PART-1 FORM 801 [see Rule 17A(2)] TRANSACTION-WISE VAT SALES TO CUSTOMERS e-ANEXURE, e-LOC

advertisement

![PART-1 FORM 801 [see Rule 17A(2)] TRANSACTION-WISE VAT SALES TO CUSTOMERS e-ANEXURE, e-LOC](http://s2.studylib.net/store/data/016947222_1-fd898eba575f8458e01be1825021f012-768x994.png)

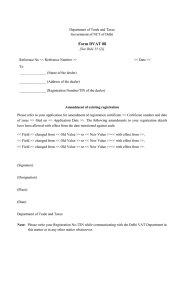

PART-1 FORM 801 [see Rule 17A(2)] TRANSACTION-WISE VAT SALES TO CUSTOMERS e-ANEXURE, e-LOC A. Information of Claimant Dealer TIN of Claimant Dealer Period Covered by the V From To SALES Other Local e-Annexure Taxable SALES (DD/MM/YYYY) (Rs.) B. List of TRANSACTION -WISE SALES on which VAT is charged separately. Sr.No Tax Invoice No. Tax Invoice TIN of Customers Date Net Output VAT Taxable Amount Rs. Gross Total Rs. Amount Rs. a b c d e f 1 2 3 *LOC:- List of Suppliers of Claimant Dealer. * Net Taxable Amount means - Sales Amount on which VAT is charged separately. * Gross Amount means - Total Value of Sales to Customer including, VAT, insurance, freight, any other charges etc shown separately in invoices. * Other Local Taxable Sales means:- the sales which are inclusive of tax i.e. the taxable Sales where the taxes are not collected separately. g PART-2 FORM 801 [see Rule 17A(2)] TRANSACTION-WISE VAT PURCHAES FROM SUPPLIERS e-ANEXURE, e-LOS A. Information of Claimant Dealer TIN of Claimant Dealer V Period Covered by the From PURCHAES To Other Local e-Annexure Taxable (DD/MM/YYYY) Purchases (Rs.) B. List of TRANSACTION -WISE PURCHASES on which VAT is charged separately. Sr.No Tax Invoice Tax Invoice No. TIN of Suppliers Date Net Input VAT Taxable Amount Rs. Amount Rs. a b c d e f 1 2 3 *LOS:-List of Suppliers of the Claimant Dealer * Net Taxable Amount means:- Purchase Amount on which VAT is charged separately. * Gross Amount means:- Total Value of Purchases of Supplier including, VAT, insurance, freight, any other charges etc shown separately in invoices. * Other Local Taxable Purchases means- the purchase which are inclusive of tax i.e. the taxable purchases where the taxes are not collected separately. Gross Total Rs. PART-3 FORM 801 [see Rule 17A(2)] CUSTOMER WISE DEBIT NOTE OR CREDIT NOTE e-ANEXURE, e-Cr/e-Dr for e-LOC A. Information of Claimant Dealer TIN of Claimant Dealer V Period Covered by the From To SALES CR/DR e-Annexure NOTE/GOODS (DD/MM/YYYY) RETURN (Rs.) B. List of CUSTOMER-WISE DEBIT NOTE/CREDIT NOTES on which VAT is charged separately. Debit Debit TIN of Net Output Sr. Note/Cre Note/Cre Customers Taxable VAT Gross No dit Notes dit Notes Amount Amount Total Rs. No. Date Rs. Rs. b c e f a d 1 2 3 *e-Cr/Dr. for e-LOC:- Credit Note/Debit Note issued Dealer to his Customers. * Note - The details in respect of Credit Notes / Debit Notes to be submitted only when there is variation in sale price in respect of goods sold. g PART-4 FORM 801 [see Rule 17A(2)] SUPPLIER- WISE DEBIT NOTE OR CREDIT NOTE e-ANEXURE, e-Cr/e-Dr for e-LOS A. Information of Claimant Dealer TIN of Claimant Dealer Period Covered by the V From To PURCHASE CR/DR e-Annexure NOTE/GOODS RETURN (DD/MM/YYYY) (Rs.) B. List of SUPPLIER-WISE CREDIT NOTE/ DEBIT NOTES on which VAT is charged separately. Debit TIN of Sr. No Debit Note/ Net Taxable Input VAT Suppliers Credit Note Note/Credit Note Amount Rs. Amount Rs. Date No. a b c d e f 1 2 3 *e-Cr/Dr. for e-LOC:- Credit Note/Debit Note issued Dealer to his Customers. * Note - The details in respect of Credit Notes / Debit Notes to be submitted only when there is variation in sale price in respect of goods sold. Gross Total Rs.

![FORM VAT 126 canteens) for the month of [See Rule 44 (2)(a)]](http://s2.studylib.net/store/data/016946992_1-03402c6060a7141d9dddd900f81fb970-300x300.png)