A Quantitative Overview of US Casualty Insurance and Reinsurance: Trends and Conclusions

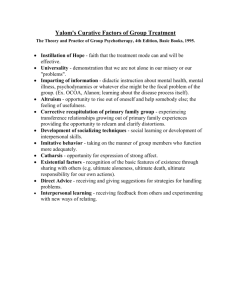

advertisement

A Quantitative Overview of US Casualty Insurance and Reinsurance: Trends and Conclusions Presented by: Isaac Mashitz May 20, 2008 CARE Boston Meeting Isaac Mashitz CARe Meeting - Boston May 20, 2008 A Quantitative Overview of US Casualty Insurance and Reinsurance: Trends and Conclusions – Neither the author nor Swiss Reinsurance America Corporation ("Swiss Re America") make any warranty or representation concerning the completeness or accuracy of the Paper or the information contained therein. Swiss Re America and the author disclaim all responsibility for liability, cost or expense arising out of reliance upon the Paper or its contents. This Paper is not intended to replace the Recipient’s own analysis, procedures and controls, in whole or in part, or to modify any reinsurance agreement or other legal obligation. – By accepting this document, the recipient acknowledges and accepts the foregoing. Page 2 Copyright 2008, Swiss Reinsurance America Corporation. Swiss Re America reserves all rights in and to the paper and its contents. US P&C Primary Industry Commercial Auto/ Truck Liability/ Medical 1. Losses grew less than 3% per year over last 20 years. 2. Premium remained static from 1987 to1999 as losses grew more than 50% 3. Commissions appear remarkably stable. 4. 2006 was still very profitable. Premium and loss static since 2003. Page 3 Accident Gross Earned Commission Estimated Estimated Discounted Year Premium Ratio Ultimate Loss Ultimate LR Loss & Comm Ratio 1984 6.46 8.41 130% 109% 1985 8.66 9.65 111% 91% 1986 13.11 9.88 75% 69% 1987 14.99 10.80 72% 71% 1988 14.76 11.41 77% 74% 1989 15.04 12.18 81% 76% 1990 15.02 11.83 79% 74% 1991 14.75 12.2% 10.80 73% 70% 1992 14.87 11.4% 10.95 74% 72% 1993 15.23 11.3% 11.78 77% 77% 1994 15.75 11.3% 13.15 83% 85% 1995 15.12 12.1% 12.54 83% 81% 1996 15.27 12.2% 13.22 87% 84% 1997 15.34 12.7% 14.05 92% 90% 1998 15.13 13.0% 14.58 96% 94% 1999 15.54 12.7% 16.44 106% 104% 2000 17.00 12.5% 17.09 101% 98% 2001 18.54 12.9% 16.75 90% 88% 2002 21.83 12.6% 16.30 75% 79% 2003 23.96 12.3% 15.99 67% 73% 2004 24.59 12.7% 15.88 65% 73% 2005 25.14 12.3% 16.47 66% 73% 2006 24.85 16.96 68% 73% Total 380.94 307.12 81% Annual Growth 1987-2006 (Exp. Fit) 3.0% 2.7% 1987-2006 2.7% 2.4% Source: AM Bests Averages and Averages and primary company Annual Statements US P&C Primary Industry Commercial Auto/ Truck Liability/ Medical 1. Restated Loss Ratio is remarkably stable. 2. Only a small residual cyclical effect. Conclusion: Soft market u/w losses were driven by inadequate premium rather than extraordinary growth in losses. Page 4 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Annual Growth Gross Earned Premium 6.46 8.66 13.11 14.99 14.76 15.04 15.02 14.75 14.87 15.23 15.75 15.12 15.27 15.34 15.13 15.54 17.00 18.54 21.83 23.96 24.59 25.14 24.85 380.94 Estimated Ultimate Loss 8.41 9.65 9.88 10.80 11.41 12.18 11.83 10.80 10.95 11.78 13.15 12.54 13.22 14.05 14.58 16.44 17.09 16.75 16.30 15.99 15.88 16.47 16.96 307.12 Estimated Ultimate LR 130% 111% 75% 72% 77% 81% 79% 73% 74% 77% 83% 83% 87% 92% 96% 106% 101% 90% 75% 67% 65% 66% 68% 81% Smoothed Premium 14.99 15.43 15.89 16.35 16.84 17.34 17.85 18.37 18.92 19.48 20.05 20.64 21.25 21.88 22.53 23.20 23.88 24.59 25.31 26.06 3.0% Source: AM Bests Averages and Averages and primary company Annual Statements Restated Loss Ratio 72% 74% 77% 72% 64% 63% 66% 72% 66% 68% 70% 71% 77% 78% 74% 70% 67% 65% 65% 65% US P&C Primary Industry Commercial Auto/ Truck Liability/ Medical 1. It is astounding that from 1989 to 2001 original12 month LR was always between 80 and 85 while the ultimate LR varied between 73 and 106. 2. 1991 had a 12 mo LR of 82 and 1999 had a 12 mo LR of 85!!!!! Page 5 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Gross Earned Premium 6.46 8.66 13.11 14.99 14.76 15.04 15.02 14.75 14.87 15.23 15.75 15.12 15.27 15.34 15.13 15.54 17.00 18.54 21.83 23.96 24.59 25.14 24.85 380.94 Estimated Ultimate Loss 8.41 9.65 9.88 10.80 11.41 12.18 11.83 10.80 10.95 11.78 13.15 12.54 13.22 14.05 14.58 16.44 17.09 16.75 16.30 15.99 15.88 16.47 16.96 307.12 Estimated Ultimate LR 130% 111% 75% 72% 77% 81% 79% 73% 74% 77% 83% 83% 87% 92% 96% 106% 101% 90% 75% 67% 65% 66% 68% 81% Original 12 Mo Ultmate LR Source: AM Bests Averages and Averages and primary company Annual Statements 82% 83% 82% 81% 81% 82% 83% 81% 84% 85% 85% 84% 80% 73% 69% 67% 67% US P&C Primary Industry Commercial Auto/ Truck Liability/ Medical 1. Ceded LR/Gross LR is over 100% in and only in soft markets. 2. Over last ten years claim frequency trend is negative and claim severity trend about 4%. How does this compare to ISO? Accident Gross Earned Estimated Estimated Year Premium Ultimate Loss Ultimate LR 1984 6.46 8.41 130% 1985 8.66 9.65 111% 1986 13.11 9.88 75% 1987 14.99 10.80 72% 1988 14.76 11.41 77% 1989 15.04 12.18 81% 1990 15.02 11.83 79% 1991 14.75 10.80 73% 1992 14.87 10.95 74% 1993 15.23 11.78 77% 1994 15.75 13.15 83% 1995 15.12 12.54 83% 1996 15.27 13.22 87% 1997 15.34 14.05 92% 1998 15.13 14.58 96% 1999 15.54 16.44 106% 2000 17.00 17.09 101% 2001 18.54 16.75 90% 2002 21.83 16.30 75% 2003 23.96 15.99 67% 2004 24.59 15.88 65% 2005 25.14 16.47 66% 2006 24.85 16.96 68% Total 380.94 307.12 81% Ceded LR/ Gross LR 129% 106% 87% 90% 94% 93% 100% 92% 98% 96% 99% 95% 98% 105% 114% 118% 116% 119% 104% 97% 101% 100% 97% # of Reported Claims 2,236,205 2,360,143 2,298,522 2,330,799 2,506,967 2,553,366 2,323,254 2,146,880 2,021,454 1,981,776 1,941,306 1,666,291 Annual Growth 1995-2005 (Exp. Fit) Page 6 Source: AM Bests Averages and Averages and primary company Annual Statements -1.8% Average 5,609 5,602 6,111 6,254 6,557 6,693 7,212 7,595 7,910 8,015 8,485 10,176 4.4% US P&C Primary Industry Other Liability - Occurrence + Products Occ & CLM Md 1. No growth in premium 1989 to 2000 while losses nearly doubled. 2. Premium doubled 2000 to 2006 and still growing. 3. Commission ratio declining ’02-’05. 4. Twenty year avg loss trend under 5%. Large increase in ’05,’06. But ’05, ’06 still profitable 5. Radical loss drop ’85’87 & premium drop ’87-’89. Page 7 Accident Gross Earned Commission Estimated Estimated Discounted Year Premium Ratio incl PL Ultimate Loss Ultimate LR Loss & Comm Ratio 1984 9.43 19.81 210% 154% 1985 14.55 19.40 133% 99% 1986 25.49 15.16 59% 55% 1987 26.15 13.59 52% 54% 1988 23.64 13.93 59% 58% 1989 21.58 14.36 67% 63% 1990 21.12 14.83 70% 66% 1991 20.18 10.7% 14.45 72% 63% 1992 19.64 11.0% 14.17 72% 65% 1993 19.66 11.5% 14.75 75% 71% 1994 20.82 11.4% 15.97 77% 74% 1995 19.77 12.2% 15.72 79% 74% 1996 19.16 12.4% 16.32 85% 79% 1997 19.55 12.2% 18.56 95% 87% 1998 20.76 11.6% 22.25 107% 96% 1999 21.82 11.3% 26.06 119% 109% 2000 22.06 11.8% 26.95 122% 110% 2001 27.59 11.6% 28.11 102% 92% 2002 32.79 12.0% 25.71 78% 78% 2003 39.33 11.7% 25.55 65% 68% 2004 43.93 11.2% 25.63 58% 63% 2005 45.15 10.8% 28.26 63% 65% 2006 47.51 31.40 66% 72% Total 581.68 460.94 79% 0% Annual Growth 1987-2006 (Exp. Fit) 3.9% 4.9% 1987-2006 3.2% 4.5% *OL and Products (CM and Occ.) Source: AM Bests Averages and Averages and primary company Annual Statements US P&C Primary Industry Other Liability - Occurrence + Products Occ & CLM Md 1. Restated Loss Ratio is stable. 2. Residual cyclical effect. Conclusion: Soft market u/w losses were driven by inadequate premium rather than extraordinary growth in losses. Page 8 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Annual Growth Gross Earned Premium 9.43 14.55 25.49 26.15 23.64 21.58 21.12 20.18 19.64 19.66 20.82 19.77 19.16 19.55 20.76 21.82 22.06 27.59 32.79 39.33 43.93 45.15 47.51 581.68 Estimated Ultimate Loss 19.81 19.40 15.16 13.59 13.93 14.36 14.83 14.45 14.17 14.75 15.97 15.72 16.32 18.56 22.25 26.06 26.95 28.11 25.71 25.55 25.63 28.26 31.40 460.94 Estimated Ultimate LR 210% 133% 59% 52% 59% 67% 70% 72% 72% 75% 77% 79% 85% 95% 107% 119% 122% 102% 78% 65% 58% 63% 66% 79% Smoothed Premium Source: AM Bests Averages and Averages and primary company Annual Statements 26.15 26.96 27.80 28.66 29.55 30.46 31.41 32.38 33.38 34.42 35.48 36.58 37.72 38.88 40.09 41.33 42.61 43.93 45.29 46.69 3.1% Restated Loss Ratio 52% 52% 52% 52% 49% 47% 47% 49% 47% 47% 52% 61% 69% 69% 70% 62% 60% 58% 62% 67% US P&C Primary Industry Other Liability - Occurrence + Products Occ & CLM Md 1. It is astounding that from 1991 to 2001 original12 month LR was always between 77 and 84 while the ultimate LR varied between 72 and 122. 2. 1991 had a 12 mo LR of 77 and 2000 had a 12 mo LR of 84!!!!! Page 9 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Gross Earned Premium 9.43 14.55 25.49 26.15 23.64 21.58 21.12 20.18 19.64 19.66 20.82 19.77 19.16 19.55 20.76 21.82 22.06 27.59 32.79 39.33 43.93 45.15 47.51 581.68 Estimated Ultimate Loss 19.81 19.40 15.16 13.59 13.93 14.36 14.83 14.45 14.17 14.75 15.97 15.72 16.32 18.56 22.25 26.06 26.95 28.11 25.71 25.55 25.63 28.26 31.40 460.94 Estimated Ultimate LR 210% 133% 59% 52% 59% 67% 70% 72% 72% 75% 77% 79% 85% 95% 107% 119% 122% 102% 78% 65% 58% 63% 66% 79% Original 12 Mo Ultmate LR Source: AM Bests Averages and Averages and primary company Annual Statements 77% 77% 79% 78% 78% 78% 78% 82% 84% 84% 78% 71% 67% 68% 65% US P&C Primary Industry Other Liability - Occurrence + Products Occ & CLM Md 1. Ceded LR/Gross LR is over 100% in and only in soft markets. 2. Over last ten years claim frequency trend and claim severity trend is about 4% & 2% but data is very erratic. What is going on? How does this compare to ISO? Page 10 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Gross Earned Premium 9.43 14.55 25.49 26.15 23.64 21.58 21.12 20.18 19.64 19.66 20.82 19.77 19.16 19.55 20.76 21.82 22.06 27.59 32.79 39.33 43.93 45.15 47.51 581.68 Estimated Ultimate Loss 19.81 19.40 15.16 13.59 13.93 14.36 14.83 14.45 14.17 14.75 15.97 15.72 16.32 18.56 22.25 26.06 26.95 28.11 25.71 25.55 25.63 28.26 31.40 460.94 Estimated Ultimate LR 210% 133% 59% 52% 59% 67% 70% 72% 72% 75% 77% 79% 85% 95% 107% 119% 122% 102% 78% 65% 58% 63% 66% 79% Ceded LR/ Gross LR 132% 114% 86% 82% 87% 87% 94% 91% 94% 91% 93% 92% 97% 101% 105% 115% 123% 94% 89% 89% 92% 95% 96% Annual Growth 1995-2005 (Exp. Fit) Source: AM Bests Averages and Averages and primary company Annual Statements # of Reported Claims 4,937,584 4,859,856 4,761,191 6,875,710 4,911,344 5,256,146 8,973,351 5,211,799 9,432,271 6,057,983 5,780,622 4,820,277 3.5% Average 3,183 3,357 3,897 3,236 5,307 5,127 3,133 4,934 2,709 4,231 4,890 6,513 2.1% US P&C Primary Industry Worker’s Compensation 1. Data anomaly ’94-’95. Trends only from ’95. Premium drop ’91-’94 & ’95-’00. Continuous increases since ’99. 2. Losses decreased dramatically ‘90-’94. Why? 3. Loss increase in ’06 but still profitable. Premium still increasing. 4. Commission Ratio declining ’01-’05 Page 11 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Annual Growth 1995-2006 (Exp. Fit) 1995-2006 Gross Earned Premium 17.82 20.99 26.12 29.75 34.00 38.03 43.39 46.47 44.51 42.62 42.67 33.00 31.70 29.62 29.32 28.53 31.22 34.93 39.68 44.51 46.80 50.02 51.76 837.46 5.6% 4.2% Commission Ratio 6.0% 5.4% 4.5% 4.3% 4.4% 4.4% 4.1% 3.7% 4.0% 4.2% 4.7% 5.9% 6.1% 6.9% 7.7% 8.5% 8.6% 9.0% 8.5% 8.1% 8.2% 7.2% Estimated Ultimate Loss 19.57 22.28 25.63 28.35 33.27 37.55 41.39 39.45 32.43 27.89 28.30 22.56 23.51 25.51 29.49 31.69 34.14 34.62 31.54 30.91 31.25 33.90 38.02 703.28 Estimated Discounted Ultimate LR Loss & Comm Ratio 110% 88% 106% 81% 98% 79% 95% 82% 98% 83% 99% 82% 95% 79% 85% 71% 73% 64% 65% 60% 66% 63% 68% 63% 74% 68% 86% 79% 101% 92% 111% 104% 109% 102% 99% 92% 79% 79% 69% 71% 67% 71% 68% 70% 73% 82% 84% 3.8% 4.9% Source: AM Bests Averages and Averages and primary company Annual Statements US P&C Primary Industry Worker’s Compensation 1. It is astounding that from 1989 to 2001 original12 month LR was always between 76 and 90 while the ultimate LR varied between 65 and 111. 2. 1992 had a 12 mo LR of 89 and 1999 had a 12 mo LR of 88!!!!! Page 12 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Gross Earned Premium 17.82 20.99 26.12 29.75 34.00 38.03 43.39 46.47 44.51 42.62 42.67 33.00 31.70 29.62 29.32 28.53 31.22 34.93 39.68 44.51 46.80 50.02 51.76 837.46 Estimated Ultimate Loss 19.57 22.28 25.63 28.35 33.27 37.55 41.39 39.45 32.43 27.89 28.30 22.56 23.51 25.51 29.49 31.69 34.14 34.62 31.54 30.91 31.25 33.90 38.02 703.28 Estimated Ultimate LR 110% 106% 98% 95% 98% 99% 95% 85% 73% 65% 66% 68% 74% 86% 101% 111% 109% 99% 79% 69% 67% 68% 73% 84% Original 12 Mo Ultmate LR Source: AM Bests Averages and Averages and primary company Annual Statements 90% 90% 90% 89% 81% 78% 78% 76% 79% 87% 88% 87% 89% 79% 74% 74% 74% US P&C Primary Industry Worker’s Compensation 1. Restated Loss Ratio is remarkably stable. 2. Only a small residual cyclical effect. Conclusion: Soft market u/w losses were driven by inadequate premium rather than extraordinary growth in losses. Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Gross Earned Premium 17.82 20.99 26.12 29.75 34.00 38.03 43.39 46.47 44.51 42.62 42.67 33.00 31.70 29.62 29.32 28.53 31.22 34.93 39.68 44.51 46.80 50.02 51.76 837.46 Estimated Ultimate Loss 19.57 22.28 25.63 28.35 33.27 37.55 41.39 39.45 32.43 27.89 28.30 22.56 23.51 25.51 29.49 31.69 34.14 34.62 31.54 30.91 31.25 33.90 38.02 703.28 Estimated Ultimate LR 110% 106% 98% 95% 98% 99% 95% 85% 73% 65% 66% 68% 74% 86% 101% 111% 109% 99% 79% 69% 67% 68% 73% 84% Smoothed Premium 33.00 34.30 35.66 37.07 38.54 40.07 41.66 43.31 45.02 46.80 48.66 50.58 4.0% Page 13 Source: AM Bests Averages and Averages and primary company Annual Statements Restated Loss Ratio 68% 69% 72% 80% 82% 85% 83% 73% 69% 67% 70% 75% US P&C Primary Industry Worker’s Compensation 1. Ceded LR/Gross LR is signif over 100% in and only in unprofitable years. 2003 is very low. Trend is up but data is not mature. 2. Over last ten years claim frequency trend is signif neg and claim severity trend is almost 10%. How does this compare to NCCI? Page 14 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Gross Earned Premium 17.82 20.99 26.12 29.75 34.00 38.03 43.39 46.47 44.51 42.62 42.67 33.00 31.70 29.62 29.32 28.53 31.22 34.93 39.68 44.51 46.80 50.02 51.76 837.46 Estimated Ultimate Loss 19.57 22.28 25.63 28.35 33.27 37.55 41.39 39.45 32.43 27.89 28.30 22.56 23.51 25.51 29.49 31.69 34.14 34.62 31.54 30.91 31.25 33.90 38.02 703.28 Estimated Ultimate LR 110% 106% 98% 95% 98% 99% 95% 85% 73% 65% 66% 68% 74% 86% 101% 111% 109% 99% 79% 69% 67% 68% 73% 84% Ceded LR/ Gross LR 109% 105% 104% 109% 112% 110% 106% 101% 100% 95% 96% 97% 101% 102% 115% 118% 121% 123% 105% 88% 95% 96% 99% Annual Growth 1995-2005 (Exp. Fit) Source: AM Bests Averages and Averages and primary company Annual Statements # of Reported Claims 6,008,530 6,078,534 5,512,491 5,680,676 5,562,682 5,747,657 5,341,648 4,806,807 4,029,974 3,815,603 3,676,448 3,219,391 -5.0% Average 3,754 3,868 4,628 5,192 5,696 5,941 6,480 6,561 7,670 8,190 9,222 11,810 9.1% US P&C Primary Industry Other Liability - Claims Made Professional Liability/E&O/D&O 1. Much greater growth in both premium & loss (8%-10% vs 2%-5%) 2. From ’87 to ’01 premium doubled while loss grew sixfold. Losses grew dramatically 19972001. (21% p.a.) 3. Premium is static since 2004. Loss appears to be growing. 4. 2006 still appears profitable. Page 15 Accident Gross Earned Estimated Estimated Discounted Year Premium Ultimate Loss Ultimate LR Loss Ratios 1984 0.60 1.79 300% 223% 1985 1.14 2.18 191% 136% 1986 2.42 1.60 66% 50% 1987 5.55 2.50 45% 37% 1988 5.88 3.01 51% 41% 1989 6.17 3.71 60% 47% 1990 6.33 4.16 66% 51% 1991 6.63 4.01 60% 48% 1992 6.44 4.31 67% 55% 1993 6.96 3.94 57% 48% 1994 7.26 4.66 64% 56% 1995 7.40 4.54 61% 51% 1996 7.91 5.01 63% 53% 1997 8.00 6.02 75% 63% 1998 8.66 8.61 100% 83% 1999 8.80 10.18 116% 100% 2000 10.07 12.27 122% 104% 2001 10.89 14.10 130% 108% 2002 15.66 15.67 100% 89% 2003 19.88 12.76 64% 59% 2004 22.44 12.58 56% 53% 2005 22.88 13.64 60% 55% 2006 22.49 14.79 66% 59% Total 220.46 166.05 75% 0% Annual Growth 1987-2006 (Exp. Fit) 8.0% 10.4% 1987-2006 7.6% 9.8% *Other Liability (CM & Occ.) Source: AM Bests Averages and Averages and primary company Annual Statements US P&C Primary Industry Other Liability - Claims Made Professional Liability/E&O/D&O 1. Restated Loss Ratio is profitable but varies from 42 to 82. Need two separate premium growth patterns due to loss surge. 2. Only a small residual cyclical effect. Conclusion: Soft market u/w losses were driven largely by an extraordinary surge in losses with premium growth lagging. Page 16 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Total Annual Growth Gross Earned Premium 0.60 1.14 2.42 5.55 5.88 6.17 6.33 6.63 6.44 6.96 7.26 7.40 7.91 8.00 8.66 8.80 10.07 10.89 15.66 19.88 22.44 22.88 22.49 220.46 Estimated Ultimate Loss 1.79 2.18 1.60 2.50 3.01 3.71 4.16 4.01 4.31 3.94 4.66 4.54 5.01 6.02 8.61 10.18 12.27 14.10 15.67 12.76 12.58 13.64 14.79 166.05 Estimated Ultimate LR 300% 191% 66% 45% 51% 60% 66% 60% 67% 57% 64% 61% 63% 75% 100% 116% 122% 130% 100% 64% 56% 60% 66% 75% Smoothed Premium *Other Liability (CM & Occ.) Source: AM Bests Averages and Averages and primary company Annual Statements 5.55 6.02 6.54 7.10 7.71 8.37 9.09 9.87 10.71 11.63 12.62 13.71 14.88 16.16 17.54 19.04 20.67 22.44 24.37 26.45 8.6% Restated Loss Ratio 0.45 0.50 0.57 0.59 0.52 0.51 0.43 0.47 0.42 0.43 0.48 0.63 0.68 0.76 0.80 0.82 0.62 0.56 0.56 0.56 US P&C Primary Industry Other Liability - Claims Made Professional Liability/E&O/D&O 1. Ceded LR/Gross LR is significantly over 100% in and only in soft markets. 2. Over last ten years claim frequency trend and claim severity trend is about 5% & 8%. How does this compare to ISO? Accident Gross Earned Estimated Estimated Ceded LR/ # of Reported Year Premium Ultimate Loss Ultimate LR Gross LR Claims Average 1984 0.60 1.79 300% 121% 1985 1.14 2.18 191% 127% 1986 2.42 1.60 66% 116% 1987 5.55 2.50 45% 94% 1988 5.88 3.01 51% 100% 1989 6.17 3.71 60% 103% 1990 6.33 4.16 66% 103% 1991 6.63 4.01 60% 98% 1992 6.44 4.31 67% 96% 1993 6.96 3.94 57% 92% 1994 7.26 4.66 64% 105% 1995 7.40 4.54 61% 100% 122,688 37,015 1996 7.91 5.01 63% 106% 119,563 41,878 1997 8.00 6.02 75% 111% 118,387 50,884 1998 8.66 8.61 100% 119% 126,656 68,013 1999 8.80 10.18 116% 107% 138,287 73,583 2000 10.07 12.27 122% 117% 148,272 82,783 2001 10.89 14.10 130% 130% 165,327 85,291 2002 15.66 15.67 100% 105% 178,200 87,952 2003 19.88 12.76 64% 94% 181,343 70,336 2004 22.44 12.58 56% 95% 172,033 73,132 2005 22.88 13.64 60% 96% 161,527 84,443 2006 22.49 14.79 66% 93% 120,104 123,129 Total 220.46 166.05 75% Annual Growth 1995-2004 (Exp. Fit) Page 17 *Other Liability (CM & Occ.) Source: AM Bests Averages and Averages and primary company Annual Statements 5.5% 8.4% Ultimate Losses Compared to GDP US Gross Domestic Product CA/GL/WC/PL 1. Insured loss as a % of GDP grew by about 25% in soft market and returned to normal levels as market hardened. 2. I believe this explains residual cyclical effect after premium smoothing in earlier exhibits. Page 18 Accident Year 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Ultimate Losses Primary Industry 55.36 58.06 64.14 74.93 84.36 90.46 93.58 89.23 85.21 85.34 92.28 101.16 Annual Growth Exponential Fit Amounts in USD Billions 5.6% 4.9% GDP 7,398 7,817 8,304 8,747 9,268 9,817 10,128 10,470 10,971 11,734 12,455 13,246 5.4% 5.2% Ultimate losses As a % of GDP 0.75% 0.74% 0.77% 0.86% 0.91% 0.92% 0.92% 0.85% 0.78% 0.73% 0.74% 0.76% Average 1995 - 2006 0.81% US Reinsurance Industry Reserve Development All Lines - Net - $ Billions 1. Historically for reinsurers, adverse development only occurred during soft market accident years. 2. Historically for reinsurers, hard market years develop favorably. 3. For reinsurers, the years 1989-1996 are remarkably stable Source: Bests Aggregates and Averages Page 19 Accident Year 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Original Reserves 3.6 4.2 6.2 6.7 6.0 6.1 6.4 7.2 7.7 8.3 8.9 9.6 10.1 10.1 10.0 12.2 13.0 17.2 13.7 14.8 15.4 18.0 12.8 Developed Reserves 6.0 5.6 5.5 5.1 4.9 5.8 6.1 6.8 7.7 7.8 8.5 9.0 10.6 11.5 14.2 18.5 19.8 20.3 14.3 13.0 14.3 17.9 12.8 Adv/ (Fav) Dev 2.4 1.4 (0.7) (1.6) (1.1) (0.3) (0.3) (0.4) (0.5) (0.4) (0.6) 0.5 1.3 4.3 6.3 6.8 3.1 0.6 (1.8) (1.2) (0.1) Percent Develop 67% 33% -11% -24% -18% -5% -5% -6% 0% -6% -4% -6% 5% 13% 43% 52% 52% 18% 4% -12% -8% -1% 1984-85 1986-88 7.8 18.9 11.6 15.5 3.8 (3.4) 49% -18% 1989-96 1997-2001 2002-2006 64.3 62.5 74.8 62.3 84.3 72.3 (2.0) 21.9 (2.5) -3% 35% -3% Soft Market Hard Market Stable Market 70.3 93.7 64.3 95.9 87.8 62.3 25.7 (5.9) (2.0) 37% 84-85 & 97-01 -6% 86-88 & 02-06 -3% 89-96 after 10 years 10 years 10 years 10 years 10 years 9 years 10 years 10 years 10 years 9 years 10 years 10 years 10 years 10 years 9 years 8 years 7 years 6 years 5 years 4 years 3 years 2 years 1 year