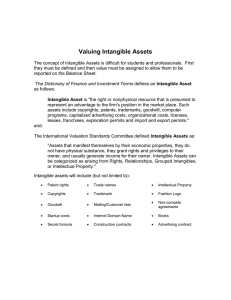

Intangible Assets I. Overview, Valuation, and Characteristics of Intangible Assets

advertisement

Intangible Assets I. Overview, Valuation, and Characteristics of Intangible Assets – The term “intangible assets” refers to certain long-lived legal rights and competitive advantages developed or acquired by a business enterprise. They are typically acquired to be used in operations of a business and provide benefits over several accounting periods. Intangible assets differ considerably in their characteristics, useful lives, and relationship to operations of an enterprise and are classified accordingly. a. Classification of Intangible Assets i. Identifiability 1. Intangible assets may be either specifically identifiable (patents, copyrights, franchise, etc.) or not specifically identifiable (goodwill). 2. Patents, copyrights, franchises, trademarks, and goodwill are the common intangible assets tested on the CPA exam. ii. Manner of Acquisition 1. Purchased Intangible Assets – intangible assets acquired from other enterprises or individuals should be recorded at cost. Legal and registration fees incurred to obtain an intangible asset should also be capitalized. 2. Internally Developed Intangible Assets a. The cost of intangible assets not acquired from others (developed internally) and not specifically identifiable (or having indeterminate lives) should be expensed against income when incurred. b. Examples i. Trademarks (except for the capitalizable costs identified below) ii. Goodwill from advertising iii. The cost of developing, maintaining, or restoring goodwill c. The exception is that certain costs associated with intangibles that are specifically identifiable can be capitalized, such as: i. Legal fees and other costs related to a successful defense of the asset, registration or consulting fees, design costs, and other direct cots to secure the asset. d. Expected Period of Benefit – Classification of the intangible asset depends upon whether the economic life can be determined or is indeterminable. e. Separability – The classification of the intangible asset depends upon whether the asset can be separated from the entity (a patent) or is substantially inseperable from it (a trade name or goodwill). f. GAAP vs. IFRS: Under IFRS, research costs related to an internally developed intangible asset must be expensed, but an intangible asset arising from development is recognized if the entity can demonstrate all of the following: i. Technological feasibility has been established. ii. The entity intends to complete the intangible asset. iii. The entity has the ability to use or sell the intangible asset. iv. The intangible asset will generate future economic benefits. v. Adequate resources are available to complete the development and sell or use the asset. vi. The entity can reliably measure the expenditure attributable to the development of the intangible asset. b. Capitalization of Costs – A company should record as assets the cost of intangible assets acquired from other enterprises or individuals. i. Cost is measured by the amount of cash disbursed or the fair value of other assets distributed, the present value of amounts to be paid for liabilities incurred, and the fair value of consideration received for stock issued. ii. Cost may be determined either by the fair value of the consideration given or by the fair value of the property acquired, whichever is more clearly evident. iii. The cost of unidentifiable intangible assets is measured as the difference between the cost of the group of assets or enterprise acquired and the sum of the costs assigned to identifiable assets acquired, less liabilities assumed. iv. The cost of identifiable assets should not include goodwill. c. Expensing of Cost – Costs of developing, maintaining, or restoring intangible assets that are not specifically identifiable, have indeterminate lives, or are inherent in a continuing business and related to an enterprise as a whole (goodwill) should be deducted from income when incurred. i. Expenses that increase the useful life of the intangible asset will require an adjustment to the calculation of the annual amortization. II. Amortization – The value of intangible assets eventually disappears; therefore, the cost of each type of intangible asset (except for goodwill) should be amortized by systematic charges to income over the period estimated to be benefited. Candidates should be aware a patent is amortized over the shorter of its esimated life or remaining legal life. a. Method – The straight-line method of amortization should be applied unless a company demonstrates that another systematic method is more appropriate. The method and estimated useful lives of intangible assets should be adequately disclosed in the notes to the financial statements. b. Goodwill (Impairment Approach) – Amortization of purchased goodwill is no longer permitted. The required approach is to test goodwill (both previously recorded and newly acquired) under the impairment approach. c. Miscellaneous Rules i. Worthless – write off the entire remaining cost to expense if an intangible asset become worthless during the year (due to a technological change or due to an unsuccessful patent defense lawsuit) ii. Impairment – write down the intangible asset and recognized an impairment loss if an intangible asset becomes impaired (due to a change in circumstances that indicate that the full carrying amount of the asset may not be recoverable). iii. Change in Useful Life – If the life of an existing intangible asset is reduced or extended, the remaining net book value is amortized over the new remaining life. iv. Sale – If an intangible asset is sold, simply compare its carrying value at the date of sale with the selling price to determine the gain or loss. d. Income Tax Effect—Amortization of acquired intangible assets that are not specifically identifiable is deductible over a 15-year period in computing income taxes payable. This may create a temporary difference, and interperiod allocation of income taxes is appropriate. III. Valuation a. U.S. GAAP: finite life intangible assets are reported at cost less amortization and impairment. Indefinite life intangible assets are reported at cost less impairment. b. IFRS: Intangible assets can be reported under either the cost model or the revaluation model. i. Cost Model: intangible assets are reported at cost adjusted for amortization and impairment. ii. Revaluation Model: intangible assets are initially recognized at cost then revalued to FV at a subsequent revaluation date. Revaluated intangible assets are reported at FV on the revaluation dated adjusted for subsequent amortization and subsequent impairment. Revaluations must be performed regularly so that at the end of each reporting period the CV of the intangible asset does not differ materially from FV. If an intangible asset is accounted for using the revaluation model, all other assets in its class must also be revalued unless there is no active market for the intangible assets. 1. Revaluation losses are reported on the income statement, unless the revaluation loss reverses a previously recognized revaluation gain. A revaluation loss that reverses a previously recognized revaluation gain is recognized in other comprehensive income and reduces the revaluation surplus in accumulated other comprehensive income. 2. Revaluation gains are reported in other comprehensive income and accumulated in equity as revaluation surplus, unless the revaluation gain reverses a previously recognized revaluation loss. Revaluation gains are reported on the income statement to the extent that they reverse a previously recognized revaluation loss. 3. Impairment: If revalued intangible assets subsequently become impaired, the impairment is recorded by first reducing any revaluation surplus in equity to zero with further impairment losses reported on the income statement. IV. Start-up Costs – Expenses incurred in the formation of a corporation (legal fees) are considered organizational costs. a. For Book Purposes – Start-up costs, including organizational costs, should be expensed when incurred. i. Start-up costs include costs of the one-time activites associated with: 1. Organizing a new entity (legal fees for preparing a charter, partnership agreement, bylaws, original stock certifications, filing fees, etc.) 2. Opening a new facility. 3. Introducing a new product or service. 4. Conducting business in a new territory or with a new class of customer. 5. Initiating a new process in an existing facility. ii. Start-up costs do not include costs associated with routine, on-going efforts to refine, enrich, or improve the quality of existing products, services, processes, or facilities; business mergers or acquisitions; or ongoing customer acquisition. V. Legal Fees a. Fees to obtain Intangible Assets – Capitalize legal and registration fees incurred to obtain an intangible asset because such fees establish the legal rights of the owner. b. Legal fees incurred in defending an Intangible Asset i. Successful = Capitalize – Capitalize legal fees incurred in successfully defending an intangible asset because a future benefit will be derived. ii. Unsuccessful = Expense – Fees incurred in an unsuccessful defense should be expensed as incurred. VI. Goodwill – Goodwill is the representation of intangible resources and elements connected with an entity (management or market expertise or technical skill and knowledge that cannot be identified or valued separately). Goodwill means capitalized excess earnings power. a. Calculation of Goodwill i. Acquisition Method: GW is the excess of an acquired entity’s FV over the FV of the entity’s net assets, including identifiable intangible assets. ii. Equity Method: Involves the purchase of a company’s capital stock. GW is the excess of the stock purchase price over the FV of the net assets acquired. b. Maintaining Goodwill – Costs associated with maintaining, developing, or restoring goodwill are not capitalized as goodwill (they are expensed). Goodwill generated internally or not purchased in an arms length transaction also is not capitalized as goodwill. VII. Franchises – Franchise operations include a franchisee that receives the right to operate one or more units of a franchisor’s business for one or both of two types of fees. a. Initial Franchise Fees – These fees are paid by the franchisee for receiving intial services from the franchisor. Such services might include site selection, supervision of construction, bookkeeping services, and quality control. b. Continuing Franchise Fees – These fees are received for ongoing services provided by the franchisor to the franchisee. Usually, such fees are calculated based on a percentage of franchise revenues. Such services might include management training, promotion, and legal assistance. Fees should be reported by the franchisee as expense and as revenue by the franchisor, in the period incurred. VIII. IX. Research and Development Costs: Research is the planned efforts of a company to discover new information that will help either create a new product, service, process, or technique or significantly improve the one in current use. Development takes the findings generated by research and formulates a plan to create the desired item or to improve significantly the existing one. a. Accounting for Research and Development: Under U.S. GAAP, the only acceptable method for accounting for research and development costs is a direct charge to expense, except for: i. Materials, equipment, or facilities that have alternate future uses; Capitalize and depreciate such tangible assets ii. Research and development costs of any nature undertaken on behalf of others under a contractual arrangement. iii. Items not considered Research and Development 1. Routine periodic design changes to old products or trouble shooting in production stage (these are manufacturing costs, not research and development expenses.) 2. Marketing Research 3. Quality Control Testing 4. Reformulation of a chemical compound Computer Software Development Costs a. Computer Software Developed to be Sold, Leased, or Licensed i. Technological Feasibility – Technological feasibility is established upon completion of: 1. A detailed program design, or 2. Completion of a working model ii. Accounting for Costs 1. Expenses costs (planning, design, coding, and testing) incurred until technological feasibility has been established for the product. 2. Capitalize costs (coding, testing, and producing product masters) incurred after technological feasibility has been established. a. Amortization of Capitalized Software Costs – Annual amortization (on a product by product basis) is the GREATER of: i. Straight Line = Total Capitalized Amount X (1 / Estimate of Economic Life) ii. Percentage of Revenue = Total Capitalized Amount X (Current Gross Revenue for the Period / Total Projected Gross Revenue for Product) 3. Inventory: Costs incurred to actually produce the product are product costs charged to inventory. iii. Balance sheet – Capitalized software costs are reported at the LOWER OF COST or MARKET, where MARKET = NET REALIZABLE VALUE b. Computer Software Developed Internally or Obtained for Internal Use Only i. Expense costs incurred in the preliminary project state and costs incurred in training and maintenance. ii. Capitalize costs incurred after the preliminary project state and for upgrades and enhancements, including: 1. Direct costs of materials and services. 2. Costs of employees directly associated with project, and 3. Interest costs incurred for the project. iii. Capitalized costs should be amortized on a straight line basis. iv. If software previously developed for internal use is subsequently sold to outsiders, proceeds received (from the license of computer software, net of incremental costs) should be applied first to the carrying amount of the software, then recognized as revenue (after the carrying amount of the software has reached zero). X. Impairment – The carrying amount of identifiable intangibles and goodwill and fixed assets held for use and to be disposed of needs to be reviewed at least annually or whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. a. Impairment of Intangible Assets other than Goodwill: The impairment test applied to an intangible asset other than GW is determined by the asset’s life. An intangible asset has a finite life when it is possible to estimate the useful life of the asset. If it is not possible to determine the useful life of an intangible asset, then the asset has an indefinite life. If an intangible asset has a finite life, it is amortized over that life. If it has an indefinite life, it is not amortized. i. Intangible Assets with Finite Lives: test for impairment using a 2-step test 1. Step 1: The CV of the asset is compared to the sum of the undiscounted cash flow expected to result from the use of the asset and its eventual disposition. 2. Step 2: If the CV exceeds the total undiscounted future cash flows, then the asset is impaired and an impairment loss equal to the difference between the CV of the asset and its FV is recorded ii. Intangible Assets with Indefinite Lives (including GW): it is generally not possible to estimate total future cash flows expected to result from the use of the assets and its disposition. As a result, an intangible asset with an indefinite life is tested for impairment by comparing the FV of the intangible asset to its CV. If the asset’s FV is less than its CV, an impairment loss is recognized in an amount equal to the difference. b. Reporting an Impairment Loss: Report as a component of income from continuing operations before income taxes. The CV of the asset is reduced by the amount of the impairment loss. Restoration of previously recognized impairment losses is prohibited, unless the asset is held for disposal. c. GAAP vs. IFRS: Under IFRS, an impairment loss for an intangible asset other than GW is calculated using a 1-step model in which the CV of the intangible asset is compared to the intangible asset’s recoverable amount, defined as the greater of the asset’s FV less cots to sell and the asset’s value in use. Value in use is the present value of the future cash flows expected from the intangible asset. IFRS allow the reversal of impairment losses. d. Goodwill Impairment: Calculated at a reporting unit level. Impairment exists when the CV of the reporting unit GW exceeds its FV. i. Reporting Unit: An operating segment, or one level below an operating segment. The GW of one reporting unit may be impaired, while the GW for other reporting units may or may not be impaired. ii. Evaluation of GW Impairment: 1. Step 1: Identify potential impairment by comparing the FV of each reporting unit with its CV, including GW 2. Step 2: Measure the amount of GW impairment loss by comparing the implied FV of the reporting unit’s GW with the CV of that GW.