAJORS 15 42 39 Fall 2011 18 57 26 Fall 2012 23 49 Fall 2013 F P Total F P Total F P Total F P Total FTE FTE FTE FTE FTE FTE FTE FTE FTE FTE FTE FTE 46 7 53 27 5 32 39 6 45 26 7.667 33.667 Fall 2010 Fall 2011 Fall 2012 Fall 2013 # of FTE faculty assigned to the program FTE Student/FTE Faculty Ratio Important Notes: FTE Students = Number of FT Students + (number of PT Students/3) FTE Faculty = Number of FT Faculty + (number of PT Faculty/3) This methodology is used by SJU for all external reporting. Includes Online learning students. TCB_ACC_TAX_MS_Q Self-Study Template 8 5b. Below you will find the credit hours the department has delivered by full-time faculty and part-time faculty (including administrators) and the total credit hours consumed by non-majors. Credit Hours Fall 2005 Fall 2006 Fall 2007 Fall 2008 Fall 2009 Taught # % # % # % # % # % FT Faculty 3550 68% 3718 69% 4576 71% 5602 81% 5488 74% PT Faculty 1698 32% 1669 31% 1906 29% 1312 19% 1905 26% Total 5248 100% 5387 100% 6482 100% 6914 100% 7393 100% % consumed by NonMajors 32% Credit Hrs Taught 32% Fall 2010 Number Fall 2011 Percent Number 29% 41% Fall 2012 Percent Number Fall 2013 Percent Number Percent F-T Faculty 5,751 77.1% 4,571 66.6% 4,621 76.5% 4,684 79.0% P-T Faculty (inc Admin) 1,706 22.9% 2,293 33.4% 1,423 23.5% 1,245 21.0% 0.0% Total 7,457 100% 0.0% 6,864 Fall 2010 % Consumed by Non-Majors 1,620 TCB_ACC_TAX_MS_Q 21.7% 100% Fall 2011 1,446 21.1% 0.0% 6,044 100% 0.0% 5,929 Fall 2012 1,344 22% 22.2% 100% Fall 2013 1,431 24.1% Self-Study Template 9 5c. Below you will find the number of courses the department has delivered by full-time faculty and part-time faculty (including administrators). Courses Fall 2005 Fall 2006 Fall 2007 Fall 2008 Fall 2009 Taught # % # % # % # % # % FT Faculty 56 68% 59 70% 65 73% 66 79% 71 73% PT Faculty 26 32% 25 30% 24 27% 18 21% 26 27% Total 82 100% 84 100% 89 100% 84 100% 97 100% Courses Taught Fall 2010 Number Fall 2011 Percent Number Fall 2012 Percent Number Fall 2013 Percent Number Percent F-T Faculty 69 76.7% 80 70.2% 80 79.2% 80 80.8% P-T Faculty (inc Admin) 21 23.3% 34 29.8% 21 20.8% 19 19.2% 0.0% Total TCB_ACC_TAX_MS_Q 90 100% 0.0% 114 100% 0.0% 101 100% 0.0% 99 100% Self-Study Template 10 5d. What is the representative nature of faculty in terms of demographics, tenure and diversity? (See departmental information on next page). How well does this support the program? (Suggested limit 1/2 page) 2005 FT 2006 PT Total # % # % Male 14 74% 11 61% Female 5 26% 7 Total 19 100% Black 1 Hispanic FT 2007 PT Total # % # % 25 14 70% 14 78% 39% 12 6 30% 4 18 100% 37 20 100% 5% 0 0% 1 0 0 0% 0 0% 0 Asian 3 16% 1 6% White 15 79% 14 Unknown 0 0% Total 19 100% Tenured 16 Tenure-Track FT 2008 PT Total # % # % 28 15 71% 11 73% 22% 10 6 29% 4 18 100% 38 21 100% 0% 1 6% 1 0 0 0% 0 0% 0 4 0 0% 3 17% 78% 29 17 85% 10 3 17% 3 3 15% 18 100% 37 20 100% 84% 16 18 3 16% 3 Not Applicable 0 0% Total 19 100% FT 2009 PT Total # % # % 26 14 70% 9 82% 27% 10 6 30% 2 15 100% 36 20 100% 0% 0 0% 0 0 0 0% 0 0% 0 3 3 14% 1 7% 56% 27 17 81% 13 4 22% 7 1 5% 18 100% 38 21 100% 90% 18 18 2 10% 2 0 0 0% 19 20 100% FT PT Total # % # % 23 15 71% 12 86% 27 18% 8 6 29% 2 14% 8 11 100% 31 21 100% 14 100% 35 0% 2 18% 2 0 0% 2 14% 2 0 0% 1 9% 1 0 0% 0 0% 0 4 3 15% 1 9% 4 3 14% 1 7% 4 87% 30 16 80% 6 55% 22 16 76% 10 71% 26 1 7% 2 1 5% 1 9% 2 2 10% 1 7% 3 15 100% 36 20 100% 11 100% 31 21 100% 14 1000% 35 86% 18 17 85% 17 17 81% 17 3 14% 3 3 15% 3 4 19% 4 0 0 0% 0 0 0% 0 0 0% 0 20 21 100% 21 20 100% 20 21 100% 21 Gender Ethnicity Tenure Status TCB_ACC_TAX_MS_Q Self-Study Template 11 2010 FT 2011 PT Total # % # % 14 70% 9 82% Female 6 30% 2 18% Total 20 FT 2012 PT Total # % # % 15 71% 12 75% 27 8 6 29% 4 25% 31 21 FT 2013 PT Total # % # % 17 71% 11 92% 10 7 29% 1 8% 37 24 FT PT Total # % # % 18 72% 12 100% 8 7 28% 36 25 Gender Male 11 23 16 12 28 0% 12 30 7 37 Ethnicity Black 0% Hispanic 0% Asian American Indian/Alaskan Native 3 White 17 15% 2 1 0% 85% 7 18% 2 0% 0% 0 0% 9% 4 0% 0 64% 24 2 or More Races Native Hawaiian/Pacific Islander 14% 3 0% 17 81% 10 13% 2 0% 0% 0 0% 19% 6 0% 0 63% 27 1 Unknown Total 3 2 0% 20 1 11 9% 1 21 21% 2 0% 18 75% 6 25% 3 0% 1 8% 1 0% 0 0% 1 8% 1 17% 7 20% 3 25% 8 0% 0 0% 0 50% 24 58% 26 0% 0 1 0% 31 5 3 1 16 6% 1 24 0% 19 76% 7 1 0% 37 5 1 12 8% 1 0% 36 25 12 37 Tenure Status Tenured 15 75% 15 15 71% 15 15 63% 15 16 64% 16 Tenure-Track 3 15% 3 4 19% 4 7 29% 7 8 32% 8 Not Applicable 2 10% 2 2 10% 2 2 8% 2 1 4% 1 Total 20 20 21 21 24 24 25 TCB_ACC_TAX_MS_Q 25 Self-Study Template 12 5e. What evidence exists that the program’s faculty have engaged in research and scholarship on teaching and/or learning in the program’s field of study? (Suggested limit 1/2 page) 5f. What initiatives have been taken in the past five years to promote faculty development in support of the program? (Suggested limit 1/2 page) 5g. The table below shows the amount of external funding received by the department. If available, please provide the dollar amount of externally funded research for full-time faculty supporting the program under review. (Program dollar amounts are available through departmental records.) Fiscal Year External Funding 04/05 05/06 06/07 07/08 08/09 $ Amount Program $ Amount Department Fiscal Year External Funding 09/10 10/11 11/12 12/13 $ Amount Program $ Amount Department - - - - 5h. Please comment on the table below that shows trends in overall course evaluation and instructional vibrancy for your program (if available), your college and the university. (Suggested limit ½ page) TCB_ACC_TAX_MS_Q Self-Study Template 13 Overall Evaluation (Spring) 2011 2012 2013 Instructional Vibrancy (Spring) 2011 2012 2013 Taxation (Q) - - - - - - Tobin College of Business 4.09 4.24 4.25 4.36 4.49 4.50 Total Graduate 4.14 4.16 4.30 4.37 4.39 4.52 Note: Institutional Vibrancy is the average of the first 14 questions on the course evaluation, with questions pertaining to course organization, communication, faculty-student interaction, and assignments/grading. All course evaluation questions range from 1 (Strongly Disagree) to 5 (Strongly Agree). 5i. What percentage of full time faculty assigned to this program have terminal degrees or industry certifications renewed within the past 2 years? Comment. (Suggested limit 1/3 page) Standard 5. Comments: Indicate to what extent the program has the faculty resources required to meet its mission and goals. Include references from 5a – 5i. (Suggested limit 1 page) Standard 5. Additional comments if needed. (Suggested limit 1 page) STANDARD 6. The program has adequate resources to meet its goals and objectives. And, it is cost-effective. 6a. Narrative/Supportive Technological Environment - Comment on classrooms and labs meeting industry-standards for quality and availability of hardware, software, and peripherals; library space, holdings and services; science laboratories, TV studios, art/computer graphic labs; etc. (Suggested limit 1 page) 6b. Narrative/ Supportive Physical Environment - Comment on level of faculty and student satisfaction with HVAC; faculty and student satisfaction with classroom lighting, crowdedness, and acoustics; flexible teaching environments, and faculty offices, etc.. (Suggested limit 1 page) 6c. To what extent has the University funded major capital projects, e.g., renovations, which are linked directly to the program during the past five years? (Bulleted list) 6d. If external data that describes the cost effectiveness of the program has been provided by your School/College Dean, please comment on the program’s cost-effectiveness. (Suggested limit 1 page) TCB_ACC_TAX_MS_Q Self-Study Template 14 Standard 6. Additional comments if needed. (Suggested limit 1 page) STANDARD 7. Effective actions have been taken based on the findings of the last program review and plans have been initiated for the future. Comments: (Suggested limit 1page) TCB_ACC_TAX_MS_Q Self-Study Template 15