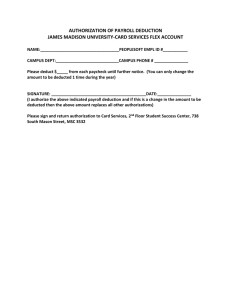

Form C-II BiharValue AddedTax Act, 2005 [See rule 29(4)(i)]

advertisement

![Form C-II BiharValue AddedTax Act, 2005 [See rule 29(4)(i)]](http://s2.studylib.net/store/data/016946521_1-69cdc6071f1e00f3a3d37cdb1d375ea6-768x994.png)

Form C-II Certificate of Tax Deducted at Source under Section 41 of the BiharValue AddedTax Act, 2005 [See rule 29(4)(i)] Printed Serial Number : ........................................................... 1. Name and Address of the person making deduction ........................................................................................................................................................................................ ........................................................................................................................................................................................ ........................................................................................................................................................................................ 2. Name and Address of the ........................................................................................................................................................................................ Dealer (Contractor/Supplier) from whose bill deduction has been made 3. Dealer’s TIN (if any) ........................................................................................................................................................................................ ........................................................................................................................................................................................ ........................................................................................................................................................................................ 4. In case of Registered dealer, ........................................................................................................................................................................................ name of the Circle in which ........................................................................................................................................................................................ the dealer is registered 5. Total value of the Contract/Supply in respect of ............................................................................................................................ which the deduction has been made ............................................................................................................................ 6. Total amount of Bill in respect of which the payment has been made 7. Amount of Tax deducted Rs. ........................................................................ In Words: Rupees ................................................................................................................................................................................................................ only. 8. Cheque/Draft details in respect of amount deducted: Cheque/DD Number ........................................................... Dated ............................................. 9. Number and Date of Letter vide which the Cheque/Draft mentioned above at serial 8 has been dispatched to concerned Circle Amount ................................................................. ................................................................................................................................. ................................................................................................................................ CERTIFICATE Certified that amount of Rs. ......................................................................... (in words Rupees .................................................................. ............................................................................................................................................................ ) has been deducted from the Bill/Invoice raised by the Works Contractor/Supplier in respect of Part/Full execution of the contract. Place ................................................... Signature of Issuing Authority ..................................................................... Date ................................................... Designation ............................................................................................................................ Seal of the Office

![FORM VAT 126 canteens) for the month of [See Rule 44 (2)(a)]](http://s2.studylib.net/store/data/016946992_1-03402c6060a7141d9dddd900f81fb970-300x300.png)