Form DVAT 24

advertisement

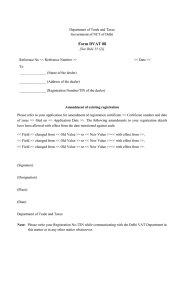

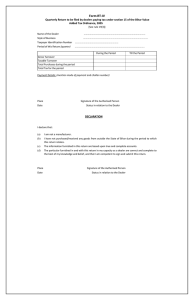

Department of Value Added Tax Government of NCT of Delhi Form DVAT 24 (See Rule 36 of the Delhi Value Added Tax Rules, 2005) << Date >> Reference No << Reference Number >> To ______________ (Name of the dealer) ______________ (Address of the dealer) ______________ (Registration Number of the dealer) Notice of default assessment of tax and interest under section 32 Whereas I am satisfied that the dealer has not furnished returns/furnished incomplete returns or incorrect returns / furnished a return that does not comply with the requirements of Delhi Value Added Tax Act, 2004 / any other reason << Specify the reasons>> The dealer is hereby directed to pay tax of an amount of rupees __________________ and furnish proof of such payment to the undersigned on or before << Date >> for the following tax period(s) Tax Period (mm/dd/yy to mm/dd/yy) Amount (Rs.) Tax Interest Total Total (Signature) (Designation) (Place) (Date) Note: Please write your Registration No. while communicating with the Delhi VAT Department in this matter or in any other matter whatsoever. 1 Department of Value Added Tax Government of NCT of Delhi Form DVAT 24A (See Rule 36 of the Delhi Value Added Tax Rules, 2005) Reference No << Reference Number >> << Date >> To ______________ (Name of the dealer) ______________ (Address of the dealer) ______________ (Registration Number of the dealer) Notice of assessment of penalty under section 33 Whereas I am satisfied that the dealer has a liability to pay penalty under section 86 of Delhi Value Added Tax Act, 2004 for the following reasons << Specify the reasons>> 1. 2. Now therefore the dealer is hereby directed to pay penalty of an amount of rupees ________________ and furnish proof of such payment to the undersigned on or before << Date >> . (Signature) (Designation) (Place) (Date) Note: Please write your Registration No. while communicating with the Delhi VAT Department in this matter or in any other matter whatsoever. 2