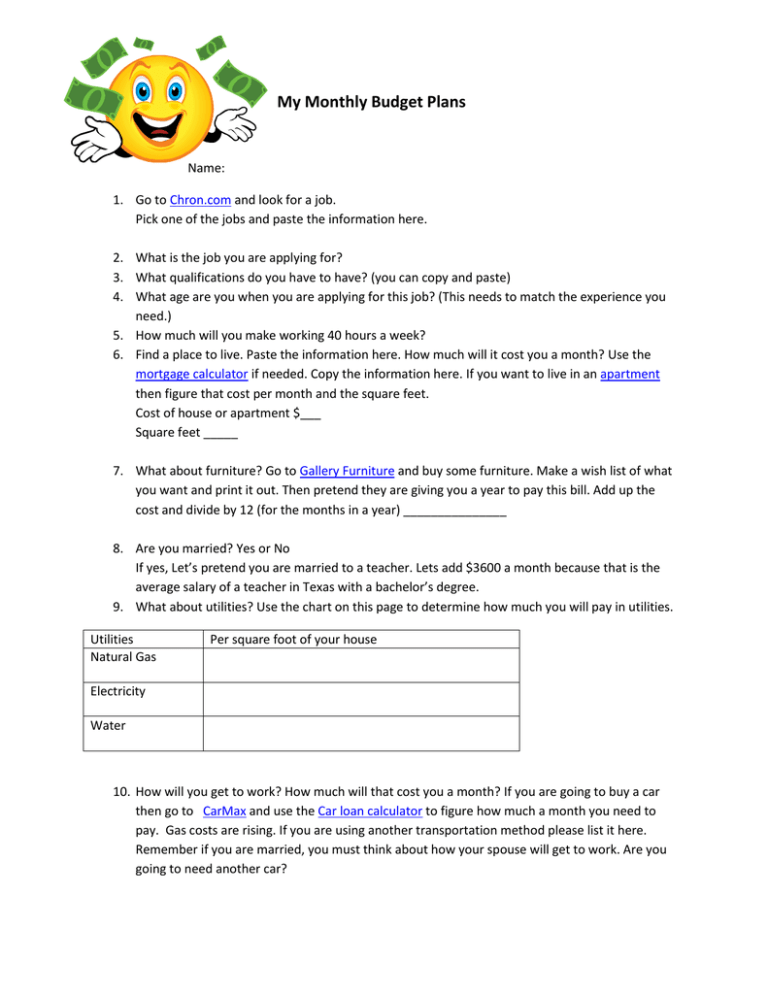

My Monthly Budget Plans

advertisement

My Monthly Budget Plans Name: 1. Go to Chron.com and look for a job. Pick one of the jobs and paste the information here. 2. What is the job you are applying for? 3. What qualifications do you have to have? (you can copy and paste) 4. What age are you when you are applying for this job? (This needs to match the experience you need.) 5. How much will you make working 40 hours a week? 6. Find a place to live. Paste the information here. How much will it cost you a month? Use the mortgage calculator if needed. Copy the information here. If you want to live in an apartment then figure that cost per month and the square feet. Cost of house or apartment $___ Square feet _____ 7. What about furniture? Go to Gallery Furniture and buy some furniture. Make a wish list of what you want and print it out. Then pretend they are giving you a year to pay this bill. Add up the cost and divide by 12 (for the months in a year) _______________ 8. Are you married? Yes or No If yes, Let’s pretend you are married to a teacher. Lets add $3600 a month because that is the average salary of a teacher in Texas with a bachelor’s degree. 9. What about utilities? Use the chart on this page to determine how much you will pay in utilities. Utilities Natural Gas Per square foot of your house Electricity Water 10. How will you get to work? How much will that cost you a month? If you are going to buy a car then go to CarMax and use the Car loan calculator to figure how much a month you need to pay. Gas costs are rising. If you are using another transportation method please list it here. Remember if you are married, you must think about how your spouse will get to work. Are you going to need another car? 11. If you bought a car you will need to pay for gas. Gas is getting expensive. These prices are based on what families in Houston have told me they spend in gas every month. (Remember if you need two cars you have to double the price of gas.) Small car $300 Medium Car $400 Truck or SUV $500 12. Will you have kids? How many children do you have? ________ So in all there are ____ people living at your house. 13. Let’s pretend your kids are going to go to Holy Trinity Day School. Look the handbook for prices. If your kids are school age then you do not have to figure day care but you need to pay $100 a month in school supplies, lunches, etc. 14. What about a TV? How about a computer? Go to Best Buy and make a wish list. Print it out. Let’s pretend they will give you a year to pay this bill. Add up what you spent and divide it by 12 (for the months) ____________ 15. Do you want Cable? How about Internet? Go to the Direct TV website to find which package you are going to get or look at Comcast to price internet or internet and TV. 16. Do you want a cell phone? GO to AT&T to buy a phone. 17. What about food? Add $200 a month per person in your family for food. (This is the average for Texas) 18. What about health insurance and costs? Use the chart from GPISD to figure the cost for your family. Also, add $50 per person a month for doctor visits and medicine. (This is cheap) 19. What about clothes and accessories? Let’s just say we will spend $100 a month per person. 20. What about taxes? The average American pays about 8% of their income in taxes. That means you will need to take your monthly income (and your spouse’s if you are married) and multiply that by .08. This is how much you need to plan to pay in taxes. 21. Will you have student loans? That job you found, was one of the qualifications a degree? If so, Figure on paying this for student loans a month… Associate’s Degree $100 Bachelor’s Degree $200 Master’s Degree $300 Doctoral Degree $500 Do not forget if you are married, your spouse is a teacher so they will pay $200 a month. 22. Now you are ready to fill out the worksheet. 23. Use this worksheet to put your budget into an Excel spreadsheet. 24. Draw two scenario cards from Mrs. Hatten and add this to your budget. (Should you save some money for one of these events?) 25. What did you notice? Do you want to edit any of your decisions? My Monthly Budget Worksheet 5. My income = $_________ 6. The cost of my home $______________ 7. Cost of my Furniture (Divided by 12) $___________ 8. If you are married add $3600 to your income. 9. Natural Gas $______ Electricity $________ Water $___________ 10. Transportation $____________ 11. Gas? $___________ 13. Day Care or Cost of Children? $_______ 14. Electronics $_______ 15. Cable and Internet? $_______ 16. Cell phone and service $___________ 17. Food $_______ 18. Health insurance $_________ Meds and Doctor visits _______ 19. Clothes $___________ 20. Taxes $______ 21. Student Loans $_________