ACG 2071 Managerial Accounting Honors College Spring 2007 -2

advertisement

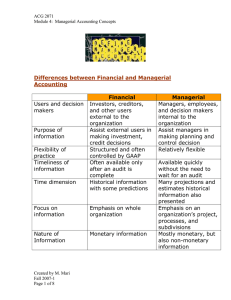

ACG 2071 Managerial Accounting Honors College Spring 2007 -2 Instructor’s Information: Professor Maria C Mari, CPA, CMA, CFrA School of Business – Kendall Campus Office: 6319 #29 Office telephone: 305-237-0341 Office email: mmari@mdc.edu Office hours: MW 11am to 1pm or TR 12:30 – 1:30pm Faculty website: http://faculty.mdc.edu/mmari/ Course Description: The Managerial Accounting provides students will an overview of the specialized areas of cost accounting and managerial accounting. This course emphasizes the role of accountants in the decision making process. This course is an independent study course. Students are not required to attend a formal class but must complete the assignments by the due date stated. It is recommended that students meet semi monthly with the instructor to discuss their progress, in addition, to weekly e-mail messages. Pre-Requisite: ACG 2021 or ACG 2001 and ACG 2011 Co-Requisite: ACG 2071 Lab. Students will be required to complete fifteen hours in the Business Resource Center. Textbook: Financial and Managerial Accounting, Warren, Reeve, and Fess 9th edition. Students will also be required to purchase the e-Instruction clickers for use in the class. Information will be given in class as to which clickers and how to purchase them. Course Competencies: To understand the different responsibilities in the reporting for financial accounting purposes and for managerial accounting purposes. To understand the different cost accounting systems and their application to specific business structures. To review data prepared under job order costing system and verify the cost data developed. To prepare and analyze reports on equivalent units of production. To diagram the flow of costs through the process cost system. To develop financial statements using the absorption costing and direct or variable costing method. To make analytical investigations into the relevant costs and their relationship to production levels. To use break-even analysis, operating leverage, and other methods to determine production information. To understand the effect of changes in cost variables on production decision. To analyze the use of responsibility reporting on the attribution of costs to departments. To prepare a master budget with flexible levels of production To prepare a master budget with flexible levels of production To analyze master budgets to determine the feasibility of completion of budgetary goals or adjustment of such goals. To complete cash budget and make decisions concerning the appropriate use of excess funds. To review the standard cost systems. To analyze variances and determine which departments are responsible for them. To analyze capital expenditures for feasibility using both present value and non-present value methods. To rank capital expenditure projects for decision-making purposes. To make decisions using the differential analysis method. To understand the accounting implications of bonds and the computation of market prices. To prepare a statement of cash flows. To analyze the financial statements as to their liquidity, profitability, and other ratios. Evaluation Methods: Method: Examinations Case Studies Honors Project Class participation Total points available 100 pts each 10 pts each 40 pts each 4 pt each Points 300 40 40 112 492 Grading: Grade A B C D F Maximum points 492 443 354 344 295 Minimum points 443 354 344 295 0 Examinations: The students will complete four examinations over the semester including a comprehensive final. The lowest grade will be dropped in the calculation of your final grade. Makeup Policy: There are no make-ups allowed in this course. Case Studies: Students will complete the case studies available online in the web. The cases will be individually done or team work depending on the case. Honors Project: Students will complete a podcast of course material. Class Participation: Students will receive points for answering questions in class using the Clickers purchased. Extra Credit: Students will be able to earn a maximum of five extra credit points during the semester. Student Responsibilities and Conduct Academic Dishonesty (as defined by the College) includes, but is not limited to cheating on examinations; receiving help from other students (unless permitted by the instructor) plagiarizing; submitting work from another course (unless permitted by the instructor); and assisting anyone doing these things. Academic Dishonesty is considered to be a serious offense and may result in failing an assignment, receiving an “F” in the course, or dismissal from the College. See the Students’ Rights and Responsibilities Handbook for further information. Students should make a special effort to arrive in class ON TIME. IT is disruptive and discourteous to the instructor and to other students. If tardiness is unavoidable’ please come into the class and sit quietly without bothering other students. Cell phones, pagers, or beepers should be turned off when entering the classroom. Please inform those who call you that when you are in class you are unable to receive calls. Due Date: Last day to turn in work is April 15, 2007 at Noon No exceptions will be made!!!