Biological and Psychobehavioral Correlates of Risk Taking, Credit Scores, and Automobile

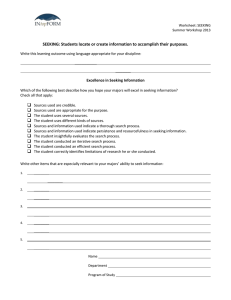

advertisement

Biological and Psychobehavioral Correlates of Risk Taking, Credit Scores, and Automobile Insurance Losses: Toward an Explication of Why Credit Scoring Works Patrick Brockett (brockett@mail.utexas.edu), and Linda Golden (mkllg@mail.utexas.edu) Presentation to the Casualty Actuarial Society Predictive Modeling Conference on October 11, 2007, Las Vegas, Nevada Reference for details: Brockett, Patrick L. and Linda L. Golden “Biological and Psychobehavioral Correlates of Risk Taking, Credit Scores, and Automobile Insurance Losses: Toward an Explication of Why Credit Scoring Works,” Journal of Risk and Insurance, Vol 74(1), March 2007. 23-63. Available electronically from JSTOR, Blackwell Publishing, accessible from www.ARIA.org, or by emailing the authors 75 Copies available at the meeting The most important development in the past two decades in personal lines of insurance may well be the use of an individual’s credit history as a classification and rating variable to predict losses. Empirical Relationship Demonstrated The statistical evidence between insured losses and credit score has been repeatedly demonstrated. Very strong correlation between a bad credit score and increased insurance losses. Research Examples. . . . . . Chart 6 Incurred loss (dollars) Average Incurred Loss es Within Each Decile for Policies Grouped by Credit Score Decile 1,000 $918 900 1st credit sco re decile = lo west credit score $846 800 700 10 th credit sco re decile = h ighest credit score $791 $707 $668 $703 $681 $631 600 $584 $568 $558 8th 9th 10 th 500 400 300 200 100 - /\/\/\/\ No credit score available 1st 2n d 3rd 4th 5th 6th 7th ------ Credit score decile ------ Excerpted from University of Texas study conducted for Texas legislature, 2003 Chart 5 Average Relative Loss Ratios By Credit Scores for Standard Market Data Set Av g. relative loss ratio 1.8 1 st credit sco re decile = lowest credit score 1.53 1.6 1 0th credit sco re decile = h ighest credit score 1.4 1.2 1.28 1.07 1.06 1.00 1.0 0.99 0.88 0.84 0.8 0.78 0.72 0.76 9 th 1 0th 0.6 0.4 0.2 0.0 /\/\/\/\ No credit score available 1 st 2 nd 3 rd 4 th 5 th 6 th 7 th 8 th ------ Credit score decile ------ Excerpted from University of Texas study conducted for Texas legislature, 2003 Tillman and Hobbs (1949): drivers with bad credit history have repeated crashes at a rate six times higher than those with good credit history. Washington state study (1968): within the group with a history of no automobile accidents, 64% had good credit and 35% had bad credit-- among group with two or more automobile accidents, 35% had bad credit, -almost twelve times the percentage (3%) who had good credit Other correlates: divorce, legal problems, job turnover, lower education Research Results Summarized “…a man drives as he lives.” Tillman and Hobbs, 1949 The purpose of this research is to present a “missing link” explaining why credit scores are associated with insurance losses. The outcome of the debate over the use of credit scoring has implications for the social acceptability of Actuarial Standard #12, and has implications for other variables useful for underwriting. Heuristic Model Insured Loss = f(X1,X2) Credit Score = g(Y1,X2) Where: X1 denotes a vector of automobile specific characteristics, X2 denotes a vector of person specific psychological (and possibly biological) characteristics, and Y1 denotes a vector of credit specific attributes Proposition: The correlation between Insured Losses and Credit Score is high and positive because of the common vector factor X2 (which is in turn correlated with both X1 and Y1 ). Simplified Model of Conjunctive Influences between Insured Losses and Credit Insured Auto Losses Risk Taking Behavior (Driving) Biochemical Psychobehaviora l Profile Risk Taking Behavior (Financial) Credit Score The Core Idea Connector between risk taking behavior in automobile insurance losses and credit scores and financial risk taking is the psychological dimension. Most easily identified psychological characteristic is the personality type known as “sensation seeking” or “novelty seeking.” It is related to responsibility and risk taking. Psychobehavioral Profile of Sensation Seeking/Novelty Seeking Reduced Deliberation Reduced Perceived Risk Increased Perceived Benefits Overestimation of Skills Risky Behaviors Risky Driving High Risk Occupations Drinking/ Drug Use High Risk Sports Drinking/ Driving Reduced Personal Responsibility 1These terms are often used interchangeably in the literature. The “sensation seeking” term comes from Zuckerman (1979) and “novelty seeking” is attributable to Cloninger (1987). A Biological Component “If serotonin is the brakes, dopamine is the accelerator in the drive to risky behavior.” Zuckerman and Kuhlman, 2000 Biochemical and Psychobehavioral Profile of Sensation Seeking/Novelty Seeking Low Levels of MAO-A High Levels of Norepinephrin e Low Levels of MAO-B Low Levels of Serotonin Corticosterone High Levels of Dopamine High Levels of Testosterone Low Levels of Cortisol Marriage Stress Depression Exploratio n Amplifies reaction to stimuli Impulsivit y Arousal Employment High SES Antisocial Behavior Low Intellect LEGEND Biochemicals Low Education Risk Taking Responses Low Occupational Status Socio-cultural Outcomes Mediating Factors 1These SENSATION SEEKING terms are often used interchangeably in the literature. The “sensation seeking” terms comes from Zuckerman (1979) and “novelty seeking” is attributable to Cloninger (1987). Influences on sensation seeking and novelty seeking have implications for automobile insurance losses. Comprehensive Overview of Biochemical and Psychobehavioral Influences Related to Paid Automobile Insurances Losses Potential Biochemical Influeners Driver Psycho-behavioral Profile Monoamine Oxidase Cortisol Risk Appraisal Judgments Post-Accident Decisions and Influences on Loss Amount Loss Incurred by Insurer Insured’s Possible Claim Size Build-Up 3rd Party at Fault Accident Inattentive to Details or Environment Risk Perceptions Judgments At Fault Accident Actual Loss to Insured Distractibility/ Lack of Focus Dopamine Corticosterone Accident Characteristics Impulsive Driving Decisions Serotonin Norepinephrine Risky Driving Behavior Sensation Seeking/Novelt y Seeking Aggressive/ Antisocial Behavior Insured’s Loss Mitigation Activities Testosterone Irresponsibility Regarding Driving Behavior Insured’s Reporting Decision Accident Caused by Act of God Age, Gender, Marital Status, Education, SES, Rural/Urban/Inner City Dweller Prior Policy Limits & Policy Coverage Decisions by Insured Vehicle Characteristics Prior Deductible Choice by Insured Other High RiskTaking Behaviors Driver Characteristics & Demographics Actual Paid Insurance Losses Reported Loss to Insurer Driver Psychological and Economic Profile Influences Biochemical Psycho-behavioral System Feedback Financial decision making is also related to psychobehavioral and biochemical variables. Brown and Harlow (1990) examined blood samples and determined that financial risk taking is related to blood chemistry. Other research has shown sensation seeking/novelty seeking is related to financial decision making………. Reduced risk perception and risk appraisal play an important role in the individual’s propensity for sensation seeking which, in turn, is an integral part of the individual’s financial decision making. Risk tolerance is evident in both the filing of insurance claims and excessive credit card use (impulse buying which may be linked to MAO and dopamine or financial stress linked to serotonin, cortisol, dopamine, and norepinephrine). Debt and poor money management create and are the result of financial stress which may be linked to serotonin, cortisol, dopamine, and norepinephrine. Each of these decisions directly impacts the individual’s credit score which is often used as a variable in predicting losses in automobile insurance coverage. Miraplex and chemically induced risk taking …and financial decision making determines, in part, a person’s credit score… Comprehensive Overview of Biochemical and Psychobehavioral Influences Related to Credit Score Potential Biochemical Influencers Psycho-behavioral Profile Monoamine Oxidase Risky Financial/ Credit Behavior Impulsive Financial/Purchase Decisions Risk Appraisal Judgments Serotonin Risk Perception Judgments Inattentive to Details or Environment Distractable/Unabl e to Focus Length of Credit Record Missed Payment History Late Payment History Dopamine Corticosterone Total Credit Card Debt to Credit Line Ratio Defaults on Debts or Derogatory Public Records Cortisol Norepinephrine Credit History Record Sensation / Seeking Novelty Seeking Irresponsible Regarding Financial or Credit Obligations Testosterone Economic Exigencies Medical Exigency Divorce Unemployment Number of Credit Lines Open Credit Inquiries in Past 30 Days Credit Score Notice that: The same risk taking correlates show up across realms from driving to financial decision-making. Why? Possible Theoretical Explanations Risk Homeostasis Theory: all behaviors hold some level of risk and the challenge of driving is to maximize the overall benefits of the behavior. The driver learns to adjust behaviors when a discrepancy is observed between the observed level of risk and the target level of risk. (Burns and Wilde 1995; Wilde 2002) Target Risk Theory: an adaptation of risk homeostasis that necessitates the adjustment of driving behavior so that perceived risk is in line with target risk. (Wilde 2002) The biochemical mechanisms coupled with Wilde’s Homeostasis Theory suggests an intrinsic biological mechanism at play in the relationship between risk taking and behavior of all types. Irrespective of the viability of theoretical explanations, we can graphically summarize the biochemical and behavioral commonalities between credit scores and insured loss generation. . . . Putting All The Relationships Together, We Have . . . Biological and Psychobehavioral Correlates of Risk Taking, Credit Scores, and Automobile Insurance Losses Low Levels of MAO-A Low Levels of Serotonin High Levels of Norepinephrine Low Levels of Cortisol High Levels of Testosterone High Levels of Dopamine Corticosterone Exploration Depression Stress Impulsivity Amplifies reaction to stimuli Arousal SENSATIO N SEEKING Impulsive driving decisions Risk Appraisal Judgments Antisocial Behavior Impulsive financial/purchase decisions Risk Perception Judgments Inattention to details or the environment (road conditions, road signs, traffic conditions) Inattention to details or the environment (interest rates, penalty fees, payment due dates) Risky Driving Behavior Risky Financial/Credit Behavior Distractibility/ lack of focus Distractibility/lack of focus (no financial planning, no savings) Credit History Irresponsibility regarding driving behavior (drinking, speeding, light/sign running, unsafe lane changes Irresponsibility regarding financial or credit obligations (extravagance, overextended on credit cards) Insurance Losses Credit Score Thank you very much for your attention. Questions? Comments?