2012 社会经济研究中心 Issues Related to the Implementation of the Minimum Wages Order 2012

社会经济研究中心

2012

最低薪金法令之落实

Issues Related to the Implementation of the Minimum Wages Order 2012

隆雪中华总商会研讨室 / KLSCCCI Seminar Room

2013 年 1 月 19 日 / 19 th January 2013

最低薪金法令之落实

Implementation of Minimum Wage

最低薪金

•

雇主须缴付雇员的最低每小时、 每天或每月工资。

(国际劳工组织)

•

由国家薪金咨询理事会 (NWCC) 在国家薪金咨询理

事会 (Act 732) 第 2 条确定所指“基本工资” 。

Minimum wages

•

The lowest hourly, daily or monthly wages that employers shall pay the employees. (ILO)

•

Means “Basic Wages” as determined by the National

Wages Consultative Council (NWCC) under section 2

National Wages Consultative Council (Act 732).

社会经济研究中心 / Socio-Economic Research Centre

2

最低薪金法令之落实

Implementation of Minimum Wage

目的:

• 确保满足雇员及其家属的基本需要;

• 为雇员提供足够的社会保障;

• 鼓励工业通过投资于更高的技术和提高劳动生产率,提升价

值链;和

• 减少国家对非熟练外劳的依赖。

Objectives:

• To ensure basic needs of employees and their families are met;

• To provide sufficient social protection to employees;

• To encourage industry to move up the value chain by investing in higher technology and increase labour productivity; and

• To reduce nation’s dependence on unskilled foreign labour.

社会经济研究中心 / Socio-Economic Research Centre

3

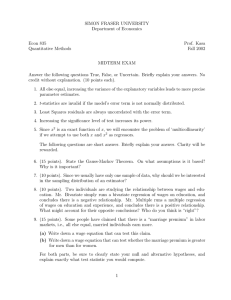

最低薪金法令

Minimum Wages Order

•

宪报通知的日期: 2012 年 7 月 16 日

•

Date of gazette notification: 16 July 2012

正式生效

Commencement Date

向理事会申请延期

Apply to Council for deferment

超过 5 名雇员

More than five employees

2013 年 1 月 1 日

1 January 2013

2012 年 10 月 3 日

之前

Before 3

October 2012

5 名雇员或以下

Five employees or less

2013 年 7 月 1 日

1 July 2013

2013 年 4 月 2 日

之前

Before 2 April

2013

社会经济研究中心 / Socio-Economic Research Centre

4

最低薪金法令

Minimum Wages Order

• 不限于雇员人数,雇主根据马来西亚标准职业分类

(MASCO)

的分类下进行专业活动:

科学和工程

/

健康

/

教学

/

业务和行政管理

/

信息和通信技

术

/

法律、 社会和文化

/

酒店、零售及其他服务。

• Regardless of the number of employees employed, an employer who carries out a professional activity classified under the Malaysia Standard Classification of Occupations

(MASCO) :

Science and Engineering / Health / Teaching / Business and

Administration / Information and Communications Technology

/ Legal, Social and Cultural / Hospitality, Retail and Other

Services.

社会经济研究中心 / Socio-Economic Research Centre

5

最低薪金法令

Minimum Wages Order

• 本法令不适用国内佣人(根据

1955

年就业法令

[Act 265]

,

第

2

条,沙巴劳工条例

[

第

67

章

]

第

2

条和砂拉越劳工条例

[

第

76

章

]

第

2

条定义)。

• 例如:做饭工人、 家庭佣人、孩子的护士、园丁、洗

衣女工、看守员和司机。

• This Order shall not apply to a domestic servant as defined under section 2 of the Employment Act 1955 [Act 265], section 2 of the Sabah Labour Ordinance [Cap. 67] and section

2 of the Sarawak Labour Ordinance [Cap. 76]

• Example: a cook, house-servant, child’s nurse, gardener, washerwoman, watchman and driver.

社会经济研究中心 / Socio-Economic Research Centre

6

区域

Region

马来半岛

Peninsular Malaysia

沙巴与纳闽

Sabah and Labuan

砂拉越

Sarawak

最低薪金

Minimum Wages

按政府核定的比率

Approved Rates by

Government

每月

Monthly Rate

(RM)

每小时

Hourly (RM)

900 4.33

800

800

3.85

3.85

社会经济研究中心 / Socio-Economic Research Centre

7

处罚

Penalty

•

在此法令下,没有遵守最低薪金的雇主,一旦被

检举,轻则每名员工最高罚款 1 万令吉,重则入狱

2 年,或两者兼施。

•

Under the Act, employers which do not comply with the minimum wage policy risk a maximum fine of

RM10,000 per worker, or two years’ jail or both.

Source: www.mohr.gov.my

社会经济研究中心 / Socio-Economic Research Centre

9

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

对外劳的依赖是无法避免

• 马来西亚在 2012 年拥有 1280 万的员工。

• 3.1% 的劳动力或大约 400,000 在失业。

• 大约 400 万外国工人。

• 没有足够的本地工人取代外国工人。

Dependency on Foreign Workers is Unavoidable

• Malaysia workforce: 12.8 million (2012).

• 3.1% (400,000) unemployed.

• Approximately 4 million foreign workers.

• Not enough local workers to replace foreign workers.

社会经济研究中心 / Socio-Economic Research Centre

10

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

制造业的性质

• 制造行业不能有一个固定的工资制度,由于津贴是基于生产力和

担当作为奖励的作用,例如“出席津贴”和“轮班津贴”。

• 这些津贴,包括通常在制造业中支付的餐费和交通,范围从每名

工人每月 200 令吉到 300 令吉 (马来西亚塑料制造厂商协会 MPMA

估计),随公司、行业和地理位置而定。

Nature of Manufacturing Industry

• The manufacturing sector is not able to have a fixed wage system as incentives are needed for “attendance allowance” and “shift allowance”.

• These allowances, including meal and transport that are typically paid in the manufacturing, range from RM200 to RM300 per worker per month

(Malaysian Plastics Manufacturers’ Association computation), depending on the company, industry and geographical location.

社会经济研究中心 / Socio-Economic Research Centre

11

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

雇主的成本影响 / Cost Impact on Employers

• 目前雇员的净薪(包括加班费、 奖金、 轮班、 出席和其他津贴)特别

是制造行业以按照 MPMA 的计算,范围从本地工人的每人每月 RM1,200

到 RM1,500 ,和外国工人每人每月 RM1,000 到 RM1,300 。

• The current take home pay (inclusive of overtime, bonus, shift, attendance and other allowances) for the employees typical in the manufacturing industry as computed by MPMA ranges from RM1,200 to RM1,500 for local workers and

RM1,000 to RM1,300 for foreign workers per worker per month.

社会经济研究中心 / Socio-Economic Research Centre

12

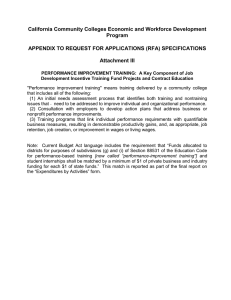

雇主的成本影响 / Cost Impact on Employers

Source: Malaysian Plastics Manufacturers’ Association (MPMA)

社会经济研究中心 / Socio-Economic Research Centre

13

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

雇主的成本影响

• 至于雇主,提高基本薪金(或“最低工资”)从现有工资率到每月

RM900 将会大幅增加劳工成本,加上成本的乘数效应的因素,例如加

班、 奖励、 津贴、奖金、 EPF 、征税和其他的外国工人费用,将会看

到雇主的成本,以 MPMA 的计算,逐步升级到超过每月 RM2,100 。

• 可以估计本地工人的劳工成本增加将占约 28% 和外国工人约 39% 。

Cost Impact on Employers

• Raising the Basic Salary to RM900 per month would have a substantial increase in labour cost, after factoring in the multiplier effect of cost such as overtime, incentive, allowances, bonuses, EPF, levy and other expenses for foreign workers, as computed by MPMA, employer’s cost escalated to more than RM2,100 per month.

• It can be estimated that the increase in labour cost for local workers will be about 28% and 39% for foreign workers.

社会经济研究中心 / Socio-Economic Research Centre

14

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

冲击效应

• 据马来西亚国家新闻社 (2012 年 5 月 3 日)的报道,马来西亚泰

国商会主席, Yap Swee Chuan 先生指出在 2012 年 4 月实施最低工

资已导致更多泰国雇主与雇员之间的工业纠纷。

• 雇主不只是增加每月领取 900 令吉的雇员的工资,他们还得调

整每月领取 900 令吉以上的雇员的工资。

Knock-On Effect

• As reported by Bernama (3 May 2012), the Chairman of the Malaysia-

Thai Chamber of Commerce, Mr Yap Swee Chuan, observed that the implementation of minimum wage in April 2012 has resulted in more industrial disputes between employers and employees in Thailand.

• Employers will not only have to top up the wages of employees who are drawing RM900 per month, they will also have to adjust the salary of employees that are drawing above RM900 per month.

社会经济研究中心 / Socio-Economic Research Centre

15

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

制造成本的影响

• 根据 MPMA ,大多数制造企业如塑料业,已经在少过 5% 的

微薄利润率下运作,或是已经承受亏损的痛苦。

• 在每月的平均基本薪金的 550 令吉到 700 令吉的增加到每月

900 令吉,如果按照 MPMA 的计算,从计算工资中排除奖励

和津贴,会增加制造成本的 3% 到 7% 。

Impact on Manufacturing Cost

• According to MPMA, most manufacturing companies such as the plastics industry are already operating on a thin profit margin of below

5% or are already suffering losses.

• An increase in the average Basic Salary of RM550-RM700 per month to RM900 per month will increase manufacturing cost by 3%-7%, if the incentives and allowances are excluded from wage calculation as computed by MPMA.

社会经济研究中心 / Socio-Economic Research Centre

16

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

中小企业的影响 – 微型企业

• 根据马来西亚中小企业公会,中小型企业的利润仅有 3% 至

5% 。一些目前亏本经营。

• 突然大幅度增加工资和劳工相关成本,将擦拭掉很大部分袖

珍型的利润或导致更大的亏损。

Impact on SMEs – Micro-enterprises

• According to the SMI Association of Malaysia, the profits of

SMEs are only 3% to 5%. Some are currently operating at a loss.

• A sudden and substantial increase in wages and labour related cost will wipe off a large portion of the miniscule profits or cause even bigger losses.

社会经济研究中心 / Socio-Economic Research Centre

17

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

就业影响

• 大多数制造商特别是中小型企业无力吸收突然和大量增加的

生产成本,将会严重削弱大多数公司而导致大规模的裁员。

加薪的良好意图可能会导致工人最终失去他们的工作, 这将

是一个具有讽刺意味的事。

Impact on Employment

• The inability of most manufacturers particularly the SMEs to absorb the sudden and substantial increase in production cost will cripple most companies which will lead to massive layoffs.

It will be an irony that the good intentions of a pay rise may lead to workers losing their jobs eventually.

社会经济研究中心 / Socio-Economic Research Centre

18

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

通膨影响

• 为了弥补生产成本的增加,有必要将它转移给消费者,否则,

如果总成本超过收入,企业将会倒闭。

• 将这成本的增加转移给消费者,只会引起对公众的通胀影响。

这将否定了靠工资为生的人获取增加工资的好处。据由马来西

亚泰国商会报道,这已在泰国体会到,在实施最低工资后,曼

谷和周边省份的生活费用已增加。

Impact on Inflation

• As increase in cost of production will have to be recovered by passing it on to consumers, failing which the enterprise will collapse if total costs exceeds revenue.

• Passing this increase in cost to consumers will only have an inflationary effect on the general public. This will negate the benefits of wage earners having an increase in wages.

社会经济研究中心 / Socio-Economic Research Centre

19

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

工资和收入分配的差异 / Differential in Wages and Income Distribution

社会经济研究中心 / Socio-Economic Research Centre

20

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

工资和收入分配的差异

• 马来西亚半岛内或在沙巴 / 砂拉越的不同地区有不同的生活费用。

• 在 2009 年,沙巴的家庭平均收入每月 883 令吉,与玻璃市的 752 令吉 、

吉兰丹的 641 令吉、吉打的 762 令吉和登嘉楼的每月 783 令吉对照。

• 2010 年各州中小型企业的平均每月薪水和工资(包括佣金、 加班费、

奖金和其他现金津贴),吉兰丹的每月平均是 531 令吉 、玻璃市 736 令吉 、

登嘉楼的 757 令吉和吉打的 881 令吉,与沙巴的 880 令吉相比。

Differential in Wages and Income Distribution

• Different areas within Peninsular Malaysia or in Sabah/Sarawak have varying cost of living.

• In 2009, Sabah has an average household income of RM883 per months as oppose to

Perlis at RM752; Kelantan at RM641, Kedah at RM762 and Terengganu at RM783 per month.

• In 2010, average monthly salary and wages (inclusive of commission, overtime, bonus and other cash allowances) of SMEs, Kelantan’s monthly average was at RM531; Perlis at RM736; Terengganu at RM757 and Kedah at RM881 compared to Sabah at RM880.

社会经济研究中心 / Socio-Economic Research Centre

21

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

工作场所中的不调和

• 国家薪金咨询理事会要求雇主在一位政府代表的面前与雇员

谈判基本工资和固定津贴的组成。

• 雇主和雇员之间对最低工资不收敛的谅解将产生冲突和工作

场所中的不调和,而引起生产力降低。

Disharmony in the Workplace

• The NWCC requests employers to negotiate with employees on the composition of basic wage and fixed allowances in the presence of a government representatives.

• The non-convergence of understanding between employers and employees on minimum wage will create conflict and disharmony in the workplace and result in lower productivity.

社会经济研究中心 / Socio-Economic Research Centre

22

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

有利于雇员的政府

• 政府推出了许多对工人友好的人力资源立法机关。他们是由私人

界雇主付费而推广的。这些包括最低工资、 强制性退休年龄、外

国工人的医疗保险和外国工人的征税。这些措施,将会增加雇主

做生意的成本。

• 作为一个自由、 开放、 竞争性的经济体系,政府应该让自由市

场运行来决定价格水平,包括私人界的工资。

Pro-Employee Government

• The government has introduced many human resource legislatures that are workers’ friendly. They are introduced at the expense of private sector’s employers. These include the minimum wage, the mandatory retirement age, medical insurance for foreign workers and foreign workers’ levy. These measures have and will increase the employers’ cost of doing business.

• As an open, free and competitive economy, the government should leave it to market forces to determine price levels including wages in the private sector.

社会经济研究中心 / Socio-Economic Research Centre

23

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

4 千 2 百份请愿书

• 国家薪金咨询理事会( NWCC )于 2012 年 11 月 10 日在人力资源部的办

事处会见了来自吉打、登嘉楼和民都鲁的代表。代表们被指示,在 3 天内

提供 3 年连续赤字的帐目,以便允许考虑上诉。

• NWCC 的这一项行动没有任何意义,因为任何具有三年连续亏损的公司

将不得不关闭。相反的, NWCC 应该关注这些公司,因他们要遵守最低薪

金制,而将面临亏本经营。

4,200 Petitions

• The NWCC met with representatives from Kedah, Terengganu and Bintulu on

10 November 2012 in the office of the Ministry of Human Resources. The representatives were instructed to provide 3 years of continuous deficit accounts within 3 days so that the appeals could be considered.

• This action by NWCC does not make sense as any company with three years of continuous loss would have to close shop. The NWCC should instead request these companies that they will operate at a loss if they have to comply with MWO.

社会经济研究中心 / Socio-Economic Research Centre

24

减轻最低薪金之落实的

建议

Recommendation to Mitigating the Implementation of Minimum

Wages

社会经济研究中心 / Socio-Economic Research Centre 25

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

1.

由于实施最低薪金制后,外劳所赚取的收入会随之增加,

甚至比本地员工还要多,因此建议政府将现在由雇主缴

交的外劳人头税,改由外劳自行承担,以减少外汇的流

失;

2.

由于微型企业在实施最低薪金制时将受到沉重压力,对

于非专业服务的微型企业,应推迟其执行 12 个月至 2014

年之后;

1. The Government should revert the payment of levy of RM1,250 per year from employers to employees (foreign workers) as was practiced earlier as the increase in wage due to MWO will more than cover the payment of levy by foreign workers;

2. As the micro-enterprises will be severely stressed when minimum wage is implemented, non-professional micro-enterprises the implementation of Minimum Wage be delayed for twelve months;

社会经济研究中心 / Socio-Economic Research Centre

26

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

3.

为了减轻中小企业的财务负担,建议将中小企业可课税

收入增加至每年 1 百万令吉,并将企业所得税率降至 18% ,

以减少中小企业所受冲击,得以维持他们的业务;

4.

鉴于西马部分州属如吉兰丹、玻璃市、吉打和登嘉楼,

与沙巴有着类似薪资结构及家庭收入,其最低薪金应当

是 800 令吉,而非 900 令吉;

3. To mitigate the financial burden of minimum wage of SMEs,

SMEs with a chargeable income of less than RM 1,000,000 per year should be levied a corporate tax rate of 18%, to cushionoff the effect to sustain their business;

4. States like Kelantan, Perlis, Kedah and Terengganu should have a minimum wage of RM800 as they have comparable salary & wages and household income as Sabah;

社会经济研究中心 / Socio-Economic Research Centre

27

最低薪金的相关问题

Issues Related to the Implementation of the Minimum Wages

5.

在制定了是次的最低薪金后,政府往后检讨时,应实行

与生产力挂钩的薪金制, 这更能让雇主接受,同时能够

有效地确保员工生产力与其薪酬成正比;

6.

国家薪金咨询理事会应认真考虑所收到的 4 千 2 百份请愿

书一律给予至少 6 个月的宽限期,让有关雇主能够有足够

的时间与员工谈判,并作出相关准备。

5. The Government should implement productivity-linked wage which is more acceptable to employers. There is no need for review of minimum wage once this is implemented. This will remove the bureaucratic red tape in reviewing minimum wage;

6. The 4,200 petitions should be considered seriously by the

NWCC. The petitioner should be granted a deferment of at

least 6 months.

社会经济研究中心 / Socio-Economic Research Centre

28

Image Banner Here

社会经济研究中心

谢谢

THANK YOU

Address : 6 th Floor, Wisma Chinese Chamber,

No. 258, Jalan Ampang, 50450 Kuala Lumpur.

Tel

Fax

: 603- 4260 3116 / 3119

: 603- 4260 3118

: serc@acccimserc.com