8.0 EMPLOYEE BENEFITS Ops Manual – release date 10/15

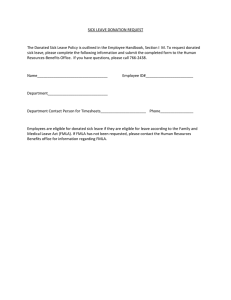

advertisement