Understanding Credit Cards Advanced Level 2.6.3.G1

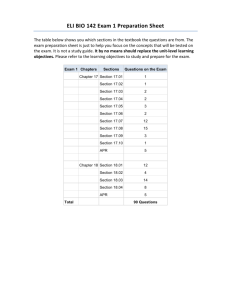

advertisement