Medical Professional Liability Melissa L. Greiner PHICO Group, Inc. September 19, 2000

advertisement

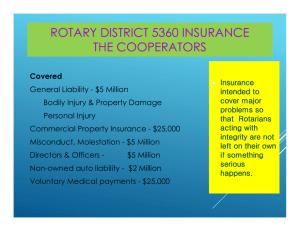

Medical Professional Liability Melissa L. Greiner PHICO Group, Inc. September 19, 2000 Medical Professional Liability Changing patient expectations Financial condition of hospitals Ancillary coverages – Directors and Officers Liability – Employment Practices Liability Changing Patient Expectations Trends in liability are the result of: Improvements in medicine and technology Advertisement Effect of media Lottery mentality Financial Condition of Hospitals Competition for patient business Shift of surgical procedures to outpatient facilities Mergers, acquisitions, divorces Financial Condition of Hospitals (cont) Increased costs of malpractice coverage Balanced Budget Act of 1997 Pressure from other 3rd party payers All of the above are resulting in: DECREASED INCOME Impact on Hospital Insurance Medical malpractice coverage impacts more obvious Souring financials may lead to more losses for ancillary coverages, even in non-profit sector – Directors and Officers Liability – Employment Practices Liability Directors and Officers Covers claims for wrongful acts committed by corporate directors, officers, agents (physicians) for their corporate decisions i.e., for alleged breach of obligations to the organization or for their actions and decisions on behalf of the organization Directors & Officers Duties Duty of Diligence - managing assets Duty of Loyalty - no personal gain or conflict of interest with organization Duty of Obedience - in accordance with statutes and terms of charter Directors & Officers Coverage No two insurance companies use exact same rating formula – Potential variation in estimated premium between two organizations with same ownership, class of business and size As many as 80 variations of the D&O form exist in today’s marketplace Exposure base varies as well Directors & Officers Coverage Exposure bases: – Assets, Revenues – Number of Ds and Os – Number of Employees “Pure” Claims-Made Defense costs within limits of liability D&O Coverage Evolution Specifically for non-profit D&O, previously did not have: – Entity coverage – Employment Practices cover – Duty to Defend provision Recent study reports two-thirds of D&O insureds purchase EPLI endorsement * * Source: Tillinghast-Towers Perrin Directors & Officers Claimants may include: – Shareholders * – Employees * – Competitors – Customers – Government Employment Practices Liability Claimants may include: – Full-time and part-time employees – Leased and temporary workers – Former employees – Applicant for employment Healthcare D&O / EPLI How are coverages unique to the health care industry? How do claimants differ in the health care industry? How are allegations different in the health care industry? Healthcare D&O / EPLI Higher ratio of non-profit entities D&O often written with staff privileges protection Coverages generally written on a smaller scale – Lower Limits of Liability – Lower exposure counts D&O Industry Needs High Technology Health Care Nondurable Goods Mftg Durable Goods Mftg Utilities 0 20 40 60 $ Millions Median Limits Source: Tillinghast-Towers Perrin 80 D&O Industry Needs High Technology Health Care Nondurable Goods Mftg Durable Goods Mftg Utilities 0 100 200 300 $ Thousands Median Premium Source: Tillinghast-Towers Perrin 400 Healthcare D&O / EPLI Wide exposure variance within healthcare continuum – Large hospitals with significant exposure and financial history – First-time purchasers in the form of newly formed practices, offices, clinics Newer entrants to the D&O market present more underwriting challenges Healthcare D&O / EPLI Common Claimants: – Employees / Health Care Providers – Government – Competitors – Customers (patients) – Shareholders (if publicly traded provider) Healthcare D&O / EPLI Common Claim Allegations: – Employment Issues – Antitrust – Fraud and Abuse – Breach of contract – Libel, slander, defamation Employment Issues Largest source of claims in health care D&O Various ways to offer EPLI coverage – implicitly covered in D&O – endorsed onto D&O policy as sublimit – offered as separate coverage with separate limits Employment Issues Mergers and acquisitions of hospitals, health plans and/or managed care could result in terminations or reassignment As revenues shrink, facilities (and employees) are downsized Credentialing physicians to determine privileges Employment Practices Liability Common Claim Allegations: – Wrongful termination or demotion – Harassment, coercion, discrimination – Negligent evaluation or reassignment – Wrongful refusal to employ qualified applicant – Negligent hiring practices Antitrust Within the context of attempting to control or monopolize: Hospital denies medical staff appointment Competing hospitals decide to merge or share services / assets Non-affiliated providers commit collusion to affect reimbursement fees Fraud & Abuse False claims and billings Over-utilization of claims for medically unnecessary services Illegal remuneration in return for referral of business Fraud by institutions - submission of false cost reports Industry Loss Ratios Direct Loss & LAE Ratio Schedule P - Other Liability Claims-Made 80% 70% 60% 50% 40% 30% 20% 10% 0% PHICO Industry 1995 1996 1997 Year 1998 1999 Reserving Considerations Health care organizations are at greatest risk of being sued Length of tail in private sector unknown due to wide variability in risk exposure Low frequency, high severity Reserving Considerations Severity in private, non profit sector is a BIG UNKNOWN – Rules out frequency/severity projection techniques Traditional link-ratio methods appropriate for insurers with history Change in exposure base or risk type presents challenges Reserving Considerations Projection methods (i.e. BF) may be more suitable Actuary must know and understand: – Coverages – Exposures – Uniqueness of own product, relative to the industry No cookbook formula!