Incremental Budget Model November 2013 An Equal Opportunity University

advertisement

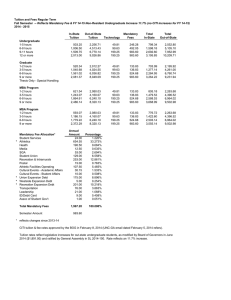

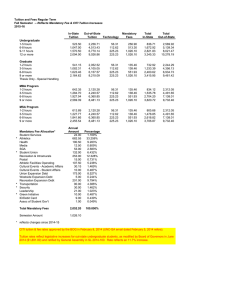

Incremental Budget Model November 2013 An Equal Opportunity University Overview 7/26/2016 2 Framework • Model centered on 2009 – 2014 Strategic Plan: – Goal 1: Prepare students for leading roles in an innovationdriven economy and global society – Goal 2: Promote research and creative work to increase the intellectual, social, and economic capital of Kentucky and the world beyond its border – Goal 3: Develop the human and physical resources of the University to achieve the institution’s Top 20 goals – Goal 4: Promote diversity and inclusion – Goal 5: Improve the quality of life of Kentuckians through engagement, outreach and service Consolidated Budget In FY 2012-13, bad debt was reclassified due to an accounting change. *In billions Budget Overview Continued: Budget Overview UK’s Major Sources of Revenue and How They Are Used Undesignated General Funds Money comes from: • State Appropriations • Tuition • Investment Income • Service Assessments Pays for: • Instruction • Public Service • Administrative Support • Scholarships 24% 12% Other UKHC Designated General Funds Money comes from: • UK HealthCare • County Appropriations • Mandatory Fees • Course and Program Fees Pays for: • Public Service • Instruction • Student Services • Academic Support 36% Auxiliary Funds Restricted Fund Fund Balance - Nonrecurring General Funds: Designated UKHC Continued: UK’s Major Sources of Revenue and How They Are Used Auxiliary Funds Money comes from: • UK Athletics • Housing • Dining • Parking Pays for: • Self-supporting auxiliary units pay all their expenses and receive no taxpayer or tuition support 6% Restricted Funds Money comes from: • Research Grants and Contracts • Endowment Income • Gifts • Federal and State Student Aid Pays for: • Research • Scholarships • Public Service 13% 8% Fund Balance Money comes from: • Savings from prior years Pays for: • Capital Projects • Faculty Start-Up Packages • Pilot Programs Breakdown of Revenue Sources 7/26/2016 9 Overview • • • • • • Total budget State support Tuition and mandatory fee revenue Sponsored project awards Realized F & A income Endowment and investment income Current Funds Revenue Budget State Support *In millions; Includes ARRA funds of $21.1 million in 2009-10 and $17.3 million in 2010-11 Tuition and Mandatory Fee Revenue Original Proposed Budget Millions $400 $380 $339 $350 $314 $300 $272 $243 $250 $289 $253 $211 $200 $150 $100 $50 $0 FY-2007 FY-2008 FY-2009 FY-2010 FY-2011 FY-2012 FY-2013 FY-2014 Research and Development Expenditures Millions $400 $350 $352 $332 $360 $373 $361 $329 $287 $300 $250 $200 $155 $150 $154 $172 $179 $144 $160 $164 $100 $50 $0 FY-2007 FY-2008 FY-2009 FY-2010 Federal Source: NSF R&D Expenditure Survey FY-2011 Total FY-2012 FY-2013* Estimate Realized F & A Income FY2007 $43.8 million FY2008 $44.1 million FY2009 $44.7 million FY2010 $50.8 million FY2011 $53.1 million FY2012 $51.8 million FY2013 $47.9 million FY2014* $41.5 million Source: Audited Financial Statements *Estimated *Estimated Millions Endowment and Investment Income Original Proposed Budget $40 $35 $31.0 $33.3 $33.9 $30 $30.1 $30.2 $25 $24.5 $21.5 $17.7 $20 $15 $10 $5 $0 FY-2007 FY-2008 FY-2009 FY-2010 FY-2011 FY-2012 FY-2013 FY-2014 Breaking Down the Budget 7/26/2016 17 FY2013 – 14 Consolidated Budget Organization Major Function 10.6% 13.8% Natural Object 1% 4.5% 3% 1% 5% 6.4% 34.7% 10.0% 36.0% 12.5% 48% 42% 36.9% 5.9% 2.6% 5.0% 0.7% Instruction 2.7% Public Service Academic Support Institutional Support Student Financial Aid Mandatory Transfers Hospital Services 5.7% 0.9% 1.3% 3.9% Research Libraries Student Services Operations and Maintenance Capital Transfers Auxiliary Enterprises 1.0% 4.6% President Provost EVPFA Research UK HealthCare University Wide Affiliated Corporations Personnel Services Operating Expenses Student Financial Aid Capital Outlay Mandatory Transfers Capital Transfers Processes and Timeline for Budget 7/26/2016 19 Timeline: University-Wide Budget Process Fall Fall/Winter /Spring January Winter /Spring Spring April (Even Years Only) June • Budget development process begins • University Budget Office collects revenue estimates; fixed cost increases; programmatic budget requests • General Assembly convenes • President’s Cabinet reviews preliminary incremental revenues and expenses; sets priorities; develops budget recommendation • CPE sets tuition and mandatory fees • General Assembly passes biennial budget • President recommends budget to the Board of Trustees Budget Decisions • Concurrent with University-wide decisions – Budget hearings and Deans’ meetings • • • • • Restructuring/allocation options Salary increase and adjustment options Program/course/administrative fees Programmatic priorities Program requests to President Budget Processes and Decisions • Implementation of University-wide decisions – Income estimates – Salary proposals and unit budgets – Budget administration