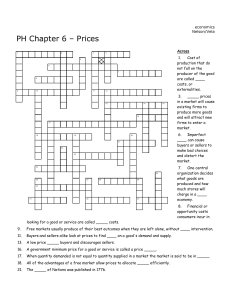

Demand, Supply, & Market Equilibrium Chapter 3

Demand, Supply, &

Market Equilibrium

Chapter 3

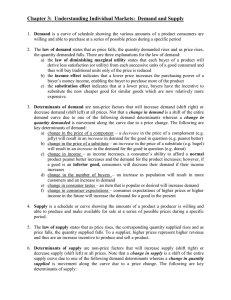

Demand

A schedule or curve that shows the various amounts of a product that consumers are willing and able to purchase at each of a series of possible prices during a specified period of time

A statement of a buyer’s plans, or intentions, with respect to the purchase of a product

Law of Demand

Other-Things-Equal Assumption

As the Price (P) falls, the Quantity

Demanded (Q

D

) rises. (P ↓ Q

D

↑)

As the Price (P) rises, the Quantity

Demanded (Q

D

) falls. (P ↑ Q

D

↓)

Thus, there is an inverse (or negative) relationship between Price and Quantity

Demanded.

Law of Demand

Common Sense

– People do buy more at low prices

– Sales!!!

Diminishing Marginal Utility

– Each additional unit of the product produces less satisfaction (or benefit, or utility)

Income Effect

– Lower prices increase the purchasing power of a buyer’s income

Substitution Effect

– Lower prices give buyers the incentive to substitute similar products

Individual Demand

Individual

Demand

P Q d

$5 10

4 20

3 35

2 55

1 80

P

6

3

2

5

4

1

D

0

10 20 30 40 50 60 70 80

Quantity Demanded (bushels per week)

Q

Determinants of Demand

Tastes

– Favorable change in consumer tastes (preferences) = More Demanded at each price

Number of Buyers

– Increase in number of buyers = Increase in Demand

Income

– Normal (Superior) Goods – Demand Varies Directly with Income

– Inferior Goods – Demand Varies Inversely with Income

Prices of Related Goods

– Substitutes: Used in place of another good

Example: Leather vs. Cloth Coats

– Complements: Used together with another good

Example: Computers & Software

– Unrelated Goods: Not related at all

Example: Potatoes & Automobiles

Consumer Expectations

Determinants of Demand

Therefore, an Increase in Demand may be caused by:

– A favorable change in consumer tastes/preferences

– An increase in the number of buyers

– Rising incomes if the product is a normal good

– Falling incomes if the product is an inferior good

– An increase in the price of a substitute good

– A decrease in the price of a complimentary good

– A new consumer expectation that either prices or income will be higher in the future

Individual Demand

Demand Can Increase or Decrease

P

6

Individual

Demand 5

Increase in Demand P Q d

$5 10

4

3

4 20

2 3 35

D

2

2

1

55

80

1

0

Decrease in Demand

D

1

D

3

2 4 6 8 10 12 14 16 18

Quantity Demanded (bushels per week)

Q

Changes in Quantity Demanded

Not to be confused with Change in Demand

– A shift of the demand curve to the right (increase in demand) or to the left (decrease in demand)

– Cause: A change in one or more determinants of demand

Change in Quantity Demanded

– A movement from one point to another point – from one price/quantity combination to another – on a fixed demand schedule/curve

– Cause: An increase or decrease in the price of the product under consideration

Individual Demand

Demand Can Increase or Decrease

An Increase in Demand

P

6

Means a Movement of the Line

Individual

5 Demand A Movement Between

Any Two Points on a

P Q d

$5

4

3

Demand Curve is

Called a Change in

Quantity

4

10

20 Demanded

3

2

1

35

55

80

2

D

2

1

0

Decrease in Demand

D

1

D

3

2 4 6 8 10 12 14 16 18

Quantity Demanded (bushels per week)

Q

Supply

A schedule or curve showing the various amounts of a product that producers are willing and able to make available for sale at each of a series of possible prices during a specific period

Law of Supply

As the Price (P) falls, the Quantity Supplied (Q falls. (P ↓ Q s

↓) s

)

As the Price (P) rises, the Quantity Supplied (Q rises. (P ↑ Q s

↑) s

)

Thus, there is a direct (or positive) relationship between Price and Quantity Supplied.

Remember, the supplier is on the receiving end of the product’s price. Therefore, higher prices don’t pose the same obstacle on the supply side as they do on the demand side.

Individual Supply

Individual

Supply

P Q s

$5 60

4

3

50

35

2

1

20

5

P

6

3

2

5

4

1

0

S

1

10 20 30 40 50 60 70

Quantity Supplied (bushels per week)

Q

Determinants of Supply

Resource Prices

– Higher Resource Prices raise production costs & squeeze profits

– Lower Resource Prices reduce production costs & increase profits

Technology

– Improvements in technology enable firms to produce units of output with fewer resources

Taxes & Subsidies

– Businesses treat most taxes as costs.

– Increase in sales or property taxes will increase production costs

& reduce supply

– Subsidies are considered “taxes in reverse”

– Thus, lower production costs/increase in supply

Determinants of Supply

Prices of other Goods

– Substitution in Production

– Example: Producing basketballs instead of soccer balls results in a decline in the supply of soccer balls

Producer Expectations

– Future Prices of Products

Number of Sellers in the Market

– Other things equal, the larger the number of suppliers, the greater the market supply

– As more firms enter the industry, the supply curve shifts to the right

– The smaller the number of suppliers, the less the market supply

– As more firms leave the industry, the supply curve shifts to the left

Individual Supply

Supply Can Increase or Decrease

P

6

S

3 Individual

S

1

5 Supply

P Q s

$5 60

4

3

4 50

2 3 35

2

1

20

5

1

0

S

2

2 4 6 8 10 12 14

Quantity Supplied (bushels per week)

Q

Changes in Quantity Supplied

Not to be confused with Change in Supply

– A change in the schedule & shift of the curve

– An increase in supply shifts curve to the right

– A decrease in supply shifts curve to the left

– Cause: A change in one or more of the determinants of supply

Change in Quantity Supplied

– A movement from one point to another on a fixed supply curve

– Cause: A change in the price of the specific product being considered

Individual Supply

Supply Can Increase or Decrease

Individual

Supply

P Q s

$5 60

P

6

5

A Movement Between

Any Two Points on a

Supply Curve is Called a Change in Quantity

Supplied

4

S

3

S

1

3

4 50

2 3 35

2

1

20

5

1

0

S

2

An Increase in Supply

Means a Movement of the Line

2 4 6 8 10 12 14

Quantity Supplied (bushels per week)

Q

Market Equilibrium

Equilibrium Price (P

E

– Market Clearing Price

)

– The price where the intentions of buyers & sellers match

– Q

D

= Q

S

Equilibrium Quantity

– The quantity demanded & supplied at the equilibrium price in a competitive market

Competition among buyers & sellers drives the price to equilibrium

Surplus: Excess Supply

Shortage: Excess Demand

Market Equilibrium

200 Buyers & 200 Sellers

Market

Demand

200 Buyers

P Q d

6

5

6,000 Bushel S

Surplus

$5 2,000 $4 Price Floor

4

4 4,000

Market

Supply

200 Sellers

P Q s

$5

4

12,000

10,000

3

2

7,000

11,000

1 16,000

2

3

$2 Price Ceiling

2

1

7,000

4,000

1,000

1

7,000 Bushel

Shortage

D

0

Bushels of Corn (thousands per week)

Government-Set Prices

Price Ceilings

– The maximum legal price a seller may charge for a product or service

– Prices at or below the ceiling are legal

– Prices above are not

– Examples: Rent Controls

– Sometimes leads to black markets & political pressure to lower prices

Price Floors

– A minimum price fixed by the government

– A price at or above the floor are legal

– Prices below are not

– Distort resource allocation

Efficient Allocation

Productive Efficiency

– The production of any particular good in the least costly way

Example: Have $100 worth of resources

Can produce a bushel of corn using either $5 or $3 of those resources, leaving either $95 or $97 remaining for alternative uses

Which is better?

Allocative Efficiency

– The particular mix of goods & services most highly valued by society (minimum cost production assumed)

– Society wants iPods instead of cassette tapes

– However, society also wants cell phones

– Competitive markets help assign allocative efficiency

Equilibrium Price & Quantity

In competitive markets, produces an assignment of resources that is “right” from an economic perspective

Demand reflects MB based on utility received

Supply reflects MC of producing good

Remember:

– MB>MC Expand Output

– MB<MC Reduce Output

– MB=MC Optimal Output

Changes in Supply, Demand,

& Equilibrium

Changes in Demand

– Supply Constant, Demand Increases

Raises P

E and Q

E

See pg 57, Figure 3.7 a

– Supply Constant, Demand Decreases

Reduces P

E and Q

E

See pg 57, Figure 3.7b

Changes in Supply

– Demand Constant, Supply Increases

Reduces P

E

, Increases Q

E

See pg 57, Figure 3.7c

– Demand Constant, Supply Decreases

Increases P

E

, Reduces Q

E

See pg 57, Figure 3,7d

Changes in Supply, Demand,

& Equilibrium

Complex Cases: (See pg. 57, Table 3.7)

– Supply ↑ Demand ↓ P

E

↓ Q

E

?

– Supply ↓ Demand ↑ P

E

↑ Q

E

?

– Supply ↑ Demand ↑ P

E

? Q

E

↑

– Supply ↓ Demand ↓ P

E

? Q

E

↓