NAME:________________________________________________ TANSEY-MACRO: EC 3000 July 17, 2016

NAME:________________________________________________

TANSEY-MACRO: EC 3000

FINAL EXAM

April 16, 2020

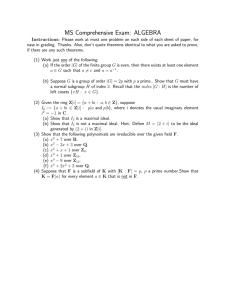

1. Following is data where the prime rate is the dependent variable and the percentage change in the exchange rate (yen per dollar) is the independent variable.

SUMMARY OUTPUT

Regression Statistics

Multiple R

R Square

Adjusted R

Square

Standard Error

0.125506

0.015752

0.002628

8.11361

Observations

ANOVA

77

Regression

Residual

Total df

1

75

76

SS MS F

79.01515 79.01515 1.200279

4937.3 65.83066

5016.315

Significance

F

0.276772

Intercept

Exchange rate

(Yen/$)

Coefficients

-1.67867

Standard

Error t Stat P-value

1.219134 -1.37694 0.172628

0.255935 0.233608 1.095572 0.276772

Discuss these results with respect to: a) What macroeconomic concept that we have studied is being tested? b) Is that relationship confirmed statistically by the above results? (make sure you explain what R-square, the F-test, and the T-test are telling us about statistical significance). c) Interpret the meaning of the coefficient, .255935.

1

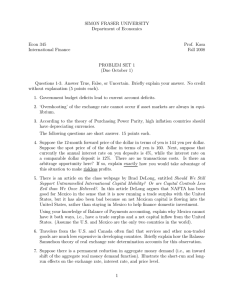

2. Here is the Line-Fit plot diagram showing the relationship between the percentage change in the Producer Price Index (PPI%chg on the X-axis) and the prime rate (Y-axis).

PPI%chg Line Fit Plot

12

10

8

6

4

2

20

18

16

14

0

Prime Rate

Predicted Prime

Rate

-0.2

0 0.2

0.4

PPI%chg

Discuss these results with respect to: a) What macroeconomic concept that we have studied is being tested? b) Is there a positive or a negative relationship between the two variables according to the line showing the predicted prime rate?

3. Read the following article:

Wholesale Price Decline Sets U.S. Record

By Martin Crutsinger, the Associated Press

Wholesale prices, helped by sharp decreases for energy and new cars, plunged 1.6 percent last month in the biggest decline in more than a half-century of record keeping…

2

Wall Street was encouraged. The Dow Jones industrial average closed up 20.48 points, at 9608, just above its close on Sept. 10…

Even excluding the usually volatile food and energy sectors, wholesale prices were down

0.5 percent. That drop reflected a 4.7 percent decline in new-car prices, the biggest onemonth drop in 29 years, reflecting heavy discounting last month to move a backlog of unsold cars.

The index dropped to 139.1, its low this year. The composite number uses 1982 wholesale prices for a baseline of 100.

Economists said the report showed an absence of price pressures not only at factories, farms and other producers of finished goods but also at earlier stages in the production pipeline, with costs dropping by 1.5 percent for intermediate goods and a steep 9.1 percent for crude goods. …

Analysts said consumers should find plenty of bargains as the holiday shopping season opens- and for months to come if demand slumps….

…But signs of weakness have grown dramatically…, with 415,000 Americans laid off in

October alone, the biggest one-month drop in payroll employment in 21 years…

Declining inflation pressures will give the Federal Reserve more room to cut interest rates to jump-start economic growth, analysts said. …

The 1.6 percent plung in the Producer Price Index for October, four times what analysts had been expecting, was the largest drop since the government began tracking wholesale inflation in 1947. Prices had been up 0.4 percent in both August and September.

So far this year, wholesale prices have been declining at an annual rate of 0.8 percent, a turnaround from the 3.6 percent increase last year.

(Kansas City Star. Saturday, Nov 10, 2001)***

Answer the following questions: a) Over the last two years has the economy, as measured by GDP growth rate been negative, slowly positive, or fast? b) Why do you think so?

3

c) Over the next two years will the economy, as measured by GDP growth rate, be negative, slowly positive, or fast? d) Why do you think so? e) When do you think this article was written?

4. Answer the following questions:

A.

How can inventories and the change in inventories be used in forecasting?

(make sure you talk about stocks and flows)

B.

At the end of the Carter administration Saving was zero, the U.S. government was running a surplus and the United States was running a negative trade balance with the rest of the world. Furthermore gross investment was greater than depreciation. Would net investment be negative or positive?

C.

What is happening to oil prices and why are they changing so rapidly?

4

5. Set out a Keynesian system of equations characterizing an economy with:

A government sector

And a foreign sector

Where Y= disposable income, C= consumption, I= investment, E=Exports, M= Imports and where a,b,c,d… are parameters, and where the subscript “o” indicates an exogenous variable. a) What are your exogenous variables in your system?__________________________________________ b) What are your endogenous variables in your system?_____________________________ c) From this system of equations compute the reduced form of the system. Show each step of the derivation of this system. d) When you are done circle JUST the part of the reduced form system which constitutes the multiplier. e) Suppose John McCain decides he wishes to balance the federal budget so that there is a zero deficit. What variables can he change without affecting the multiplier (HINT: there are only two exogenous variables or parameters that he will have within his power)?

5

f) If he changes both variables by the same amount so that they do not increase or decrease the deficit, will he have any affect on the GDP? How do you Know? g) Suppose he raises both of them by the same amount, which of the following will occur (there is more than one answer- circle all of the right answers)

*

*

More of an injection

More of a leakage

*

*

Less of an injection

Less of a leakage h) However, suppose he decides to raise the income tax rate to balance the budget.

Will a rise in the tax rate cause the economy to be more stable or less stable? i) Suppose the net change in your injections and leakages is either a positive (or negative) $100,000. What will the impact on the economy be if the marginal propensity to import is .2, the income tax rate is .5, and the marginal propensity to consume is .8. j) Which of the following types of stability will characterize the GDP’s response to outside shocks. Explain.

Damped (stable)

Damped oscillatory

Limit cycle

Strange (Oscillatory explosive)

Explosive

6. Suppose you start out with 1000 yen but next year you want to maximize the amount of yen that you earn. Following is the chart, just like the third homework, that sets out the exchange rates for the current year (1 st row), the interest rates you can earn in different countries (2 nd

row), and the exchange rates that will exist for the following year (3 rd

row) for the four different countries. (HINT: All of the exchange rates show the relationship of foreign currencies to the dollar (first row) or the dollar

6

per foreign currency (3 rd

row) so you will need to find the foreign currencies in terms of each other in order to do the problem).

Investme nt in

U.S.

Investme nt in

Europe

Investme nt in

Japan

(in yen)

Investme nt in

India

(in rupees)

"Currency per U.S. $" country interest rate

"U.S. $ equivalent"- 1 year forward

Foreign currency/dollar percentage change/year

Dollar/foreign currency

(in $) (in euros)

1 2

0.2

1

0.05

3

3

0.1

2

2

0.2

4

ANSWERS

Initial 1000 yen investment ¥ ¥ ¥ ¥

Put your answers in the final row and circle the one that gives the largest. Show work below:

Investment in the U.S:

Investment in Europe:

Investment in Japan:

Investment in India:

Your finally rid of me!!!! You’re done. You have all been a wonderful class. Yowl anytime you need a recommendation.

7