FinTech Regulation 101 Joint Regulator Info Session

advertisement

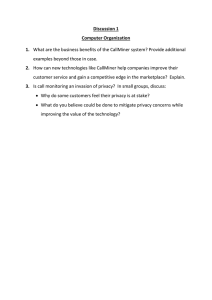

FinTech Regulation 101 Joint Regulator Info Session Mark Adams Senior Executive Leader, Strategic Intelligence and Co-ordinator, Innovation Hub Tony Richards Head of Payments Policy, RBA Neil Grummit General Manager, Credit and Operational Risk Services Bradley Brown Acting National Manager, Strategic Intelligence & Policy Este Darin-Cooper Director, Regulation and Strategy Outline of today • Five short presentations – Our agency’s role – Our agency’s interest – How we can assist fintech – Any matters to highlight • Questions & Answers panel Fintech: Some numbers – US$ estimates • • • • • • • $20B global investment $300M Australian investment $77B US alternative finance $4.5B UK alternative finance $350M Australian alternative finance $19B assets under roboadvice in USA $20B global savings for financial sector via blockchain over next decade Australia’s financial regulatory framework Parliament Government Treasury Regulators Financial system regulation responsibilities Council of Financial Regulators APRA ASIC RBA ACCC ATO AUSTRAC OAIC Prudential Financial markets and services Financial stability Competition Tax and SMSF compliance AML/CTF Privacy Sector data collection Source: FSI Interim Report 2014 Corporate Governance Payments Resources Culture Current financial regulatory perimeters RETAIL PAYMENT SYSTEMS REGULATION CONDUCT REGULATION Market participants Marketplace lenders Managed investment schemes Wholesale dealers, funds and advisers Non-bank lenders Financial advisers Financial brokers and intermediaries Custodians Credit rating agencies Retail FX dealers Non-cash payment facility issuers PRUDENTIAL REGULATION Purchase payment facilities ADIs Retail payment systems Insurers Card schemes Superannuation funds Central clearing parties Credit rating agencies OUTSIDE THE PERIMETER SMSFs Fund administrators Technology providers Source: FSI Interim Report 2014 Virtual currencies By contrast: US financial regulatory framework ASIC’s Innovation Hub ASIC - Topics • Innovationhub.asic.gov.au – for informal assistance • Digital advice consultation paper • Marketplace lending information sheet • FCA cooperation agreement • Regulatory sandbox Working draft graphic Existing sandbox framework • Modular licensing • Operate as a representative • ASIC discretion – organisational competency • Informal assistance • Power and policy exists to grant waivers and no action letters Tony Richards Reserve Bank of Australia Payments System Board Mandate • Powers under the PSRA and PSNA are to be used to – control risk in the financial system – promote efficiency in the payments system – promote competition in the market for payment services • Powers under the Corporations Act are to be used to – contribute to overall stability of the financial system Neil Grummit APRA APRA – What do we do? • Role prudential supervision => entity financial & operational resilience + systemic stability • Regulatory requirements much more onerous within the prudential perimeter • But prudential perimeter is small & defined by the ‘Industry Acts’ banking general insurance life insurance superannuation private health insurance APRA – & FinTech • No idea how this will develop => principles-based, technology neutral approach informed by consideration of materiality • Many (most?) developments will fall outside prudential perimeter, but will be employed by APRA regulated entities? • How can we help? Engage on prudential framework (e.g. how to stay outside!) Exercise our various discretions where warranted Bradley Brown AUSTRAC AUSTRAC’s vision and functions A financial system free from criminal abuse. • Australia’s Financial Intelligence Agency – collect and disseminate actionable intelligence – 45 domestic partners, 83 international partners • Australia’s AML/CTF Regulator – educate, supervise, enforce – effective regulatory reform Collaboration, innovation and inspiration AML/CTF Act – key obligations • A person that provides a designated service is a reporting entity, and has obligations under the Act to: – enrol or register with AUSTRAC – implement and maintain an AML/CTF program to identify, assess and manage the risk of money laundering and terrorism financing – identify their customers and undertake ongoing customer due diligence – submit reports to AUSTRAC – keep records. Our interest in fintechs Drivers of change • Digital Transformation of the financial industry • Proliferation of Non-Cash transactions • More ‘customer-centric’ in product design and delivery Opportunities • Exploiting technologies – distributed ledger / digital identity / biometrics Key messages • Opportunities in public / private partnerships • We are open to engagement – influence design and embed regulatory safeguards – co-discovery of potential applications – consider applications for relief • New approaches to regulation Este Darin-Cooper OAIC Protecting information rights – advancing information policy Overview • Privacy – why you should care • Risks of ignoring privacy • Tips to minimise your risk profile Why privacy? • Good data handling practice drives commercial success • Build consumer trust • Avoid reputational damage The risks of ignoring privacy • Damage to your reputation jeopardise funding / scaling / acquisition • Need to redesign to retrofit privacy cost and delay • Regulatory scrutiny increased compliance obligations • Public sanctions damage to reputation / bottom line Tips to minimise your risk profile • Conduct privacy impact assessments (PIAs) • Be open and transparent • Collect and retain anonymised data where possible • Secure the data you hold • Be prepared for a data breach Questions & Answers Panel