Entrepreneurial Resource Handbook

advertisement

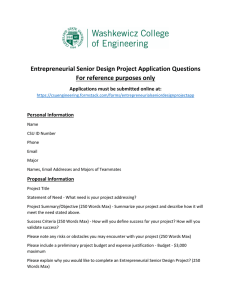

Entrepreneurial Resource Handbook DISCLAIMER This Entrepreneurial Handbook was developed by students to help student entrepreneurs as part of an Ontario Partnership for Innovation and Commercialization (OPIC) work-study project. It contains a lot of useful information, but the Ted Rogers School of Management and OPIC do not warrant the information that is contained in the Handbook. The Entrepreneurial Resource Handbook Entrepreneurship Program Fall 2008 Table of Contents Entrepreneurial Resource Handbook ................................................................................. 0 Table of Contents ................................................................................................................ 1 Incorporating Your Business .............................................................................................. 2 Incorporation Kit ............................................................................................................. 2 Essential Forms ............................................................................................................... 2 NUANS Name Search .................................................................................................... 3 Business Number/ GST Number .................................................................................... 3 Helpful Websites for Small Business ............................................................................. 3 Business Plan Resources for Entrepreneurs ........................................................................ 4 Suggested Books for Creating a Business Plan .............................................................. 4 Preparing a Business Plan ............................................................................................... 7 Online Sample Business Plans ........................................................................................ 8 Canadian Government Services for Creating & Operating a Business .......................... 9 Market Research Websites ............................................................................................ 10 Exploring New Business Ideas and Franchising Opportunities .................................... 10 Tradeshow and Invention Show Information ............................................................... 11 Sources of Financing......................................................................................................... 12 Types of Funding Programs .......................................................................................... 12 Government Grants & Loans: Funding Program Types ................................................ 12 Contact the Small Business Funding Centre for further information: .......................... 17 Venture Capitalist (VC) Funding .................................................................................. 17 Legal Aspects of a Business Idea...................................................................................... 19 Intellectual Property, Copyrights, and Patents .............................................................. 19 FAQs for Entrepreneurs and Future Business Owners ................................................. 20 Human Resources: .................................................................................................... 20 Financing: ................................................................................................................. 21 Tax Related: .............................................................................................................. 22 Insurance: .................................................................................................................. 24 Suppliers and Contractors: ........................................................................................ 24 Miscellaneous Useful Information .................................................................................... 26 Must Read Books for Entrepreneurs ............................................................................. 26 Entrepreneurial/Business Magazines/Websites ............................................................ 26 Entrepreneurial Self-Assessment Tests......................................................................... 27 Appendix ........................................................................................................................... 28 1 The Entrepreneurial Resource Handbook Incorporating Your Business The following links and forms are to government and government sponsored websites that help entrepreneurs: Incorporate Search for a business name Register the name Obtain a business number Obtain a GST number Apply and fill-out forms for various industry specific licenses and legal forms The first place an entrepreneur may want to visit is the Industry Canada website (www.ic.gc.ca). By looking through the website, there is a lot of information for various industries in Canada. Incorporation Kit The following link is an Incorporation Kit provided by the Canadian government which helps to break down the incorporation process. http://www.ic.gc.ca/epic/site/cd-dgc.nsf/en/cs02717e.html (downloadable PDF file) This kit provides information on: Required forms and documents The role of Corporations Canada Methods to incorporate Types of incorporation How to fill out the various forms The classes of shares and distribution Contact information Essential Forms Form 1 is the Articles of Incorporation. The online fee is $200; fax and mail costs $250. The online method is much faster and easier to use. The following link will lead you to the online registration: 2 The Entrepreneurial Resource Handbook www.strategis.ic.gc.ca/corporations > click “Online Filing” from the menu on the leftside of the page. An example of Form 1 and Form 2 can be found in the Appendix (see Appendix A; Appendix B). NUANS Name Search NUANS® is a computerized search system that compares a proposed corporate name or trade-mark with databases of existing corporate bodies and trade-marks. This comparison determines the similarity that exists between the proposed name or mark and existing names in the database, and produces a listing of names that are found to be most similar. (www.nuans.com, 2008) In order to perform an online real-time search you must register with Strategis. It is a free registration and gives you access to other areas of Strategis which may be of value to you. Business Number/ GST Number To apply for your Business Number/ GST # you must fill out the form (online or hardcopy) from the Canada Revenue Agency website (http://www.cra-arc.gc.ca/bro/). There is no cost for applying for a GST number. See Appendix C for example of the Business Number Application Form Helpful Websites for Small Business www.sbe.gov.on.ca – Provides resources and economic information for small businesses in Canada. There are many sections that are useful; in particular the Forms and Licenses and Permits sections. www.strategis.ic.gc.ca – Portal for everything to do with business in Canada www.incorporationcanada.ca – Straight-forward guide and resources for getting started. They offer various incorporation packages that are sponsored by the Canadian Government. www.corporationcentre.ca – Good website with incorporation packages offered. Not limited to Ontario, other provinces are included as well. 3 The Entrepreneurial Resource Handbook Business Plan Resources for Entrepreneurs Suggested Books for Creating a Business Plan 1. Building a Dream Publisher: New York; Toronto: McGraw-Hill, 7th ed, c2008. Author: Good, Walter 2. Business Plans Handbook: a compilation of actual business plans developed by small businesses throughout North America. Publisher: Detroit, MI: Gale Research, Inc., Author: Gale Research Inc. 3. How to write a .com business plan : the Internet entrepreneur's guide to everything you need to know about business plans and financing options Publisher: New York; Toronto : McGraw-Hill, 2001. Author: Eglash, Joanne. 4. How to write a business plan Publisher: London; Philadelphia: Kogan Page Limited, 2nd ed, c2006. Author: Finch, Brian. 5. How to write a business plan [Electronic Source] Publisher: Berkeley, CA : Nolo, 7th ed, 2005. Author: McKeever, Mike P. 6. The business start-up kit Publisher: Chicago: Dearborn Trade, c2003. Author: Strauss, Steven D., 19587. The complete idiot's guide to starting a home-based business Publisher: New York: Alpha Reference, c2000. Author: Weltman, Barbara, 19508. The entrepreneur's guide to writing business plans and proposals 4 The Entrepreneurial Resource Handbook Publisher: Westport, Conn : Praeger, 2008. Author: Chambers, K. Dennis, 19439. The Ernst & Young business plan guide Publisher: Hoboken, N.J.: J. Wiley & Sons Inc., 3rd ed, c2007. Author: Ford, Brian R. Et al 10. The independent filmmaker's guide to writing a business plan for investors Publisher: Jefferson, N.C. : McFarland, 2004. Author: Campisi, Gabriel, 196811. The 30-second commute [electronic resource]: the ultimate guide to starting and operating a home-based business Publisher: New York: McGraw-Hill, c2004 Author: Williams, Beverley. Et al 12. Writing and presenting a business plan Publisher: Mason, OH : Thomson/South-Western, c2006[i.e. 2005]. Author: Carolyn A. Boulger 13. Business Plans Made Easy Publisher: Entrepreneur Press, 2005. Author: David H. Bangs 14. Entrepreneurial New Ventures Publisher: Dame Thomas Learning, 2001. Author: Joel Corman & Robert N. Richey 15. Model Business Plans Publisher: Prentice Hall Press, 1998. Author: Wilbur Cross & Alice M. Richey 16. Building a Dream Publisher: McGraw-Hill Ryerson, 1993. Author: Walter S. Good 17. Framework for Creating a Business Plan Publisher: Ryerson University. Author: K. Jensen 5 The Entrepreneurial Resource Handbook 18. Marketing Strategies for Small Business Publisher: www.ryerson.ca/~kjensen . Author: K. Jensen 19. BizPlan Express Publisher: South-Western College Publishing, 1998. Author: Jill E. Kapron 20. The Perfect Business Plan Publisher: Random House Inc., 2005. Author: William Lasher 21. Bankable Business Plans Publisher: Thompson, 2004. Author: E.G. Rogoff 22. Business Plan to Business Reality Publisher: Pearson Prentice Hall, 2003. Author: James R. Skinner 23. The Definitive Business Plan, 2nd Ed. Publisher: FT Prentice Hall, 2002. Author: Richard Stutely 24. Business Plans That Work Publisher: McGraw Hill, 2004. Author: Jeffery A Timmons, A. Zacharakis, S. Spinelli 25. New Venture Creation, 5th Ed. Publisher: Irwin McGraw-Hill, 1994 Author: Jeffery A. Timmons 6 The Entrepreneurial Resource Handbook Preparing a Business Plan 1. Canada Business Interactive Business Planner (IBP) this is the first business planning software product designed specifically to operate on the World Wide Web. The IBP uses the capabilities of the Internet to assist entrepreneurs in preparing a 3 year business plan for their new or existing business – www.canadabusiness.ca/ibp 2. BizPlanIt’s Virtual Business Plan is a leading business plan consulting firm that is also committed to providing high-quality free business plan resources for the doit-yourself business plan writer. If you're searching for business planning tips, tools and advice from experts who have prepared hundreds of business plans you've come to the right place – www.bizplanit.com/vplan.html 3. Write An Effective Business Plan by using the workbook provided by the Entrepreneurship Centre dedicated to helping entrepreneurs make educated decisions about starting and growing their businesseswww.entrepreneurship.com 4. The Business Development Bank of Canada (BDC) is a financial institution wholly owned by the government of Canada. BDC will aid the creation of a business plan as it plays a leadership role in delivering financial, investment and consulting services to Canadian small and medium-sized businesses interested in start-ups, growth, acquisitions, international markets, etc. - http://www.bdc.ca 5. Ernst and Young Business plan booklet presents a generalized outline for writing a business plan. The outline is intended to be used with Ernst & Young’s Business Plan Guide, published by John Wiley & Sons. The guide can be purchased at many bookstores, or see page 15 for ordering information http://www.techventures.org/resources/docs/Outline_for_a_Business_Plan.pdf 6. TD Canada Small Business Planner (133 K) can help you prepare a business plan for your company, no matter what size. If you have an established business, you will be able to test possible scenarios or prepare comprehensive business plans to support your banking needs. If you are thinking about, or are in the process of establishing a new business the TD Canada Trust Business Planner can help you and your banker consider all important variables http://www.tdcanadatrust.com/smallbusiness/pdf/SBBPlanner.pdf 7 The Entrepreneurial Resource Handbook Online Sample Business Plans Bullet Proof Business Plans provide ideas of what should go into a business plan, along with key factors to consider when preparing a plan document. This website is a courtesy to students, entrepreneurs and educators to assist them furthering their entrepreneurial pursuits. You may access sample business plans listed below a. Sample business plan for TopTouch Technology Inc., a technology company http://www.bulletproofbizplans.com/bpsample/Sample_Plan/sample_plan.html b. Sample business plan for 2MBA, a company that develops innovative beverage equipment for the corporate owners of major food brands http://www.businessplans.org/2mba/2mba00.html c. Sample business plan for Sana Sana, is a B2B2C solution company that provides mutually beneficial partnership between Hispanic consumers of health care and the businesses-payers, providers and suppliers of health services and non-health related companies alike-which would like to serve them http://www.businessplans.org/sana/sana00.html d. Sample business plan for Fabrica, a is company that provides no-tradeoffs solution to the weaver's quandaryhttp://www.businessplans.org/Fabrica/Fabric00.html e. Sample business plan for Vusion, Inc., company is developing a chemical analyzer and Sensor Cartridge, based upon the Electronic Tongue TM technology, which can instantly analyze complex chemical solutionshttp://www.businessplans.org/Vusion/Vusion00.html f. Sample business plan for JetFan Technology Limited, is a company that develops and market commercial applications for an innovative fan impeller ("fan blade") technology - the JetFanTm http://www.businessplans.org/JetFan/JetFan00.html 8 The Entrepreneurial Resource Handbook Canadian Government Services for Creating & Operating a Business 1. Canadian business is a government information service for business and startups entrepreneurs; helps to start-up a business, financing, taxes, human resources, importing, exporting, regulations, research and statistics, Government Contract and tenders, Innovation and regulations, etc. This Website reduces the complexity and burden of dealing with various levels of government by serving as a single point of access for federal and provincial/territorial government services, programs and regulatory requirements for business http://www.canadabusiness.ca/gol/cbec/site.nsf 2. Canada-Ontario Business Call Centre (COBSC) also provides access to accurate, timely and relevant information on federal and provincial business-related programs, services and regulations. They provide information to on start-ups, business planning, operating a business, advertising, technology and innovation, intellectual property, international trade, e-Business, Selling to the Government, selling or closing your business, financing, regulations and licensing, taxes, market research, small business workshops. Excellent Website for Aboriginals, New Comer to Canada, Women Entrepreneurs, Youth, Exporters/Importers http://www.cbsc.org/ontario a. Also See http://www.cobsc.org/en/podcasts.cfm for Business podcast series that are designed to help with business start-ups, growing a business and outline some of the most difficult aspects of business ownership. Excellent for students, commuters and those with little time. Just load to podcast ready devices and GO! 3. The Business Development Bank of Canada (BDC) is a financial institution wholly owned by the government of Canada. BDC will aid the creation of a business plan as it plays a leadership role in delivering financial, investment and consulting services to Canadian small and medium-sized businesses interested in start-ups, growth, acquisitions, international markets, etc. - http://www.bdc.ca 4. The Centre for National Business Development offers entrepreneurs and businesses looking to start or expand their business, engage in R&D, hire employees, purchases real estate for business, train staff, invest in capital expenditures more resources by providing loans and grants - http://canadiangrants-loans.org//index.php 5. Industry Canada provides an in-depth, industry-specific analysis, statistics, contacts, news, events, financing and regulatory information for Canadian 9 The Entrepreneurial Resource Handbook business. An excellent source to find industry information when creating a business plan or during business operations. This department also offers help in program areas which include developing industry and technology capability, fostering scientific research, industry setting telecommunications policy, small business development, Business tools and resources, Company directories, Consumer information, Financing, etc.http://www.ic.gc.ca/epic/site/ic1.nsf/en/h_00066e.html 6. Canadian Economy Online is a one stop guide the country’s economy’s statistics, to learn about concepts and events affecting the economy as well as provides access to a wealth of federal government information. This is an excellent source for entrepreneurs and business owners who are interested in the economic conditions affecting their business. Great source to conduct market/economy research when creating a business plan http://canadianeconomy.gc.ca/english/economy/index.cfm Market Research Websites 1. The Inventor’s Network which provides a list of major inventor’s show held in the U.S. – www.inventnet.com/tradeshows.html 2. Publishers of Trade Shows Worldwide, Newsletter in Print, and a number of other useful trade publications – www.gale.com 3. Provides a detailed listing of trade shows and conventions in all areas of the economy – www.tradeshowbiz.com 4. A comprehensive directory focusing on conferences, conventions, trade shows, and workshops across the range of industries– www.allconferences.com 5. A searchable database of almost 7,000 trade shows, exhibitions, and conferences scheduled to be held all over the world – www.eventseye.com 6. Ernst and Young is a global leader in assurance, tax, transaction and advisory services. They also aim to have a positive impact on businesses and markets, as well as on society as a whole - http://www.ey.com/global/content.nsf/Canada/Home Exploring New Business Ideas and Franchising Opportunities 1. 2. 3. 4. Waterpaws Canine Aquatic Centre - www.waterpaws.ca Six Acres restaurant/bar – www.sixacres.ca Kerri’d Treasures Unique Gifts – www.kerridtreasures.com La fourmi biunique Inc. Natural and organic food products – www.lafourmibionique.com 10 The Entrepreneurial Resource Handbook 5. 6. 7. 8. 9. Focused Student books and educational products – www.focusedstudents.com Zold Online Inc. Consignment eBay store – www.zoldonline.com Harmony Naturopathic Health services – www.harmonynaturopath.com HELP Group management Inc. First aid and safety training – www.hgmi.ca Department Camera which specializes in video services and equipment rentals to commercial clients – www.departmentcamera.tv 10. Mandy Kan. “the Dessert Lady” and her high-quality bakery in the Yorkville district of Toronto 11. Jason Wagner’s Website for his Trackitback loss recovery service identification labels and ID tags – www.trackitback.com 12. Ariz David’s trendy, high-end kitchenware store Cucina Moderna – www.cucinamoderna.ca 13. Entrepreneurs online which provides access real life entrepreneurs who answers questions, tips on how to grow you business, franchising opportunities, business ideas, current economic conditions videos, business coaching and other tools/services - http://www.entrepreneur.com 14. Canadian Franchising Association - www.cfa.ca 15. International Franchise Association is a consumer guide to buying a franchise – www.franchise.org/franchiseesecondary.aspx?id=10002&LangType=1033 16. Franchise.com is a source for top franchises for sale, information about today's best franchises and business opportunities, and resources to help potential buyer learn about franchising and small business ownership http://www.franchise.com/ 17. BizBuySell is the Internet's largest and most heavily trafficked business for sale marketplace, with more business for sale listings, more unique users, and more search activity than any other service. BizBuySell currently has an inventory of over 50,000 businesses for sale, and more than 800,000 monthly visits. BizBuySell also has one of the largest databases of sale comparables for recently sold businesses and one of the industry's leading franchise directoriesMostly American companieshttp://www.bizbuysell.com/ Tradeshow and Invention Show Information 1. The Inventor’s Network which provides a list of major inventor’s show held in the U.S. – www.inventnet.com/tradeshows.html 2. Publishers of Trade Shows Worldwide, Newsletter in Print, and a number of other useful trade publications – www.gale.com 3. Provides a detailed listing of trade shows and conventions in all areas of the economy – www.tradeshowbiz.com 11 The Entrepreneurial Resource Handbook 4. A comprehensive directory focusing on conferences, conventions, trade shows, and workshops across the range of industries– www.allconferences.com 5. A searchable database of almost 7,000 trade shows, exhibitions, and conferences scheduled to be held all over the world – www.eventseye.com Sources of Financing Types of Funding Programs Government Grants & Loans: Funding Program Types Taken from: http://www.grants-loans.org/programs.php Depending on the size & nature of your business you may be eligible for anywhere between $1500 to $10 million dollars in the form of: 1. Grants and Subsidies (one-time & renewable): When you receive this money, you don't have to pay it back. It's yours to use under the terms of the grant. The federal and provincial governments know that it's tough for small businesses like yours to bring new products to market, make your company more efficient, or hire employees. So they provide billions of dollars a year to aid Canadian product innovation and grow small businesses. For example, the National Research Council Industrial Research Assistance Program (NRC/IRAP) provides non-repayable contributions (a fancy name for grants) to small and medium-sized Canadian businesses who are interested in growing by using technology to commercialize services, products and processes in Canadian and international markets. Bruce Elliott, a self confessed "idea man" from the Northwest Territories, developed his concept for fibreglass telephone poles with help from IRAP. The program funded the salary of a senior engineer and provided grants to help assemble fabrication equipment to test new production methods. The federal and provincial governments also recognize that some regions and business sectors need more economic development support than others. Businesses across the country are eligible for some of the billions of dollars in funding allotted for this development. 12 The Entrepreneurial Resource Handbook Small businesses accessing grant programs enjoy a bonus benefit: once you've successfully received funding, you're more likely to get additional grants from the same agency because you meet their program requirements. There are currently 39 Federal and 57 Provincial programs available, offering between $1,500 - $500,000 worth of funding. 2. Low-interest or no-interest loans: While a grant is obviously an ideal source of government funding, you have an even greater chance of accessing government programs which provide financing for small businesses through loans. So if you've made the rounds of the banks and been shown the door, don't give up yet. In fact, government loans are often better than bank loans. They may be interest-free, or may offer highly competitive rates. (In some cases, your loan may even be considered "non-repayable", which is another way the government says "grant".) Government loans carry additional advantages. They're more likely to be unsecured; that is, you don't need to put up collateral against the loan. You'll find loans under a variety of programs, directed at different industries, different geographical regions, and even loans directed specifically at women and young entrepreneurs. For example, the federal Canadian Youth Business Foundation (CYBF) offers start-up loans of up to $15,000, amortized over three to five years, to young people starting a business. Young, in CYBF parlance, means anywhere from 18 to 34 years old. You'll need to complete a viable business plan as part of the program, but that should be top of your to-do list anyway. The program often matches you with an experienced business person who can mentor you during (and after) the start-up phase. Evan and Erin McAskile were turned down by every bank they went to while trying to open a country inn. But at 27 and 28, they were eligible for a CYBF loan, and the couple received $15,000. Since the loan was unsecured, they were able to leverage it into additional loans totalling $75,000 – some of it from the very banks who had previously turned them down. Programs such as this form the bulk of government funding for small business. It's in your interest to seek and find those for which you're eligible. There are currently 83 Federal and 82 Provincial low or no-interest loan programs available, offering between $1,500 - $10 million worth of funding. 13 The Entrepreneurial Resource Handbook 3. Tax refunds or tax credits: Getting money is obviously beneficial. But not having to pay it amounts to the same thing, and can even be better. The government offers a variety of programs that decrease your tax burden, including programs that provide a lower tax rate for small businesses, award tax credits for hiring eligible apprentices, and provide investment tax credits (ITCs) for qualified expenditures in R&D. For example, the Scientific Research and Experimental Development (SR&ED) program is a federal tax incentive program to encourage Canadian businesses of all sizes and in all sectors to conduct research and development in Canada that will lead to new, improved, or technologically advanced products or processes. Consider the advantages for those projects that qualify. Canadian-controlled private corporations can earn an ITC of 35 percent up to the first $2 million of qualified expenditures for SR&ED carried out in Canada, and 20 percent on any excess amount. Other Canadian corporations, proprietorships, partnerships, and trusts can earn an ITC of 20 percent of qualified expenditures for SR&ED carried out in Canada. Since it's a refundable tax credit, you get the refund in cash, even if you don't make a profit. And beyond that, you receive a full tax deduction in the year you incur the expenses – even if they're capital expenses. You can also carry over R&D deductions to subsequent years. And what if your project's a dud? Even if the R&D is ultimately unsuccessful, you have still earned the credits. Finally, if the project is something you are going to do anyway, filing for your tax claim is a no-brainer… it's free money back! There are currently 11 Federal and 23 Provincial programs available, offering between $3,500 - 2 million worth of funding. 4. Government insurance against business risks: For low or even no premiums, you can have the government insure your business against various risks, providing valuable assurances to financial institutions and making it easier for you to borrow. For example, Export Development Canada (EDC) will insure your accounts receivable, covering your full book of business for up to 90 percent of your losses against such risks as customers refusing to pay. Your insurance might also cover refusal to accept the goods, bankruptcy or insolvency, cancellation of import or export permits, currency transfer, contract cancellation, and wars or insurrections. 14 The Entrepreneurial Resource Handbook Mark Alan, who exports erosion control blankets to the U.S. swears by the program. "It gives me the comfort that I'll get at least 90 percent of the money I invoice," he says. "And it gives the bank some kind of security in terms of my receivables in the U.S. so they will lend more against those receivables." There are currently 7 Federal and 8 Provincial programs available, offering between $20,000 - 10 million worth of funding. 5. Government Relocation Incentives: If you're willing (or eager) to move to a new facility or even a new province, you may find incentives that make the move that much more attractive. For example the government of Nova Scotia offers a substantial payroll rebate to eligible companies expanding in or relocating to the province. Companies must create a specified number of jobs at a determined salary within a set timeframe. For a relocating company, that can be easily predicted. There are currently 7 Federal and 6 Provincial programs available, offering between $5,000 - $500,000 worth of funding. 6. Government guaranteed loans: One of the reasons banks shy away from financing small businesses is the high risk factor. Many small businesses fail, and when that happens, the bank is stuck with a bad loan. But if someone is willing to guarantee the loan, or a substantial part of it, financial institutions are a lot more willing to pony up. It's like having Dad co-sign for that car loan. Government insurance (available for low premiums or even no premiums) provides this option to small businesses. For example, the Canadian Small Business Funding Program (CSBFP) can help you get a loan of up to $250,000 to buy or improve real property or equipment, or to make leasehold improvements. Your loan will finance up to 90 percent of these costs. Interest rates on CSBF loans are either floating or fixed, but the floating rate can't be more than three percent higher than the lender's prime rate, and fixed rates can't be more than three percent higher than the lender's residential mortgage rate. You will pay a fee of two percent of the total amount of the loan, but this, too, can be financed and added to the total – as long as it doesn't exceed the maximum of $250,000. CSBF loans of various amounts help small businesses across the country. When cash flow got tight due to the seasonal nature of his outfitter business, Gary Jaeb of True North Safaris in the Northwest Territories received $24,000 to maintain and modernize his fleet of small fishing boats. 15 The Entrepreneurial Resource Handbook Private investigator Dick Lee of British Columbia's Kootenays took over the company he worked for when his boss retired, and brought the company up to date with new computer equipment, thanks to financing of $38,285 under the program. And entrepreneurs Danny Guillaume and Jeff Grajczyk revamped a Moose Jaw, Saskatchewan tourist attraction with a $224,000 government-backed loan from the Royal Bank. Guaranteed government purchases of your product or service: With a firm commitment from the government, you can count on predictable cash flow. This increases your chances of financing from banks and/or investors, and lends your business a preferred supplier status, which will build confidence in your other customers. Government Information & Services: In addition to money, the government provides a number of programs which offer valuable services and resources. These might include training programs, consulting services, mentorship programs, the opportunity to attend trade fairs, and introductions to potential suppliers, partners and customers. In many cases, these services would normally bear a substantial cost, so you're not only getting the business building value of the service, but you're saving money, too. Conditionally Repayable Contribution: Often, when the government invests in your business, the program has a built-in protection for you. In this case, you might be required to pay back the amount only if the venture proves successful. It's like having a really nice venture capitalist invest in your company, but only wanting a return on the investment if your project is successful and profitable. Grants in-lieu of Property Taxes: In many areas the government offers a break on property taxes to encourage investment. It is like getting the money as a grant since you would have had to pay it back otherwise. Equity Financing: In this case, the government invests in your company, much as a venture capitalist or angel might. The difference is, the government is often more interested in economic stimulus and less anxious about the return on the investment – so there's less pressure on you to deliver profits to them. Access to Resources: Sometimes, the equipment and facilities you need to 16 The Entrepreneurial Resource Handbook develop or research a product are beyond your business' capabilities. Through the government you may gain access to state-of-the-art expertise, resources and facilities. The SBFC has research staff with expertise in the government funding opportunities of every province and region of Canada. Our databases are arranged to be easily referenced both by area and business type. If any government office offers funding for your type of venture, we have it listed and referenced so you can access it easily. There is money available now for qualified new and existing small businesses. Contact the Small Business Funding Centre for further information: Phone toll free 1-800-658-9792 to discuss your needs with an information counsellor. Venture Capitalist (VC) Funding If you are looking for some venture capitalist funding for your start-up or if you are looking for another round of financing, the Canada's Venture Capital & Private Equity Association (CVCA) has a list of member venture capitalists that are interested in investing in a variety of firms. The following is a categorized directory for these VCs: www.cvca.ca MaRS Group What is MaRS? MaRS is a non-profit innovation centre connecting science, technology and social entrepreneurs with business skills, networks and capital to stimulate innovation and accelerate the creation and growth of successful Canadian enterprises. Contact Information MaRS Centre, South Tower, 101 College Street, Suite 100 Toronto, ON Canada M5G 1L7 T 416.673.8100F Website: http://www.marsdd.com/MaRS-Home.html MaRS Services MaRS group offers their services through three main categories: MaRS Venture Group; is a resource centre for entrepreneurs, technology start-ups and emerging growth companies. The Venture Group provides access to quality information resources, business tools and broad international networks of mentors, talent, market connections, angels, investors and other advisors. The MaRS Venture Group is ideal for start-ups as they provide valuable resources to aid in this stage of the business development. Educational program are provided to the 17 The Entrepreneurial Resource Handbook community at large, to no cost to individuals. The topics are recurring issues that the MaRS advisors have identified for entrepreneurs. The focus is on companies that are technology based, operate in high growth industries such as health care, biotechnology, energy, advanced materials, advanced manufacturing, nanotechnology, and information and communication technologies. MaRS Incubator They offer a reasonably priced laboratory and office space for start-up and emerging companies. The MaRSMaRS Incubator allows early stage companies an area to “plug-and-play” office and laboratory facilities that cover basic lab research space requirements. The Incubator is currently home to 22 companies, representing a diversity of industries including information technology, life sciences, biotechnology and medical devices. Currently 90% leased, the Incubator has 44 private offices and 42 private labs that can be reconfigured to accommodate individual requirements. Walls within the office and lab areas may be removed or added for maximum space and flexibility. 18 The Entrepreneurial Resource Handbook Legal Aspects of a Business Idea Intellectual Property, Copyrights, and Patents A trademark can be a word, phrase, letter, number, sound, smell, shape, logo, picture, and aspect of packaging or a combination of these. Trademarks serve to identify the company or individual that goods or services originate from and to distinguish those goods or services from other traders. Registration of a trademark gives the owner proprietary rights in relation to that mark.1 Copyright is a right given automatically to the creator of new content, granting them the exclusive right (with some exceptions) to reproduce, perform or display the work. There is no application process for a copyright. Any new work is automatically covered by copyright (this is a change from earlier copyright law). Despite the fact that copyrights are automatically granted after a work is created, you can still register a copyright, and doing so allows you to sue for statutory damages against infringers. Copyrights are officially for “a limited time,” though that limited time has been expanded repeatedly over the years, and currently stand at "life of the creator + 70 years."2 A patent is an exclusive right, or a monopoly, granted to someone for a limited time in exchange for publicly disclosing a new and non-obvious invention. The purpose of a patent, as discussed last week, is supposed to be to provide additional incentive for the invention to be created in the first place. While many insist that the purpose of the patent system is to force the disclosure of those inventions, that's, at best an exaggeration, and at worst, a complete myth. Generally speaking, a patent lasts 20 years from the date of filing. Under current US law, patentable subject matter has expanded quite a bit over the years, and now includes things that at times were not considered patentable, including software and business models or methods.3 The following links direct you on how to obtain IP, the associated costs, and accompanying forms: 1. The Canadian Intellectual Property Office (CIPO), a Special Operating Agency (SOA) associated with Industry Canada, is responsible for the administration and 1 Music Industry Piracy Investigations website accessed on March 10, 2008 at http://www.mipi.com.au/trademarks.htm 2 The Insight Company for the Information Age website accessed on March 14, 2008 at http://www.techdirt.com/articles/20080228/003450379.shtml 3 The Insight Company for the Information Age website accessed on March 14, 2008 at http://www.techdirt.com/articles/20080228/003450379.shtml 19 The Entrepreneurial Resource Handbook 2. 3. 4. 5. processing of the greater part of intellectual property in Canada. Provides all the information on Patents, trademarks and copyrights in Canada. Forms and documents provided - http://strategis.ic.gc.ca/sc_mrksv/cipo/corp/corp_maine.html An intellectual property matchmaking system linking industry, researchers, and others from over 100 countries around the world – www.ubcflintbox.ca The Canadian patents database administered by the Canadian Intellectual property office as a vehicle for inventors and entrepreneurs to get together – www.patents1.ic.gc.ca Host of the World Bank of Licensable Technology, a global technology database – www.innovationcentre.ca Source of the Catalogue of Government Inventions Available for Licensing, and annual catalogue produced up until the early 1900s to bring businesses and entrepreneurs opportunities to license and market U.S. government-owned inventions - www.ntis.gov FAQs for Entrepreneurs and Future Business Owners Human Resources: 1. What issues do I need to deal with when I hire employees? a. It is important, initially, to determine the nature of the relationship with staff. Will it be a contractual or an employment relationship? As an employer, entrepreneurs/businesses have certain responsibilities (for example, collecting and remitting CPP and EI) that you would not have in a contractor relationship. The Canada Customs and Revenue Agency (CCRA) guide entitled Employee vs. Self-Employed outlines the terms and conditions that must be examined and analyzed to make this decision. Many businesses are required to register their employees with the Workplace Safety & Insurance Board and pay premiums for insurance that covers time lost to injury. Examine the options at the WSIB web site. As an employer, businesses are required to deduct specified amounts off of an employee’s pay for CPP, EI and Income Tax. They also need to make contributions on employees' behalf for CPP and EI. Please see the Employers' Guide to Payroll Taxes at the Canada Customs and Revenue Agency web site. 2. What do I do if I want to fire someone in Canada? a. Before firing an employee, employers are encouraged to consult the Employment Standards Act, 2000. This provided employers with reasonable 20 The Entrepreneurial Resource Handbook grounds for termination of employment under the laws of Canada as relates to Ontario – http://www.e-laws.gov.on.ca/html/statutes/english/elaws_statutes_00e41_e.htm Financing: 1. How much will it cost to start a business? a. How much it will cost really depends on the type of business being considered. Many home-based businesses can be started on a shoestring. Larger retail-type operations will cost substantially more. It's a good idea to make a comprehensive list of all your anticipated start-up expenses and then prepare a 12-month cash flow. The Entrepreneurship Centre has a publication in our Resource Centre that may be of interest to future entrepreneurs/business owners. "How to Start and Grow Your Own Small Business with Nothing Down" includes over 850 business ideas that you can successfully start for less than $300. 2. I am looking to finance my growth. What options are available? a. When looking to finance growth, a number of options available to potentials. It is much easier to obtain bank financing for an existing business than it is for a new venture. If it is an existing business, the bank may finance the growth based on the company's accounts receivables, inventory, assets, and debt coverage (the ability of the company to service the debt repayment through their cash flow). Ensure that the most current financial statements prepared as well as a document outlining why they require financing, and how much money is required. Also consider factoring, an equity investment or growing through cash flow. 3. What are the 10 top mistakes entrepreneurs make when asking for money? a. It's no secret that "the numbers" are exceedingly important to a venture capitalist (VC) when deciding whether or not to provide money to a growing company. But there is much more to the VC decision-making process than just crunching the numbers. Other factors -- including subjective impressions - may be just as important to what a VC ultimately decides. It is here that entrepreneurs seeking capital often needlessly make mistakes that can prove fatal to their pleas for financial backing. There are 10 mistakes that entrepreneurs often make when looking for investment capital. Published by Beacon Venture Capital and the (US) National Consortium of Entrepreneurs, this article makes very interesting reading. 21 The Entrepreneurial Resource Handbook 4. What government financing is available? a. There are many government financing programs for businesses, generally targeted to specific industries, geographical areas or particular groups of entrepreneurs. Almost all financing programs consist of loans. There are very few grants available. However, they do exist for the arts/culture industry. One fairly accessible financing program is Canada Small Business Financing (CSBF), a loan that is guaranteed by the Government of Canada in the event of a default on the loan. For information on government financing programs for business visit the financing section of the Canada-Ontario Business Service Centre (COBSC) web site or call them at 1 (800) 567-2345.Take advantage of the Internet access available in our Resource Centre, or use the direct connection to COBSC's Info Fax system available across from the free information area at the Entrepreneurship Centre. Be sure to look into our Starting Your Business orientation session. Tax Related: 1. What taxes do I pay if I hire someone as an employee? a. Hiring a paid-employee on the other hand requires the payment of payroll deductions. These premiums often involve a deduction from the employee's cheque and an equal (or slightly greater) contribution by the employer, which is then remitted to the government by the employer. All employers are expected to remit payroll deductions for Canadian Pension Plan (CPP), Employment Insurance (EI), and Federal Income Tax. Some businesses depending on their size and nature of their work may be required to pay taxes to the Workplace Safety and Insurance Board or the Employer's Health Tax. 2. Do I need to keep all my receipts for tax deductions? a. Yes, you may receive cash or property from many different places. If you don't have records showing your income sources you may not be able to prove that some sources are non-business or non-taxable. Keeping control of your financial records could mean tax savings and can prevent most of the problems you might encounter if you get an audit on your income tax or GST returns. 22 The Entrepreneurial Resource Handbook 3. How do you suggest I keep track of my invoices and receipts? a. We would suggest a computer software package for your record keeping needs. Most software packages are easy to use, require minimal computer and accounting knowledge, provide a plethora of useful reports and tools and more importantly meticulously keep track of all facets of your business from inventory to customer addresses from overdue debts to GST. There are several small business accounting software packages such as: Simply Accounting by ACCPAC M.Y.O.B by MYOB Inc. QuickBooks Pro by Intuit. 4. What taxes do I have to collect? a. You may have to collect GST (Goods and Services Tax) and PST (Provincial Sales Tax) as follows: GST: If your gross revenue (total sales before expenses) is $30,000 or more in any twelve-month period, you must register for GST. Most goods and services are taxed at 7%. If your gross revenue is less than $30,000, then you may voluntarily register for and charge GST. When making this decision, consider: Will it be an accounting hassle? For some, particularly those using a manual bookkeeping system, accounting for GST means another two columns to balance. · If you don't charge GST, you won't be able to take advantage of the Input Tax Credit. This allows you to deduct GST you have paid from that which you have collected. Not charging the GST will inform everyone that your gross sales are less than $30,000. 5. Can I deduct business expenses? a. You can generally deduct business expenses - if they are incurred to produce income. If you claim expenses, you must be able to back up your claim. You do this by keeping all your business-related vouchers and receipts, and by recording all your expenses in a journal. Examples of expenses you can deduct· accounting/legal fees · advertising expenses · professional fees and dues · licence costs · interest and bank charges · meals and entertainment, maintenance, repairs and vehicle expenses · use of a workspace in your home · inventory and costs of goods sold typically, only a % of any expense can be claimed. Related information is available at the Canada Business Services Centre web site. See also the CCRA's "Business and Professional Income" tax guide. Copies are available at CCRA offices or the CCRA web site. 23 The Entrepreneurial Resource Handbook Insurance: 1. Where do I go for D&O insurance? a. Whether Non- Profit or Profit, Public or Private, the Directors and Officers of a company face an increasing risk of personal liability for any actual or alleged breach of duty, neglect, error, misstatement, misleading statement, act or omission in the performance of their duties. This website provides corporate directors and officers with more information regarding obtaining insurance to prevent possible liabilities as outlined abovehttp://www.hubinternational.com/content_image.aspx?id=944 For a comprehensive review of legal liability for directors and officers of notfor-profits, visit Industry Canada’s “Primer for directors of not-for-profit corporations” at http://strategis.ic.gc.ca/epic/internet/incilppdci.nsf/en/cl00689e.html 2. What kind of insurance should I get and where? a. For businesses and non-profit groups in Canada, having the right insurance is essential to surviving and thriving in a world that is full of opportunity, but also full of risk. The right type and amount of insurance will provide some financial peace of mind to organizations navigating their way through the sometimes-complex world of business, these include not limited to: loss of physical assets, liability to a third party, business interruption, loss/illness of key staff you may want to insure against any or all of these situations. i. Business owners can obtain more information from an insurance company/broker to see which would be fit for your company. ii. This website with choosing the right kind of insurance before going to a third party for help http://www.ibc.ca/en/Business_Insurance/ Suppliers and Contractors: 1. Where can I find contact information for suppliers or competitors? a. The best sources for listings of companies in Canada are the Canadian Trade Index, the Scott's Register, Fraser's Register, Ontario Business Source Book and the Thomas Register (U.S). All of these books are available as reference material and public use at the SSM Enterprise Centre. 2. If I hire people for my business as contractors what taxes do I pay? 24 The Entrepreneurial Resource Handbook b. There are two methods of hiring help to conduct your business - contracting and paid-employees. Contracting is used when a person provides a specific service for a set fee for a set duration. Some examples of this would include electrician, business/marketing consultant, bookkeeping, small jobs or casual labour, other positions where a specific skill set is required. For this the employer does not pay any premiums to the government because the contracted employee is assumed to have his own business providing these services on contract. However it is very wise to have it clearly outlined in the agreement that the employer is not responsible for paying premiums. 25 The Entrepreneurial Resource Handbook Miscellaneous Useful Information Must Read Books for Entrepreneurs 1. Strikingitrich.com: Profiles of 23 Incredibly Successful Websites You’ve Probably Never Heard Of, Jaclyn Easton and Jeff Bezos 2. Crossing the Chasm, Geoffrey A. Moore 3. Good to Great: Why Some Companies Make the Leap... and Others Don't, Jim Collins 4. The Monk and the Riddle, Randy Komisar 5. The Tipping Point: How Little Things Can Make A Big Difference, Malcolm Gladwell 6. The MouseDriver Chronicles: The True-Life Adventures of Two First-Time Entrepreneurs, John Lusk and Kyle Harrison 7. Positioning: The Battle for Your Mind, Al Ries and Jack Trout 8. Seven Habits of Highly Effective People, Steven Covey 9. Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not, Robert T Kiyosaki and Sharon L Lechter 10. Management Challenges for the 21st Century, Peter F Drucker 11. My Start-Up Life: What a (Very) Young CEO Learned on His Journey Through Silicon Valley, Ben Casnocha and Marc Benioff 12. Built to Last: Successful Habits of Visionary Companies, James Collins and Jerry Porras 13. Giants of Enterprise: Seven Business Innovators and the Empires They Built, Richard Tedlow Entrepreneurial/Business Magazines/Websites 1. Canadian Business Magazine – www.canadianbusiness.com 2. PROFIT Magazine – www.canadianbusiness.com/profit_magazine/index.jsp 3. The Globe and Mail Report on Small Business Magazine – www.reportonbusiness.com/rosbmagazine 4. The Financial Post Magazine print edition – www.canada.com/nationalpost/financialpost/printedition 5. INC Magazine – www.inc.com 6. Entrepreneur Magazine – www.entrepreneur.com 7. Fortune Magazine – www.money.cnn.com/magazines/fortune 26 The Entrepreneurial Resource Handbook Entrepreneurial Self-Assessment Tests The links below are useful assessment tests for future entrepreneurs to measure their potential as an entrepreneur. No quiz or test can predict one’s future as an entrepreneur; however, it can prove beneficial developing your skills as well users can compare it to that of proven successful entrepreneurs. 1. This tool provided by the Business Development Centre will help to better measure one’s entrepreneurial potential. It consist of 50 statements, and will take about 15 minutes to complete http://www.bdc.ca/en/business_tools/default.htm 2. Home of the National Entrepreneurship Test developed by PROFIT - www.saultcanada.com/ecssm/entrepreneur/entrepreneur.asp?tNav=t2 3. The Entrepreneur Test and interactive test designed to help user to assess their entrepreneurial and business skills =readiness – www.bizmove.com/other/quiz.htm 4. The following questionnaire will help evaluate to entrepreneurial aptitude. It consists of 50 questions. Results will be calculated when all questions are completed http://www.communityfutures.com/cms/Entrepreneur_Test.15.0.html 5. Bank of Scotland Entrepreneurship Test to see how future entrepreneurs measure up with other entrepreneurs and to see if they have what it takes to succeed - http://www.fortytwodegrees.co.uk/issue-2/test.html 27 The Entrepreneurial Resource Handbook Appendix ENT 726 Business Plans Tips for Market / Company / Industry Analysis - a Selection of Secondary Resources 1. CANADIAN DEMOGRAPHICS / MARKETS FP Canadian markets Canadian Demographics Library homepage > Catalogue > Title search > FP markets Canadian demographics Available in CDROM near Reference area, and print in Reserve collection HC111 .C37 2007 Print Measurement Bureau - Canadian consumer survey of purchasing preferences Library homepage > Catalogue > Title search > print measurement bureau Reserve collection PN4914.R43 P54 2007 Spending Patterns in Canada Library homepage > Catalogue > Title search > spending patterns in Canada Statistics Canada – Census … From Library homepage - Research Help >>Multidisciplinary Research Guide >> Social Science Data >> Canadian - By Subject - Under Business, Statistics Canada Business Data - Access market characteristics using census data - Click: the statistics icon for Community Profiles - 2006 community profiles - Census Tract (CT) Profiles - Enter a postal code, and SUBMIT (Can see population change, population breakdown by age groups) Statistics Canada: Other resources such as Annual Demographic Statistics,E-STAT; CANSIM 2. NAICS: SIC : Numbers that denote line of business. Many ways to find US and Canadian NAICS or SIC codes. E.g., via Ryerosn Library - Library homepage> Catalogue title search > naics Select : Naics Canada Connect to NAICS 2007, Html version 28 The Entrepreneurial Resource Handbook - View Standard Classification (search NAICS, or drill down the categories) Alternate: - Library homepage> Research Help > Business - Company/Industry Sources - In left menu, choose : Internet Industry Resources - Scroll down to SIC section & select : North American Industry Classification System (NAICS), US Census Bureau - Select NAICS 2007, In search box type : bakeries - View results - Click commercial bakeries, 311812 the # for a definition 3. COMPANIES SEDAR – for public co. corporate communications including annual reports. Also searchable by broad industries. FP Advisor – Financial statistics on Canadian public cos., & industry stats.(sample search) - Library homepage - Articles and Indexes - Indexes by Subject - Finance and Investment - Scroll down, click on FP Advisor. - Your will be at FPinfomart.ca homepage - In Snapshots type : research in motion A ‘Snapshots’ search for a company will rank major public companies (competitors) within the industry. Canadian Key Business Directory - Ref HF3223.C24. Also on CD near Ref Desk Ontario Business to Business Sales & Marketing Directory : Ref HF5072.O58.O58 --also on CD Ontario Business Metro Directory (Scott’s) Industrial directories; - Library website > Catalogue title search Yellow Pages; business search by keyword: http://canada411.yellowpages.ca/ Canadian Company Capabilities –a source for lists of exporters, as well as suppliers of products. (Companies self-register to this directory www.ic.gc.ca) (sample search) - Library homepage > Research Help > Business - Company/Industry Resources - In left menu, choose : Internet Company Sources - Company Directories : Canadian Company Capabilities Strategis - SEARCH - GO TO DETAILED SEARCH 29 The Entrepreneurial Resource Handbook - In product service/license type: Flour - SEARCH - View, Ellison Milling Alternate: (sample search for ‘Apparel’) - In NAICS box type : 315299, then SEARCH Hoovers – a source for US and Canadian co information. Includes large or some smaller private cos. Users may also build a list of companies (competitors) operating in a given line of business. - Library homepage –www. library.ryerson.ca - Articles and Indexes - Indexes by Title - Hoovers online - Click on companies - Type: wal-mart canada and SEARCH - Click: wal-mart canada corp - Click overview, to see Key Information This database includes both private and public, Canadian cos, but will not have in depth information on private cos. Also, Library does not subscribe to all links on screen. Lexis/Nexis – US and Canadian co information, as well as news and legal resources. Extensive info. on public cos, but briefer for private companies. Factiva: Business news; also source of competitor / industry stats. on US and larger Cdn cos. Net Advantage – Extensive financial info. on US public cos, and financial market information 4. INDUSTRIES: FP Advisor – a source for industry financial statistics on large Canadian industries. (sample search) - Library homepage - Articles and Indexes - Indexes by Title, and scroll to select FP Advisor - Click : industry reports and select Communications Equipment Statistics Canada – a most important source for Canadian socio-economic and demographic statistics, etc., but no company names. You are less likely to be asked to pay for your info. if you access the website via the library homepage. Several ways to access this site via the Ryerson e.g. - Library homepage - Research Help - Reference . 30 The Entrepreneurial Resource Handbook - Statistics Canadian Sources >Statistics Canada, then Statistics Canada Statistics Canada, Business Data – focusing on specific business data - Canadian Sources - By Subject - Under Business, Statistics Canada Business Data - Gather data to compare your business to your industry - Click: the statistics icon for Retail and wholesale sales (note the varied economic tables) - Economic indicators by province and territory (monthly, etc) - Retail sales by type of store - Retail sales by type of store - Retail sales by type of product - Retail store sales by selected commodity, quarterly Market Research Handbook - Library catalogue > title search (good for looking at overall trends industry and economy) Canadian Business Patterns – market characteristics, employment and income trends, etc - Library homepage >Research Help >Reference - Statistics - Canadian Sources >Statistics Canada, then Business & Financial Data Quarterly Financial Statistics for Enterprises – Title search in library catalogue SEDAR – for public company annual reports and other corporate communications. Competitive environment sometimes found in ‘Management Discussion & Analysis’. Industry search available. - Library homepage > Research Help > Reference > Annual Reports Industry Canada – Strategis; Canadian Industry Statistics. Double check date. Hoovers – a source for US and Cdn co stats. as well as industry info, the latter not always accessible. Includes large, and some smaller private cos. Users may also build a list of companies operating in a given line of business. - Library homepage –www. library.ryerson.ca Articles and Indexes >> Indexes by Title >>Hoovers online Build a List Click : company location Under Country select : Canada Under US/State / Can/province select : Ontario Click : industry 31 The Entrepreneurial Resource Handbook - Select : Primary In NAICS box type : the US naics you need View results Net Advantage – a source for in-depth industry reports on larger US industries.(sample search) - Library homepage - Articles & Indexes - Indexes by Title - Click : Net Advantage - In Publication Search box, under Select Publication, choose: Industry survey - In Quicklinks search box, under Industry Surveys choose Apparel & Footwear - Click on arrow at right - Click : industry 5. CANADIAN ECONOMY Conference Board of Canada - current econ.; econ. forecasts plus CMA level (sample search) - Library homepage > Articles & Indexes - Indexes by Title - Conference Board of Canada - Click here to access elibrary > - Browse by topic .> - Section on economic trends (Current & forecasting) Statistics Canada – Access via library homepage so that you do not pay for DLI information Toronto Economic Indicators – Library homepage> title search. Includes merchandising. Bank reports. Library homepage; Research Help >>Business >>Company Industry Sources >> Internet industry sources >> Economic Conditions Canadian Economy Online: http://www.canadianeconomy.gc.ca/english/economy/ 6. PUBLISHED BACKGROUND INFORMATION Articles about the industry, economy, regulatory environment etc. are sometimes found in business journals and newspapers in library databases CBCA Complete, Factiva, ABI Inform, Business Source Elite, Business & Company Resource Center), and newspapers (Globe and Mail) etc. 32 The Entrepreneurial Resource Handbook 7.Google Source for company websites, government business info websites, government information, information from associations, and free or fee/based websites such as Stats Link Canada. Help: Reference Desk 416-979-5055, Select 3 www.library.ryerson.ca: click ASK A Librarian; lefraser@ryerson.ca Statistics librarians may also assist with certain Statistics Canada information 33