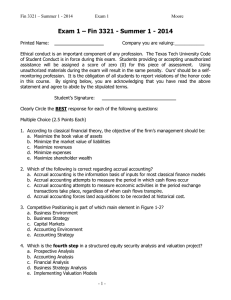

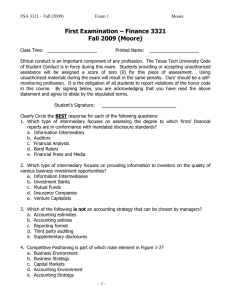

First Examination – Finance 3321 Summer 2010 (Moore)

advertisement

FSA 3321 – Summer 1 (2010) Exam 1 Moore First Examination – Finance 3321 Summer 2010 (Moore) Class Time: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: 1. Which type of intermediary focuses on aggregating funds from individual investors and analyzes different investment alternatives? a. Information Intermediary b. Auditors c. Financial Analysts d. Bond Raters e. Investment Banks or Mutual Funds 2. Which type of intermediary focuses on providing information to investors on the quality of various business investment opportunities? a. Information Intermediaries b. Investment Banks c. Mutual Funds d. Insurance Companies e. Venture Capitalists 3. Which of the following is not an accounting strategy that can be chosen by managers? a. Accounting estimates b. Accounting policies c. Reporting format d. Third party auditing e. Supplementary disclosures 4. Competitive Positioning is part of which main element in Figure 1-2? a. Business Environment b. Business Strategy c. Capital Markets d. Accounting Environment e. Accounting Strategy -1- FSA 3321 – Summer 1 (2010) Exam 1 Moore 5. In the US, the accounting treatment (GAAP) for recognizing warranty expense in the period the selling activity takes place and not necessarily in the period when warranties are paid is determined and justified by: a. Accrual Accounting b. Matching Principle c. Periodicity Principle d. Revenue Recognition Principle e. The IASB 6. Which is the third step in a structured equity security analysis and valuation? a. Prospective Analysis b. Accounting Analysis c. Financial Analysis d. Business Strategy Analysis e. Implementing Valuation Models 7. Which step in a structured business valuation analysis involves estimating the firm’s cost of capital? a. Prospective Analysis b. Accounting Analysis c. Financial Analysis d. Business Strategy Analysis e. Implementing Valuation Models 8. One of the main reasons that firms are allowed flexible financial accounting standards under GAAP is: a. It provides firms a better opportunity to report the underlying economic substance of transactions and events. b. It gives the firms the opportunity to reduce the volatility of earnings so that investors can provide better forecasts of future performance. c. It allows managers to better tie earnings to performance for compensation purposes. d. It gives firms the opportunity to mark-to-market the physical assets so that balance sheet values are more relevant to decision makers. e. None of the above. 9. The impact of unrealized foreign currency gains (losses) and unrealized financial asset (liability) gains (losses) is capture in which part of the income statement? a. Net Income b. Operating Income c. Comprehensive Income d. Income from Continuing Operations e. Gross Profit -2- FSA 3321 – Summer 1 (2010) Exam 1 Moore 10. Which of the following line items is reported earliest in the income statement? a. Extraordinary Expenses b. Operating Income c. Cost of Goods Sold d. Income from Continuing Operations e. Net Income 11. Identify the proper sequence in which following items would be presented on the income statement is: 1. Net Revenue 2. Operating Income 3. Comprehensive Income 4. Income from Continuing Operations 5. Gross Profit a. b. c. d. e. 1, 1, 1, 1, 1, 2, 5, 3, 5, 4, 3, 2, 5, 3, 3, 4, 4, 4, 2, 5, 5 3 2 4 2 12. Which of the following statements is correct? a. The FASB has the legal authority to proscribe GAAP. b. Transparent financial reporting practices allow users to get a true and fair picture of the firm. c. Conservatism of financial reporting standards never reduces valuation relevance. d. Prospective analysis involves estimating the cost of capital for the firm. e. The external auditor certifies the financial statements are correct. 13. Which of the following is not an element of the “Five-Forces” model? a. Industry Profitability b. Rivalry Among Existing Firms c. Threat of New Entrants d. Bargaining Power of Customers e. Threat of Substitute Products 14. An a. b. c. d. e. industry having a high degree of price competition would be characterized by: Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation Few Exit Barriers, High First mover advantage, Low Product Differentiation Low Industry Concentration, High Distribution Access, Low Firm Excess Capacity Low Concentration, Low Fixed-Variable Cost Ratio, Few Legal Barriers to Entry Supply > Demand, Low First Mover Advantage, Low Fixed to Variable Cost Ratio -3- FSA 3321 – Summer 1 (2010) Exam 1 Moore 15. Which of the following would lead to the lowest degree of industry price competition? a. Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, Low First Mover Advantage, Low Product Differentiation c. Low Industry Concentration, Low Distribution Access, Low Customer Switching Costs d. High Industry Concentration, High Fixed-Variable Cost Ratio, Hi product differentiation e. Supply > Demand, High Legal Barriers to Entry, Steep Industry Learning Curves 16. Which of the following would provide the best measure of learning economies when performing an Five Forces Industry Analysis? a. Cost of Goods Sold / Total PPE b. Advertising Expense / Total Revenues c. Total Annual Research and Development Expenses d. Total Annual Warranty Expenses e. Total Annual Research and Development Expenses / Total Revenues 17. Which of the following strategies would provide the best measure of excess capacity for an industry analysis of firms? a. Cost of Goods Sold / Total PPE b. Advertising Expense / Total Revenues c. Cost of Goods Sold / Inventory d. Total Annual Warranty Expenses / Sales e. Total Annual Research and Development Expenses / Total Revenues 18. Determining whether the firm currently has the resources and capabilities to deal with the identified key success factors is an example of:? a. Competitive Strategy Analysis b. Differentiation Analysis c. Analysis of the Degree of Actual and Potential Competition d. Analysis of the Threat of Substitute Products e. Analysis of the Bargaining Power in Input and Output Markets 19. The ability of consumers to shop elsewhere if they do not like WalMart’s price & delivery terms is an example of: a. Bargaining power of firm over suppliers b. Bargaining power of supplier over firm c. Bargaining power of customers over firm d. Bargaining power of firm over customers e. None of the above 20. Which of the following is not used to determine the Threat of New Entrants? a. First Mover Advantage b. Relationships c. Legal Barriers to Entry d. Switching Costs e. Distribution Access -4- FSA 3321 – Summer 1 (2010) Exam 1 Moore 21. Which of the following does not necessarily create corporate value? a. Managing the value chain b. Maintaining a good fit between the company’s specialized resources and the portfolio of businesses in which the company is operating. c. Good allocation of decision rights between the headquarters office and the business units to realize all the potential economies of scope. d. Internal measurement, information, and incentive systems that reduce agency costs. e. Investing significant resources to product advertising and marketing activities. 22. Which of the following models, theorems or hypotheses, if absolutely true in the real world, would make the activities of information production or financial analysis a socially and economically non-productive activities? a. Capital Asset Pricing Model b. Weak Form Efficient Market Hypothesis c. Strong Form Efficient Market Hypothesis d. Modigliani and Miller Theorem, without taxes e. Residual Income Valuation Model 23. Which of the following statements is correct with respect to Efficient Markets? a. Weak form market efficiency presumes asset prices fully reflect past information and expectations of future information. b. Strong form market efficiency is incompatible with the existence of futures markets and the current spot markets (e.g. commodity and equity cash markets). c. Semi-strong market efficiency would suggest that, on average, asset prices are correct (this makes investing a “fair game”), and that asset prices react to new information. d. Strong form market efficiency requires asset prices do not reflect private information. 24. Assume PG is the fair insurance price for Good drivers and PB is the fair insurance price for Bad drivers, where PG = 100, PB = 300 and 30% of the drivers are Good drivers. If insurers do not have a mechanism to distinguish good and bad drivers, what price(s) will result in the voluntary insurance market (assume linear risk preferences)? a. Good drivers pay 100 and Bad drivers pay 300 b. All drivers pay 100 c. All drivers pay 200 d. All drivers pay 240 e. All drivers pay 300 25. Which of the following environmental structures (designs) is necessary for differential insurance prices to obtain that approach theoretically fair prices of PG and PB ? a. Insurance is mandated b. Insurance is voluntary c. Information is perfect and verifiable d. Population statistics regarding the proportion of good and bad drivers are known e. Imperfect information can be gathered and processed -5-