Backcasting National Accounts Data Examples from United States Experience

advertisement

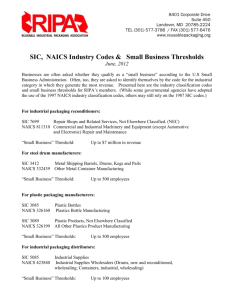

Backcasting National Accounts Data Examples from United States Experience Brent Moulton Advisory Expert Group on National Accounts Washington DC 9 September 2014 www.bea.gov Why backcast economic data? ▪ Provide a service to data customers ▪ Maintain time-series consistency ▪ Produce longer time series to study changes in the economy over time ▪ Understand sources of economic growth and productivity over time www.bea.gov 2 When is backcasting used? ▪ Changes in classification Industry and other classification systems ▪ Changes in concepts Newly recognized asset or redefined activity ▪ Expanded detail Sub-aggregate breakouts ▪ When data are not available to directly measure the economic variables www.bea.gov 3 Approaches ▪ Microdata approaches Detailed reclassification of micro units ▪ Macrodata approaches Concordance tables Proportional splicing Interpolation/Backward extrapolation with or without indicator www.bea.gov 4 Examples in the US national accounts ▪ GDP-by-industry estimates 1947 - 1997 North American Industry Classification System (NAICS) ▪ Reclassifications of exports and imports For example, new treatment of merchandising in BPM6 ▪ Recognition of R&D as fixed assets Newly constructed measures of R&D investment www.bea.gov 5 GDP by industry and NAICS ▪ U.S. statistical agencies implemented new classification system in different years Economic Census data - 1997 Tax data - 1998 Employment and earnings data - 2001 Prices - 2004 ▪ Prior to 1998, GDP by industry was based on Standard Industrial Classification (SIC) ▪ Users urged BEA to provide NAICS time series ▪ Not feasible to convert source data to NAICS www.bea.gov 6 Backcasting GDP by industry ▪ Designed a backcasting technique 1997 concordance of detailed SIC to NAIC data Backward extrapolate concordance with SIC source data Create published level SIC – NAICS conversion matrices 1987-1997 Convert published SIC estimates to NAICS Conversion matrices for 1977-1986 had less SIC detail For 1947-1976, 1977 matrix held constant Vki, t-p = Vki, t-p · (nki, t-p / nki, t-p+1 ) Where: www.bea.gov i = industry t = 1997 p = 1,…,10 k = VA component (output, intermediate inputs, compensation, GOS) n = conversion coefficient V = dollar value of VA component 7 Evaluating results ▪ Reasonableness and consistency checks Growth rates compared to published SIC industries Aggregation of industry level real value added compared against expenditure-based real GDP www.bea.gov 8 Recognition of R&D as fixed asset ▪ 2013 NIPA comprehensive revision ▪ New estimates of R&D output and investment ▪ Less available and reliable data further back in time Time period Source data Comments 1981 - present R&D expenditure surveys Detailed costs by industry (business, and economic census data academic, government); relatively consistent across time 1957-1980* R&D expenditure surveys Less consistency of surveys across time 1953-1956 Insufficient data Geometric interpolation 1920-1953 Various research studies of R&D costs Selected years; straight line interpolation between data points *Prior to 1981 - aggregate estimates deemed more reliable than detailed industry data – proportionally scaled detail to hit aggregates www.bea.gov 9 Summary ▪ Many different reasons to backcast ▪ Each instance has unique requirements ▪ Necessitates resourcefulness and inventiveness ▪ Need to weigh the benefit of backcasting against the resources required and the resulting quality of the estimates ▪ Need a strong evaluation process www.bea.gov 10