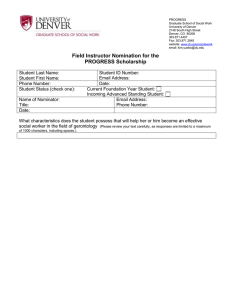

C l a i r e P . ...

advertisement

Claire P. Rowland Experience Claire Rowland counsels clients on a broad range of employee benefits issues including all aspects of qualified retirement plans, nonqualified deferred compensation plans, executive compensation, and health and welfare benefit plans. Her clients have included a variety of employers ranging from large multimillion- and multibilliondollar entities to small professional corporations and nonprofit organizations. Claire is a Qualified Pension Administrator (QPA) and Qualified 401(k) Administrator (QKA) with the American Society of Pension Professionals and Actuaries (ASPPA) (2002). Claire regularly assists clients with maintaining the continued qualification of clients’ qualified plans as well as with the correction of plan document failures and plan operational failures in accordance with IRS and DOL requirements and guidance. In addition, she helps clients comply with the requirements of Code Section 409A applicable to executive compensation and nonqualified deferred compensation plans. Attorney Before joining Stoel Rives, Claire was an associate with Sherman & Howard L.L.C. in Seattle, WA Denver, Colorado (2009-2015) where she also served as a law clerk (2007-2009), a (206) 386-7519 direct summer associate (2008) and a paralegal (2003-2007). Representative Work (206) 386-7500 fax claire.rowland@stoel.com Defends employers in IRS and DOL audits of qualified retirement plans. Education Counsels on compliance with ERISA, IRS and DOL regulations and statutes. Designs and drafts plan documents, amendments, restatements, summary plan University of Denver Sturm College of Law, J.D., 2010, with highest honors Recipient, Scholastic Excellence descriptions, notices and communications. Awards, Lawyering Process, Advanced Prepares determination letter applications for qualified retirement plans. Legal Research, Administrative Law, Bankruptcy Law Counsels on correction options, alternatives and procedures with respect to qualified retirement plan document failures and operational failures. Prepares corrective VCP filings for IRS and DFVCP filings for DOL. Advises on compliance with Code Section 409A in executive compensation matters and Code Section 409A correction procedures under IRS Notices 2008-113 and 2010-6. Prepares analyses of controlled group and affiliated service group relationships. Performs due diligence reviews of employee benefit plans in mergers and acquisitions transactions. Advises on compliance with COBRA continuation coverage requirements. Drafts business associate agreements to comply with HIPAA and HITECH Act. University of Maryland, B.A., American History, 1992, cum laude Admissions Washington Colorado Claire P. Rowland Drafts client advisories regarding guidance and requirements issued by the IRS or DOL with respect to qualified retirement plans and nonqualified deferred compensation plans. Professional Honors and Activities Board Member (2013-2015); Chair, Communications Committee (2014-2015); Western Pension & Benefits Council, Denver Chapter Member (2015-present); Government Affairs Committee, American Society of Pension Professionals and Actuaries Civic Activities Member, University of Denver Sturm College of Law Alumni Council, 2010-present Alumni Council Liaison, University of Denver Law GOLD (formerly Recent Alumni Hub), 2012-2015 Presentations & Publications Co-author, "Developments in Employee Benefits Law: Same-Sex Marriage and Title VII’s Protection for LGBT Employees," Stoel Rives World of Employment Blog, Jan. 2016 Moderator, “The ACA and New Trends in Health and Welfare Plan Design” and “Wellness Programs and Strategies Under the New Regulations,” Western Benefits Conference, Las Vegas, Nevada, July 2014 Panelist, “Thorns in Your Administrative Side” and “Ask the Experts,” Denver Benefits Summit, Denver, Colorado, Apr. 2014