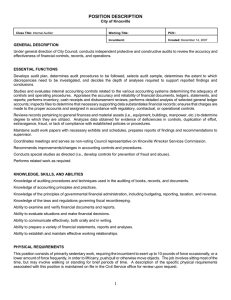

Internal Audit Manager Class Code: 10554 METROPOLITAN GOVERNMENT OF NASHVILLE & DAVIDSON COUNTY

advertisement

Internal Audit Manager Class Code: 10554 METROPOLITAN GOVERNMENT OF NASHVILLE & DAVIDSON COUNTY Established Date: Jul 8, 2008 Revision Date: Aug 18, 2008 SALARY RANGE $41.23 - $64.50 Hourly $3,298.05 - $5,159.94 Biweekly $7,145.78 - $11,179.88 Monthly $85,749.36 - $134,158.56 Annually FLSA: Exempt JOB OBJECTIVE: Serves as an audit resource with developed expertise in performance and supervision of internal audit activities in accordance with accepted auditing procedures, practices, and standards. Is responsible for assisting the Metropolitan Auditor in accomplishing the office’s objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, internal control, financial reporting, service delivery, and governance processes. Uses tact and diplomacy to build executive management consensus for complex issues. Represents the office in the absence of the Metropolitan Auditor. JOB DESCRIPTION: MAJOR JOB RESPONSIBILITIES Manages multiple concurrent audit projects staffed internally, including overseeing planning, fieldwork, reporting, and customer relationships. Manages large audit projects outsourced to consultants, including drafting related RFP’s, serving on proposal evaluation panels, managing the resulting contracts, and coordinating and facilitating all aspects of related fieldwork and reporting. Manages investigation of hotline complaints or other sensitive matters. Manages professional staff development, strategic plan implementation, and office-wide performance. Manages internal initiatives to improve audit processes. Performs assigned audit projects to include developing audit scope, objective, and methodology; preliminary planning; individual and group interviews; program development; qualitative and quantitative data collection, transference, and reproduction; meeting agenda and results documentation; work paper preparation, indexing and organization; entrance and exit conferences; and report and correspondence preparation. Helps others negotiate points of difference with stakeholders. Assists with the audit universe risk assessment process and annual audit plan preparation. Performs assigned audit quality assurance support duties to include work paper review and verification, and cross-reference checking. Keeps up-to-date on issues and laws affecting work and the profession as a whole Coaches teams on necessary judgment for balancing exposure to risk with cost benefit of control responses. Coaches teams to recognize overarching themes among risks and observations Produces and communicates information to executive level management. Performs related duties and fulfills responsibilities as required. SUPERVISION EXERCISED/SUPERVISION RECEIVED Employee oversees work of Internal Auditors and provides staff development and training opportunities. Employee works with general direction and reports to a designated supervisor, who makes staff assignments and provides assistance with extremely complex or difficult problems. WORKING ENVIRONMENT/PHYSICAL DEMANDS Work involves everyday risks or discomforts which require normal safety precautions typical of such places as offices, meeting and training rooms, etc. Work area is adequately lighted, heated, and ventilated. Employee works primarily in an office setting under generally favorable working conditions. Work is sedentary; however, there may be some walking, standing, bending, carrying light items, etc. No special physical demands are required to perform the work EMPLOYMENT STANDARDS: EDUCATION AND EXPERIENCE Bachelor’s Degree in Accounting, Finance, Information Systems, or Master’s of Public Administration and seven years of internal or public accounting auditing experience or Master’s of Accountancy or Business Administration, and six years of internal or public accounting auditing experience and Two years of supervisory responsibility for three or more audit professionals More specific education, experience or certification requirements may be included in the position announcement as vacancies occur. PERFORMANCE STANDARDS Expert knowledge of auditing practices and standards Excellent oral and written communication skills Skill in recognizing and reinforcing quality work Ability to build team trust and motivate employees. Ability to coach professional staff to effectively manage multiple priorities. Ability to train and evaluate the work of professionals. Ability to set reasonable expectations. LICENSES/ CERTIFICATIONS: Multiple certifications as a Certified Public Accountant (CPA), Certified Internal Auditor (CIA), Certified Fraud Examiner (CFE), or Certified Information Systems Auditor (CISA), or other applicable professional designation. Valid "Class D" Driver's License may be required for some positions in this classification.