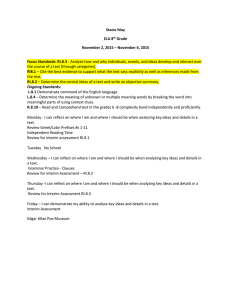

Plumas Lake Elementary School District 2013-14 Second Interim Presentation March 12, 2014

advertisement

Plumas Lake Elementary School District 2013-14 Second Interim Presentation March 12, 2014 Financial Reporting Cycle Budget development is a continuous process • Annual financial reporting: • Budget Adoption – Due July 1, 2013 • First Interim – Due December 16, 2013 • Second Interim – Due March 17, 2014 • Unaudited Actuals – Due September 15, 2014 • Budget is developed based on assumptions in June; • Assumptions are usually based on the information in the May Revise • Assumptions change during the year and we are required to file two interim reports during the year: • First Interim – Due December 16, 2013 • Second Interim – Due March 17, 2014 • Budget Timeline: • Governor released his Budget Proposal for 2013-14 in January • Governor released the May Revise in May, which is based on updated revenue and expenditure data • Legislature met its constitutional deadline and passed the 2013-14 budget and trailer bills on June 15 • Local Control Funding Formula -Changes how schools receive State Aid • Every district has a unique target base grant that will restore funding to 2007-08 funding levels by full implementation • Districts will move toward the target each year • Governor signed budget bill in June Local Control Funding Formula • Local Control Funding Formula (LCFF) begins in 2013-14 • Department of Finance estimates that achieving full funding levels under the LCFF will take eight years • Funding based on the demographic profile of the students in the District • Goal is to simplify how state funding is provided • Local Control and Accountability Plan (LCAP) is an important component of LCFF • District will be required to develop, adopt, and annually update a three year LCAP, beginning in July 1, 2014 • California Department of Education (CDE) making system changes to implement the new formula and does not expect to have those completed until July 2014 Local Control Funding Formula • Local Control Funding Formula (LCFF) has replaced revenue limits and works as follows: • “Target Funding “level will be calculated every year • • • Districts will receive a base grant amount based on grade-level Adjustments will be made for class size reduction (grade span) Districts will receive supplemental funding based on percentage of low income, English learners and students in foster youth • Economic Recovery Target (ERT) is the difference between what the District would have received under the old funding and the amount the District would receive under the LCFF in 2020-21 (with COLA adjustments) • “Funding Floor” will be calculated based on 2012-13 Funding Level • Percentage of the “Gap” between the Target and Floor will be funded • Categoricals are now a part of the LCFF with the exception of the following: • Transportation (add-on and can be used for any educational purpose) • Targeted Instructional Improvement Grant (TIIG) (add-on and can be used for any educational purpose) • Special Ed • Child Nutrition Second Interim Budget Assumptions Budget Development First Interim Second Interim COLA 1.565% 1.57% 1.57% Deficit Factor 18.997% 11.78% 11.78% GAP Funding Rate State Categorical Programs COLA 0 0 0 Federal COLA 0 0 0 Average Daily Attendance 1056.68 District: 1050.5 County: 6.68 1094.83 1112.84 Unduplicated percentage (English Learners, Foster Youth, and Free & Reduced Price Meals) District: 1090 County: 4.84 39.72% District: 1108 County: 4.84 39.72% Second Interim Budget Assumptions • Proposition 39 approved by voters on November 6, 2012 provided: • The Schools and Local Public Safety Protection Act of 2012 provides funding through the Education Protection Account (EPA) • Not additional funding, State Aid is decreased by this amount • District will receive $1,179,455 in funding, which will be used for teachers’ salaries • California Clean Energy Jobs Act • Funding for clean energy projects – funded for five years • District will receive$106,252 in 2013-14 and in subsequent years • Common Core State Standards Implementation (CCSSI) Funds – District received $216,437 in one-time funding Budget Revisions • Board requested budget revisions: • • • • Riverside Meadows – added $10,000 for upgrades Breakfast - $3,000 for free breakfast during testing Infrastructure – Wi-Fi Nodes $5,000 Update District Web site - $5,000 2013-14 Revenue Sources Revenue Source 2013-14 Budget Development 2013-14 Budget First Interim (FI) 2013-14 Budget Second Interim (SI) Changes (SI –FI) Notes Revenue Limit Sources $6,529,561 7,441,642 $7,629,666 $188,024 LCFF Changes due to ADA Changes Federal Revenue $277,734 $365,256 $369,770 $4,514 Impact Aid Other State Revenue $1,047,997 $598,640 $602,742 $4,102 Lottery Other Local Revenue $491,348 $444,853 $445,468 $615 Local revenue Interfund Transfers In $23,000 $23,000 $23,000 Total Revenue $8,369,640 $8,873,391 $9,070,646 From Fund 52 for CFD Admin costs $197,255 2013-14 Expenditures 2013-14 Budget Adoption 2013-14 Budget First Interim (FI) 2013-14 Budget Second Interim (SI) Changes (SI – FI) Notes Certificated Staff $3,887,597 $3,966,261 $3,962,758 ($3,503) Adjusted teachers’ salaries Classified Salaries $1,396,056 $1,409,719 $1,385,031 ($24,688) Adjusted para salaries Employee Benefits $1,593,126 $1,587,822 $1,558,017 ($29,805) Adjusted statutory benefits and Health, Dental & Vision Books and Supplies $337,067 $557,670 $462,356 ($95,314) Added $5K for Wi-Fi nodes, decreased Common Core technology expenditures Services/Op Expenses $1,014,091 $1,114,966 $1,121,518 $6,552 Adjusted inter-fund direct costs (Fund 13) Capital Outlay $0 $90,315 $90,315 Other Outgo $268,852 $301,896 $302,035 $139 County transfer for SPED Transfers of Indirect ($12,486) ($12,524) ($12,792) ($268) Indirect Fund 13 Interfund Transfers Out $38,711 $70,680 $70,906 $226 Adjusted transfer to Fund 13 Total Expenditures $8,523,014 $9,086,805 $8,940,144 ($146,661) Clean energy $ General Fund Summary Category 2013-14 Budget Development 2013-14 Budget First Interim 2013-14 Budget Second Interim Beginning Balance $2,856,956 $2,856,956 $2,856,956 Revenue $8,369,640 $8,873,391 $9,070,646 Expenditures $8,523,014 $9,086,805 $8,940,144 Net Increase/Decrease ($153,374) ($213,414) $130,502 Ending Fund Balance $2,703,582 $2,643,542 $2,987,458 $454,340 $447,007 Revolving Cash $5,100 $5,100 $5,100 Restricted Funds $70,388 $29,500 $157,125 CCSSI - $124,700 $410,188 $410,188 $1,744,414 $1,968,039 Economic Uncertainty $425,001 Committed - COP Debt Service $410,188 Local Control Funding Formula $193,700 Impact Available for budget shortfalls $1,599,205 Multi-Year Projections (MYP) Budget Assumptions 2013-14 Budget Second Interim 2014-15 Projection 2015-16 Projection Statutory COLA 1.565% 1.87% 0.86% 1.99% 2.12% Gap Funding 11.78% 16.49% 28.05% 18.69% 33.95% Average Daily Attendance (ADA) K-8 District County Special Ed 1090 1108 4.84 1090 1108 4.84 1090 1108 4.84 California CPI 2.3% 2.2% 2.5% 2.4% COLA State Categoricals 1.80% 0.86% 2.3% 2.2% Federal COLA 0 0 0 Common Core State Standards Implementation Funds Revenue: $216,437 Expenditures: $91,737 Revenue: 0 Expenditures: $124,700 N/A Prop 39 Clean Energy Jobs Act $106,252 $106,252 $106,252 Multi-Year Projections • Multi-year projections are based on the Governor’s Budget released in January • Governor will revise his budget in May • May revise projections will be used to develop budget for the 2014-15 school year • Step increases included for all eligible employees • No changes to Health, Dental, and Vision Multi-Year Projections – Second Interim 2013-14 Projection 2014-15 Projection 2015-16 Projection Beginning Fund Balance $2,856,956 $2,987,458 $3,138,649 Revenue $9,070,646 $9,269,365 $9,750,198 Expenditures $8,940,144 $9,118,174 $9,154,231 Net Increase (Decrease) in Fund Balance $130,502 $151,191 $595,967 Ending Fund Balance $2,987,458 $3,138,649 $3,734,616 Revolving Fund & Restricted $157,125 (CCSSI - $124,700) $32,423 $32,423 Reserved for Economic Uncertainty $447,007 $455,909 $457,712 Certificates of Participation Debt Service $410,188 $409,563 $408,788 Available for Budget Shortfalls $1,968,039 $2,235,654 $2,830,593 Cash • Deferrals are still in the budget, cash is monitored every month • State Budget included funding to buy back most deferrals • Remaining Deferrals: • April - 38% of the apportionment deferred to July • May – 97% of the apportionment deferred to July • June – 100% of the apportionment deferred to July • Education Protection Account (EPA) –approximately 20 percent of our State Aid that will be paid on a quarterly basis Fund 13 - Cafeteria Fund Category 2013-14 Budget Development 2013-14 Budget First Interim (FI) 2013-14 Budget Second Interim (SI) Beginning Balance $500 $500 $500 Audit Adjustment Changes (SI – FI) Notes ($944) Revenue $427,512 $427,512 $427,515 Transfer In $38,711 $38,471 $38,697 $226 Contribution from General Fund Expenditures $466,223 $465,983 $465,765 ($218) Adjusted Salaries and Direct costs Net Increase (Decrease) in Fund Balance $0 $0 $444 Ending Balance $500 $500 $500 Fund 14 - Deferred Maintenance Category 2013-14 Budget 2013-14 Development Budget First Interim 2013-14 Budget Second Interim Beginning Balance $86,098 $86,098 $86,098 Revenue $34,482 $1,100 $1,100 Transfers In (From General Fund) 0 $32,209 $32,209 Expenditures $35,000 $35,000 $35,000 Net Increase (Decrease) in Fund Balance ($518) (1,691) (1,691) Ending Fund Balance $85,580 $84,407 $84,407 Change Notes - Fund 25 – Capital Facilities Fund Category 2013-14 Budget Development 2013-14 Budget First Interim 2013-14 Budget Second Interim Beginning Balance $883,784 $883,784 $883,784 Revenue $59,445 $60,945 $67,314 Transfers In $526,035 $526,035 $526,035 Expenditures $585,480 $1,412,407 $1,412,407 Net Increase (Decrease) in Fund Balance $0 ($825,427) ($819,058) Ending Fund Balance $883,784 $58,357 $64,726 Cash with fiscal agent $6,512 $1.62 1.62 Cash with county $877,273 $58,355 $64,724 Change Notes $6,369 Developer Fees From Fund 52 Fund 52 – Debt Service Fund for Blended Component Units Category 2013-14 Budget Development 2013-14 Budget First Interim 2013-14 Budget First Interim Beginning Balance $1,175,302 $1,175,302 $1,175,302 Revenue $681,572 $681,752 $681,752 Expenditures $397,392 $397,392 $397,392 Interfund Transfers Out $549,035 $549,035 $549,035 Net Increase (Decrease) ($264,855) ($264,855) ($264,855) Ending Fund Balance $910,447 $910,447 $910,447 Cash w/ fiscal agent $402,714 $402,714 $402,695 Assigned – Debt Service $507,733 $507,733 $507,752 Change Note Summary and Recommendation • Second Interim projections show an operating surplus of $132,466 in the General Fund for the current year • Based on multi-year projections and current assumptions staff recommend the Board approve Second Interim with a positive certification and the budget adjustments within Any questions?