What can we learn from the link between The Italian experience

What can we learn from the link between

Trade and Business statistics?

The Italian experience

Stefano Menghinello, Filippo Oropallo, Marco Giorcelli

National Institute of Statistics – Italy

Agenda item 7, Friday 4 Feb 2011, Morning Session, 9:30 - 12:30

Global Forum on Trade Statistics

2-4 February 2011

Geneva, Switzerland at WTO

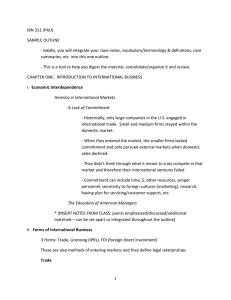

Issues covered by this presentation

Users of Trade statistics nowadays address new questions

Business analysts and policy makers want to know more about key actors and competitiveness drivers of Global trade

How trade statisticians should react to this demand shift?

A substantial change from a product based toward a business oriented perspective is needed in the compilation of trade statistics

How can trade statisticians successfully manage it?

The set up of a new statistical frame based on the link between Trade and Business statistics at the enterprise / trade operator level

Which sort of “New Trade Figures” can be obtained from the link between Business and Trade Statistics?

First type of output : Figures based on the ID code of trade operators

Second type of output : Figures based on the link with the BR

Third type of output : Figures and analytical analysis based on the full integration of trade statistics with business surveys

Conclusions

The demand driven shift from a product oriented toward a business perspective in the compilation of trade statistics

OLD QUESTIONS

What is traded?

Where is traded?

Istat

20%*

NEW QUESTIONS

Who trades what where?

Are exporting companies leading productivity growth?

Which is the contribution of foreign

MNEs to national trade?

Which companies are engaged in

Global Value Chains?

OLD STATISTICAL

FRAME

Product based approach independent from the link with business statistics

NEW STATISTICAL

FRAME

Enterprise oriented approach based on the full integration with business statistics

The set up of a new statistical frame based on the integration at the enterprise level between Trade and Business statistics

The link between the list of trade operators and the Business

Register is the GATEWAY to any new and successful developments in trade statistics

Trade flows micro-data Business surveys

List of Trade operators

Administrative and fiscal data

Special surveys on

Globalisation: MNEs and international sourcing

FIRST TYPE OF OUTPUT SECOND TYPE OF OUTPUT THIRD TYPE OF OUTPUT

“ new figures” based on the count of trade operators, for instance by products and markets

“new figures” on the business characteristics of exporting and importing enterprises

“new figures” and analysis based on the full integration between Trade and

Business Statistics

The Italian experience in the production of new statistics based on the link between Trade and Business statistics

ISTAT has a consolidated experience in the production of new trade statistics of Type One and Type Two

A large set of tables on trade operators and exporting and importing companies is included in the Foreign Trade Statistics Yearbook, jointly published by ISTAT and the National Agency promoting firms internationalisation (ICE) since the late ’90s. They are also available in the on line database COEWEB

As a result, the business structure of our exporters community is well known to national analysts and policy makers

ISTAT has developed new statistics on the spatial distribution of exports, on the contribution of foreign MNEs to national trade figures and, more recently, analytical analyses on trade firms

Figures and analysis show strong evidence on the superior performance of exporting companies as compared to other businesses

ISTAT is setting up an in-depth integration between Trade statistics and Business surveys (including MNEs) finalised to new statistics on the population of exporting companies (SBS variables) and on intra-firm trade by products

Micro-level complex data warehousing

An example of new trade Statistics – Output Type One

The “competitive” position of Italian firms and their Chinese suppliers during the recovery phase of Italian exports

1th Semester 2010/ 1 th Semester 2009

Unit value export growth

Negative

Positive

Total

Unit value import growth

Negative

20,6

28,1

48,7

Positive

23,5

27,8

51,3

Total

44,1

55,9

100,0

Both Italian and Chinese suppliers decrease unit values

Competitiveness reduction or costs seeking strategy?

Both Italian and Chinese suppliers increase unit values

Competitiveness

Strengthening?

An example of New Trade Statistics – Output Type Two

Italian medium and large size firms potentially engaged in Global Value Chains - 2008

MIGS_EXPORTS

Energy

Energy

0,2

Intermediate goods

0,0

Capital goods

0,0

MIGS_IMPORTS

Consumer durable goods

0,0

Consumer non durable goods

0,0

Other

0,0

TOTAL

0,2

Intermediate goods

Capital goods

Consumer durable goods

Consumer non durable goods

Other

TOTAL

0,1

0,0

0,0

0,0

0,0

0,3

30,3

6,7

1,9

3,2

0,1

42,2

1,5

13,3

0,3

0,3

0,3

15,7

0,2

0,2

2,0

0,0

0,0

2,4

1,2

0,3

0,2

11,4

0,0

13,0

8,1

8,9

3,5

5,6

0,3

26,3

41,4

29,4

7,9

20,5

0,6

100,0

Share in % of medium and large size companies potentially engaged in

Global Value Chains

TOTAL= Around 10.000 large and medium size exporting companies

An example of New Trade Statistics: Output Type Three

Performance gap between exporting and non exporting manufacturing firms by employment class - year 2008

1,5

1,4

1,3

1,2

1,1

1,0

2,0

1,9

1,8

1,7

1,6

20-49 50-249 more than 249

Labour productivity Labour cost Profitability Investment per worker

LEGENDA:

1=equal performance

>1 superior performance of exporting firms over non exporting ones

An example of New Trade Analysis: Output Type Three

Taxonomy and performance of exporting enterprises by total factor productivity (TFP) intensity

Empirical analysis based on a micro level panel dataset

TFP quantiles

High TFP

Mediumhigh TFP

Mediumlow TFP

Performance indicators BEFORE (2001-2007) and DURING (2008-

2009) the GLOBAL CRISIS

Highest growth (2001-2007): Export +70.2% ,Employment +12.4%

Labour productivity +20%, Control of the fall of profitability (2001-

2007): (-5%)

Highest resistance (2008-2009): Export -24.2%, Employment -2.6%

Medium-high growth (2001-2007): Export +49.5%, Employment +6.6%

Labour productivity +18.7% Loss in profitability: (-16.7%)

Low resistance (2008-2009) Export -30.7%, Employment -5.7%

Medium-low growth (2001-2007): Export +27.2%, Employment +3.7%

Labour productivity +17%, High loss in profitability (-30.9%)

Low resistance (2008-2009) Export -32.6% Employment -8.9%

Low TFP

Low growth (2001-2007): Export +1.7%, Employment -3.7%, Labour

productivity +12.2%, Highest loss in profitability (2001-2007): (-63.2%)

Worse resistance (2008-2009) Export -38.3% Employment -14.2%

Future developments by ISTAT: the set up of an integrated firm level data warehouse for the to analysis of complex internationalisation behaviour

Motivations: Businesses, and especially fast growing firms, adopt complex internationalisation strategies, which include the contextual presence of arms-length transactions, as well as cooperation and ownership linkages

Data sources: A number of national surveys, including foreign trade in goods and Outward and Inward MNE data, and international databases will be fully integrated at the firm level in order to effectively monitor the behaviour of firms deeply engaged in globalisation

ISTAT firm level data warehouse on Globalisation: ISTAT is setting up a micro-level data warehouse which integrates all these sources, from which empirical analysis and queries can be carried out at the product, enterprise, and enterprise group level.

This is a major IT project: Oracle relational database optimised for microlevel data analysis

This is a major statistical project: Product based and enterprise based surveys are not fully harmonised. Benchmarking and calibration with respect to different target populations is needed.

Accessibility of the data warehouse by national or international researchers, given confidentiality constraints , is a goal of this project.

Conclusions

A substantial change in the approach to compile trade statistics notably from a product based to an enterprise oriented perspective is needed to successfully face a substantial shift in users demand

The link between the list of trade operators and the national Business

Register is essential to obtain further developments in this area. In effect the BR is the GATEWAY to any substantial innovations in this area.

A wide range of outputs can be obtained from the integration of trade and Business statistics, staring from business characteristics of exporting and importing enterprises to more complicated analysis on enterprise performance and internationalisation patterns.

Surprisingly enough, these new statistics can be developed at zero costs for respondents (no additional statistical burdens)

The set up of a micro-level data warehouse including all relevant globalisation related surveys is crucial to develop complex statistical