Econ 522 – Lecture 14 (Oct 23 2008) Logistics midterm Tuesday

advertisement

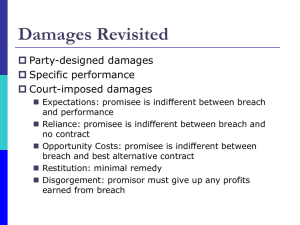

Econ 522 – Lecture 14 (Oct 23 2008) Logistics midterm Tuesday Chao OH Monday 11-12 My OH Monday 2:30-3:30 (also 1:30-2:30 if needed) Next Thursday: lecture will most likely be canceled, you should all go to Menzie Chinn’s talk about the crisis (I’ll send out an email about it once I hear back from the organizers of the talk) Don’t forget to vote! I’ll give out solutions to HW2 at end of lecture one of the home work problems – Friedman: “A physician comes upon an auto accident, stops, and treats an unconscious and badly bleeding victim. A week later the victim receives a bill for services rendered. Must he pay it?” Consider the following alternatives: (i) (ii) (iii) (iv) The victim need not pay anything The victim must pay only the value of whatever materials were used up in treating him (bandages, etc.) The victim must pay the going market rate for comparable medical services The victim must pay whatever the doctor demands Which of these do you expect to lead to the most efficient outcomes? Why? The key: once the accident, and the treatment, have already happened, any transfers between victim and doctor do not impact efficiency. (No value being created or destroyed when the victim pays the doctor.) So the only way to answer the question is to look at how each rule would change behavior – the incentives for the doctor to stop and help, incentives to drive too much and too fast, and so on. (Examples.) Last new topic: Repeated Games Nearly everything we’ve done so far has assumed a one-shot interaction that is, we’ve been assuming that the parties to a contract are only interested in maximizing their gain from that one particular contract, and are not concerned with any future interactions with the same partner. Of course, in many cases, this is not true Example. There’s a coffee shop near my house, and I go there several times a week. One day, I forget my wallet, and ask if I can pay them back the next day for a cup of coffee and a muffin. They say yes, and I show up the next day with the money. Why? Economists would say: The reason I pay them back is that I want to keep transacting with them in the future, and the value I expect to get from those future transactions is worth more to me than the $3 I could save by breaking my promise now And the reason they trusted me is that they expected this would be the case. From a theoretical point of view, repeated games can be very hard to analyze, because a lot of different things can happen But one of the things that can happen is that we can cooperate in a repeated game, even if we could not cooperate in the same one-shot game. Let’s go back to the original agency game we did a couple weeks ago. You choose whether to trust me with $100, which I can double by investing it; and then I decide whether to keep the $200 or return $150 to you and keep $50 for myself But now, suppose there is the possibility of playing the game more than once. In particular, suppose that each time we play the game, there is a 10% chance it’s the last time we play, and a 90% chance that we get to play again. Think about my incentives to repay your money or keep it for myself. If I keep it for myself, I get a payoff of $200; but then you’ll never trust me again, so that’s all I’ll ever get. On the other hand, if I give you back your $150, you’ll probably trust me again the next time, and the time after that, and the time after that (provided I keep returning it). So the value I expect to get out of the relationship is 50 + .9 X 50 + .9^2 X 50 + .9^3 X 50 + … = 50 / (1 - .9) = 500 > 200 So I’m much better off returning your money, since I’ll make more money in the longrun if you keep trusting me. The same thing can happen with a repeated version of the prisoner’s dilemma. Recall that in the one-shot prisoner’s dilemma, the only equilibrium was for both of us to rat on each other and go to jail for several years However, if we expect to play the prisoner’s dilemma over and over, it turns out to be an equilibrium to both keep quiet Actually, what turns out to be an equilibrium is for both of us to do the following: o Keep quiet the first time we play o As long as neither of us has ever ratted on the other, keep quiet o Once either of us has ever ratted, I rat every time we play forever This is called a “grim trigger” strategy – we play a good (cooperative) strategy, but if either of us every rats, this triggers a “punishment phase” where we are unable to cooperate The threat of moving to this punishment phase keeps us both quiet, even though either of us would gain in the short-term by ratting each other out. So in the prisoner’s dilemma, or the agency game, if the game will be played over and over, it’s possible to get cooperation. Similarly, in situations where contracts cannot be enforced, repeated interactions with the same parties can lead to voluntary cooperation. Even when you won’t always be transacting with the same person, transacting within a small community, where people are aware of your reputation, leads to a similar incentive. The Friedman book mentions an article by Lisa Bernstein on diamond dealers in New York. To quote: Buying and selling diamonds is a business in which people routinely exchange large sums of money for envelopes containing lots of little stones without first inspecting, weighing, and testing each one. The New York diamond industry was at one time dominated by orthodox Jews, forbidden by their religious beliefs from suing each other – making it a trust-intensive industry conducted almost entirely by people who could not use the legal system to enforce their agreements. While the industry had become more diverse by the time Bernstein studied it, dealers continue to rely almost entirely on private mechanisms to enforce contracts – in part for religious reasons, in part to maintain privacy, in part, perhaps, because those mechanisms functioned better than the courts. At the center of the system is the New York Diamond Dealers’ Club, which arranges private arbitration of disputes among diamond merchants. Parties to a contract agree in advance to arbitration; if, when a dispute arises, one of them refuses to accept the arbitrator’s verdict, he is no longer a diamond merchant – because everyone in the industry now knows he cannot be trusted. Similar arrangements exist elsewhere in the world and exchange information with each other. Presumably the amount diamond merchants are willing to risk on a single deal depends in part on how long the other party has been involved in the industry and thus how much he would lose if he had to leave it. Recall that in the first couple lectures on contract law, we introduced a number of pronouncements from Cooter and Ulen, including: The first purpose of contract law is to enable cooperation, by converting games with noncooperative solutions into games with cooperative solution Considering the effect of repeated games, Cooter and Ulen add a sixth one to the list: The sixth purpose of contract law is to foster enduring relationships, which solve the problem of cooperation with less reliance on the courts to enforce contracts. (We saw with the agency game that one way to allow for cooperation was to introduce enforceable contracts. Repeated interactions, or enduring relationships, give another way to get cooperation in what seems like a game with a noncooperative solution.) The textbook gives a couple of examples of how courts sometimes do this For instance, by assigning legal duties to relationships that arise out of contracts o for instance, a bank has a fiduciary duty to its depositors which goes well beyond the terms they agree to on the account o a franchisee who runs a local McDonalds has certain duties to the franchisor o These duties are meant to encourage an enduring business relationship. Similarly, courts sometimes treat long-term business relationships differently o encouraging the parties to “repair the relationship” rather than simply ruling on the merits of the dispute. endgames But there is a problem with enforcing agreements via reputation or repeated interaction In the examples so far, we’ve assumed that we don’t know how long we’ll keep interacting, but that it might go on indefinitely However, if there is a particular date when we know our relationship will be over for sure, this can lead to a problem. Suppose we are going to play the agency game once a month for five years – that is, we’re going to play 60 times Clearly, getting $50 60 times is much better than getting $200 once, so it seems there should be no problem with getting me to return your money early on in the interaction. However, think about the problem from the other end. The last time we play, there’s no longer any future gain if I return your money, since we already know it’s our last time playing. Given that, you expect me to steal the money you give me in game #60, so you don’t lend me the money. But now think about game #59. We both know that we won’t cooperate in game #60 – that’s true regardless of what happens in game #59. So what happens in game #59 doesn’t affect future play so once again I have no reason to return your money, so I keep it; and you expect this, so you don’t trust me. But now if we don’t expect to cooperate in game #59 or #60, there’s no reason for you to trust me in game #58. And so on. So in a finitely repeated game, cooperation can unravel from the back, and we can fail to cooperate form the very beginning! (People have done lab experiments – getting people (usually undergrads) to play the prisoner’s dilemma with each other for small cash payments. o In finitely repeated games, people usually do choose to cooperate in the early stages, but not toward the end. o The theory, however, predicts that we shouldn’t even get cooperation in the first round of the game!) This is referred to in Cooter and Ulen as the “endgame problem” Once we know there is a finite end date to our interaction, cooperation can unravel They discuss an example where this happened: the collapse of communism across much of eastern Europe in 1989. While communism was felt to be much less efficient than capitalism, the replacement of central planning with markets actually led to a decrease in growth rather than the anticipated increase. Why? Under communism, a lot of production relied on the black market, or the semilegal gray market. Since these transactions weren’t protected by law, they relied on long-term relationships to accomplish cooperation. However, the fall of communism, and the uncertainty that came with it, upset these relationships, causing lots of important cooperation to break down. So while repeated interaction gives us a way to cooperate without relying on courts to enforce contracts, having a definite end date to the interaction can spoil it. Keep in mind, though, that to sustain cooperation, the game doesn’t have to actually go on forever; it just has be possible at each stage that it might continue. The probability the game will be played again is like a discount factor – you discount the future gains by the probability they will occur As long as this probability is not too low, the possibility of future gains may still be enough to sustain cooperation. And that’s contract law. To quickly recap what we’ve done: We motivated contract law by looking at the agency game – if you can’t trust me to return your money, we miss out on a valuable investment opportunity Contracts give a way for a promise to be legally binding, allowing us to cooperate in instances where we could not have otherwise The first purpose of contract law: to enable cooperation We introduced the Bargain Theory of contracts, under which a promise is binding if it was given as part of a bargain, which requires three elements, offer, acceptance, and consideration We introduced the principle that unlike the Bargain Theory, efficiency requires enforcing a promise if both the promisor and the promisee wanted it to be enforceable when it was made We gave an example of how private or asymmetric information can disrupt trade and cause inefficiency; second purpose of contract law is to encourage efficient disclosure of information We introduced the idea of efficient breach o Breach is efficient when the promisor’s cost of performing is higher than the promisee’s benefit from performance o Third purpose of contract law is to secure optimal commitment to performing o Expectation damages leads to efficient breach We introduced idea of reliance investment o Investment by the promisee which makes performance more valuable o Fourth purpose of contract law is to secure optimal reliance o When expected gains from reliance are included in expectation damages, we get efficient breach but overreliance o When expected gains from reliance are excluded from expectation damages, we’ll get efficient reliance but excessive breach o Cooter and Ulen propose modifying expectation damages to cover gains from only efficient reliance – nice theoretically, hard practically o Courts tend to reward only foreseeable reliance We introduced the notion of default rules – rules that cover gaps in contracts o Two approaches: Cooter and Ulen: set default rule to rule that is efficient in most cases, so most parties can save transaction costs o Ayres and Gertner: in some cases, use penalty defaults, to encourage information disclosure by better-informed party o Famous case of Hadley v Baxendale as an example Baxendale (shipper) is likely the efficient bearer of the risk of delay, since he can take steps to avoid it But the ruling penalized Hadley (the miller) for not disclosing how urgent the shipment was – to give an incentive to provide that information Also discussed a few immutable rules, or regulations Next, we looked at a number of situations where a contract would be invalidated/not enforced, and economic reasons for why o Contracts which derogate public policy o Incompetence (but not drunkenness) o Dire constraints – duress and necessity Contracts extracted under threat of refusing to create value are enforceable; contracts extracted under threat of destroying value are not Contracts renegotiated under duress are not enforceable; contracts renegotiated under changed circumstances are o Impossibility Efficiency requires assigning the liability for impossibility to the party that can bear the risk at the least cost (either by mitigating it, or by spreading it out over many transactions) o Misinformation: fraud, failure to disclose, frustration of purpose, mutual mistake (but not unilateral mistake) Efficiency often requires enforcing contracts which unite knowledge and control, not those which separate knowledge and control To give an incentive for discovery, efficiency generally requires enforcing contracts based on one party’s knowledge of productive information, especially if that knowledge was the result of active investment; but efficiency need not reward purely redistributive information o Vagueness In general, this can be seen as a penalty default – by refusing to enforce vague contracts, the courts force parties to be more clear o Adhesion and unconscionability (lesion) Next, we looked at remedies, among them: o Expectation damages o Opportunity cost damages o Reliance damages o Restitution, disgorgement, specific performance o General unenforceability of penalty clauses in contracts We looked at the effects of different remedies on decisions to breach, to invest in reliance, and to invest in performance o Like with injunctions and nuisance damages, with low transaction costs, any remedy can lead to efficient breach through renegotiation o But with high transaction costs, only expectation damages lead to efficient breach o When damages < benefit from performance, inefficient breach, or underinvestment in performance o When damages include any expected gains from reliance, overreliance o (“Paradox of compensation” – no damage rule that achieves efficient levels of everything. Anti-insurance – one cute attempt to solve the problem.) And finally, today, we covered repeated games, and the sixth purpose of contract law, to foster enduring relationships, which solve the problem of cooperation with less reliance on courts for enforcement And that’s it. Answers for homework 2. Office hours Monday (Chao in morning, me in afternoon). I’ll send out an email about next Thursday. Good luck on Tuesday.