DEPARTMENT ADMINISTRATION: AN OVERVIEW Agenda and Table of Contents for 11/11/05 Welcome

advertisement

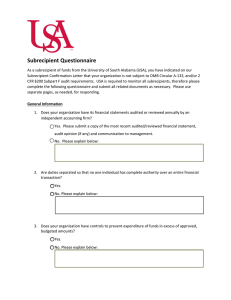

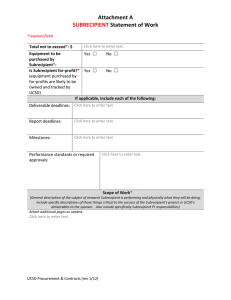

DEPARTMENT ADMINISTRATION: AN OVERVIEW Agenda and Table of Contents for 11/11/05 Welcome Kathy Illian, Trainer, Financial Services ---------- Security and Training Update Kathy Illian, Trainer, Financial Services Page 2 Subcontracts Susan Harman, Subcontracts Specialist, OGC Page 9 Procurement Normandy Roden, Director, PSC Page 27 Internal Audit, Internal Controls Jean Stewart, Director, Internal Audit Page 28 Internal Service Centers Shaun McMullin, Manager, Finance Page 29 GAR, GIR, and PIE Terry Pew, Manager, Finance Page 54 Speedtype (Chartfield) Set-up Jeanne Paradeis, Manager, Finance Page 72 Facilities and Administrative Costs Kim Huber, Controller, UCDHSC Page 73 Speaker Contact Information Evaluations Page 82 Attendees ----------- Security and Training Update Learning Objectives: Understand the new access request forms for Finance and CIW Understand the new “Fiscal Code of Ethics” training requirement Effective November 1, 2005, anyone seeking access to any of our financial systems – Finance and Procurement, Human Resources, Procurement Card, and/or Central Information Warehouse (CIW) -- will need to self-enroll in the Blackboard course, "Fiscal Code of Ethics Training" (see Blackboard Enrollment ); will need to complete the course -only once regardless of how many systems are to be accessed--; and will need to submit the certification as noted in the course prior to any access being granted. For Finance, Human Resources, and CIW, acquiring access is a three-step process: 1. With supervisor’s input, determine systems and access profiles needed 2. Submit the appropriate forms: o Finance and Procurement: http://www.cusys.edu/security/Form_Financial_System_Access.pdf o CIW: http://www.cu.edu/security/CIW_Request_Form.doc o HR: http://www.cusys.edu/security/ps/HR_Access_Req.pdf 3. Take online and / or instructor-led training as required To register for Finance and Procurement training: For required instructor-led training: New operators will need to self-enroll in the instructor-led Finance and Procurement training. Fill out and submit the form at http://www.uchsc.edu/finance/PS_Registration.htm to do so; training is held at both UCD and Fitzsimons monthly. (UCDHSC employees and affiliates are welcome to attend at either location). For required online (Blackboard) training: New operators will be automatically enrolled in the Blackboard Financial and Procurement training shortly (24-48 hours) after your Financial System Access Request Form has been submitted to the Financial System Access Coordinator. New operators, or those who have not yet completed the “Fiscal Code of Ethics” course, will need to selfenroll in the Blackboard Fiscal Code of Ethics Training Training For CIW access: For required online (Blackboard) training: New operators, or those who have not yet completed the “Fiscal Code of Ethics” course, will need to selfenroll in and complete the Blackboard “Fiscal Code of Ethics Training”. For instructions, see: http://www.cu.edu/policies/Fiscal/Fiscal-Code-of-Ethics_Training.pdf Training For Human Resources access: Follow the steps at: http://www.cu.edu/pbs/hrms/training/index.html New operators, or those who have not yet completed the “Fiscal Code of Ethics” course, will need to selfenroll in and complete the Blackboard “Fiscal Code of Ethics Training”. For instructions, see: http://www.cu.edu/policies/Fiscal/Fiscal-Code-of-Ethics_Training.pdf PLEASE NOTE: Procurement Card access and training is arranged through the Procurement Service Center: http://www.cu.edu/psc/purchasing/procurementcard/ 2 3 4 5 6 7 Subcontracts Determine when a subcontract is needed Understand the overall processes and procedures related to subcontracts The following documents can be viewed in its most current format at: http://www.uchsc.edu/ogc/admin/sub/sub_qa.pdf http://www.uchsc.edu/ogc/subawards.htm (see Word document) 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 REQUEST FOR SUBRECIPIENT AGREEMENT Exhibit B or Amendment to existing Subrecipient Agreement COMPLETE ONE FORM FOR EACH SUBRECIPIENT SECTION A 1. UCDHSC Principal Investigator: Titles (i.e. MD, Professor, etc): School: Department/Division if applicable: 2. Sponsor: 3. Sponsor’s Award #: 4. Project Title: 5. Proposal Routing #: 6. HSC Project #: 7. Speed Type #: 8. Expected period of Subrecipient’s Participation in this project (i.e., Project Period): 9. Current BUDGET PERIOD of Subrecipient Agreement 10. Was this Subrecipient proposed in the funding application? Yes or No? Please explain. 11. If not, have you subsequently obtained approval from the Sponsor for this Subrecipient? Yes or No? Please explain. 12. Is PHI (Protected Health Information under HIPAA) being provided from UCDHSC to the Subrecipient? Yes or No, or explain 13. Is PHI being provided from Subcontractor to UCDHSC? Yes or No, or explain 2-5- to to PLEASE ENTER ANY COMMENTS OR SPECIAL INSTRUCTIONS SECTION B Subrecipient’s Full Legal Name: Subrecipient’s Principal Investigator: Person responsible for performing, or supervising, the work to be performed under this agreement. Name and Degree: Title or Positions: Institution Name: Street Address: City, State & Zip: Phone: E-mail Address: 24 Subrecipient’s Contractual/Legal Contact: Subrecipient’s Institutional Official, who will be signing the agreement and/or who should be notified (in addition to the PI) of any changes to the agreement. USUALLY NOT THE SAME PERSON AS ABOVE Name and Degree: Title or Positions: Institution Name: Street Address: City, State & Zip: Phone: SECTION C One-Year Budget Information (for the Current period – indicated in Section A-8) DELETE ANY LINES THAT DO NOT APPLY Personnel Or Salary Benefits $ $ $ Consultant Costs Supplies Travel Patient Care Inpatient Outpatient Other Expenses $ $ $ Equipment Alterations/Renovations $ $ $ $ $ ? prior approval required ? prior approval required USE THIS SECTION ONLY IF YOUR SUBRECIPIENT IS ALSO CONTRACTING A PORTION OF THE WORK TO A SUBRECIPIENT. Consortium/Contractual $ ? prior approval required Total Direct Costs F&A Costs @ % $ $ note any exclusions here (e.g., rent) Total Costs $ Subrecipient Name Personnel Supplies Travel Patient Care Other Expenses Direct Costs F&A Total Costs $ $ $ $ $ $ $ $ 25 Regarding F&A: Enter the F&A rate (%) and amount applicable to this Subrecipient agreement. If it is 0, then enter 0. Use the Subrecipient’s Federally negotiated/approved F&A rate (G&C may request documentation of Subrecipient’s rate and effective date.) If there is an F&A rate cap on the award, use the lower rate. For NIH Grants Use the Subrecipient’s Federally negotiated/approved F&A rate THAT WAS IN EFFECT AT THE BEGINNING OF THE COMPETITIVE CYCLE OF THE GRANT. SECTION D –PLEASE COMPLETE ALL INFORMATION UCDHSC Department Information: Name of Person Name of PI Who monitors the subrecipient? (Receives invoices & responsible for contacting Grants and Contracts when necessary) (If different from person monitoring the subrecipient) Title or Positions: Department/Division: Building Name: Street Address/Room: P. O. Box: City, State, Zip: Phone: Campus Box: Email: Fax : Title or Positions: Department/Division: Building Name: Street Address/Room P. O. Box: City, State, Zip: Phone: Campus Box: Email: Fax : SECTION E PROVIDE A STATEMENT OF WORK - THIS IS A KEY COMPONENT IN THE SUBRECIPIENT AGREEMENT Brief Description (see notes below): Subrecipient will be responsible for: Enter a brief description of what you are expecting from the Subrecipient and their PI. The Statement of Work should attempt to answer the following questions: 1. What is the purpose or objective(s) of the work to be performed by the subrecipient? 2. Provide an explanation of the work to be performed. 3. Provide a timetable or schedule of the work to be performed, if applicable. 4. Provide specification of how the work’s progress or results are measured. 5. Identify any deliverables, products, or expected outcomes. If the work you are expecting is better suited to a lengthy, detailed Statement, provide a copy and we will include it as an Exhibit to be attached to the agreement (or amendment). 26 Procurement Learning Objectives: Understand the PSC resources Learn about the Procurement Newsletter The PSC home page and link to the newsletter are located at: http://www.cu.edu/psc/index.html 27 Internal Audit and Internal Controls Learning Objectives: Understand the mission of the Internal Audit department Understand internal controls and your role with them The Internal Audit home page is located at: http://www.cusys.edu/audit/ 28 Internal Service Centers Learning Objectives: Understand the definition and purpose of Internal Service Centers Understand the processes and policies involved with Internal Service Centers The fiscal policy and related exhibits below are on the web in their most current form at: http://www.ucdhsc.edu/admin/policies/ 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 Exhibit B HOW TO DO A COST STUDY A cost study requires that the total costs involved with performing a service be identified and quantified. These costs are identified over a certain period of time such as a fiscal year and the volume of goods or services sold over that same time period are identified. The total identified costs are divided by the total volume of goods or services sold to determine the cost per occurrence. Each Service Center will use the budget it develops for the next fiscal year as the basis for its cost study to set the rates for the next fiscal year. Most Service Centers will have one operating program and one renewal and replacement program, but offer multiple services. This program information will be helpful in identifying total costs, but will not provide everything that is needed to perform the cost study. Identifying time spent per service, supplies used per service, volume of activity, and statistics for allocating indirect costs are examples of information that will have to be accumulated outside of the accounting system. The estimated sales volume and the billing rates should be used to determine the budgeted revenue for the service center. If the Service Center provides several different significant services, the Service Center manager should consider creating separate programs for each activity. Usually there are two types of costs that need to be included in your rate setting calculation - direct costs and indirect costs. Direct costs are costs that can be directly identify to the service or goods being provided. Examples of direct costs are salaries and benefits for those directly providing the service and direct supplies. Indirect costs are costs that cannot be directly identified to the service provided. Examples of indirect costs include administrative salaries and benefits, supplies and general administrative recharges and facility allocations. Unless only one service is provided, both the direct and indirect costs will need to be identified to each of the different services. This will require determining the time spent on the different tasks for each person and identifying the supplies used on each activity. This may require an estimate. The indirect costs need to be allocated across the different services provided so that they are included in the final rates. There are two primary methods of identifying the direct costs to each service: 1. The first method, which is called “specific identification,” involves identifying the average time spent by each person on each individual occurrence of each procedure as well as identifying the average cost of supplies and average equipment time. This will usually require keeping records for a sample of procedures and averaging the results. The time increments for labor are converted to dollars based on the hourly pay of the employees and the time increments for equipment are converted to dollars based on the annual depreciation and maintenance and repair costs of the equipment. Supply costs should be based on the cost of the most recent purchase. Depreciation information for equipment is available from the Space and Property Management section of Finance. 49 2. The second method of identifying direct costs is called the “gross” method. With this method, costs are identified over a period of time (usually at least six months). It requires identifying percentages of time that employees spend with each type of procedure, the percentage of supplies used for each type of procedure and the percentage of time equipment is used. This method is normally used when there are not many different procedures and if people, supplies, and equipment can be easily identified to each type of procedure. The percentages are converted to dollars based on the total salaries and benefits of the individuals, the total dollars spent on supplies, and the total depreciation and maintenance of equipment. There are three primary methods that can be used to identify indirect costs: 1. The first method is to use a percentage mark-up. This method is often used in re-sale operations such as a bookstore or pharmacy. The total identified indirect costs would be divided by the total identified direct costs for all tasks performed by the service center. This percentage would then be multiplied times the direct cost billing rate and the result added to the direct cost billing rate to derive a total rate. 2. The second method of allocating indirect costs is similar to the percentage mark-up but requires identifying the total direct costs for each service, derive a percentage relationship to total for each of the direct cost subtotals, and apply these percentages to the total indirect costs. The results are then added to the total direct costs for each service to calculate a total billing rate. 3. The third method is to attempt to identify the indirect costs to each service being provided based on some allocation statistic such as square feet used or time spent. Indirect costs for each service would then be added to the direct costs to derive a total rate per service. 50 University of Colorado Health Sciences Center Service Centers COST STUDY EXAMPLE ABC Department 1. Project Annual Expenditures Use the instructions found in the Budget Section (III.B) of this policy to create the operating plan for the Service Center for the next fiscal year. Budget Summary for Next Fiscal Year FTE Salaries/Benefits Operating Expenses Travel Cost Allocations Equipment Depreciation Transfer* (Account Codes 400001-439999) (Account Codes 450000-699999) (Account Codes 700001-709999) (Account Codes 960100-960200) (Account Code 997100) Total Expenses Budget 3.0 $100,000 47,000 1,000 4,500 2,000 3.0 $154,500 *Periodic transfers will be made to a Renewal and Replacement program in the Plant Fund for future equipment acquisitions. These transfers will be based on actual depreciation calculations for existing equipment, and equipment purchased and put into use during the fiscal year for which the rates are being calculated. 2. Identify Unallowable Expenses (may require a separate program) Less: Unallowable Expenses Total Allowable Cost Study Expenses 3. ( 300) $ 154, 200 Allocate Expenditures of Services The ABC Department provides three different laboratory tests, Test A, B and C. Identify direct expenses for each type of service provided. Direct Expenses Salaries/Benefits Jones, Mary Smith, John Operating Expenses Equipment Depreciation Total Direct Expenses Test A Test B Test C Total FTE .50 .43 0 0 FTE $20,000 .25 15,000 .14 22,000 0 400 0 FTE $10,000 .25 5,000 .43 8,000 0 300 0 FTE $10,000 1.00 15,000 1.00 14,000 0 800 0 $ 40,000 35,000 44,000 1,500 .93 $57,400 .39 $23,300 .68 $39,800 2.00 $120,500 51 4. Identify Total Indirect Expenditures Indirect Expenses: Salaries/Benefits Operating Expenses Travel Cost Allocations Equipment Depreciation 25,000 3,000 1,000 4,500 500 Total Indirect Expenditures 5. 34,000 Adjust Indirect Expenditures for Unallowables Eliminate unallowable expenditures. Less: Unallowable Expenses Adjusted Indirect Expenses 6. ( 300) 33,700 Distribute Indirect Costs to Each Service Divide the total allowable indirect expenses ($33,700) by the total direct expenses ($120,500) to establish an indirect/direct cost ratio. (This is method #2 from Exhibit B. Methods #1 or #3 explained in Exhibit B are also acceptable.) Indirect/Direct Expense Ratio 7. 27.97% Apply Indirect Cost Ratio Multiply the indirect/direct cost percentage times the direct costs for each type of procedure. Indirect Expense per Test 8. Test A Test B Test C Total $16,053 $6,516 $11,131 $33,700 $29,816 $50,931 $154,200 Combine Direct and Indirect Costs Add the direct costs and indirect costs for each type of procedure. Total Direct & Indirect Expenses at 6/30/XX $73,453 52 9. Adjust for Fund Balance Adjust total direct and indirect expenses by the projected current year increase or decrease in the 60-day fund balance limit. In this example, fund balance is projected to increase by $10,000 at the end of this fiscal year. This means the current year rates generated $10,000 in excess revenue. As a result, the $10,000 needs to be subtracted from the total expenses for each procedure. This is done by allocating the $10,000 across the three procedures based on the percentage relationship of the identified expenses for each procedure. % to Total Projected Fund Balance (Increase) Decrease Adjusted Total Expenses 10. Test A Test B Test C 47.6% 19.3% 33.1% (4,760) (1,930) (3,310) $68,693 Total (10,000) $27,886 $47,621 $144,200 750 800 2,550 $37.18 $59.53 Estimate Sales Volume Identify the volume of procedures projected to occur for the year. Number of Procedures 11. 1,000 Calculate Billing Rate Divide the total adjusted expenses by the total projected volume. Billing Rates for Next Fiscal Year $68.69 53 General Administrative Recharge (GAR), General Infrastructure Recharge (GIR), and Pooled Investment Earnings (PIE) Learning Objectives: Understand how and why GIR and GAR are calculated and assessed Understand how and why PIE is calculated and distributed These fiscal policies are on the web in their most current form at: http://www.ucdhsc.edu/admin/policies/ 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 Speedtype (Chartfield) Set-Up Learning Objectives: Understand the speedtype setup process/ paperwork Understand the program attributes determination process 72 Facilities and Administrative (F&A) Costs Learning Objectives: Understand what F&A is and why it is assessed Understand the process of F&A assessment The Finance and Administration Newsletter is available at: http://www.uchsc.edu/news/ 73 74 75 76 77 78 79 80 81 Speaker Contact Information Kathy Illian Trainer, Financial Services Kathleen.Illian@uchsc.edu Dave Tice Accountant, Finance David.Tice@uchsc.edu Amy Gannon Director, Financial Compliance Amy.Gannon@uchsc.edu Eileen Teel Director, Student Employment Eileen.Teel@cudenver.edu Susan Harman Subcontracts Specialist, OGC Susan.Harman@uchsc.edu Normandy Roden Director, PSC Normandy.Roden@cu.edu Jean Stewart Director, Internal Audit Jean.Stewart@cusys.edu Shaun McMullin Manager, Finance Shaun.McMullin@uchsc.edu Terry Pew Manager, Finance Terry.Pew@uchsc.edu Jeanne Paradeis Manager, Finance Jeanne.Paradeis@cudenver.edu Kim Huber Controller, UCDHSC Kim.Huber@uchsc.edu 82