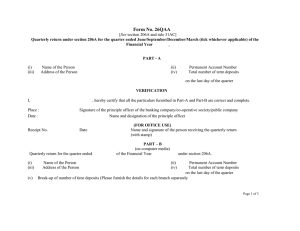

Form No. 26QA See

advertisement

Form No. 26QA [See section 206A and rule 31AC] Particulars required to be maintained for furnishing quarterly return under section 206A 1. (a) (b) 2. Particulars of the payer : (a) (b) (c) Name Branch/Division/Office/Unit BSR Code, if any (d) (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) Address : Flat/Premises No. Name of the premises/building Road/Street/Lane Area/Location Town/City/District State Pin Code Telephone No. (ix) 3. Tax deduction and Collection Account No. (TAN) Permanent Account No. (PAN) (c) (d) Financial Year Assessment Year E-mail Details of time deposits for the quarter ended of the Financial Yea r under section 206A. Page 1 of 2 Particulars of the person Sl. No. Details of time deposit on the first day of the Quarter*** Amount (301) 1. Name (302) PAN* Date of Birth** Flat / Premises No. Name of the premises Road / Street / Lane Area / Location Town / City / District State Pin Code (303) (304) (305) (312) Reference No. (313) Details of time deposit made during the Quarter*** Amount (314) Reference No. (315) Details of time deposits not to be included in Form No. 26QA for next Quarter Amount (316) Reference No. (317) Interest paid / credited during the Quarter Reasons**** (318) (319) (306) (307) (308) (309) (310) (311) * Mention NA where PAN is not available. **Mention NA where Date of Birth is not available. *** Time deposits to be reported in Form No. 26Q (rule 31A) not to be included in this Form. **** Write 1 for encashment during the Quarter, 2 for renewal, 3 if interest likely to be payable to the person during the Financial Year exceeds Rs. 5,000/-, and 4 for any other reason. 2. Page 2 of 2

![Register VR-III [See Rule 10]](http://s2.studylib.net/store/data/016946557_1-821e84266048f5f87a7ea6654310c1f7-300x300.png)