Can fund managers asset allocate? Andrew Clare, Dirk Nitzsche

advertisement

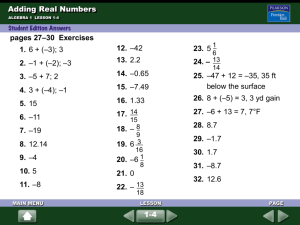

Can fund managers asset allocate? Andrew Clare, Dirk Nitzsche & Meadhbh Sherman Centre for Asset Management Research, Cass Business School, London. Click to edit Master title style Overview • What we are assessing are TAA skills • Previous, related work • Data & methodologies • Sub-set of results • Summary • All the results are preliminary; final version of paper should be available in September; also in process of updating the results Copyright: Andrew Clare, 2012 Page 1 Click to edit Master title style Some previous work in this area • Sharpe (1988, 1992) asserted that: • a fund’s asset allocation decisions account for almost all of its fund’s performance • Brinson, Hood and Beebower (1986) examine the performance of 91 US pension funds using data from 1974 to 1983 they found that: • the policy mix explained 93.6 percent of the average fund’s return variation over time (as measured by the R2) • Brinson, Singer and Beebower (1991) quarterly returns data on 82 US pension funds spanning the period 1977 to 1987 • active investment decisions did little to improve portfolio performance because any abnormal performance was insignificant Copyright: Andrew Clare, 2012 Page 2 Click to edit Master title style Some previous work in this area • Using UK pension fund data, Blake, Lehmann & Timmerman (1999) • the majority of return is derived from the strategic asset allocation decision • Using data on large Canadian and US pension funds Andonov et al (2011) find: • that changes in asset allocation, market timing and security selection generate positive abnormal returns of 17, 27 and 45 basis points per year respectively • Using a small sample of US managers Weigel (1991) finds that • the vast majority (over 75%) of managers exhibit positive, significant market timing ability • managers that are good at market timing are paying for this skill in the form of negative returns to non-market-timing strategies Copyright: Andrew Clare, 2012 Page 3 Click to edit Master title style Data • We collected monthly, net of fee returns data on multi-asset class retail funds managed in Canada, the UK and the USA • Data sample is January 2000 to December 2010 – 714 funds • We also collected data on monthly proportions of multi asset class funds invested in: Cash, Govt bonds, Corporate bonds & Equities • Data sample is January 2006 to December 2010 – 355 funds • We use the two data sets as the basis for two approaches to the problem Copyright: Andrew Clare, 2012 Page 4 Click to edit Master title style The multi-asset class funds All categories Conservative Allocation Moderate Allocation Aggressive Allocation Equity 50.17 30.98 58.57 68.08 Bond 34.99 48.61 29.88 17.23 Cash 9.54 12.35 7.74 6.04 Other 3.78 6.33 2.51 4.67 No. of funds 349 116 196 37 All categories Cautious Managed Balanced Managed Active Managed Equity 63.76 45.24 68.74 80.97 Bond 17.17 33.20 12.99 2.31 Cash 10.15 12.78 9.80 7.23 Other 8.58 8.34 8.25 9.26 No. of funds 134 48 49 37 All categories 48.48 36.97 10.53 1.26 231 Fixed Income Balanced 26.01 50.76 14.62 1.66 73 US UK Canada Equity Bond Cash Other No. of funds Copyright: Andrew Clare, 2012 Neutral Balanced 53.26 34.23 10.06 1.06 95 Equity Balanced 64.1 23.67 7.08 1.05 58 Tactical Balanced 64.05 26.45 8.53 0.73 5 Page 5 Click to edit Master title style Methodology • We apply variants of two methodologies to determine whether fund managers can ‘time’ their asset allocation decisions • We effectively test for tactical rather than strategic timing abilities • Methodology 1: • This is based on the “conditional beta” approach which imputes timing ability using fund returns (Ferson and Schadt (1996)): • We use several variants of this approach on the longer data set Copyright: Andrew Clare, 2012 Page 6 Click to edit Master title style Methodology 1 • If θ2 is positive it implies successful timing of equity market • If θ3 is positive it implies successful timing of corp bond market • If θ4 is positive it implies successful timing of govt bond market • If θ5 is positive it implies successful timing of cash Copyright: Andrew Clare, 2012 Page 7 Click to edit Master title style Results – US and UK Timing coefficients 1 2 3 4 US All US- Conservative Allocation US- Moderate Allocation US- Aggressive Allocation % Neg % Sig Pos % Sig Neg % Pos % Neg % Sig Pos % Sig Neg % Pos % Neg % Sig Pos % Sig Neg % Pos 3 Timing Coeff Equity 1.43 6.30 25.50 74.50 0.00 13.51 18.92 81.08 0.86 6.90 18.10 81.90 2.04 4.59 31.12 68.88 4 Corp 4.58 0.86 78.51 21.49 13.51 2.70 75.68 24.32 1.72 0.00 81.90 18.10 4.59 1.02 77.04 22.96 5 Govt 0.86 10.60 24.07 75.93 2.70 10.81 35.14 64.86 0.00 7.76 22.41 77.59 1.02 12.24 22.96 77.04 6 Cash 7.74 47.85 21.49 78.51 8.11 37.84 24.32 75.68 7.76 51.72 18.10 81.90 7.65 47.45 22.96 77.04 % Sig Pos % Sig Neg % Pos UK-All UK- Cautious Managed UK- Balanced Managed % Neg UK- Active Managed % Sig Pos % Sig Neg % Pos % Neg % Sig Pos % Sig Neg % Pos % Neg % Sig Pos % Sig Neg % Pos % Neg % Sig Pos % Sig Neg % Pos % Neg 0 7.46 13.43 86.57 0.00 12.50 16.67 83.33 0.00 4.08 8.16 91.84 0.00 5.41 16.22 83.78 9 Equity 10 Corp 5.22 1.49 55.97 44.03 4.17 0.00 58.33 41.67 6.12 2.04 53.06 46.94 5.41 2.70 56.76 43.24 11 Govt 0 14.18 11.19 88.81 0.00 14.58 27.08 72.92 0.00 18.37 0.00 100.00 0.00 8.11 5.41 94.59 12 Cash 1.49 13.43 32.09 67.91 0.00 29.17 2.08 97.92 2.04 8.16 44.90 55.10 2.70 0.00 54.05 45.95 • Corporate bond timing more prevalent than equity market timing • UK Cautious Managed, can’t seem to time cash! Copyright: Andrew Clare, 2012 Page 8 Click to edit Master title style Results – Canada Timing coefficients Canada-All % Sig Pos % Sig Neg % Pos Canada- Fixed Income Balanced % Neg % Sig Pos % Sig Neg % Pos Canada- Equity Balanced Canada- Neutral Balanced % Neg % Sig Pos % Sig Neg % Pos % Neg % Sig Pos % Sig Neg % Pos Canada- Tactical Balanced % Neg % Sig Pos % Sig Neg % Pos % Neg 15 Equity 0.43 12.12 26.41 73.59 1.37 21.92 8.22 91.78 0.00 10.53 30.53 69.47 0.00 3.45 43.10 56.90 0.00 0.00 20.00 80.00 16 Cor Bond 3.46 3.46 43.29 56.71 0.00 6.85 16.44 83.56 5.26 1.05 52.63 47.37 5.17 3.45 60.34 39.66 0.00 0.00 60.00 40.00 17 Gov Bond 2.6 0.87 55.84 44.16 2.74 1.37 75.34 24.66 2.11 1.05 49.47 50.53 3.45 0.00 43.10 56.90 0.00 0.00 40.00 60.00 18 Cash 4.33 9.96 42.86 57.14 1.37 6.85 34.25 65.75 6.32 9.47 48.42 51.58 5.17 15.52 44.83 55.17 0.00 0.00 40.00 60.00 • Bond timing more prevalent than equity market timing for Canadian funds • However, overall proportion that are found to have significant timing ability in all three markets is very low. Copyright: Andrew Clare, 2012 Page 9 Click to edit Master title style Results – summary US (%) UK (%) CAN (%) % with All 4 classes Pos 0.29 0.00 1.30 % with 3 out of 4 Pos 7.45 4.48 9.96 % with 2 out of 4 Pos 35.24 23.13 46.75 % with 1 out of 4 Pos 55.59 52.99 38.96 % with none Pos 1.43 19.40 2.16 % with All 4 classes Sig + Pos 0.00 0.00 0.00 % with 3 out of 4 Sig + Pos 0.00 0.00 0.00 % with 2 out of 4 Sig + Pos 0.57 0.00 0.87 % with 1 out of 4 Sig + Pos 13.47 6.72 9.09 % with none Sig + Pos 85.96 93.28 89.18 • Arguably Canadian managers are the better tactical asset allocators Copyright: Andrew Clare, 2012 Page 10 Click to edit Master title style Methodology 2 %ACj,t = α + βjRj,t+1) + εj,t • This approach is much simpler and much more direct, than the returnsbased approach • It asks whether weightings rise/fall in proportion to market returns • A positive value for β indicates that it does • Again, we use a number of variants of this approach Copyright: Andrew Clare, 2012 Page 11 Click to edit Master title style Timing the equity market 80.0 71.15 70.0 60.28 Proportion of fund managers 60.0 57.34 50.0 40.0 37.50 30.0 21.79 20.0 12.96 10.0 6.29 5.36 0.0 ALL Copyright: Andrew Clare, 2012 US UK CAN Page 12 Click to edit Master title style Timing credit 60.0 49.36 Proportion of fund managers 50.0 40.0 36.06 28.57 30.0 24.48 20.0 10.0 5.36 4.51 7.05 1.4 0.0 ALL Copyright: Andrew Clare, 2012 US UK CAN Page 13 Click to edit Master title style Timing the govt bond market 70.0 66.43 60.0 Proportion of fund managers 52.68 50.0 46.43 42.31 40.0 30.0 20.0 16.07 10.0 5.63 6.29 1.28 0.0 ALL Copyright: Andrew Clare, 2012 US UK CAN Page 14 Click to edit Master title style Timing cash 70.0 61.54 60.0 55.94 Proportion of fund managers 55.49 50.0 40.0 37.50 34.62 34.27 30.0 29.58 20.0 10.0 3.57 0.0 ALL Copyright: Andrew Clare, 2012 US UK CAN Page 15 Click to edit Master title style DGF … the new balanced • Most of the research says that strategic asset allocation gives the biggest bang for one’s buck • In this work we are really looking at TAA • There have been a huge number of DGFs launched recently; there is SAA embedded in these funds • Some DGFs emphasise the TAA overlay as an added source of return Copyright: Andrew Clare, 2012 Page 16 Click to edit Master title style Summary • These are just a small set of the preliminary results • But the basic finding is that: • Using returns-based data there is little evidence of TAA ability amongst these managers • Using asset class weights, there is much more evidence of TAA ability • However, in both cases it is still very difficult to distinguish this skill from luck • But as we know, sometimes it’s better to be lucky than good! Copyright: Andrew Clare, 2012 Page 17