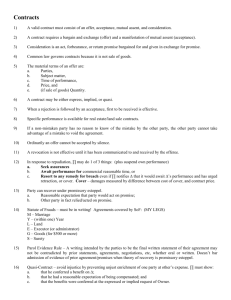

3010 Contract cases and notes The Kinds of Bargains Legally Enforced

advertisement

Emz Contracts – Spring Case Briefs 2001 3010 Contract cases and notes The Kinds of Bargains Legally Enforced A. Bargains 4) Methods of Acceptance General Rules: 1) Acceptance must be clear & unequivocal 2) Acceptance must be communicated to the offering party 3) Silence is not sufficient for communication of acceptance (but one can accept by conduct) 4) Offerer can't impose silence on the other party as a mode of acceptance. 5) Any change in the terms of the original offer constitutes a counter offer & a rejection of the original offer (Cardiff v. Maggs). 6) The offering party can specify any mode of acceptance. If no mode specified, acceptance can be made by any reasonable means. Manchester Dioscesan Council v. Commercial & Gen. Invest. [1969] Ratios: 1) Offeror can insist on any mode of acceptance & is not bound by difference modes unless he chooses to be. 2) If offero r prescribes a particular method of acceptance, but doesn't insist that it's the only acceptable method, one can accept by any other mode which is no less advantageous to offerer 3) If offerer will accept only one specific mode of acceptance, he must make that clear. British Road Services Ltd v. Arthur Truckload of whisky to D stolen during the night. Limitation clause in the contract was suspect. Although there were questions of acceptance on the written offer, since the actions (accepting for delivery) showed that there was acceptance, it was deemed. The limitation clause was upheld. ?: was there acceptance of the exclusion clause Delivery note (no ex clause) was the original offer. The K included the exemption clause because the agent (the driver) agreed to the counter offer by storing the goods in the warehouse (acceptance). It was also considered that since in the business, this is the usual practice, the pl should have known that the agent would agree to said clause. The pl had contained a clause stating the their terms were superior. This clause was not part of the contract because the counter-offer came afterwards and was accepted. 5) Consideration: Hallmark of Bargain White v. Bluett (1853) Facts: The deceased father agreed to let the son out of a promissory note in return for him not complaining about not getting fair treatment. What the case stands for: No, there was no consideration because the son cannot abstain from doing what he had no right to do. Ratio: A promise to do something that you are not allowed to do already is not good consideration. Hamer v. Sidway (1891 US) Facts: The nephew agreed not to drink, use tobacco, swearing, and playing cards in exchange for money. The nephew had sold the debt and a third party is suing the estate. What the case stands for: Yes, consideration may consist either in some right, interest, profit, or benefit accruing to the one party, or some forbearance, detriment, loss or responsibility given, suffered, or undertaken by the other. Ratio: detriment to promisee in request of promisor = consideration Thomas v. Thomas (1842) Facts: The P. agreed to pay one pound per month to the executors and keep the house in good shape in exchange for a house willed to her. There is an action to eject her from the house. What the case stands for: Yes, though there must be some movement from promisee to promisor or some detriment on the part of the promisee for consideration and, therefore, honouring memory is not consideration, but keeping the house and the payments (even one pound) are fresh consideration. The Great Northern Railway Company v. Witham (1873) Facts: Witham submitted a tender (offer) to sell articles to the Railway company for 12 months. He decided not to sell the iron to them anymore – claiming that the contract was void for lack of consideration (it was a promise to supply without a promise to buy). Found: The acceptance and the consideration was the placing of the order by the railway company. (Witham could have taken back the offer before the acceptance with notice (Dickinson v. Dodds)) (noted that GNR may have been in an awkward position for agreeing to buy only from them – unilateral contract involving mutuality) Tobias v. Dick (1937) Facts: The two sides agreed to a sales restriction and operated on this understanding for some time. There was some kind of trickery on the part of Tobias. Tobias then does not sell the crushers. So Dick went to Eatons. Then, P. said there was a breach. What the case stands for: No consideration for the promise of exclusive right to sell. No mutuality (where both sides incur obligations because of a K = good consideration). It was not a K of Agency because Dick has no control once the machines are handed over. Suggestion that Tobias was shady so did not bring in an implied term for consideration.. K of agency – principle/agent. Agent has power to act on behalf and bind the principle in a K. (would return stuff if not sold) Wood v. Lucy (1917) Facts: D. employed P. to act as an agent for her to exclusively enter into contracts endorsing fashions on her behalf. They will split the money 50/50. She then started performing his task (finding the fashions). He sued but she said that there was no consideration for the promise of the exclusive right because she gained nothing. What the case stands for: consideration = implied promise that she will use his efforts (otherwise why have the K at all?) for Wood. B. Problems With Bargain Theory 1) Pre-existing duty 1. Is there anything given for the promise? Beyond legal duty? Circumstantial? To do extra? 2. Even if so, is there an over-riding policy consideration? Harris v. Watson (1791) Facts: P. was a seaman on the ship of D in the Napoleonic wars. In a period of danger, D. told P. that he would pay him more if he would do more work. He then did not pay. What the case stands for: Plaintiff does not have right to the money. When the freight is lost the wages are lost. This is to protect the captain from being blackmailed into paying more. (policy) Stilk v. Myrick (1809) Facts: The plaintiff was told by D. that he would be paid part of the deserting men’s wages in exchange for more work that would have to be done. He later was not paid. What the case stands for: The P does not get the money. The crew had a pre-existing duty to do everything in their power to work the ship safely. Therefore, there was no consideration for the extra pay. Hartley v. Posenby (1857) Facts: Crew was so reduced that to go to sea was dangerous. Offered extra money and went. Result: There was consideration because there was not a duty to go and put himseld in danger. Got the money. Smith v. Dawson (1923) Facts: P. was building a house for D. When the house burned down, P. refused to continue unless D. paid part of the insurance money. D agreed, then did not pay. Issues: Can P. collect? Was there a duty to continue building? Was there consideration (argued that right to break contract was given up (supported by Holmes theory)? What the case stands for: P. cannot collect. There was a pre-existing duty. A promise to continue to do that which you are already bound to do cannot count for consideration. (not allowed to break the contract, so cannot use that for consideration) 2 Raggow v. Scougall and Co. (1915) Facts: P. was to work for a wage reduced over the course of the war. He agreed then sued for full wage. On the basis that there was no consideration for this change in pay. Part of the first contract was that if the business became uneconomic, the contracts would cease. What the case stands for: No consideration. This formed a new contract, so the work and pay itself was consideration. D. gave up the right to close the business. If parties mutually agree to destruct K, and replace it with a new one, the pre-existing duty under the original K is terminated Gilbert Steel Ltd. v. University Construction Ltd. (1976) BINDING ** Canadian Authority** Wilson at the Ontario Court of Appeal Facts: P. agreed to supply steel to D. for a price. P. then increased the price due to market changes. D agreed to the new price but then paid the lower, old price. 3 argmts used to say there was considn given. Considn was: 1. Increased credit rating (benefit) for the extra 60 days. Ct rejects. 2. Rescinded 1st agmt and replaced w new K. Ct rejects: only changed term in K (price) 3. Promise for good price on steel in future. Ct rejects. Not substantial enough. What the case stands for: There was a new contract when they agreed to a new price, but there was no consideration given in exchange for the higher price. UC paid the lower price since the second contract was void. Williams v. Roffey Bros. Ltd. (1991) NOT binding **not binding and does not follow Canadian authority**( English Court of Appeal) (not yet adopted in Canada) Facts: D. (contractor) hired P. (sub-contractor) to do carpentry work. P. realised that he would need more money to complete the job, so they agreed. D. asserted: not valid and refused to pay because there was no consideration. What the case stands for: There was consideration. (1) P had reason to doubt that D would complete K o/w – must be based on genuine likelihood that, acting in good faith, party is not going to complete. (2) The other party derived a PRACTICAL BENEFIT from the performance of the pre-existing duty (not being faced with late charges etc) (3) There is no duress or fraud (Doctrine of Economic Duress: defense to perfnce of K - if economic pressure was excessive, severe, & unrsble, the K would not be enforced) Foakes v. Beer (1884) H.L. Facts: P. agreed to pay money over a period of time in exchange for D’s undertaking not to sue for interest. D. then sued. What the case stands for: No consideration. P. had a pre-existing duty to pay, so no benefit accrued to the defendant. Cannot give a lessor sum for a larger sum and call that consideration. -- reversed by Statute: Mercantile Law Amendment Act 1990 page 274 – part performance, if expressly accepted by the creditor in satisfaction, extinguishes the previous duty and obligation. (does this kinda go to a compromise?) 2) Compromises - courts want to uphold a compromise for public policy Cook v. Wright (1861) Facts: D. promised to pay an amount in exchange for P not suing. It turns out that there was no right to sue at all. What the case stands for: A compromise may be consideration where the position of the parties in the compromise is altered so that, if the question is afterward opened up they cannot be replaced as they were before the compromise. It is this detriment of the party consenting to a compromise arising from the necessary alteration (loss of evidence, time passing, etc) in his position that is the real consideration. As long as you have a bona fide blf in your claim, then your agmt to give up your claim is good considn Fairgrief v. Ellis (1935) Facts: P’s were invited to take care of D’s home in exchange for the home after his death. They did so until his wife came back and he asked them to leave and give up their interest in the house for $1000, even though he was not legally obliged to do so. Decision: D’s bona fide expectation that, in exchange for $1000, the P’s would vacate and give up their interest is good consideration. 3 Toronto-Dominion Bank v. Fortin (1978) (BCSC) Facts: Security agreement – receiver compromises to forget about claim for a breach and D pay 10 000. Problem: Terms of receivership do not give power to sell assets – D claims that compromise not valid because no authority and therefore no consideration in the compromise. Decision: Distinguish Cook, receiver was an officer of the court and therefore should be held to a higher standard. Is not allowed to take advantage of D’s mistake. 3) Past Consideration Lampleigh v. Brathwait (1615) Facts: P worked to get a pardon for D and then D promised to pay him. What the case stands for: Where there was a request made for an act in a K, past consideration can be good consideration. The promise couples with the work done before. Pao On v. Lau Yiu Long (1980) Facts: D. promised to purchase shares back from P at fixed price in exchange for not selling them for a year. The parties replaced this contract with one in which D. could compel P. to purchase. Also, was there economic duress. What the case stands for: An act done before the giving of a promise to make a payment or to confer some other benefit can sometimes be consideration for the promise. The act must have been done at the promisor’s request: The parties must have understood that the act was to be remunerated either by a payment or the conferment of some other benefit; and payment, or the conferment of a benefit, must have been legally enforceable had it been promised in advance. No economic duress. - 3 necy precondns for good past consideration: 1. The earlier act (past consideration) must be done at the promisor’s request 2. Parties must have ustd that the act was to be renumerated by payment or conferral of other benefit. 3. That payment or benefit must have been enforceable had it been promised in advance. C. Non-Bargain Promises: Estoppel Estoppel: ( a non bargain promise – lacking offer, acceptance and/or consideration): to stop someone from changing their position with respect to a fact that they have asserted / previously represented Promissory Estoppel: promises intended to be binding, intended to be acted on, and in fact acted on are enforceable in law to the extent that the party making the promise is estopped from acting inconsistently with it, even though there is no considn. (High Trees) Hughes v. Metropolitan Railway Co. (1877) Facts: Landlord gave notice of six months but negotiated an alternative in the meantime. When negotiations broke down, thought there was a six month period. Landlord served eviction. Waiver=landlord waived the right to end the contract. To turn this right back on, must give notice. What the case stands for: The person who otherwise might have enforced rights will not be allowed to enforce them where it would be inequitable having regard to the dealings which have then taken place between the parties. Ratio: If a party had previously relied on a waiver of rights, the person seeking to end the contract must give notice to end the waiver and return to their strict legal rights Central London Property Trust v. High Trees House (1947) Facts: D. agreed to ½ rent from P because of war times. but then handed affairs over to a receiver who brought this proceeding to find out what to do. Decision: There is a promissory estoppel, but it only stops them from acting inconsistently with the promise. When the flats were filled, the promise was over and the rent full. What the case stands for: The change in the rent was made without consideration. But a promise intended to be binding, intended to be acted on and in fact acted on, is binding so far as its terms apply. There was not fact estoppel because it was not a waiver but a promise not to take full rent. It was promissory estoppel which can be taken back with (1) reasonable notice or (2) inherent conditions of self-destruction. (this looks like it is getting rid of the doctrine of consideration!) 4 Combe v. Combe(1951) Preserves doctrine of consideration Facts: Wife claims maintenance from husband on the basis of promise. She claims promissory estoppel, he cannot just take the promise away. What the case stands for: There was no consideration (wife had only promised not to sue, not valid) so no bargain. Cannot use promisory estoppel because it does not give a cause of action in itself. There must be a valid K first. (Shield, not a sword) - in the US, gone a bit further to call is promissory estoppel if it has been relied upon (instead of const) Gilbert Steele Consideration Doctrine: There was a new contract when they agreed to a new price, but there was no consideration given in exchange for the higher price. UC paid the lower price since the second contract was void. Estoppel?: No. Distinguished High Trees in that the promise was positive action (to pay more). Stopping you from going back on promise and therefore you must pay more – this is a shield AND using a sword (trying to get money). Estoppel is not contract enforcement, it is a shield and not a sword. D&C Builders v. Rees (1965) Facts: D owed money to P for work done. Said they would give 300 or nothing. P. Was in dire financial straits and accepted the 300 to clear the account. P. sued for the full amount. D. claims promissory estoppel. What the case stands for: Generally payment of a lesser sum is no discharge of a greater sum. But, applying Hughes, the person who might otherwise have enforced his rights will not be allowed to do so where it would be inequitable, having regard to the dealings which have taken place between the parties (promissory estoppel is a good doctrine). In this situation, there was no true accord so the creditor can claim the full amount. (he who come to equity must come with clean hands) Mercantile Law Amendment Act, RSO 1990. No consideration required if the expressly accepted. (is this US?) Owen Sound Public Library Board v. Mial Dev. Ltd. (1979) Contrary to Gilbert Steele – undermines the doctrine of consideration and support promissory estoppel Facts: Term in a construction contract that money must be paid. Library had defaulted. Contractor then has the right to walk away. Project manager had assumed that did not have to pay since no seal (this should not have mattered). Contractor walked away (at this point the project was not going well). Issue Library claimed estoppel – you promised us that the time period would not start until you got the seal. Result Court recognized the promissory estoppel. Reasonable for the library to expect that the time period was suspended. Contractor not entitled to terminate the K. Ratio: It is possible to use promissory estoppel to get a positive action (ie to pay money). This stops the person from rescinding the promise. (does not give damages) (Waiver argument is different because it would be: waiver of right to terminate K while going to get seal. Will order to continue K and pay damages) D. Unilateral Contracts Carlill v. Carbolic Smoke Ball Company (1893) Facts: D. made offer that 100 pounds would be given to anyone who used the ball and still got influenza. P. used the ball but D would not give the money, saying that the agreement was made with no one and that even if there was an offer, there was no acceptance. What the case stands for: It is a general offer to anyone who fulfills the conditions and performance is the acceptance and consideration. Errington v. Errington (1952) (England) Facts: Father bought a house for son and daughter-in-law to live in. They started making the payments. Father’s estate gave notice that the offer was revoked. Result: A unilateral contract – a promise of the house in return for their act of paying the instalments. The acceptance and consideration was the payments by the couple. The offer could not be revoked after they accepted. 5 Dawson v. Helicopter Exploration Co. Ltd. (1955) Facts: D. agreed to give P. an interest in mineral deposits if he brought them to the site. They then rescinded before he had an opportunity to fulfil the performance. They said that performance was necessary for acceptance. What the case stands for: A unilateral contract properly has the offeror passive and the other party active. The other party is expected to perform. Where possible, the court will interpret an offer as calling for bilateral acceptance. This was a bilateral contract, and therefore enforceable. III Contracts and Third Parties A. Third party Beneficiaries 1. Agency – B goes to C acting as A’s agent and makes a contract. Must have: medium of contract; authority; consideration from the principle. The contract is then between A and C (the third party and the principle) 2. Assignment – selling something intangible (a right) from a K. K between A and C. A transfers legal rights to C in assignment. 3. Trust – creates a beneficial owner. Tweddle v. Atkinson (1861) Facts: Two fathers made a contract to pay to the son (in law). They did not. What the case stands for: Privity of Contract: Someone that is not a part of the contract for the purposes of liability cannot sue upon it for his own advantage. Dunlop v. Selfridge & Co. (1915) Facts: Dew and Dunlop bound one another to deal with each other. An order was placed for a tire from Selfridge. Selfridge charged less than Dunlop. Selfridge ordered from Dew who ordered from Dunlop. A price management agreement was then signed between Dunlop and Dew and between Dew and Selfridge. Dunlop is suing under this agreement arguing agency. (Dunlop has no privity of K with Selfridge, but Dunlop has the interest in the clause between Dew and Selfridge not to sell for less) What the case stands for: No consideration flowed from Selfridge to Dunlop. As well, the contract made between Dew and Selfridge was not made with Dew acting as Dunlop’s agent. Only a person who is a party to a contract can sue on it. If a person with whom a contract not under seal has been made is able to enforce it consideration must have been given him to the promisor or to some other person at the promisor’s request. A principal not named in the contract may sue upon it if the promisee really contracted as his agent. But there still must be consideration flowing from the principal. Privity of Contract is total. (should have put in a clause Dunlop to Dew not to sell to someone who will sell less – express) New Zealand Shipping Co. v. A.M. Satterthwaite (1975) *** followed by SCC in ITO v. Miida) Facts: The shipper is Ajax. Entered into contract with the carrier to deliver it to Satterthwaite. There was a clause in the contract limiting liability and time of liability including the agents of the carrier. The clause expressly stated that the carrier was acting as an agent with respect to this limitation for any of its agents. New Zealand damages the drill when unloading. New Zealand shipping wants to claim the benefit of this clause in Ajax Satterwaite K. What the case stands for: The performance of the services by the shipper was the consideration for the agreement by the shipper that the appellant should have the benefit of the exemptions and limitations contained in the bill of lading. An agreement to do an act which the promisor is under an existing obligation to a third party to do, may quite well amount to a valid consideration and does so in the present case: the promisee obtains the benefit of a direct obligation which he can enforce. Implied a unilateral contract – if someone unloads my goods, I will not sue them. Greenwood (affirmed by SCC) Facts: Landlord has a covenent by tenant to insure against fire. There is a fire due to workman’s negligence. Tenant sued Landlord’s workmen in negligence. Workman wanted to be covered by the covenant. Held: Privity of contract means that the workman were not privy to the contract and so could not sue. Must be a party to the contract to sue. 6 London Drugs v. Nagel (1992) Facts: P. stored a transformer with D. D’s employees damaged it, but D had a limit of $40 on liability. What the case stands for: Employees may obtain the benefit of an employer’s liability limitation where: (the doctrine of privacy is relaxed when:) 1. The limitation of liability clause must, either expressly or impliedly, extend its benefit to the employees (or employee) seeking to rely on it; Intend to extend to third party; and 2. the employee seeking the benefit of the limitation of liability clause must have been acting in the course of their employment and must have been performing the very services provided for in the contract between their employer and the plaintiff customer when the loss occurred; within contemplation of the K Fraser River Pile & Dredge Ltd v. Can-Dive Services Ltd (1999) - further extension of benefits for third party - contract had said – any charterer B. Void Contracts (in third party situation) 1. Mistaken Identity Ingram v. Little (1961) Facts: Man said he was someone with wealth and, on this basis, P. accepted a cheque in exchange for a car. Cheque bounces. The car shows up in innocent 3rd party who bought car in good faith. What the case stands for: Majority – P. intended to make the contract with “Hutchinson” but was deceived, as this man did not exist. Thus, no contract was formed and D. must pay. The first contract was void and the car is recovered. Minority – A mistake avoids the contract if at the time it is made there exists some state of fact which, as assumed, is the basis of the contract and as it is in truth, frustrates the object. This contract was void because the identity of the person was essential to the contract (void ab initio) If the identity is simply an attribute, the contract is only voidable (property cannot be recovered) Lewis v. Averay (1972) ***same court, L D, different decision) Facts: Same facts as above. What the case stands for: The defendant does not have to pay. When two parties have come to a contract – or rather what appears, on the face of it, to be a contract – the fact that one party is mistaken as to the identity of the other does not mean that there is no contract, or that the contract is a nullity and void from the beginning. It only means that the contract is voidable, that is, liable to be set aside at the instance of the mistaken person, so long as he does so before third parties have in good faith acquired rights under it. 2. Documents mistakenly signed Principle of non est factum: K is totally void where one party to the K can show that they signed it having been misled as to the character and nature of the document and they signed it without carelessness or negligence. If misled re something other than the character and nature then just voidable. Anglia Building Society v. Saunders Facts: She signed a transfer of sale thinking that it was a gift. She could not read and had trusted her nephew. The intended effect was the same. Claimed that it was a non est factum.(not my deed) Ratio: Must be a fundamentally different document to find it voidable using non est factum Cugnet (1956) --- carelessness on the part of the signer is irrelevant for a non est factum case Marvco Color Research v. Harris et al (1982 SCC) **overturn Cugnet** Facts: a couple was defrauded by a trusted man who was, de facto, their son-in-law and mistakenly signed a document. What the case stands for: The defence of non est factum is only available where the signer proves that (1) the document was, because of a misrepresentation, fundamentally different from what it was thought to be; and (2) that the signer was not negligent in making the mistake. 7 IV. The Interpretation and Enforcement of Contracts A. Unsigned Documents Thorton v. Shoe Lane Parking Ltd (1971) Facts: Parked care in underground. Getting something out of the trunk and injured by parking attendant’s negligence. There was an exclusion clause stating under K was a limitation. Got ticket from an automated ticket machine. Ratio: For an unsigned document must bring the clauses in a K to the customer’s notice if you want to rely on them B. The Parol Evidence Rule About the admissibility of pre-contract negotiations. Unless you are alleging an exception to the rule, the court will not hear of previous agreements that pre-date a signed K. - this presumption against the previous agreements is stronger when it contradicts the written contract unilateral = acceptance is an action (not a mutual promise) bilateral – mutual promises collateral contract or warranty – the signing of the contract is a consideration for another contract (if you sign then) Hawrish v. Bank of Montreal (1969) Facts: H. signed a guarantee for money but thought that it was only for existing debt. An oral agreement at the time led him to believe that this was the case. What the case stands for: The collateral agreement allowing for the discharge of the appellant cannot stand as it clearly contradicts the terms of the guarantee bond which state that it is a continuing guarantee. Only where there is parol evidence of a distinct collateral agreement, which does not contradict or be inconsistent with the written instrument, is first evidence admissible. Tilden Rent-A-Car v. Clendenning (1978) Facts: D. asked for insurance on his car rental. Though it was not drawn to his attention and he clearly did not read it, the policy said that there was no coverage where laws are broken. The rest of the policy said that everything was covered. What the case stands for: “In modern commercial practice, many standard form printed documents are signed without being read or understood. In many cases the parties seeking to rely on the terms of the contract know or ought to know that the signature of a party to the contract does not represent the true intention of the signer, and that the party signing is unaware of the stringent and onerous provisions which the standard form contains. Under such circumstances, I am of the opinion that the party seeking to rely on such terms should not be able to do so in the absence of first having taken reasonable measures to draw such terms to the attention of the other party.” - Where onerous / unusual condition, ct will treat that as an unsigned K where the K was of a type and signed under circumstances that nobody expects it to be read (almost as though it wasn’t signed) - Relatively well-accepted exception to parol evidence rule (contracts must be signed) 8 Gallen v. Allstate Grain (1984) Facts: P asked D if weeds would destroy the crop. D. said no. Weeds did destroy the crop. What the case stands for: If it is said that an oral representation, that was made for the contract document was signed, contains a warranty giving rise to a claim for damages, evidence can be given of the representation, even if the representation adds to, subtracts from, varies or contradicts the document if the document does not contain the whole agreement. It is a warranty if the representation became a part of the contractual relationship between the maker and the recipient. (1) The signed contract made no mention of the warranty given orally. (2) The written contract appeared to be the whole agreement – this is not usually too difficult a hurdle to overcome (3) Many arguments allowed parol evidence to be used. (a) The representations formed a collateral contract (i) This shifts the risk to allstate grain. (b) These statements were at least a negligent misrepresentation (4) Reasons to get by the parol evidence rule: (a) Grounds of invalidity (i) Misrepresentation (ii) Mistake (iii) Incapacity (iv) Lack of consideration (v) Lack of contracting intention (b) To dispel ambiguities – establish a term bound by custom or establish the factual matrix for the agreement. (c) Support a claim for rectification (d) Establish a condition precedent to the agreement (e) To establish a collateral agreement (f) In support of an allegation that the contract does not represent the whole deal (g) In support of a claim for an equitable remedy (incl. Innocent, negligent, or fraudulent misrepresentation) (h) In support of a claim that there was negligent misrepresentation claimable in tort (5) You can admit evidence of a collateral contract. There is only a presumption that adding to, contradicting, or varying the contract is not admissalbe. This presumption varies in strength. It is least strong where the written clause is general and the parol is specific or where the contract was a standard form, not a negotiated contract. Sliding Presumption (6) Principle of Harmonious Interpretation -- if you can read them to be consistent, then you ought to. (7) In this case, the form was standard, the weeds were specific, and so the presumption can be overcome. for plaintiff (8) Parol evidence rule is only applicable to agreements before the contract was signed Rectification - The parties’ deal is embodied in a written formal contract. But one party says that the written contract is wrong and does not reflect the deal made. You asks the court to rectify the error (often just a clerical error). Courts use the standard of clear and convincing evidence to do anything. Penalty clauses – in the K, liquidated damages – if it is too much of a penalty, courts throw it oue Forfeiture – required to give up a right if break contract – to overcome – must show penal and unconscionable E. Exclusion and Limitation Clauses Suisse Atlantique - no rule of a fundamental breach of contract making the exclusion clause out. Only look at the construction of the contract strictly – did the parties intend for the clause to apply here? If it was a fundamental breach (in that it stopped the purpose of the contract, clearly not) Plastercine (1970) - Fundamental breach doctrine - distinction: result of breach is to being able to bring the contract to an end (voidable) - breach automatically comes to an end (void) 9 Photo Production v. Securicor (1980) - HL Facts: An employee of D. set a fire in P.’s building. There was an exclusion clause. What the case stands for: Here the words are clear. Both parties relied upon this clause. Liability is excluded. A fundamental breach resulted in reading the term strictly. Ratio: Rule of strict construction of an exclusion clause. What did the parties intend to cover? Look at: 1. purpose of the K – here securicor did not know much about the business it was protecting 2. interpret the clause – how specific or general? 3. fairness of the contract – not paying very much for the K, not fair to expect much in return Beaufort Realties v. Chomedey Aluminum (1980) – Canadian – follows Photo Facts: D. agreed to do construction work for P. P. waived his right to builders’ liens (exclusion/limitation clause). D. broke their contract (fundamental breach). P. liened the property. What the case stands for: The proper approach is the Photo approach in which you look to the true construction of the contract in the event of a fundamental breach. In this case the contract should be treated as being at an end. This phrase was communicated. Dissent – Wilson, overriding view is just what is reasonable to expect – fundamental breach and construction no. Hunter engineering v. Syncrude (1989) – SCC (2:2) Facts: Syncrude contracted for gears, which failed and caused losses. There was an exclusion clause limiting the amount of time. This occurred outside the designated time. What the case stands for: it is preferable to interpret the terms of the contract, in an attempt to determine exactly what the parties ageed. If on its true construction the contract excludes liability for the kind of breach that occurred, the party in breach will generally be saved from liability. Unconscionability/fundamental breach is an exception. - Dixon + LaF – rule of construction – did parties intend for the exemption in this situation? If unconscionable, will not apply the exclusion clause (a grossly unfair bargain that would shock the average person) - Wilson + Dube – we do no have the unfair contract act so have to be more careful. Rule of construction and then balance the fairness (the fundamental breach doctrine instead of unconscionability – this doctrine is too narrow) (this is a lower threshold then Dixon’s grossly unfair) - Waddams implies that these are really the same thing – strict construction, then look at the fairness (just different doctrines for the second part) Fraser Jewellers v. Dominion Electric Protection (1997) On C A Facts – pl bought alarm protection. Alarm went off, delay in response of D (negligence). Exclusion clause. Pl had not read K. Issue: did the exclusion clause apply? Found 1. not a fundamental breach because the pl did get a lot from the K 2. Not having read the K was irrelevant (distinguish Tilden) because the clause was obvious and they should have. - looked at fundamental breach (Hunter – Wilson and Dube) not unconscionability (as per Hunter LaF+ Dixon) Delaney v. Cascade river Holidays Ltd. (1983) (BCCA) Facts: Deceased hastily signed a waiver after having paid for the trip. What the case stands for: The release contained provisions so onerous and unusual that it was the duty of Cascade to see that the provisions were “effectively called to the attention of the other party under the penalty of their being held non-binding on the latter party.” (majority found that could not prove causation for the negligence action so the exclusion clause was irrelevant) Minority found negligence so: what about the clause? Negligence was explicitly excluded. How to get around this? (a) “not part of the contract” argument – the deceased made arrangements over the phone. He paid before he signed the contract. Notice of the terms was not contemporaneous with entry into the contract (payment). (b) But it is a signed document. Tilden Rent-a-Car. Where there is a document signed, you can only treat it with due deference if the party that signed it could have been expected to read the contract. This is the situation here. In this case, the clause was so onerous that the defendants had to bring it specifically to the attention of the plaintiff. (c) Does a strict construction and then looks at fairness (per Wilson Hunter) – should have given more notice of the exclusion clause given that it allowed for negligence like this. When consid’g exclusion clause, ask (Nemetz in Delany v. Cascade River Holidays): Was there considn for clause and is it even a part of the K? Were onerous terms of clause brought to notice of signor? (Think of Tilden) 10 F. Unconscionability: the limits to enforcement Marshall v. Canada Permanent Trust (1968) Facts – action for specific performance of a sale of land. Trust claims that Walsh was mentally incapacitated when he signed the agreement and therefore it was not binding. Issue: How far does the vendee have to go to make sure the vendor is in the right mind? Was he taking advantage? Found: In looking at unconscionability, it is irrelevant if Marshal knew of Walsh’s mental state. All that must be established for the defendant to get rescission of the contract is: 1. Walsh was incapable of protecting his interests – found yes 2. that it was an improvident transaction for Walsh – found that it was equitable – he had not made a bad K for himself. Lloyds Bank Limited v. Bundy (1975) Facts: Old man mortgaged family house and now the bank is foreclosing. What the case stands for: Undue influence: pers getting you to sign K has unusual pwr over you. If sign unfair K bc relying on a pers who puts you in this posn, have not given free consent and K cannot stand makes K voidable. 2 categs: (1) Rlnps in which law presumes undue influence. IE: parent child, religious leader disciple, trustee trust beneficiary, etc. This presumption is rebuttable where independent legal advice or the contract actually was fair. (2) Look at actual rlnp & say in that partic case there was rlnp of undue influence. Must show through evid Unconscionability: even if genuinely consent, some deals that are too awful for cts to enforce for K to be found unconscionable (voidable): (a) Rqrs substantial disparity in bargaining pwr bn the 2 parties (ie diffs in econ pwr, intell, etc) (b) Having established disparity, must THEN show the bargain was grossly unfair. (9) Unconscionability is more than just undue influence. Not just that the consent is not freely given, but the court will refuse to enforce this contract. Indeed, there need not be a large degree of trust. Macaulay v. A. Schroeder Music Publishing (1974) Facts: Young songwriter signed agreement binding him to the studio for 10 years What the case stands for: Unconscionability: The test of fairness is, no doubt, whether the restrictions are both reasonably necessary for the protection of the legitimate interest of the promisee and commensurate with the benefits secured to the promisor under the contract. K not fair - serves legit aim of publisher to ensure against flops but go too far to achv this aim: time period too long, P’s rights too restricted. Test: did D have superior bargaining power and did he use it to exact promises onerous to P G. Misrepresentation and breach of contractual warranty Fraud – deceit, either knowledge of or reckless behaviour -> damages Innocent misrepresentation – rescission of the K (no damages possible) - for rescission, must be able to ‘restitutio in integrum’ – restore in whole (this has been relaxed recently) - in equity, so must have clean hands Sale of goods act – warranty – gives rise to damages - conditions – if breached, can terminate K Heilbut, Symons & Co. v. Buckleton (1913) Facts: Man bought shares when an intermediary told him that it was a rubber co. It was only part a rubber co. Argue: Collateral contract theory – warranty – if you promise me that this is a rubber company, I will buy it. (Not on these facts) What the case stands for: A person is not liable in damages for an innocent misrepresentation, no matter in what way or under what form the attack is made. (even if collateral warranty) “An affirmation at the time of the sale is a warranty, provided it appear on evidence to be so intended.” 11 Bentley v. Smith (1965) – expands Heibut for collateral warranty Facts: D. told P that the car was in a certain condition and previously owned by a particular person. What the case stands for: If a representation is made in the course of dealings for a contract for the very purpose of inducing the other party to act on it, and it actually induces him to act on it by entering into the contract, that is prima facie ground for inferring that the representation was intended as a warranty. Esso Petroleum v. Mardon (1976) Facts: Mardon ran business based on Esso’s prediction of a high rate of fuel consumption. This was not met. The gas station had to be built entrance differently because of a new city by-law. Argues – collateral warranty broken. The promise of the entrance is what induced me to enter the contract. What the case stands for: A person with special knowledge or skill that makes a representation with the intent to induce someone into a contract, he is under a duty to use reasonable care to see that the representation is correct, and that the advice, information, or opinion is reliable. Expression of opinion IS NOT a collateral K. Must be sthg about a fact to be a collateral K. More likely to be found a collateral warranty if party making it was in a better position to know the truth of the statement than the party hearing it. Statement has to actually induce, and be intended to induce, the person who hears it to enter into the K. It has to be something that is of real significance to the parties. Mistake as Grounds for Contractual Remedy Old Categories of mistake 1. common mistake (shared) – no remedy unless extreme – res extincte (thing does not exist); res sua – never belonged to the vendor – if possible, just fix the mistake 2. mutual mistake (cross purposes) – if extreme, no contract (Raffles) 3. unilateral (one party) – usually, caveat emptor – buyer beware, no remedy under mistake (try unconscionable or something) Now: 1. 2. mistake as to the terms a. is there a reasonable interpretation (Hobbs – no remedy since dumb mistake) b. who takes the risks in the contract? mistake in assumptions – risk factors a. type of K b. position of parties – including caveat emptor (buy should have put it in the K) c. policy considerations d. seriousness of the mistake A. Mistake in the Terms of the Contract Hobbs v. Esquimalt & Nanaimo Railway Company (1899) SCR Facts: P. bought land from D. but D. thought it was just selling surface rights. What the case stands for: Unilateral mistake Majority – The alleged mistake was an unreasonable and careless one, and in view of the fact that the plaintiff went into possession under the contract, I do not think that it can be said to be unconscionable or highly unreasonable to enforce the specific performance of the contract. – Hobbs got choice of continuing contract as written or getting out entirely. Dissent – There was no contract – the company thought they were selling something different than what Hobbs thought he was buying. Raffles v. Wichelhaus (1864) HL Facts: A shipment was agreed upon to arrive on a certain ship named “Peerless” but arrived on a different “peerless” What the case stands for: There was no consensus ad idem and therefore no binding contract. (test for no contract due to a mutual mistake: no reasonably expected meaning (term had a true ambiguity) and there was no risk assumption in the contract) 12 Staiman Steel Ltd. v. Commercial & Home Buildings Ltd (1976) (On CA) Facts: The auctioneer auctioned off ‘all the rest’ of the steel. Issue: Was there a mistake as to if the steel that was in a pile already auctioned was included? Held: Using the reasonable person test, the building steel would not be included. If the RP would have included steel, vendee would have got damages. If had found a mistake by the vendor as to the term – (Raffles) then would have no contract at all. B. Mistake in Underlying Assumptions Bell v. Lever Brothers Ltd.(1932) Facts: D. bought out P. manager when there was a merger. They later found out that he had been acting improperly as manager. Lever Mistake: the terminability of the contract Bell mistake: did not know what he had done was wrong – claims mutual mistake Mistake (court stated): Common mistake that K was not terminable What the case stands for: If mistake operates at all it operates so as to negative or in some cases nullify consent. Mutual mistake and implied conditions whether as to existing or as to future facts raises the following question: “does the state of the new facts destroy the identity of the subjectmatter as it was in the original state of facts?” Ct: simply a mistake in the value of the K not sufficiently serious mistake. But in this case was more then quantity. Solle v. Butcher (1950) Facts: parties agreed to a rent that was higher than the rent mandated by rent control. Mistake: Both parties thought that the building was exempt from rent control What the case stands for: A contract is liable in equity to be set aside if the parties were under a common misapprehension either as to facts or as to their relative and respective rights, provided that the misapprehension was fundamental and that the party seeking to set it aside was not himself at fault. Scott v. Coulson (1903) Facts: Sold an insurance policy for Mr. Death on the assumption that he was alive. Mr. Death was dead. By the time the get to executing the actual document, one of the parties knew that he was dead. There was a cash surrender value that makes the contract worth more. Ultimately the bargain turned out to be different then when the parties first made it. Decision: Appeal must be dismissed. Did not grant relief. 1) Analogous to perished goods case. K about goods that do not exist. Not really true as we are not bargaining for Mr D, but for his life insurances 2) because the one party ws in the possession of facts that changed the game. This was very unfair in equity. This was dishonest in equity, so they will not permit a party to enforce the transaction WE have an underlying assumption that Mr. D is alive when they make this deal. On whom should we impose the lost of the risk. If we enforce, it will fall upon the vendor who will have to pay the higher amount. Factors: Type of contract – sale of insurance. They paid more for the cash surrender because of the possible future value. Maybe in the future before the policy comes to an end, the policy will be worth this more amount? May have to wait a long time. So what we are really buy/sell is the chance/bet about when Mr. D is going to die. So the subject matter of the contract has changed – once he is dead you are not buying the certainty not a chance. Different contract. very serious mistake C. Mistake as to Subsequent Events: Frustration Impossibility of Performance, both parties excused from K = basis of the contract gone (Safeway) 1. without fault of either party 2. the event was something unforeseen and therefore not allocated by the K 3. no in contemplation of the parties Paradine v. Jane (1647) - K for lease of land. Prince Rupert took over the land to fight battles. Lessee claims frustration of the contract so does not have to pay - Strict obligation of K – caveat emptor – should have put this in the K (even though this was unforeseeable) 13 Taylor v. Caldwell (1863) - relaxing the rule of absolute promises - rented hall. Hall burned down. Does not want to pay - court gave an implied condition – the hall will exist situations for relief (revoking the K)– personal K – if parties had thought about the possibility would have Ked it - where K is made on a particular assumption and this changes without any fault of either party Krell v. Henry (1870) - coronation cancelled, rooms rented for are not worth what they paid for - foundation of K was destroyed – revoke the K Capital Quality Homes v. Colwyn Construction (1975) Ontario (in England, would be different) - purchaser wants to develop the land - new zoning. Claims fundamental breach. Wants the deposit on the land back. - (1) no fault on either party - (2) assumption that in the future there would not be a big change - (3) this was a common venture, so clearly not in contemplation of the parties - the contract was frustrated, so give the deposit back Victoria Wood Dev. Corp. v. Ondrey (1977) (Ontario) Facts: The plaintiff bought land. It was rezoned to only be agricultural. The plaintiff had intended to divide and develop the land, but this was not in the contract. It was however, clearly a factor in the price. The pl claims that the K was frustrated and wants the deposit back like in Capital. Held: The K was NOT frustrated. Distinguish Capital in that the agreement in no way made it a condition. The risk was taken by the purchaser as this was not a joint venture. Frustrated Contracts Act BC Ch 166 Original doctrine of frustration was – if the K is frustrated, the contract was ended. If it had been part performed, the courts did not interfere. Every province enacted a statute to return the benefits under a contract that was frustrated. (restitution) KBK v. Canada Safeway (BC 2001 Ct of A) Facts: The plaintiff bought the property as described as a prime redevelopment opportunity with a specified floor space ratio. Before the contract was completed, the land was rezoned to 1/10 th the floor space – redevelopment impossible. KBK claimed that the K was frustrated and that Safeway must give the deposit back under the frustrated contracts act. Found: The contract was frustrated and KBK should get the money back. (1) without fault of either party (2) change in zoning was unforeseeable (3) beyond contemplation of the parties (4) so fundamental to the K that the change totally changed the K under the act, KBK should get the deposit back - distinguished Victoria Wood in that Safeway had more knowledge about what the venture was - nothing in the K to say who allocates this risk (the exemption clause was too general) we think that this decision is probably wrong - when you buy property, you are taking the risk, that is what is being allocated – esp for a big developer - the judgement ignored the express allocation of risk, the risk was not totally outside - all that would have been lost was the 1st instalment, specific performance could not have been used. Even expectation damages could have been argued against since the K was not complete, consideration flowing etc. 14