Loss Reserve Opinions Mary D. Miller FCAS, MAAA Ohio Department of Insurance

advertisement

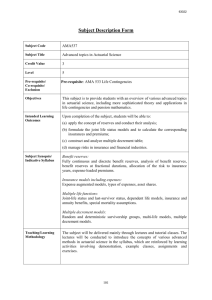

Loss Reserve Opinions Mary D. Miller FCAS, MAAA Ohio Department of Insurance CASE 2006 Fall Meeting September 13, 2006 Actuarial Hat Trick • Regulator and Vice-Chair of Casualty Actuarial Task Force of NAIC • AAA Casualty Vice-President • Newly Elected CAS Board Member I am happy to answer questions from any perspective Regulatory Actuaries and the NCAA • States with Regulatory Actuaries – – – – – – – – Texas Ohio Pennsylvania Florida California North Carolina Illinois West Virginia • States with Teams in BCS or Final 4 – – – – – – – – Texas Ohio Pennsylvania Florida California North Carolina Illinois West Virginia How Do Regulators Use Opinions? • Potentially, 55 variations on the “ensure solvency” theme! • Consequently domiciliary nuances usually apply! Reserving Risk • Generally largest risk for every company • It’s where all the other risks eventually reside • Regulator’s view of reserves depends on many variables – Solvency Position – Spread of Risk – Management competence What Should a Regulator Want to See? • Consistency with the Instructions • Consistency with other information about the company • Clarity on risks, materiality and RMAD conclusions • A report that clearly supports the opinion • Unanswered questions raise eyebrows Actuarial Opinion Summary (AOS) • Compromise position to public disclosure of information • Regulators wanted information sooner • Required to be sent only to domiciliary state – Other states may request if they can demonstrate they can protect confidentiality – Due March 15 – Will now be a supplemental filing with separate Instructions Actuarial Opinions • Carried Reserves are Management’s Best Estimate – Summary (new in 2006) shows Actuary’s Point Estimate and/or Range – Question Significant Differences • Type of Opinion: – Reasonable, Deficient/Inadequate, Redundant/Excessive, Qualified, No Opinion. • Relevant Comments – Risk of Material Adverse Deviation – Reinsurance: retroactive, financial, collectibility – IRIS Ratios 10-12 exceptional values 8 Actuarial Opinion – What Can It Tell Me? “The Company’s carried reserves fall within the reasonable range of estimates developed by the Appointed Actuary, although near the low end of that range…” 9 Actuarial Opinion – What Can It Tell Me? “As noted in Schedule F, the Company’s ceded loss and LAE reserves totaled $xxx, or 223% of surplus. Of this amount, 27.7% reflects cessions to affiliates…” 10 Actuarial Opinion – What Can It Tell Me? “In my opinion there is a risk of material adverse deviation…including uncertainties associated with the company’s changing mix of business and operations,…liabilities relating to the Company’s discontinued operations, potential reinsurance collectibility issues and estimates of liability for the Company’s A&E exposure.” 11 Actuarial Opinion – What Can It Tell Me? “The Group has experienced significant changes in its operations…The nature of the business has also changed…The Company has experienced significant changes in its claim operations…” 12 Actuarial Opinion – What Can It Tell Me? “There are points within my reasonable range of reserve estimates that … would materially reduce the Company’s surplus…Certain points nearer the high end of my range would…change the Company’s RBC status to Company Action Level.” 13 Actuarial Opinion – Regulatory Guidance “Bright Line Indicator” to Discuss the Potential for Material Adverse Deviation If 10% of the insurer’s net reserves are greater than the difference between the Total Adjusted Capital and Company Action Level Capital 14 2005 AOS Results –4 State Totals OH, TX, PA, IL(Net Only) Carried reserves are: More than 10% below Net Gross 6 1.0% 1.3% 10 2.1% 2.3% More than 5% but less than 10% below 13 2.1% 2.7% 18 3.8% 4.1% Less than 5% below 79 13.0% 16.5% 72 15.2% 16.2% Equal to but other than $0 reserve 80 13.2% 16.7% 90 18.9% 20.3% 183 30.2% 38.3% 167 35.2% 37.6% More than 5% but less than 10% above 67 11.1% 14.0% 41 8.6% 9.2% More than 10% above 50 8.3% 46 9.7% 10.4% 31 6.5% Less than 5% above Carried reserves are zero 128 21.1% Total # of Companies 606 10.5% 478 475 444 What’s the Development Trend? Development as a % of Reserves < -10% Missing -10% to – 5% CY -5% to 0% 0% to 5% 5% to 10% > 10% # of Companies 1998 143 761 335 427 297 128 311 1999 107 696 293 430 393 121 301 2000 130 647 252 442 350 151 319 2001 119 602 200 330 377 199 445 2002 138 520 192 258 409 212 493 2003 157 492 178 335 401 213 430 NAIC, 2004 Other Hot Topics • • • • • Risk Transfer/Bifurcation International Risk-focused Examinations Qualifications Standard Governance Initiatives What’s Next • October 11-12 2nd Opinion Writers Seminar • AAA - Presentation for Boards – what to expect from your actuary • Best Estimate White Paper • Results of Survey by Task Force for Enhancing the Reputation of Casualty Actuaries • CRUSAP Report