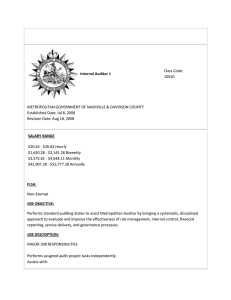

Internal Auditor 2 Class Code: 10551

advertisement

Internal Auditor 2 Class Code: 10551 METROPOLITAN GOVERNMENT OF NASHVILLE & DAVIDSON COUNTY Established Date: Jul 8, 2008 Revision Date: Aug 18, 2008 SALARY RANGE $24.96 - $32.45 Hourly $1,996.64 - $2,595.72 Biweekly $4,326.05 - $5,624.06 Monthly $51,912.64 - $67,488.72 Annually FLSA: Exempt JOB OBJECTIVE: Performs a range of auditing duties independently to assist Metropolitan Auditor by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, internal control, financial reporting, service delivery, and governance processes. JOB DESCRIPTION: MAJOR JOB RESPONSIBILITIES Performs assigned audit projects independently. Plans and conducts client meetings and communications toward mutually desired results. Independently researches and employs multiple methodologies Independently collects data for assignments, checks accuracy of own work, and analyzes data. Assists with: development of audit scope, objective, and methodology preliminary planning individual and group interviews program development qualitative and quantitative data collection, transference, and reproduction meeting agenda and results documentation work paper preparation, indexing and organization entrance and exit conferences. report and correspondence preparation Performs assigned audit quality assurance support duties, including: work paper review and verification, and cross-reference checking report review and data verification. Pursues certification as a Certified Public Accountant (CPA), Certified Internal Auditor (CIA), Certified Fraud Examiner (CFE), or Certified Information Systems Auditor (CISA), or other applicable professional designation. Performs related duties and fulfills responsibilities as required. SUPERVISION EXERCISED/SUPERVISION RECEIVED This is a non-supervisory classification. Employee works with general supervision and reports to a designated supervisor, who makes staff assignments and provides assistance with complex or difficult problems. WORKING ENVIRONMENT/PHYSICAL DEMANDS Work involves everyday risks or discomforts which require normal safety precautions typical of such places as offices, meeting and training rooms, etc. Work area is adequately lighted, heated, and ventilated. Employee works primarily in an office setting under generally favorable working conditions. Work is sedentary; however, there may be some walking, standing, bending, carrying light items, etc. No special physical demands are required to perform the work. EMPLOYMENT STANDARDS: EDUCATION AND EXPERIENCE Bachelor’s Degree in Accounting, Finance, Information Systems, or Master’s of Public Administration and two years of internal or public accounting auditing experience or Master’s of Accountancy or Business Administration More specific education, experience or certification requirements may be included in the position announcement as vacancies occur. PERFORMANCE STANDARDS Knowledge of government auditing standards Knowledge of Metro organization Critical thinking and technical skills necessary to distinguish between significant and nonessential information Skill in effectively organizing and documenting work Skill in both oral and written communication Ability to understand wide variety of departments’ practices and procedures Ability to work independently and meet deadlines Ability to analyze financial and operational data Ability to form and sustain work relationships requiring high degree of trust and cooperation Ability to develop and document complex recommendations Ability to complete assignments in timely and effective manner NOTE: Employee is expected to be pursuing certification as a Certified Public Accountant (CPA), Certified Internal Auditor (CIA), Certified Fraud Examiner (CFE), or Certified Information Systems Auditor (CISA), or other applicable professional designation. LICENSES REQUIRED Valid "Class D" Driver's License may be required for some positions in this classification.