Tuesday, we introduced some game theory; talked a little bit... property law has to answer; and introduced Coase.

advertisement

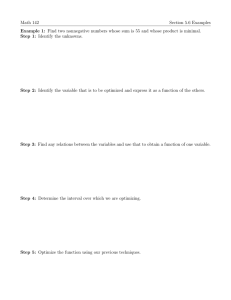

Econ 522 – Lecture 4 (Jan 29 2009) Tuesday, we introduced some game theory; talked a little bit about the big questions that property law has to answer; and introduced Coase. Since it’s pretty important, I want to spend a little more time on the Coase Theorem: In the absence of transaction costs, if property rights are well-defined and tradeable, voluntary negotiations will lead to efficiency. The initial allocation of property rights (who owns what to start with) will matter for distribution, but will not matter for efficiency. Return to Coase’s example: a rancher who raises cattle next door to a farmer. There is a risk that the rancher’s herd will wander onto the farmer’s land and eat some of his crops. And there are several ways to reduce this risk: the farmer could build a fence around his crops the rancher could fence in his herd the rancher could reduce the size of his herd the farmer could reduce the size of his crops, or plant something the cows don’t like, or plant something the cows don’t like around the edges Coase makes two key points: first, don’t pose the question as the rancher harming the farmer o the harm only happens because of both parties’ activities o so think of both of them as causing the harm but second, as long as there are no transaction costs and the rancher and farmer are free to negotiate with each other, whichever solution is the most efficient – whether it’s to do nothing and live with the harm, or for the rancher to build fence, or for the farmer to build a fence, or one of the other ones, or some combination – is the one that will end up happening so who starts out with responsibility for any damage that occurs doesn’t matter for efficiency – we’ll get the efficient result either way, as long as property rights are clear, and tradeable, and there are no transaction costs -1- I mentioned Tuesday, as I was running out of time, that Coase lists a bunch of examples: An early English case of a building which was built in such a way that it blocked air currents from turning a windmill A building in Florida which cast a shadow over the swimming pool and sunbathing areas of a nearby hotel A doctor whose office was next door to a confectioner, who built a new examination room and found that the vibration from the confectionery’s machinery prevented him from listening to his patients’ chests through a stethoscope in that room A chemical manufacturer whose fumes interacted with a weaver’s products while they were drying after bleaching A house whose chimney no longer worked well after its neighbors rebuilt their house to be taller In each case, he argues, regardless of who is held to be liable, the parties can negotiate with each other and take whatever remedy is cheapest to fix (or endure) the situation. To quote Coase: “Judges have to decide on legal liability but this should not confuse economists about the nature of the economic problem involved. In the case of the cattle and the crops, it is true that there would be no crop damage without the cattle. It is equally true that there would be no crop damage without the crops. The doctor’s work would not have been disturbed if the confectioner had not worked his machinery; but the machinery would have disturbed no one if the doctor had not set up his consulting room in that particular place… If we are to discuss the problem in terms of causation, both parties cause the damage. If we are to attain an optimum allocation of resources, it is therefore desireable that both parties should take the harmful effect into account when deciding on their course of action. It is one of the beauties of a smoothly operating pricing system that… the fall in the value of production due to the harmful effect would be a cost for both parties.” -2- The point he makes here about a “smoothly operating pricing system” is that opportunity costs matter Suppose I’m the farmer, and it would cost me $200 to build a fence to protect my crops, and it would cost the rancher $400 Now suppose we’re in a “farmer’s rights” world, where it’s the rancher’s responsibility to stop his herd from causing any damage. I have no direct incentive to build a fence o It costs me $200, and I get no direct benefit But under a “smoothly operating pricing system”, not building a fence also costs me money o If the rancher would be willing to pay me $400 to build the fence, then not building the fence costs me $400 o So under a “smoothly operating pricing system,” it would be more costly for me not to build the fence than to build it o And this would only be true if me building the fence is efficient o So we’ll get to efficiency for sure, regardless of where we started. Let’s go back to the car example to illustrate a few more things about bargaining. I have a car, it’s worth $3,000 to me, and it’s worth $5,000 to you. And suppose that you have $10,000, so being able to afford the car isn’t an issue. $3,000 is called my threat point It’s the level of utility that I can guarantee myself by not trading with you So there’s no reason for me to accept an outcome where I end up with less than $3000 worth of utility This is also called my reservation utility, or my outside option, since it’s what I can get by refusing to cooperate. $10,000 is your threat point You already have $10,000, so there’s no reason for you to settle for an outcome worth any less than that Making negotiations voluntary – we both have to agree to any trade – means neither of us will ever accept a deal worse than our threat point -3- If we don’t trade, I end up with utility equivalent to $3,000, you have $10,000, so our combined surplus is $13,000. Suppose we do trade. I sell you the car for some price P. Now I end up with P, you end up with $5,000 + $10,000 – P, and our combined surplus is $15,000. $2,000 are the gains from trade This is the amount of new surplus we can create if we cooperate Now, we both have to end up with at least as much utility as our threat point and our combined utilities will be $2,000 higher if we cooperate so our negotiations can be thought of as figuring out how to divide these gains that is, in the final outcome, we will each get our threat point, plus some fraction of the gains from trade There are lots of different approaches to actually modeling bargaining some are based on certain axioms or assumptions, some use game theory in this case, they all predict that I’ll sell you the car for some price between $3,000 and $5,000 we already said, if I sell you the car for some price P, that my payoff will be P and yours will be $15,000 – P so saying P will be between $3,000 and $5,000 is the same as saying, we will realize the gains from trade, and each of us will get at least our threat point in order to make a sharper prediction, sometimes we’ll assume that the gains from trade are divided equally if I value the car at $3,000 and you value it at $5,000, this means you pay $4,000 for it or, since the gains from trade are $2,000, dividing them equally means we each end up $1,000 better off than our outside option (threat point) Recall that we did need a couple key assumptions to predict such a nice, efficient outcome we need clear, tradeable property rights and we need a total absence of transaction costs In half an hour, we’ll look more closely at transaction costs – some of the things that can get in the way of voluntary bargaining leading to efficiency. But at least in the cleanest cases – when there are not transaction costs – bargaining will lead to efficiency. If my car is worth more to you than it is to me, we will both find it worthwhile to come to some agreement where you get the car -4- Some of you may remember General Equilibrium Theory from 301 General Equilibrium is when everyone does whatever is best for them, given the prices they see o consumers maximize utility, firms maximize profits, etc. and prices are such that markets all clear and the First Welfare Theorem states that General Equilibrium is always efficient. The first time I taught this class, on the second day of class, I solved an example of this a setting with two consumers one of them is a hops farmer – he had lots of hops, he ate hops, and liked beer too the other was a brewer – he didn’t own any hops, but he had a technology for turning hops into beer The first thing we did was to find the general equilibrium Given a set of prices for hops and beer, we could work out how much hops and how much beer the farmer would demand Given a set of prices, we could also work out how much beer the brewery would produce to maximize profits And then we found the set of prices such that markets cleared And we showed, as expected, that the result was efficient Next, we worried about externalities Suppose the farmer hates the smell emanating from the brewery But there are no environmental controls – the brewery can do whatever it wants Because the externality, the general equilibrium is now inefficient o the farmer would like the brewery to brew less beer, so the smell is weaker o but he has no control over market prices But then comes Coase, and he says that the farmer could just negotiate with the brewer Farmer says look, how about instead of paying you $9 per six-pack for this many beers, I’ll pay you a little more for a little fewer That way, you can produce less beer, but still earn higher profit So they reach an agreement, and it’s efficient -5- And the point of Coase is that, whoever starts off with the “air rights,” we’ll get to efficiency If the brewery starts off with the right to pollute, the farmer can negotiate a reduction in pollution If the farmer starts off with the right to breathe clean air, the brewery can go to him and negotiate rights to pollute some And in either case, they’ll reach an efficient outcome They’ll be different outcomes – if the farmer starts off with the right, he’ll end up richer, and able to consume more, than if the brewery does – but in either case, the outcome will be efficient. So another way to think about Coase is to say that we can overcome externality problems by expanding property rights to include whatever is causing the externality The problem with an externality is that it’s something that enters your utility function, but there’s no market for it By creating a market for “air rights” – that is, by turning “air rights” into a tradeable good – we can use the pricing system to get to efficiency, regardless of who starts off owning these rights. Harold Demsetz, in “Toward a Theory of Property Rights” (on the syllabus), summarizes Coase this way: in a world without transaction costs, “The output mix that results when the exchange of property rights is allowed is efficient and the mix is independent of who is assigned ownership (except that different wealth distributions may result in different demands).” Elsewhere, he points out, “A primary function of property rights is that of guiding incentives to achieve a greater internalization of externalities.” Again, stick with the “farmer’s rights” world, where the farmer could build a fence for $200, or the rancher could for $400 If I’m the farmer, then my not building the fence imposes an externality of $400 on the rancher – it forces him to spend $400 on a fence But with property rights, this costs me $400 in opportunity cost – since instead, I could get him to pay me $400 and build the fence So now not building the fence costs me $400 – exactly the same as the externality it causes So the “smoothly functioning price system” causes me to internalize the externality and do what’s efficient. -6- Thus, in order for an externality to persist, Demsetz argues, “The cost of a transaction in the rights between the parties… must exceed the gains from internalization.” We can always solve the externality problem by introducing a transaction But this will also come at some cost o A more extensive property right system is more complicated, and more costly to implement o Think about iron-holds-the-whale – more complete property rights (someone owns a whale once there’s a harpoon in it), but more costly to implement (more disputes) Demsetz then makes the case that property rights will naturally evolve to be more complete as the benefit outweighs the cost o that is, as the value of overcoming a particular externality grows, relative to the costs of implementing more complete (and complex) property rights. o In his words, “Property rights develop to internalize externalities when the gains of internalization become larger than the cost of internalization.” He gives the example of land ownership among Native Americans Specifically, he points out that a close relationship exists between the development of private land rights and the development of the commercial fur trade. When land is not privately owned, nobody has an incentive to increase or maintain the stock of animals on the land, or to limit their hunting; so overhunting will tend to occur o This is the classic “tragedy of the commons” described in the Hardin paper – resources that are free to everyone, tend to be overused Before the fur trade became established in North America, hunting was done primarily for food o the externality that one hunter imposed on other hunters, by lowering the amount of game available, was present, but was a fairly small problem And historians have established that at that time, Native Americans did not have anything resembling private ownership of land. As the fur trade began, furs became more valuable, since they could be traded for other goods that were not plentiful So the scale of hunting increased So overhunting became more of a problem, and the size of the externality that hunters imposed on each other increased -7- And at exactly that time, in the areas where the fur trade was most important, Native Americans began to recognize exclusive family rights to hunt and trap in particular areas. (Neat quote: “a starving Indian could kill and eat another’s beaver if he left the fur and the tail.”) o Property rights weren’t absolute o You could still cross other peoples’ land o And if you were on someone else’s land, and you were hungry, you could still hunt to eat o But you had to prove that you were only hunting for food, not for profit – by leaving the commercially valuable parts of the animal Demsetz points out that at that same time, in the southwestern plains, there were no animals of the same commercial significance, and the animals that were there tended to roam over a larger area; and in the southwest, similar private property rights did not emerge In addition, in the areas where private rights to land were emerging, careful steps were taken by the “owners” of the land to avoid overhunting – such as rotating among different hunting areas year by year, and maintaining one area in which no hunting was done. So there you have it Coase says, if property rights are complete and tradeable, we’ll always get efficiency Or in other words, we can solve any externality by expanding property rights to cover it Demsetz says yes, but this comes at a cost – more extensive property rights cost more to implement So property rights will expand when the benefits outweigh these costs o This can happen either because the benefits go up, or the costs go down o In the example we just gave from Demsetz, the benefits went up – overhunting became more of a problem, so the gains from having property rights increased o On the other hand, the invention of barbed wire probably reduced the cost of maintaining property rights – by making it easier to keep people off your property -8- Recall our statement of the Coase Theorem: In the absence of transaction costs, if property rights are well-defined and tradeable, voluntary negotiations will lead to efficiency, and the initial allocation of property rights won’t matter for efficiency. But this also suggests the converse might be true: when private negotiations are not costless, or transaction costs are not zero, that we may not get efficiency, and initial allocations may matter. When there are transaction costs, we can get inefficiencies for two reasons: first, when transaction costs are high, they will prevent certain trades that would have been beneficial o if my car is worth $3,000 to me and $5,000 to you, but it would cost us $3,000 to find each other and transact, I’ll keep the car and second, any resources actually spent overcoming the transaction costs are, in a sense, wasted o if it costs us $500 to find each other and transact, we’ll still do it, but we will have lost that $500 Coase again: “If market transactions were costless, all that matters (questions of equity apart) is that the rights of the various parties should be well-defined and the results of legal actions easy to forecast. But as we have seen, the situation is quite different when market transactions are so costly as to make it difficult to change the arrangement of rights established by the law. In such cases, the courts directly influence economic activity. It would therefore seem desirable that the courts should understand the economic consequences of their decisions and should, insofar as this is possible without creating too much uncertainty about the legal position itself, take these consequences into account when making their decisions. Even when it is possible to change the legal delimitation of rights through market transactions, it is obviously desirable to reduce the need for such transactions and thus reduce the employment of resources in carrying them out.” Coase offers two examples of institutions that may emerge in response to high transaction costs: firms, and government regulation Going back to his example of a farmer and a rancher If for whatever reason it is very difficult or costly for them to come to an agreement among themselves, one solution is for the ranch and the farmland to be both be purchased and operated by the same firm, so that the firm balances the costs and benefits of both activities and maximizes the total value of production The second example, government regulation, is the same idea, since he imagines the government as a sort of “super-firm” which considers the costs and benefits of each activity to everyone. -9- We’ve put off dealing with transaction costs until now, but it’s time to ask: what are transaction costs? Transaction costs are anything that makes it difficult or expensive for two parties to achieve a mutually beneficial trade. Cooter and Ulen divide them into three categories: search costs – difficulty in finding a trading partner bargaining costs – difficulty in reaching an agreement on the terms of the trade enforcement costs – difficulty in enforcing the agreement afterwards Search costs are self-explanatory When we think of common, standardized goods, there are likely lots of buyers and lots of sellers, so it shouldn’t be hard for them to find each other When we think of rare or exotic goods, search costs may be very significant (One of the most important effects of eBay might have been to lower search costs – if you want to buy some very specific, obscure thing, it makes it much easier for you to find some guy who’s selling it) Enforcement costs are also pretty straight-forward If I’m just buying an apple from a fruit stand, there are no enforcement costs – I give him my money, he hands me an apple, and the deal is done But think about our example from before, of a rancher and a farmer Suppose that even though the rancher is not liable for his herd’s damage, it’s cheaper for him to fence in his herd, so the farmer pays him to build a fence But now the farmer has to make sure that he actually builds it, and maintains it – the deal is part of an ongoing relationship, and has long-term consequences In the case of pollution rights, if a factory pays for the right to pollute a certain amount, or neighbors pay a factory not to pollute in excess, someone has to monitor the factory and make sure they abide by the agreement This involves ongoing costs Enforcement costs are any costs incurred after a deal is reached, to monitor or enforce the agreement - 10 - Bargaining costs are the most interesting We used the example before of my car being worth $3000 to me and $5000 to you Once we find each other, all we have to do is haggle over price and agree on something in the middle – doesn’t sound so hard However, this assumed that both of us knew exactly how we valued the car, and knew each others’ threat points When these assumptions fail, things can get more complicated, for several reasons First of all, you might worry that I know something about the car that you don’t I’ve been driving it a while, so I might know that the transmission is about to fail, or that it needs new brake pads, or that it doesn’t start well on cold mornings So you might worry that if I’m willing to sell it to you for $4000, maybe it’s because there’s something wrong with the car So one aspect of bargaining costs might include taking it to a mechanic to verify its condition and try to get an objective measure of the value of the car Famous paper by Akerloff, “The Market for Lemons,” dealing with this problem (adverse selection), showing that under some conditions, it can cause the market to fail completely So one source of adverse selection is asymmetric information Next, even if we agree on the physical condition of the car, I might not be sure exactly how badly you want it Suppose we both know the car is worth $3000 to me, but I don’t know what it’s worth to you – all I know is, you value it somewhere between $3000 and $5000 And suppose it turns out, you value it at $3100 Since you value it at more than $3000, there are gains from trade – it’s definitely efficient for me to sell you the car But now you try to convince me that the car’s only worth $3100 to you, and that I should therefore sell it to you for $3050 But here’s the problem: anything that you say to try to convince me, you could also say if the car was worth $5000 to you And I have no way of knowing whether you’re telling the truth or lying to get a better deal So if I give in and sell you the car for less than $3100, I can’t escape the possibility that I’d also sell you the car at that price if you valued it at $5000 So maybe I end up saying, “Maybe you’re telling the truth, and maybe you’re lying, but I won’t sell it for less than $4000.” Which means that some of the time, even though you value the car more than me, we don’t reach a deal There’s a famous paper by Roger Myerson and Mark Satterthwaite, “Efficient Mechanisms for Bilateral Trade,” which shows that when there’s private information of this sort, there is no way to guarantee that the efficient outcome - 11 - will always be reached – there’s always some probability that an inefficient outcome (in this case, no trade) occurs So a second source of bargaining costs: not knowing each others’ threat points There have been a number of papers on bargaining, both theoretical and experimental, that reinforce the fact that bargaining is more likely to fail if parties don’t know each others’ threat points One interpretation of threat points being private information is simply that tastes are subjective – I don’t know how much you like the color of my car, for instance But another source of uncertainty about threat points is when property rights themselves are ambiguous Consider again the problem of the rancher and the farmer, and suppose that the efficient outcome is for the farmer to build a fence to protect his crops But now suppose that the law is ambiguous – whether or not the rancher is liable for his crop’s damage is open to interpretation, or depends on the exact details of the situation, so the court’s decision is unpredictable In that case, the rancher and the farmer might not agree on what would happen if no fence was built; and so each one might be uncertain about the other one’s threat point, and therefore it might be very hard for them to come to an agreement This is one of the arguments for clear, simple, well-defined, unambiguous property rights – that they make negotiations easier, that is, effectively lowering transaction costs. - 12 - There’s another way in which bargaining can be difficult, or even impossible, which is when instead of a single buyer and a single seller, there are many parties to the deal Suppose there’s a developer, who wants to build a shopping mall, and he values the land he wants to build on at $1,000,000 Now suppose there are currently 10 houses on that land, and each homeowner values his property at $80,000 Clearly, there are gains from trade: the combined value of the plots is $1,000,000 to the developer, and $800,000 to their current owners. But now think about one of the homeowners He thinks, “If we all sell our land to the developer, this creates $200,000 of surplus. I don’t mind if all my neighbors sell out cheaply, but I want a piece of that!” And he figures that he’s the only one smart enough to ask for more money, so he asks for $120,000, figuring that still leaves the developer with a big enough surplus But now some of his neighbors do the same calculation, and ask for more money for their land And since it’s very hard to negotiate with 10 people at the same time, negotiations may fail. (One of the papers I’m working on is a game-theory model of many-to-one bargaining. The idea is this. Everyone accepts that if 9 of the homeowners have sold out to the developer, the last guy is in a pretty strong bargaining position, so he can probably get a pretty high price for his property But since everyone knows that, nobody wants to be the first to sell out – they’d rather wait for their neighbors to sell, and then be the last, so they get a better price So even when cooperation, or trade, is efficient, and might occur eventually, there can be huge delays before the trade happens, due to everyone waiting around hoping to be last.) - 13 - And the same thing can happen when there are many buyers instead of many sellers Suppose that instead of a shopping mall, the land was being bought up to be turned into a park, that would benefit 10,000 people in the community, and each of them would receive benefits worth $100 from the joy of having the park Even if the homeowners were all willing to sell for $80,000, or $800,000 total, it might be impossible to raise that much through voluntary contributions, since each citizen might think, “We only need to raise $800,000, and all my neighbors should be willing to pay $100, so even if I don’t pay anything, the park should get built!” This is the problem of freeriders – once the park is built, its use won’t be limited to the people who paid for it, so people may try to avoid paying, preferring to get the benefits for free. So when negotiations need to take place between lots of people, rather than just one buyer and one seller, there is a risk of holdout – individual sellers holding out for high prices – and freeriding – individual buyers trying to get the good for free Either of these could cause negotiations to fail, or to take a long time to conclude So another source of bargaining costs is having lots of individuals to negotiate with One final source of bargaining costs is hostility I’ll come back to this next week Many divorce agreements end up being settled by litigation, which is more costly than negotiation, not because the parties disagree about their threat points or for any other rational reason, but because the parties are angry with each other and don’t want to come to a rational agreement - 14 - So now, let’s recap what we know Coase tells us that when there are no transaction costs, the initial allocation of property rights (or liability) doesn’t matter for efficiency, since people will trade until efficiency is reached On the other hand, when transaction costs are high, the initial allocation is important, since trade may not be feasible (and even if it is feasible, it’s costly) This leads to two different notions of what the goal of property rights should be, that is, two different normative approaches we could take to designing property law. 1. Structure the law to minimize transaction costs. Cooter and Ulen phrase this as, “structure the law so as to remove the impediments to private agreements,” and refer to this as the Normative Coase approach If the law is able to reduce transaction costs, then voluntary exchange will be more likely to lead to efficiency The textbook also refers to this as “lubricating” bargaining – making it easier for bargaining to proceed without costs. We said before that one source of bargaining costs is uncertainty about threat points This suggests that bargaining costs are reduced when the law is simple and unambiguous, so that everyone is clear about everyone’s rights This seems to favor rules like fast fish/loose fish and allocating the fox to Pierson, the guy who actually killed it – these are simple rules, there is little to dispute once the rule is established, and this should make both sides’ threat points clear and encourage trade to occur when it is efficient. - 15 - However, this is not the only possible goal of the law. Like we said, when transaction costs are high, the initial allocation matters for efficiency; so a different conception of the goal of the law could be, 2. Structure the law so as to minimize the harm caused by failures in private agreements. Or really, structure the law to make the allocation as efficient as possible to begin with, so that fewer negotiations are required and their failure is less costly. This goal was put forward by Hobbes, who felt that people could not be counted on to be rational enough to cooperate Cooter and Ulen call this view of the law the Normative Hobbes approach It suggests that the law should aim to allocate property rights to whoever values them the most, so that transaction costs become irrelevant, trade is unnecessary, and efficiency is achieved no matter what This may require more complicated laws o What’s efficient may be different in different situations, so the law will have to be different in different situations more complicated So now we have two possible ideas of what property law should aim to accomplish one, lubricate private transactions or two, allocate rights to whoever values them more so now we have to ask, when is one of these aims appropriate and when is the other? we can answer this by thinking about the cost of each rule When transaction costs are reduced, they are still unlikely to be eliminated That is, lubrication works up to a point, but there will still be some transaction costs remaining When these are low, efficiency will nearly be achieved; when they are still high, the outcome may still be very inefficient. On the other hand, in order to start out at an efficient allocation, lawmakers have to figure out who values a right more highly This is not always obvious So we can imagine the lawmakers must face some sort of Information Costs to come to the correct conclusion (This can be thought of either as costs they actually incur in researching the situation, or as the costs of being wrong some of the time.) Which brings us to the principle reached by Cooter and Ulen: - 16 - When transaction costs are low and information costs are high, structure the law so as to minimize transaction costs When transaction costs are high and information costs are low, structure the law to allocate property rights to whoever values them the most Next week, we’ll take on the question of how property rights are enforced, beginning with the important paper by Calabresi and Melamed, “Property Rules, Liability Rules, and Inalienability: One View of the Cathedral.” - 17 -