’ S B

advertisement

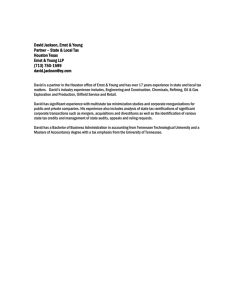

SPEAKERS’ BIOS JAMES W. BARGE SENIOR VICE PRESIDENT AND CONTROLLER, TIME WARNER Jimmy is the Senior Vice President and Controller of Time Warner, responsible for Time Warner’s overall financial planning, reporting and analysis, including budgeting, long range planning, external financial reporting and communications to the Board regarding financial performance and reporting matters. In addition, Jimmy’s responsibilities involve providing support related to many special projects, including mergers and acquisitions and other related transactions. As Controller, Jimmy is also integrally involved with many aspects of Time Warner’s investor relations and treasury functions. Jimmy has been involved in many of Time Warner’s most transforming events, including mergers with TBS and America Online. Jimmy joined Time Warner in March of 1995 as Assistant Controller. Prior to joining Time Warner, Jimmy was with Ernst & Young where he was the Area Industry Leader of the Consumer Products Group and a partner in the West Region Accounting and Auditing Department. During that period he had regional responsibility for consultations to clients across all industries in the West Region, including a heavy concentration of high tech clients based in Silicon Valley, on a wide variety of accounting and auditing issues including SEC related matters. Prior to assuming his regional responsibilities in August of 1992, Jimmy was a partner in the National Office of Ernst & Young where he was responsible for the resolution of SEC accounting and reporting issues for many of the firm's largest clients. Jimmy also served as Ernst & Young’s liaison with the SEC. Prior to his National office assignment, Jimmy was selected to participate in the highly regarded two year Professional Accounting Fellow Program in the SEC’s Office of the Chief Accountant in Washington, D.C. While at the SEC, Jimmy advised the Chief Accountant on a wide range of policy issues, including the oversight of the accounting standardsetting process, and formulating regulatory positions on a broad range of accounting and disclosure issues. Prior to the SEC fellowship, Jimmy served a variety of clients in the Atlanta Office of Ernst & Young, including The Coca-Cola Company and Coca-Cola Enterprises. In 1982, Jimmy also was selected to be a participant in Ernst & Young’s International Program where he worked in London serving a wide variety of international clients. Jimmy is a member of the Financial Executive Institute’s Committee on Corporate Reporting and on the Advisory Council for The SEC Institute. Jimmy is also a Distinguished Practitioner Lecturer for the Terry College of Business at the University of Georgia. Jimmy Graduated Summa Cum Laude from the University of Georgia with a degree in Business Administration and is a member of the AICPA and the Georgia Society of CPA’s. Jimmy is a board member of the United Neighborhood Houses of New York and former board member of Oralinqua School for the Hearing-Impaired in Los Angeles and the Auditory Education Clinic in Atlanta. He has also served as Unit Chairman and Division Chairman in previous United Way campaigns. Jimmy enjoys a wide variety of sports and ran the 2000 Boston Marathon. He and his wife, Susan, have two children and live in Greenwich, CT. RAYMOND J. BEIER PARTNER, PRICEWATERHOUSECOOPERS Ray Beier is a PricewaterhouseCoopers partner, leader of the National Technical Services (NTS) unit of PwC in the United States, and a member of PwC’s global Strategy, Development, and Research Committee. NTS is a dedicated team of partners and staff responsible for identifying emerging accounting, reporting, regulatory, and business issues and assessing their impact on the firm’s clients and assurance practice, the investor community, and other stakeholders in the capital markets. At NTS, Ray directs the work of a key unit of PricewaterhouseCoopers. NTS contributes at several levels. At one level, it is a technical think tank producing closely reasoned views of current and emerging issues for clients, standard setters such as the FASB, and regulators such as the SEC. At another level, NTS is an internal source of authoritative guidance for tens of thousands of PwC accountants and auditors across the United States. A third level is equally important today: NTS is a center for innovative thinking on key business, finance, accounting, and capital markets trends. Prior to his current role, Ray led the Structuring group of PwC’s Transaction Services practice. In that role, he worked with many of the firm’s corporate and private equity clients on structuring a wide range of transactions, including mergers, acquisitions, divestitures, financings and strategic alliances. Ray’s years of leadership in the Structuring group gave him broad experience of deals and the capital markets, which underlies his approach to accounting, business, and finance today. A CPA in several states, Ray earned an MBA at the University of Minnesota, his home state. MARK M. BIELSTEIN PARTNER, KPMG Mark Bielstein is the partner-in-charge of the Accounting Group of KPMG’s Department of Professional Practice – Audit & Risk Advisory Services in New York, New York. He is a member of the Emerging Issues Task Force of the Financial Accounting Standards Board and a former member and Chairman of the Accounting Standards Executive Committee of the AICPA. Prior to joining the Department of Professional Practice in 1997, Mr. Bielstein served as an audit engagement partner in KPMG’s San Antonio, Texas office for clients in the hospitality, real estate, construction, oil and gas, and investment services industries. Mr. Bielstein also served as the Professional Practice Partner for the San Antonio office. Mr. Bielstein joined KPMG’s San Antonio office in 1978 following graduation from Baylor University with a BBA degree in economics. ROBERT H. HERZ CHAIRMAN, FINANCIAL ACCOUNTING STANDARDS BOARD Robert H. Herz was appointed Chairman of the Financial Accounting Standards Board (FASB), effective July 1, 2002. Previously, he was a senior partner with PricewaterhouseCoopers. Prior to joining the FASB, Mr. Herz was PricewaterhouseCoopers North America Theater Leader of Professional, Technical, Risk & Quality and a member of the firm’s Global and U.S. Boards. He also served as a part-time member of the International Accounting Standards Board. Mr. Herz is both a Certified Public Accountant and a Chartered Accountant. Mr. Herz joined Price Waterhouse in 1974 upon graduating from the University of Manchester in England with a B.A. degree in economics. He later joined Coopers & Lybrand becoming its senior technical partner in 1996 and assumed a similar position with the merged firm of PricewaterhouseCoopers in 1998. During his distinguished career, Mr. Herz has authored numerous publications on a variety of accounting, auditing and business subjects. Included among those contributions is the recent book, The Value Reporting Revolution: Moving Beyond the Earnings Game, which he co-authored. Among Mr. Herz’s other activities, he chaired the AICPA SEC Regulations Committee and the Transnational Auditors Committee of the International Federation of Accountants, and served as a member of the Emerging Issues Task Force, the FASB Financial Instruments Task Force, the American Accounting Association’s Financial Accounting Standards Committee and the SEC Practice Section Executive Committee of the AICPA. JAMES A. JOHNSON PARTNER, DELOITTE AND TOUCHE, LLP Jim heads Deloitte’s Accounting Standards and Communications Group. In that role, he is responsible for formulating the Firm’s views on developing accounting standards and communicating with standard setters, the Firm’s professionals, clients and other parties interested in financial reporting. Before beginning his current role, Jim served as the Firm’s Senior Managing Director for Financial Instruments, and practiced in Deloitte’s Global Markets Group and in the Firm’s National Office. Global Markets provides accounting, tax, and risk management advice to dealers and users of innovative financial instruments, including derivatives. Jim advised major financial institutions and many of the Firm’s major multinational companies and other clients on financial instrument matters. Jim is a member of the Financial Accounting Standard Board’s Emerging Issues Task Force. His previous activities with the American Institute of Certified Public Accountants include chairing its Financial Instruments Task Force and its Block Discount Task Force. He also served the AICPA as a member of its Accounting Standards Executive Committee and its Committee on Banking. Jim was a member of the steering committee and working group that authored the Group of Thirty’s 2003 Report, Enhancing Public Confidence in Financial Reporting. Jim speaks and publishes extensively in the area of financial instruments. Jim has a Bachelor of Science and a Masters in Business Administration from the University of California at Los Angeles. RICHARD JONES PARTNER , ERNST & YOUNG Rich is a partner in Ernst & Young’s National Accounting office in New York where he is responsible for assisting the firm’s clients and engagement teams in understanding and implementing today’s complex accounting requirements. In his role in National Accounting Rich consults on a variety of technical matters including real estate, lease accounting, equity accounting, income tax accounting, non-monetary transactions, restructurings and consolidations. In addition, he is the author of Ernst & Young’s technical literature related to many of these topics. Rich is a member of the Accounting Standards Executive Committee (AcSEC), the Equipment Leasing Association’s Accounting Committee and the Emerging Issues Task Force’s lease accounting and asset impairment working groups. Prior to joining Ernst & Young’s National Office, Rich served a variety of multinational clients in the financial services, energy and manufacturing industries. Rich is a graduate of Binghamton University. BOB LAUX DIRECTOR OF TECHNICAL ACCOUNTING AND REPORTING, MICROSOFT CORPORATION Bob Laux is the director of technical accounting and reporting at Microsoft, where he is responsible for technical accounting, including interacting with and responding to accounting standard setters on numerous issues. Bob is also responsible for Microsoft’s comment letters on new accounting pronouncements, and for representing Microsoft at standard setters’ public roundtables. Prior to joining Microsoft in 2000, Bob was an industry fellow at the Financial Accounting Standards Board, where he was responsible for coordinating the activities of the Emerging Issues Task Force. Before joining the FASB, Bob spent 10 years at General Motors managing their external financial reporting, and interacting with and responding to accounting standard-setters. Laux is also a member of the AICPA's Special Committee on Enhanced Business Reporting, and a member of the Financial Reporting Committee of the Institute of Management Accountants. SUSAN MARKEL CHIEF ACCOUNTANT OF DIVISION ENFORCEMENT U.S. SECURITIES & EXCHANGE COMMISSION Susan G. Markel is Chief Accountant of the Division of Enforcement and advises the Division on investigations involving accounting and auditing matters. Ms. Markel joined the Commission's Division of Enforcement in 1994. Ms. Markel has worked on a number of the Commission's important accounting investigations, including the investigations of Cendant, WorldCom and Xerox, as well as matters relating to auditor independence. Prior to joining the Commission, Ms. Markel was an auditor for a national public accounting firm and also performed litigation support services for a Washington, D.C. law firm. Ms. Markel received a B.S. in accounting from the University of Akron in Akron, Ohio and she became a certified public accountant in 1987. PAT MCCONNELL, CPA Senior Managing Director, Bear, Sterns & Company, Inc Patricia McConnell is a Senior Managing Director of Bear, Stearns & Company, Inc. She is head of the accounting and taxation group in equity research. Her group provides technical support to Bear Stearns’ industry analysts and to Bear Stearns’ clients in financial accounting and corporate taxation as applied in financial analysis for securities valuation. For the past 16 years, she has been named to Institutional Investor’s “AllAmerica Research Team” of financial analysts. Ms. McConnell often meets with Bear Stearns’ institutional clients, explaining and interpreting the accounting policies and financial reporting of companies in which they invest. Ms. McConnell is a CPA. She is the Chairperson of the Corporate Disclosure Policy Council of CFA Institute (formerly AIMR) and member of the International Accounting Standards Board’s Standards Advisory Council. Ms. McConnell is a past Vice Chair of the International Accounting Standards Board, a former Director-at-Large of the New York Society of Security Analysts, former member of CFA Institute’s Board of Governors and a past chair of CFA Institute’s Global Financial Reporting Advocacy Committee, and Ms. McConnell served as a member of the FASB’s Financial Accounting Standards Advisory Council, User Advisory Task Group for Inflation Accounting, and Financial Instruments Project Task Force. She also served as the project coordinator for the AICPA’s Commission on Auditors’ Responsibilities. She received an MPh in Economics and an MBA from New York University. She has a BA degree from Franklin and Marshall College and an AA degree from Vermont College for Women. CONNIE MCDANIEL VICE-PRESIDENT AND CONTROLLER OF THE COCA-COLA COMPANY Connie McDaniel is Vice-President and Controller of The Coca-Cola Company. She graduated Summa Cum Laude from Georgia State University with a BBA, majoring in accounting. She obtained her CPA certificate in 1982. Connie worked with Ernst & Young in their Atlanta office from 1980 until 1989. During 1984 and 1985, she participated in the firm’s International Exchange Program and worked in Ernst & Young’s London office. Connie joined The Coca-Cola Company in 1989 where she held positions as Manager, Accounting Research; European Community Group’s Financial Services Manager; Director, Financial Reporting; Division Finance Manager, Southeast and West Asia Division, headquartered in Bangkok, Thailand; and Division Finance Manager, German Division. While in Germany, she was elected to the Board of CCDV, the German national sales company, as well as the Supervisory Board of CCE AG, the anchor bottler in Germany. In December 1999, Connie was elected to her current position. Connie is the chair of the Georgia State University School of Accountancy Advisory Council, vice-chair of the Financial Executives Institute Committee on Corporate Reporting, and a member of the Board of Trustees of the STI Classic Funds. CHARLES D. NIEMEIER MEMBER OF PUBLIC COMPANY ACCOUNTING OVERSIGHT BOARD (PCAOB) Charles D. Niemeier was named a member of the Public Company Accounting Oversight Board (PCAOB) in October 2002. He served as Acting Chair of the Board from the inception of formal Board activities January 2003 through June 10, 2003. Prior to being appointed to the Board, Mr. Niemeier served as the Chief Accountant in the Division of Enforcement of the U.S. Securities and Exchange Commission and co-chair of the Commission’s Financial Fraud Task Force for two and one-half years. Immediately before joining the Commission, Mr. Niemeier was a partner in the Washington, D.C. law firm of Williams & Connolly, LLP where he worked for eleven years. And, prior to Williams & Connolly, he practiced as a certified public accountant for 10 years. Mr. Niemeier has a J.D. from Georgetown University Law Center and a B.B.A. from Baylor University. He was born in Coryell County, Texas and is married to Theresa Catterton Niemeier. CRAIG C. OLINGER DEPUTY CHIEF ACCOUNTANT OF THE SECURITIES AND EXCHANGE COMMISSION'S DIVISION OF CORPORATION FINANCE Craig C. Olinger was appointed Deputy Chief Accountant of the Securities and Exchange Commission's Division of Corporation Finance in April 1997, after serving as an Associate Chief Accountant since 1991. His responsibilities include oversight of financial reporting matters affecting foreign registrants as well as the formulation of Division policies regarding financial reporting and disclosure by public companies. He serves as an observer to the AICPA International Practices Task Force. Prior to joining the SEC in 1986 he was employed by Price Waterhouse. Mr. Olinger received his M.A.S. from the University of Illinois and his B.S. from Lebanon Valley College. He is a member of the AICPA. LAURA PHILLIPS, DEPUTY CHIEF AUDITOR PUBLIC COMPANY ACCOUNTING OVERSIGHT BOARD Prior to joining the PCAOB in July 2003, Ms. Phillips was an audit professional with Ernst and Young LLP. From 1997 to 2001, she was a resident in the firm’s National Professional Practice Group in both New York and Cleveland. During that time, Ms. Phillips served as a Technical Audit Advisor to the Auditing Standards Board of the American Institute of Certified Public Accountants (AICPA) as well as a member of the AICPA Auditing Financial Instruments Task Force. Ms. Phillips holds a degree in accounting from Miami University. She is a certified public accountant in Ohio. LESLIE F. SEIDMAN MEMBER FASB Leslie F. Seidman was appointed to the Financial Accounting Standards Board (FASB), effective July 1, 2003. Prior to joining the Board, Ms. Seidman managed her own firm, providing consulting services to major corporations, accounting firms, and other concerns. Previously, Ms. Seidman was Vice President of Accounting Policy at J.P. Morgan & Company where she was responsible for establishing accounting policies for new financial products and analyzing and implementing new accounting standards. Ms. Seidman started her career as an auditor in the New York office of Arthur Young & Company (now Ernst & Young LLP) and is a Certified Public Accountant. Prior to launching her consulting practice, Ms. Seidman served the FASB in various capacities, most recently as Assistant Director of Implementation and Practice Issues, but also as Industry Fellow and Project Manager. Ms. Seidman is the author of Miller Financial Instruments, a comprehensive practice manual for accountants and other professionals. She has contributed to several other publications. Ms. Seidman earned a M.S. degree in accounting from New York University and a B.A. degree in English from Colgate University. NORMAN N. STRAUSS FORMER NATIONAL DIRECTOR OF ACCOUNTING, ERNST AND YOUNG, LLP EXECUTIVE PROFESSOR IN RESIDENCE, BARUCH COLLEGE Norman N. Strauss retired as a Partner of Ernst & Young LLP in September 2001 and is now in his new career as Ernst & Young’s Executive Professor in Residence at Baruch College in New York City teaching contemporary accounting topics in graduate school. He was E&Y’s National Director of Accounting Standards and a member of the Firm’s Accounting and Auditing Committee. His duties included consultation on accounting issues and developing the Firm’s positions and publications on accounting matters. He is a CPA and a member of the American Institute of Certified Public Accountants. He has a B.B.A. and an M.B.A. from Baruch College. Mr. Strauss has been Ernst & Young’s representative on the FASB’s Emerging Issues Task Force and the Financial Accounting Standards Advisory Council, and is continuing as Ernst & Young’s and Baruch’s representative on the Standards Advisory Council for the International Accounting Standards Board. He has previously served as Chairman of the AICPA’s Accounting Standards Executive Committee (AcSEC) and chaired or served on various other Task Forces of AcSEC, including Task Forces on the Conceptual Framework of Accounting, LIFO, and Accounting for Stock Options. He is also a member of the Financial Reporting Committee of the Institute of Management Accountants. Mr. Strauss is a member of Financial Executives International and a member of the Board of Trustees of the Financial Executives Research Association. He was a member of the FASB’s Impairment of Assets Task Force and Cash Flow Task Force. Mr. Strauss has frequently lectured to many business organizations on various accounting topics and has been published in the Journal of Accountancy and elsewhere. He has chaired Baruch’s Annual Financial Reporting Conference since its inception in 2002. SCOTT TAUB DEPUTY CHIEF ACCOUNTANT, OFFICE OF THE CHIEF ACCOUNTANT, U.S. SECURITIES & EXCHANGE COMMISSION Scott Taub joined the United States Securities and Exchange Commission ("SEC") staff as a Deputy Chief Accountant in the Office of the Chief Accountant in September 2002. In this role, he is responsible for resolution of accounting and auditing practice issues, rulemaking projects, and oversight of private sector standard-setting efforts and regulation of auditors. Previously, he was a partner in Arthur Andersen's Professional Standards Group, where he worked with clients on matters of accounting and auditing, developed Arthur Andersen's accounting policies, and represented the firm before the FASB, AICPA, EITF, SEC and IASB. Taub was a member of the SEC staff between 1999 and 2001 as a Professional Accounting Fellow. During his fellowship, Taub worked with registrants on many accounting and reporting issues, including the implementation of Staff Accounting Bulletin No. 101 on revenue recognition, and served as the SEC Observer on several working groups of the EITF. Taub began his career with Arthur Andersen in 1990, and spent seven years in the audit practice before originally joining the Professional Standards Group in 1997. KATHLEEN M. WALDRON PRESIDENT, BARUCH COLLEGE Dr. Kathleen M. Waldron assumed the position of President of CUNY’s Baruch College on August 2, 2004. Baruch, comprising the Zicklin School of Business, the largest accredited business school in the nation, as well as the Weissman School of Arts and Sciences and the School of Public Affairs, is one of the most selective public colleges in the northeast. US News & World Report also consistently ranks it the most diverse college in America, with students whose families come from more than 120 nations and speak over ninety languages. Dr. Waldron was dean of the School of Business, Public Administration and Information Sciences of Long Island University Brooklyn Campus from 1998 to 2004. Prior to joining Long Island University, she worked at Citibank for fifteen years. From 1996 to 1998 she was a member of the policy committee for Citibank's Private Bank, which managed over $100 billion in assets of clients from over forty countries and was in charge of Global Strategic Planning for the Private Bank with revenues of $1.4 billion. She served on a transition team when Citicorp merged with Travelers Insurance to form Citigroup in 1998. From 1991-1996, Dr. Waldron was President of Citibank International in Miami and from 1988-1991, she was director of Citibank’s International Agencies Division. Before joining Citibank, Dr. Waldron worked at Chemical Bank in the Argentine area of the Latin American Division. Dr. Waldron received her doctorate in Latin American history from Indiana University in 1977 and a Certificate in Business from New York University in 1983. Prior to her banking career, Dr. Waldron was an assistant professor at Bowdoin College in Maine and a Fulbright Scholar at the Universidad Catolica Andres Bello in Caracas, Venezuela in 1980-81. She has published several articles on Latin American finance and Latin American history and regularly delivers papers and presentations at academic and professional meetings. Dr. Waldron was a member of the Presidential Committee on the Fulbright Program, a member of the Board of Directors of Shands Hospital in Gainesville Florida, a member of the Florida International Bankers Association, and a Director of the Fulbright Association. She currently serves on the boards of Accion International and Accion U.S.A., both microcredit lending organizations and the MetroTech Business Improvement District in Brooklyn, New York. Dr. Waldron has lived and traveled extensively in Latin America. She makes her home in Manhattan.