REQUEST TO COLLEGE CURRICULUM COMMITTEE FOR CURRICULAR IMPROVEMENTS

advertisement

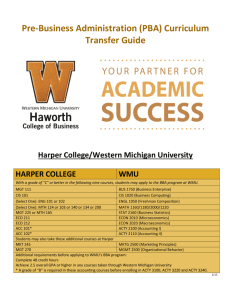

REQUEST TO COLLEGE CURRICULUM COMMITTEE FOR CURRICULAR IMPROVEMENTS DEPARTMENT: ACTY PROPOSED EFFECTIVE SEMESTER: Fall 2009 PROPOSED IMPROVEMENTS Academic Program Substantive Course Changes New degree* New course New major* Pre or Co-requisites New curriculum* Deletion (required by others) New concentration* Course #, different level New certificate Credit hours New minor Enrollment restriction x Revised major Course-level restriction Revised minor Prefix Title and description Admission requirements (attach current & proposed) x Graduation requirements General education (select one) Deletion Transfer Not Applicable Other (explain**) Other (explain**) COLLEGE: Business Misc. Course Changes Title Description (attach current & proposed) Deletion (not required by others) Course #, same level Variable credit Credit/no credit Cross-listing COGE reapproval Other (explain**) ** Other: Title of degree, curriculum, major, minor, concentration, or certificate: BBA in Accountancy Existing course prefix and #: Proposed course prefix and #: Credit hours: Existing course title: Proposed course title: Existing course prerequisite & co-requisite(s): Proposed course prerequisite(s) If there are multiple prerequisites, connect with “and” or “or”. To remove prerequisites, enter “none.” Proposed course co-requisite(s) If there are multiple corequisites, they are always joined by “and.” Proposed course prerequisite(s) that can also be taken concurrently: Is there a minimum grade for the prerequisites or corequisites? The default grades are D for undergraduates and C for graduates. Major/minor or classification restrictions: List the Banner 4 character codes and whether they should be included or excluded. For 5000 level prerequisites & corequisites: Do these apply to: (circle one) undergraduates graduates both Specifications for University Schedule of Classes: a. Course title (maximum of 30 spaces): b. Multi-topic course: No Yes c. Repeatable for credit: No Yes d. Mandatory credit/no credit: No Yes e. Type of class and contact hours per week (check type and indicate hours as appropriate) 1. Lecture 3. Lecture/lab/discussion 5. Independent study 2. Lab or discussion 4. Seminar or studio 6. Supervision or practicum CIP Code (Registrar’s use only): Chair/Director Date Chair, College Curriculum Committee Date Dean Date: Curriculum Manager: Return to dean Date Graduate Dean: Date Forward to: Date Chair, COGE/ PEB / FS President FOR PROPOSALS REQUIRING GSC/USC REVIEW: Date * Approve Disapprove Chair, GSC/USC Date * Approve Disapprove Provost Date Revised May 2007. All previous forms are obsolete and should not be used. 1. Explain briefly and clearly the proposed improvement. Require all accountancy majors to complete ACTY 4110 so that International Financial Reporting Standards (IFRS) coverage can be included in the curriculum. International accounting would be integrated into the course coverage in ACTY 3100, which means some of the ACTY 3100 content would need to be shifted to ACTY 3110. International accounting would also be integrated in the topics in ACTY 3110, which means some of the ACTY 3110 material would need to be shifted to ACTY 4110. International accounting would be integrated in ACTY 4110, which means that in order to cover the spillover topics from 3110 and international accounting, the coverage of some topics, such as governmental and non-profit accounting would be dropped from ACTY 4110. Students who want governmental accounting can enroll in ACTY 4140 as their elective. The accountancy major will remain a 30 hour major plus the ethics course. 2. Rationale. Give your reason(s) for the proposed improvement. (If your proposal includes prerequisites, justify those, too.) The SEC announced in August 2008 that it will recommend that large corporations prepare their financial statements using International Financial Reporting Standards rather than Generally Accepted Accounting Principles (GAAP) as early as 2011. All publicly traded corporations may be required to follow IFRS as early as 2014. Non-public corporations will continue to use GAAP to prepare their financial statements. As a result, the American Institute of CPAs has announced that international accounting as well as GAAP coverage will be included on the CPA exam beginning in 2011. To prepare students to meet the new professional requirements and maintain the quality of our accounting program, we must include international accounting in the curriculum. We propose requiring all accounting majors to complete ACTY 4110 so that both GAAP and IFRS can be covered in the curriculum. 3. Effect on other colleges, departments or programs. If consultation with others is required, attach evidence of consultation and support. If objections have been raised, document the resolution. Demonstrate that the program you propose is not a duplication of an existing one. This change will not affect other colleges, departments, or programs. 4. Effect on your department’s programs. Show how the proposed change fits with other departmental offerings. Currently Accountancy majors must elect two of the following courses: ACTY 4110, ACTY 4130, ACTY 4140, ACTY 4220, and ACTY 4240. Under the proposed change, accountancy majors will be required to complete ACTY 4110 and one of the following elective courses: ACTY 4130, ACTY 4140, ACTY 4220, and ACTY 4240. 5. Effects on enrolled students: Are program conflicts avoided? Will your proposal make it easier or harder for students to meet graduation requirements? Can students complete the program in a reasonable time? Show that you have considered scheduling needs and demands on students’ time. If a required course will be offered during summer only, provide a rationale. Beginning in Fall 2009, sufficient sections of ACTY 4110 will be offered so that all students graduating in fall 2009 and after will be able to enroll in ACTY 4110 and gain an understanding of international accounting.. The 4000 level electives will also be scheduled on a rotating basis so that this proposed change will not make it harder for students to meet graduation requirements. 6. Student or external market demand. What is your anticipated student audience? What evidence of student or market demand or need exists? What is the estimated enrollment? What other factors make your proposal beneficial to students? The Department of Accountancy graduates approximately 140 undergraduate students each academic year. We anticipate offering at least two sections of ACTY 4110 each semester and one section in the summer. 7. Effects on resources. Explain how your proposal would affect department and University resources, including faculty, equipment, space, technology, and library holdings. Tell how you will staff additions to the program. If more advising will be needed, how will you provide for it? How often will course(s) be offered? What will be the initial one-time costs and the ongoing base-funding costs for the proposed program? (Attach additional pages, as necessary.) Current Department of Accountancy faculty will be assigned to ACTY 4110. Courses will be taught in Schneider Hall using existing technology. No additional library resources are anticipated. No additional advising will be necessary. We anticipate offering the course every semester and in the summer. 8. General education criteria. For a general education course, indicate how this course will meet the criteria for the area or proficiency. (See the General Education Policy for descriptions of each area and proficiency and the criteria. Attach additional pages as necessary. Attach a syllabus if (a) proposing a new course, (b) requesting certification for baccalaureate-level writing, or (c) requesting reapproval of an existing course.) This course is not intended to serve as a general education course. The course can be enrolled in only by accountancy majors.. 9. List the learning outcomes for the proposed course or the revised or proposed major, minor, or concentration. These are the outcomes that the department will use for future assessments of the course or program. An additional learning outcome for the course is that students will understand how transactions are reported under Generally Accepted Accounting Principles as well as under International Financial Reporting Standards. 10. Describe how this curriculum change is a response to assessment outcomes that are part of a departmental or college assessment plan or informal assessment activities. This curriculum change is a response to indirect assessment activities conducted with stakeholders (representatives of public accounting firms who are some of our major recruiter)s. The integration of international accounting into the accounting curriculum has been a major topic of discussion with our constituency groups (i.e., alumni and recruiters) over the past year. Individuals who have been part of these discussions include Jim Leisenring (a member of the International Accounting Standards Board) and Dennis Nally (the Chairman and Senior Partner of the US Firm of PricewaterhouseCoopers LLP). 11. (Undergraduate proposals only) Describe, in detail, how this curriculum change affects transfer articulation for Michigan community colleges. For course changes, include detail on necessary changes to transfer articulation from Michigan community college courses. For new majors or minors, describe transfer guidelines to be developed with Michigan community colleges. For revisions to majors or minors, describe necessary revisions to Michigan community college guidelines. Department chairs should seek assistance from college advising directors or from the admissions office in completing this section. This course is not generally covered by transfer articulation agreements. Present Program Requirements All accounting majors are required to complete 30 hours of accounting. The following eight courses must be taken: ACTY 2100 Principles of Accounting I ACTY 2110 Principles of Accounting II ACTY 3100 Financial Accounting I ACTY 3110 Financial Accounting II ACTY 3130 Accounting Information Systems ACTY 3220 Managerial Accounting — Concepts and Practices ACTY 3240 Introductory Tax Accounting ACTY 4160 Auditing All accounting majors are required to complete two of the following elective courses: ACTY 4110 Advanced Accounting ACTY 4140 Governmental and Nonprofit Accounting ACTY 4220 Cost Accounting ACTY 4240 Advanced Tax Accounting Accountancy majors must complete Phil. 4100, Professional ethics, as one of their non-accounting elective courses. Proposed Program Requirements All accounting majors are required to complete 30 hours of accounting. The following nine courses must be taken: ACTY 2100 Principles of Accounting I ACTY 2110 Principles of Accounting II ACTY 3100 Financial Accounting I ACTY 3110 Financial Accounting II ACTY 3130 Accounting Information Systems ACTY 3220 Managerial Accounting — Concepts and Practices ACTY 3240 Introductory Tax Accounting ACTY 4110 Advanced Accounting ACTY 4160 Auditing All accounting majors are required to complete one of the following elective courses: ACTY 4140 Governmental and Nonprofit Accounting ACTY 4220 Cost Accounting ACTY 4240 Advanced Tax Accounting Accountancy majors must complete Phil. 4100, Professional ethics, as one of their non-accounting elective courses.