The Impact of Predictive Analytics on Reserving

advertisement

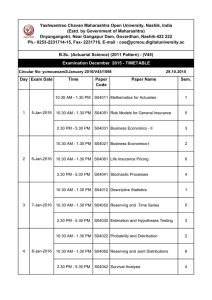

The Impact of Predictive Analytics on Reserving Brian Z. Brown, FCAS, MAAA Principal and Consulting Actuary Stan Smith Predictive Analytics Consultant April 29, 2016 Advancements In Reserving Use of stochastic methods. Advancements in computing power have allowed for more sophisticated reserving methodologies Distributions of loss reserves to better understand liabilities Deterministic methods still dominant. Traditional development methods are still the go-to choice for most reserving actuaries Methods are easier to explain to decision makers Leaving something on the table? With the abundance of data being captured, could predictive analytics help us better understand our claims data in order to make better reserve projections? 2 Advantages of applying analytics in reserving Strategic Reasons. Competitive advantage Operational Reasons. Claims management/operations Better information for pricing Better information for reinsurance procurement Financial Reasons. Quicker closure rates (lower claims costs) Lower defense costs More accurate case reserves on higher value claims Early intervention typically reduces claim costs 3 Predictive models for case reserves 4 5 Insurers cannot rest “Companies that have not actively invested in improving their pricing sophistication, efficiency and risk management are at a competitive disadvantage and will not be relevant in the long term”. Source: A.M. Best 6 MONEYBALL AND SABERMETRICS Indicators of Offensive Success MONEYBALL MEASURES TRADITIONAL MEASURE Home Runs Batting Average Stolen Bases RBI’s On-Base %-age Slugging %-age Pitch Data Expected Future Runs Scored in an inning given certain conditions. (1961-77 data set) 7 Winning an unfair game “People operate with beliefs and biases. To the extent you can eliminate both and replace them with data, you gain a clear advantage.” Michael Lewis, Moneyball: The Art of Winning an Unfair Game 8 Analytics can help identify “Useful” data Leverage more of the data being captured Traditional Approach Analyzed information Big Data Approach All available information analyzed All available information Analyze small subsets of data Analyze all data 9 Supervised versus Unsupervised approaches 10 Text mining variables Text mining refers to the process of deriving relevant and usable text that can be parsed and codified into a word or numerical value. Text mining can identify co-morbid conditions and/situations that will have profound impact on the outcome of a claim. CXR smoking Pain unchanged SAMPLE KEY WORDS/PHRASES Diabetes/insulin/injections Packs day/coughing Pain killers/anti-depression Children/school Pain unchanged Height/Weight Homemaker wife went to work c/o, CXR, FB, FX CBT – Cognitive Behavior Therapy Text sources: Adjuster notes, medical reports, independent medical exams, etc. 11 Modeling architecture Data Store. All historical data collected and organized. Training. Identifying company/internal/external data specific patterns. Testing. Using “hold out” sets to measure the accuracy of predictions. 12 Virtual data warehouse OPERATIONAL SYSTEMS • Improved Decisions UNDERWRITNG STRATEGIC • More Timely Decisions NEW Business • Efficient Use of Resources ETL LOSS DATA Medical Vendor Data TACTICAL Other DATA WAREHOUSE SCORING ENGINE Milliman DB 3RD PARTY • Improved Results BUSINESS INTELLIGENCE • REPORT • MONITOR • MEASURE Closed Loop Reporting DATA ENRICHMENT 13 Complementary Analytics Solutions Underwriting Better Decisions WC Claim Better Outcomes • Leveraging data and analytics • Improved pricing and segmentation • Improved client targeting • Predictive Modeling - proactive claim management • Data Warehouse comprehensive view of internal data 14 Decision support example - claims Quickly identify “creeping catastrophic” claims. Less than 20% of claims cause 80% of losses Create better claims outcomes with more timely and more detailed information. Loss cost reductions that generally range from 3-6% per year “Operationalize” into claims/medical protocols/rules. Integrate management of all available sources of data/information. “Second pair of eyes” on existing claim/medical vendors. Ancillary benefits. Data driven culture 15 Segmentation analysis Divide All Claims into 5 buckets of 20% each. After Scoring distribute by Risk Score Highest Risk to the Right Lowest Risk to the Left Each Claim has a individual score Worst Claim far right vs. Best Claim far left Then add actual losses to test model accuracy 20% 20% 20% 20% 20% 16 Predictive modeling in action Early ID < Day 30 High Risk Models Identify 20% of Claims that have 78% of total costs Medium Risk Low Risk 11.47% 2.19% 3.15% 4.74% 17 18 Actuarial Dashboard – Auto Liability 19 Actuarial Dashboard – Incurred Loss & ALAE 20 Actuarial considerations Changing development patterns. Nothing new for reserving actuaries, but important to monitor and be aware of implications. Reserving Pricing Reinsurance Communication with different business units is important 21 Initial measurements Is the model identifying problematic claims earlier? Impact of early intervention. Cost savings. Impact on average case reserves. Reserve strengthening Adequate Impact on payment pattern. Early intervention may result in high payments initially but lower total payments for a claim. 22 Actuarial considerations – after implementations Adjustments to standard reserving methods Berquist-Sherman Varying / Adjusting assumptions Loss Development Factors based on Anticipated patterns to change Measurement of how patterns are changing Expected Loss Ratios based on Projected cost savings 23 Predictive model case studies Closed Claim Impact Client Case Study #1 25 Payment Trends – Totals over 10 Year Period 26 Payment Trends – Averages over 10 Year Period 27 Claim Age & Payment Trends – Model Impact 28 Reserving Impact Client Case Study #2 29 Reserving Trends – Model impact first 30 days 30 Reserving Trends all open claims – Model Impact 31 Actuarial considerations Some models establish an ultimate per claim Difference between model ultimate and incurred losses produces an indication of IBNR How is pure IBNR determined? Is the model ultimate an additional methods used for reserving? How does the model ultimate change over time? Documentation. Necessary so that another actuary may be able to review work product. ASOP’s 32 Implementation considerations 33 Implementation planning is critical Who has access to the model and its results? Access to the model and its output could potentially influence behavior Could impact how case reserves are set in the future if claims adjusters have access to the model output Impacts development patterns used for traditional actuarial reserving and ratemaking techniques Would model still be relevant or applicable if underlying inputs are being changed? Staff morale. Be cognoscente of how various business units might react to the implementation of the model Intentions of model should be communicated to those who might be affected by the model Fear of job elimination (claims adjusters, traditional reserving actuaries) How to measure return on investment? Predictive modeling can be costly; make sure you’re getting the most out of your investment Designate benchmarks before modeling Regulation. Will regulators at some point need to review model? 34 Thank you Brian.Brown@Milliman.com Stan.Smith@Milliman.com