LA HARBOR COLLEGE Student Learning Outcomes (SLOs) Assessment Report Course Assessment

advertisement

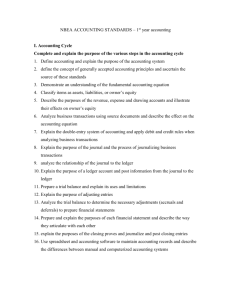

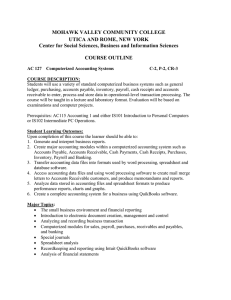

LA HARBOR COLLEGE Student Learning Outcomes (SLOs) Assessment Report Course Assessment Division: Business Discipline/Program: Computer Information Systems Course Number and Name: CIS 024 Accounting on Microcomputers Program Contact Person: Charles Davis ______________________________________ Phone: x4179_______________________ Reviewed by: Elena Reigadas, SLO Assessment Coordinator Attach additional pages as necessary. Institutional Mission Course Intended Outcomes & Goals 1. Describe the 1 2 2. Means of Assessment and Criteria for Success differences and similarities between manual and computerized accounting identify the four levels of operation within QuickBooks Pro. Means: 5 short answer and 10 multiple choice questions on an exam. Create a new company file and establish preferences and adjust the new company file to follow the accrual basis of accounting. Means: Generate computerized reports from case study narratives. Criteria: At least 70% of the students answer at least 10 questions correctly. Date: Spring 2013 Summary of Data Collected Spring 2010 Students were not concise with short answers provided, therefore, there was some uncertainty of their knowledge in short answers. Sixty of the students scored at least 70% of the Multiple Choice questions. Spring 2010 Ninety-three percent of the students were able to accomplish the correct and completed report. Criteria: At least 70% of the Four percent of the students would deliver the students had erroneously Reports that included the entered incorrect data correct data and totals which caused the report within a 4 hour period. to be incorrect while the remaining 3% of students were not aware of the process of generating Use of Results Continue to give students writing assignments to allow them to become more expressive. Provide extra material on manual accounting at the beginning of the course. Although the criteria were met, students will be encouraged to work in groups, but generate their own reports. such a report. 1 3. View the effect of period-end adjustments on the trial balance. A 15 multiple-choice and truefalse exam. Criteria At least 70% of the Spring 2011 Sixty-eight percent of the students answered question items correctly. students would score at least 70% of correct responses. 2 2 2 4. Identify the two inventory systems and identify transactions requiring sales tax. 5. 6. Customize payroll system default accounts. Transfer funds between accounts using the Transfer Funds Accounts window. Means: Criteria were almost met. Check the readability of the question items and determine the reading level. Change the wording if necessary to the level of the students. Eighty-four percent of the students were able to accomplish the correct and completed report. Six percent of the Criteria: At least 70% of the students had incorrectly students would deliver the entered data which Reports that included the caused an inaccurate correct data and totals report. While the within a 2 day period. remaining students were not aware of the process of generating such a report. Encourage students to work and groups, but generate their own reports. Criteria Means: Encourage students to work and groups, but generate their own reports. Generate computerized reports from case study narratives. Generate computerized reports from case study narratives. Spring 2011 Ninety-seven percent of the students were able to accomplish the correct and completed report. Criteria: At least 70% of the While the remaining had students would deliver the incorrectly entered data Reports that included the which caused an correct data and totals inaccurate report. This within a 2 hour period. data was obtained from the Spring 2011 semester. Means: Spring 2010 Generate computerized Ninety-two percent of the reports from case study students were able to narratives. accomplish the correct and completed report. Criteria: At least 70% of the While the remaining had students would deliver the incorrectly entered data Reports and performed the which caused inaccurate actual hands-on that results. This data was were met. Students accomplished the criteria set for these tasks. included the correct data and totals within a 2 hour period. obtained from the Spring 2010 semester. Attach additional pages as necessary. Institutional Mission Course Intended Outcomes & Goals (1) Set up a company on accounting business—company type (sole proprietorship, etc), and create a chart of accounts. (2) Enter transactions into the software and print the general journal and financial statements. (3) Process accounts receivable and sales transactions, and create customer subsidiary ledger accounts. (4) Process accounts payable and purchase transactions, and create vendor subsidiary ledger accounts. (5) Process cash payments and cash receipts, and prepare a reconciliation of the cash account. (6) Journalize adjusting entries, and prepare and print financial statements (7) Purchase and manage inventory in a merchandising business, and create subsidiary ledger accounts for inventory items. (8) Process sales transactions in a merchandising business, and manage sales returns and allowances (9) Create a payroll system, prepare a payroll, print payroll Means of Assessment and Criteria for Success Summary of Data Collected Use of Results checks, and print payroll tax returns and payroll reports. (10) Set up and manage a job costing system. (11) Set up and manage a fixed assets system, and create subsidiary ledger records for individual fixed assets. (12) Set up and manage partnership and corporate forms of business organization.