Martin Stopford China at a Turning Point President,

advertisement

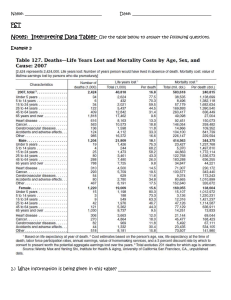

Future of China & the maritime industry Martin Stopford President, Clarkson Research China at a Turning Point The Trade Development Cycle & the One Belt One Road concept The Chairman’s Forum, Looking Ahead From the City of London Cass Business School, London 15th September 2015 Martin Stopford, Clarkson Research 1 Figure 1: World seaborne imports in 2014 12 China accounted for 41% of import growth since 2003 Billion tonnes of cargo China 10 8 6 . 2 0 1950 1953 1956 1959 1962 1965 1968 1971 1974 1977 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 Martin Stopford, Clarkson Research 4 2 Figure 2: China’s seaborne imports and exports seaborne trade Mt 2000 Sea imports Sea Exports 2015 Imports forecast Line 5 1500 1000 500 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 0 Figure 3: China’s Industrial production growth Post 1997 Asia Crisis Recession Average14%pa Source: industrial data from various sources 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 35% 30% 25% 20% 15% 10% 5% 0% -5% -10% 1992/3 Bubble Figure 4: Typical “trade development cycle” peaking • The trade development cycle (TDC) describes the import growth path of transitional economies • It has three stages:– Stage 1: modest imports funded by primary exports – Stage 2: As the economy speeds up imports of raw materials grow rapidly – Stage 3: the volume of imports grows slowly • China seems to have reached turning point 2 Value added growth Turning point China ? Resource intensive growth economy undeveloped 1 2 For the shipping industry the key issue is the timing of the two turning points Source: Maritime Economics martin Stopford (1997) Stage 1 Early Industrial Stage 2 Transitional Stage 3 Mature Trade development cycles 1950-2015: EUROPE 1,500 1,000 500 1 2010 2005 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 0 1950 • There have been four waves of regional growth:1. Europe lead the way in the 1950s Imports M tonnes 2,500 Europe 2,000 Trade development cycles 1950-2015: JAPAN Europe Japan 2,000 1,500 1,000 500 1 2 2010 2005 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 0 1950 • There have been four waves of regional growth:1. Europe lead the way in 1950s, 2. Followed by Japan in 1960 Imports M tonnes 2,500 Trade development cycles 1950-2015: SE ASIA Europe Japan SE Asia 2,000 1,500 1,000 500 1 2 3 2010 2005 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 0 1950 • There have been four waves of regional growth:1. Europe lead the way in 1950s, 2. Followed by Japan in 1960 3. Asia in about 1975 Imports M tonnes 2,500 Figure 5: Trade development cycles 1950-2015: Imports M tonnes CHINA 2,500 Europe Japan SE Asia China 2,000 1,500 1,000 500 1 2 3 4 2015 2010 2005 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 0 1950 • There have been four waves of regional growth:1. Europe lead the way in 1950s, 2. Followed by Japan in 1960 3. Asia in about 1975 4. Chinese trade started to grow rapidly in 1994 • The growth pattern was a slow start followed by rapid growth Figure 5: Trade development cycles 1950-2015 Japan SE Asia China 2,000 1,500 1,000 500 1 2 3 4 2015 2010 2005 2000 1995 1990 1985 1980 1975 1970 1965 1960 1955 0 1950 • There have been four waves of regional growth:1. Europe lead the way in 1950s, 2. Followed by Japan in 1960 3. Asia in about 1975 4. Chinese trade started to grow rapidly in 1994 • The growth pattern was a slow start followed by rapid growth Imports M tonnes 2,500 Europe Future Trade Scenario: Challenging 6.42 Japan Average 3.5 tonnes/capita 1 billion OECD import 3.5 billion tonnes of cargo 3.55 Europe 1.65 N. America Average 1.0 tonne/capita 6 billion Non-OECD countries import 6.4 billion tonnes of cargo 1.5 China 0.90 ROW World Average 1.4 tonne/capita 1.37 World 2015 0 1 2 3 4 5 6 7 8 9 Sea imports per person a year in 2015 Martin Stopford, Clarkson Research 10 11 12 11 Figure 6: China in the world maritime economy 18% Population 15% GDP (market) PPP measure of world GDP 17% GDP (PPP) 20% Sea Trade 41% of trade growth 2003-2014 Trade Growth Share of world shipbuilding 10% World Fleet 33% Deliveries CGT Deliveries 35% 30% 25% 20% 15% 10% 5% 38% Shipyard orderbook CGT Orderbook 0% • China is now 1820% of population, GDP and sea imports • Big impact on trade growth • Big shipbuilding share Exchange rate measure of world GDP China’s share of world total 2014/5 Figure 7 China’s import growth by commodity 1999-2014 0 Million tonnes increase in trade 1999-2014 200 400 600 800 1,000 Iron ore dominates trade growth Iron Ore Crude Minor Bulk Coal Metals Containerisable Grains Manufactures Chemical 877 243 235 231 96 80 51 35 17 Figure 9: Steel consumption per capita 2013 Kg per cap 0 Japan EU (27) USA China M East CIS India S Am Africa 100 200 300 400 500 600 516 274 300 515 213 227 58 105 42 Source: World Steel Association “World Steel in Figures 2014” One Belt, One Road – President Xi’s vision Moscow Istanbul Khoigas Almaty Bishkek Urumqi Samarkand Dushanbe Tehran Gwadar Central Asia Gwadar Gwadar Figure 10: China Silk Road ECONOMIC Belt • The economic belt will lop thousands of kilometres of the traditional sea routes for Chinese exports • It is a vital transport route for imports of oil, gas and other natural resources. Source Gavekal/Dragonomics Figure 11: China’s Silk Road MARITIME Belt • Improved connectivity between Asia and Europe, creating valuable new trade routes and boosting regional growth: • Measures to improve performance include – upgrade ports; – improved logistics; lower trade barriers; – financial integration Source Gavekal/Dragonomics Eurasia Land Bridge photos: Tom Miller Better connectivity will enable its underdeveloped border regions to become viable trade zones Conclusions • China is moving from the transitional stage of development to maturity • There is surplus capacity in shipbuilding, steel and infrastructure development companies. • The Silk Road Economic and Maritime Belt might open up Central Asia & maritime Asia. • Shipping will benefit from better port and inland infrastructure within Asia, and economic development, making improved transport services possible. Figure 12: The Westline – 5000 years of maritime trade 8. England 1735: merchant fleet overtakes Dutch shipping 12. Hanseatic League 1950-70 Japan: 7. Dutch 6. 1400 13. 1990s China 1970s S Korea 10. AD: trade miracle economy 1650 AD: emerges as major emerges as between N. W. leads shipping dominate power industrial power Europe and the sea trade Baltic sea 9. 1880-1950: growing power of N. America as global trade hub 5. Venice 1000: crossroads for East /West trade 4. Rome100 BC: dominates west Mediterranean 3. Greece 300BC trade centres Corinth & Athens 2. Phoenicians: 1. Gulf: trade from Lebanon 3000 BC trade between 1500-300 BC India and Babylon Sea trade scenarios 2015-2065 Sea Trade Scenario 1 4 tonnes per capita in 2065 2065 2055 2045 2035 2025 2015 2005 1995 1985 1975 1945 1935 1925 1915 1905 1895 1885 1875 1865 1865-1935 3.5% pa growth Liner & tramp shipping (pushing out sailing ships) 1965 1950-2014 4.8% pa growth Bulk, specialized, container shipping 1955 45 40 35 30 25 20 15 10 5 0 2015-2065 That works out at 1.1%2.8% pa growth Scenario 2: 1.7 tonnes per capita in 2065 Figure 8: China’s steel production & iron ore imports Steel forecast Iron Ore Imports Steel Production Iron ore imports forecast 1953 1955 1957 1959 1961 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 1000 900 800 700 600 500 400 300 200 100 0