UNIVERSITY OF COLORADO

advertisement

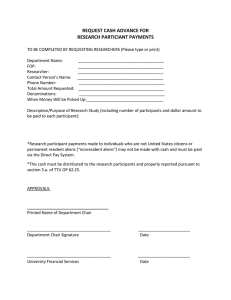

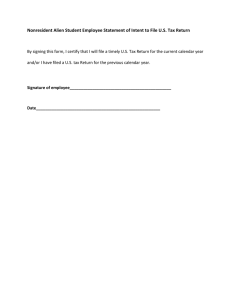

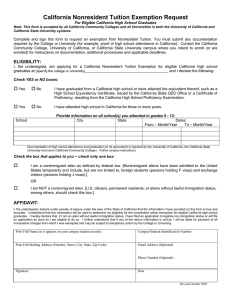

UNIVERSITY OF COLORADO Procedure for Implementation of the Tax Directive Regarding Payments to Nonresident Aliens SUBJECT: Implementation of Tax Reporting and Withholding on Payments by the University of Colorado to Nonresident Aliens REFERENCES: Federal Immigration and Naturalization Service (“INS”) Regulations Governing the Employment of Non-US Citizens Federal and State Regulations Governing Withholding of Taxes, Social Security, and Contributions to Retirement Plans EFFECTIVE DATE: This memorandum is effective January 1, 1999, and will remain in effect until specifically superceded or canceled. PURPOSE: The purpose of this memorandum is to provide the policy and procedures for both employment of and payments to nonresident aliens. DISTRIBUTION: All supervisors and administrators who may be involved in authorizing or performing payments to nonresident aliens. Introduction The University of Colorado is committed to ensuring compliance with applicable laws governing employment and payments to nonresident aliens. This commitment is also necessary to achieve correct tax reporting and withholding as required on payments to nonresident aliens. Failure by the University to report and withhold as required can lead to fines and penalties for the University, as well as cause potential tax problems for the nonresident alien individuals who receive the payments. Procedures System Administration: The tax reporting and deposits for withholding will be performed centrally for the University based on information supplied by the campuses. System Administration will also provide updates and interpret new regulations as required. Campus: Each campus will appoint a coordinator with respect to the campus’ payments to nonresident aliens. The campus coordinator will be designated by the Vice Chancellor for Administration and Finance for the respective campus. The campus coordinator will work with the University Tax Manager to ensure that the respective campus is in compliance with the tax rules, and that the campus correctly reports and withholds on payments from that campus to nonresident aliens. Tax Directive 1999-01 and the “University of Colorado Tax Guide for Foreign Visitors” will serve as the basis for application of the tax rules. D:\219547330.doc Rev. 9/99 NRA Implementation Procedure Page 2 On several of the campuses, specialized expertise with respect to payments to nonresident aliens has been established in the Payroll or Human Resources Department, or the Consolidated Service Center, as appropriate. To the extent such expertise has been developed on a campus, it is advisable to centralize the compliance effort there. For the remainder of this document, the campus Payroll or Human Resources Department, or the Consolidated Service Center, as appropriate, is assumed to be the focal point for coordinating the tax compliance process on the campuses. Campus Payroll or Human Resources Department, or Consolidated Service Center: Prior to committing to any sort of payment to a nonresident alien, the sponsoring or initiating Department should contact the Payroll or Human Resources Department, or Consolidated Service Center, as appropriate. Payments are broadly defined and include: payments for any type of reimbursement for expenses incurred by the nonresident alien, such as reimbursement for meals, travel or other expenses. payments made directly to a vendor by the University that are on behalf of the nonresident alien. This commonly includes payments for travel, lodging, and meals. payment of salary, honoraria, awards, or other forms of remuneration. Wages paid to nonresident aliens are subject to graduated withholding rates under special rules for nonresident aliens. Additionally, tax treaty provisions may apply. Under the supervision of the Payroll or Human Resources Department, or Consolidated Service Center, nonresident alien individuals will prepare Internal Revenue Service Form W-4 or the applicable tax treaty forms, as appropriate. In the case of wages, the nonresident alien individual will provide the University with Internal Revenue Service Form W-4, which must be filled out under the supervision of the Payroll/Human Resources Department. Tax treaty provisions may apply. Non-wage remuneration is generally subject to withholding at a 30% rate unless tax treaty provisions apply. payment of scholarships or grants. Scholarships or grants paid to international students by the University may be fully or partially excluded from taxation depending upon whether any of these monies are used for personal expenses beyond tuition and fees. NRA Implementation Procedure Page 3 Scholarship or grant amounts remaining after payment of tuition and fees are subject to withholding at the reduced rate of 14% (unless excluded by treaty provisions). To be subject to the 14% withholding rate, the individual must be present in the United States, and must be on an F, J, M, or Q visa. If the individual is eligible for a tax treaty, Internal Revenue Service Form 1001 must be filed with the University. The Payroll or Human Resources Department, or Consolidated Service Center, will act as the information resource for tax treaty questions, and as the central repository for the Forms 1001. The Payroll or Human Resources Department, or Consolidated Service Center, will advise the sponsoring or initiating Department on both the Immigration and Naturalization Service (“INS”) and Internal Revenue Service (“IRS”) implications of any prospective employment or payment arrangement, including the applicability of any tax treaty provisions. However, this refers only to tax issues and employment eligibility. It does not include other issues with respect to entrance requirements for nonresident aliens, such as visa acquisition and eligibility, which are handled by the campus Office of International Education (or equivalent office). Payroll or Human Resources Department, or Consolidated Service Center, will coordinate with other units, as appropriate, to ensure that the employment or payment arrangement is in accordance with University and campus policies and procedures. The designated person in the Payroll or Human Resources Department, or Consolidated Service Center, will ensure that the payment of salary, travel expenses, honorariums, etc., are in accordance with Internal Revenue Service requirements, and University/campus policies and procedures. Honorariums or independent contractor payments should not be processed for a nonresident alien prior to verifying work authorization with the campus Payroll or Human Resources Department, or Consolidated Service Center. The campus Payroll or Human Resources Department, or Consolidated Service Center, will work with the Office of International Education (or an equivalent office) as necessary to verify the nonresident alien’s visa status, work authorization, and eligibility to receive payments. See the additional discussion of work authorization under the description of sponsoring or initiating departmental responsibilities. Vouchers submitted to the Finance Office, Office of Grants and Contracts, Office of International Education (or an equivalent office), Accounts Payable, or Student Financial Aid for payment to nonresident aliens must be routed through the Payroll or Human Resources Department, or Consolidated Service Center, for approval prior to payment. Any fines, penalties, or interest for incorrect reporting or withholding assessed as a result of failure by the sponsoring or initiating Department to contact and cooperate with the Payroll or Human Resources Department, or Consolidated Service Center, will be charged to the sponsoring or initiating Department. NRA Implementation Procedure Page 4 Sponsoring or Initiating Department: (1) Prior to commitment to a nonresident alien: Sponsoring or initiating Departments are generally aware that the nonresident alien will be coming to the University, often far in advance of the actual arrival date. Sponsoring or initiating departments must insure that no offers of employment or expense reimbursement, and no payments of any kind, are made to nonresident aliens unless they have been granted the appropriate authorization and visa status by the Immigration and Naturalization Service (“INS”) in advance of their coming to the University of Colorado. See page 7 for a sample of information to be provided to nonresident aliens who may travel to the University of Colorado and provide services. To avoid problems upon the nonresident alien’s arrival, it is in the best interest of the sponsoring or initiating Department to work with both the campus’ Office of International Education (or an equivalent office) and the Payroll or Human Resources Office, or Consolidated Service Center, before the nonresident alien’s arrival date. Additionally, prior to authorizing any payments to any nonresident alien, sponsoring or initiating Departments must insure that each nonresident alien who will receive payments from the University has either a social security number (for payment of wages or other remuneration for personal services) or an individual taxpayer identification number (for non-wage payments). (2) After the nonresident alien’s arrival in the US: When the nonresident alien arrives at the University, the sponsoring or initiating Department representative should make a photocopy of the I-94 card (which should be stapled inside the passport). The I-94 card will verify payment eligibility; the copy of the I-94 card should be attached to the documents used to effect payment. Copies of the I-20 card, IAP-66, passport, visa, social security card and Employment Authorization Document (if available) may also be required. The initiating Department should check with their campus Payroll or Human Resources Department, or Consolidated Service Center, for other required documents. For students on scholarships or grants, it is important that the student’s visa status be correctly entered into the student information system. Often the student’s visa information is simply provided by the student, upon his or her application for admission to the University. The visa information provided by the student and entered into the student information system and other University records must agree to the visa status as later verified by the campus’ Office of International Education (or an equivalent office). NRA Implementation Procedure Page 5 Nonresident aliens must have one of the following visas in order to receive payment in the US: F1 J-1 H1-B TN O B-1/B-2 EAD Student Visa – employment is limited Exchange Scholar/Student/Trainee Visa Worker Visa Treaty NAFTA Visa Specialty Worker Visa Business Visa/Temporary Visitor (rules for payment discussed below) Employment Authorization Document (“EAD”) (The EAD is actually not a visa, but it does authorize employment; the person will have some form of visa in order to be issued the EAD.) B-1/B-2 payments – The law, as it pertains to B-1/B-2 visitors, changed October 1, 1998. Payments for honoraria (subject to limitations) may now be made to B-1 visa holders as well as B-2 visa holders. B-2 tourists may now receive travel reimbursement (subject to limitations) as well. In order for these payments to be made, the B-1/B-2 visitor must sign a “Compliance Statement” (see page 8)– that attests to the limitations listed below. (See also the note about Canadians under the visa waiver section.) 1) The B-1/B-2 visitor may not be present at any institution for more than 9 days 2) The visitor cannot have accepted payment from more than 5 institutions or entities in the past 6 months. For short-term visitors from certain countries, the Immigration Service has a visa waiver program. Persons using the visa waiver program will have “WB” or “WT” stamped inside their passport when they enter the country. However, without a visa, they can receive reimbursement for expenses only. Payments of remuneration, such as honorariums or fees for services, are not permitted without a work authorization. Currently, the countries with visa waivers are: Andorra Argentina Austria Australia Belgium Brunei Denmark Finland France Germany Iceland Ireland Italy Japan Liechtenstein Luxembourg Monaco The Netherlands New Zealand Norway San Marino Slovenia Spain Sweden Switzerland United Kingdom Canada is not a visa waiver country, but is a visa exempt country. Temporary visitors from Canada are not required to have a visa when entering the U.S. and are not even required to have a passport. A Canadian can cross the border with just a Canadian NRA Implementation Procedure Page 6 driver’s license for documentation. When making payments to Canadians, proof of their citizenship is required. A copy of the Canadian individual’s Canadian driver’s license should be obtained to document his or her citizenship. Canadians who enter the U.S. without passport or visa are treated as B-1/B-2 temporary visitors. The sponsoring or initiating Department must ensure that the nonresident alien individual coordinates and cooperates with the campus Office of International Education (or an equivalent office) and Payroll or Human Resources Department, or Consolidated Service Center, as necessary. The sponsoring or initiating Department must also ensure that any vouchers submitted for payment are routed through the campus Payroll or Human Resources Department, or Consolidated Service Center. Vouchers submitted to the Finance Office, Office of Grants and Contracts, Office of International Education (or an equivalent office) Accounts Payable, or Student Financial Aid for payment to nonresident aliens must be routed through the Payroll or Human Resources Department, or Consolidated Service Center for approval prior to payment. Any fines, penalties, and interest resulting from failure to comply with the tax rules for reporting and withholding on payments to nonresident alien individuals will be charged to the nonresident alien individual’s sponsoring or initiating Department. Rev. 9/99 NRA Implementation Procedure Page 7 UNIVERSITY OF COLORADO Sample of Information to be Provided to Nonresident Aliens Who May Travel to the University of Colorado and Provide Services The following information should be provided to all nonresident aliens who will be coming to the University of Colorado and expect any form of remuneration or expense reimbursement. Nonresident aliens who come to the University of Colorado and provide services for which the University of Colorado will provide reimbursement of expenses, an honorarium, payment for services, or any other remuneration must be authorized to receive such payment by the Unites States Immigration and Naturalization Service. It is the responsibility of the foreign national to obtain the type of visa that will permit the anticipated remuneration. All non-United States citizens must obtain a visa from the United States Immigration and Naturalization Service in order to work in the United States, receive reimbursement for expenses, or receive payment for services from a United States employer. There are several types of visas that may be acceptable, depending on the purpose of the visit and the length of stay. In order to avoid confusion and conflict, please ensure that you have obtained a visa that will suit the purpose of your visit prior to arriving in the United States. Rev. 9/99 NRA Implementation Procedure Page 8 UNIVERSITY OF COLORADO Compliance Statement for Payments to Visitors in Business or Tourist Status Eligibility for payments: Visitors in business or tourist status (B-1, B-2, WB, WT) may be paid honoraria or reimbursed for travel expenses if: (a) the visitor is engaged in the activity being compensated for any portion of nine days or less, AND (b) the visitor has not been paid or reimbursed by more than five other U.S. institutions or organizations during the past six months. Visitor Information: Last name (family name) As stated on Social Security card or Individual Taxpayer Identification Number (ITIN) documents First name (given name) As stated on Social Security card or Individual Taxpayer Identification Number (ITIN) documents Social Security Number or ITIN Dates of activity for which visitor is being paid Visa status Brief description of the activity: Please mark “X” if you are a Canadian and you did not receive a Form I-94 Statement of visitor: I attest that I have been engaged in the activities described above for the benefit of the University of Colorado for any portion of nine days or less and that I have not been paid or reimbursed by more than five other institutions/organizations during the past six months. Signature Date Statement of Department Head or Fund Administrator: As a sponsor of the above individual, I attest that the individual has been engaged in the activities described above for the benefit of the University of Colorado for any portion of nine days or less and that the activities for which the individual is paid or reimbursed are within the broad realm of customary academic activities associated with teaching, research, public service, or academic administration or operations. Signature Date Please attach a signed copy of this statement to the white voucher or travel expense voucher. Rev. 9/99