Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

CHAPTER 9

Reporting and Analysing Long-Lived Assets

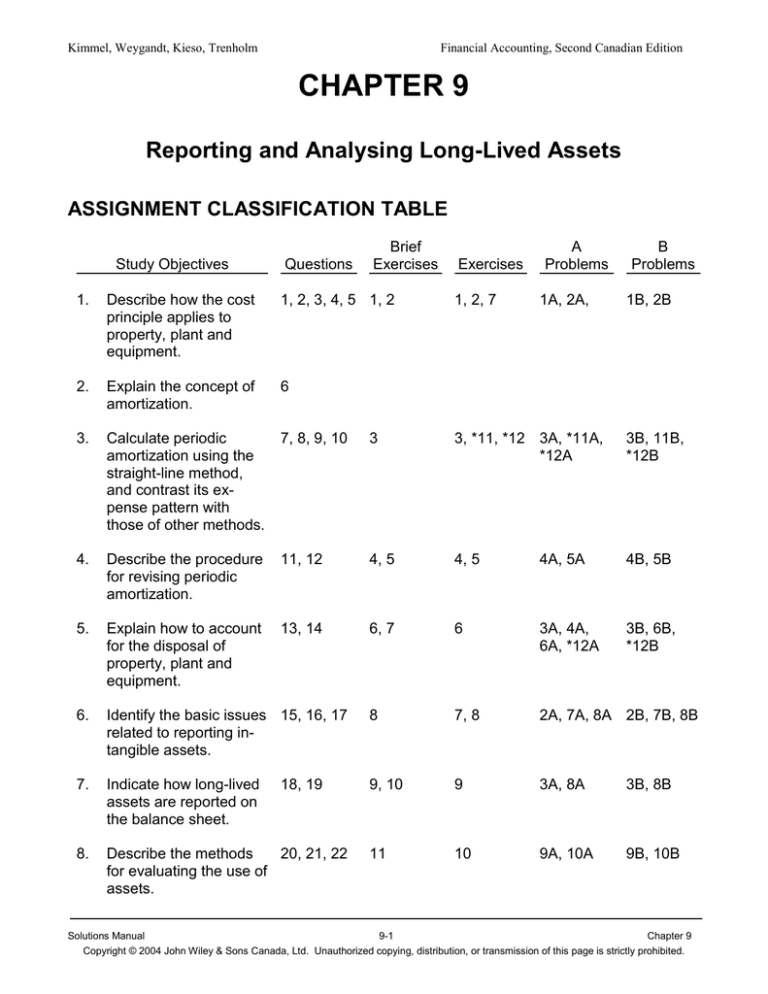

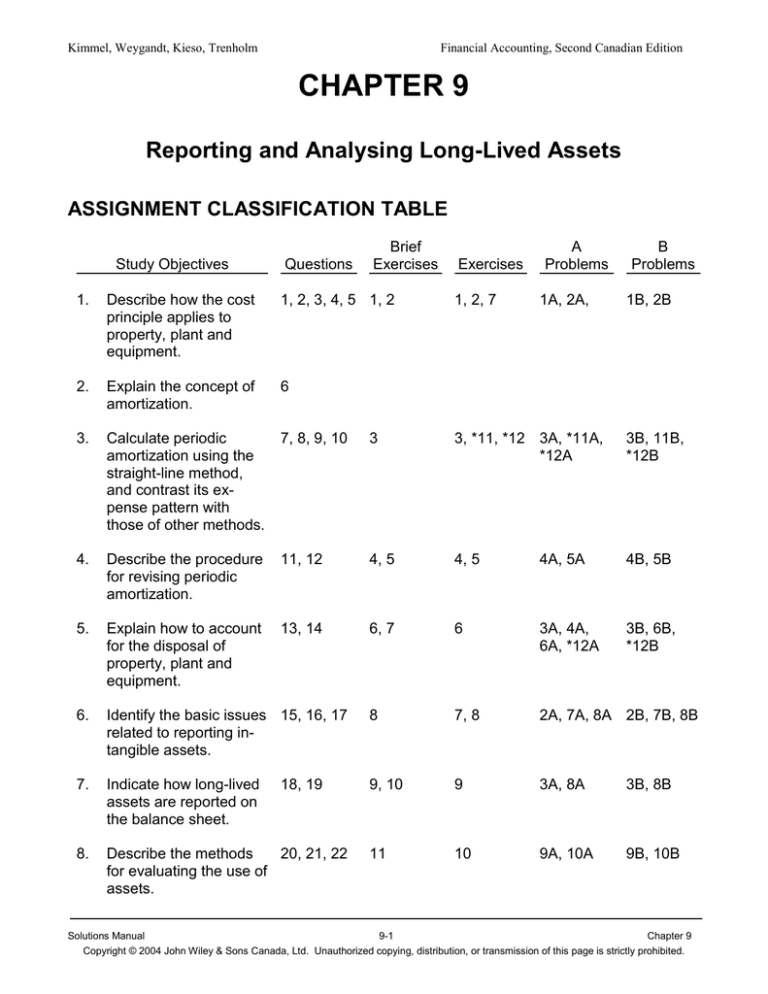

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Questions

Brief

Exercises

Exercises

1A, 2A,

B

Problems

1.

Describe how the cost

principle applies to

property, plant and

equipment.

1, 2, 3, 4, 5 1, 2

2.

Explain the concept of

amortization.

6

3.

Calculate periodic

amortization using the

straight-line method,

and contrast its expense pattern with

those of other methods.

7, 8, 9, 10

3

3, *11, *12 3A, *11A,

*12A

3B, 11B,

*12B

4.

Describe the procedure

for revising periodic

amortization.

11, 12

4, 5

4, 5

4A, 5A

4B, 5B

5.

Explain how to account

for the disposal of

property, plant and

equipment.

13, 14

6, 7

6

3A, 4A,

6A, *12A

3B, 6B,

*12B

6.

Identify the basic issues 15, 16, 17

related to reporting intangible assets.

8

7, 8

2A, 7A, 8A 2B, 7B, 8B

7.

Indicate how long-lived

assets are reported on

the balance sheet.

9, 10

9

3A, 8A

3B, 8B

8.

Describe the methods

20, 21, 22

for evaluating the use of

assets.

11

10

9A, 10A

9B, 10B

18, 19

1, 2, 7

A

Problems

1B, 2B

Solutions Manual

9-1

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Study Objectives

*9. Calculate periodic

amortization using the

declining-balance

method and the unitsof-activity method.

Financial Accounting, Second Canadian Edition

Questions

Brief

Exercises

Exercises

*23

*12, *13

*11, *12

A

Problems

B

Problems

*11A, *12A *11B, *12B

Solutions Manual

9-2

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

Simple

20-30

1A

Determine acquisition cost.

2A

Classify expenditures.

Moderate

15-20

3A

Record property, plant and equipment transactions;

prepare partial balance sheet.

Moderate

40-50

4A

Revise amortization; calculate gain or loss on disposal.

Moderate

30-40

5A

Classify operating and capital expenditures.

Moderate

10-15

6A

Record disposal of equipment.

Simple

15-20

7A

Correct errors in recording and amortizing intangible

assets.

Moderate

30-40

8A

Record intangible asset transactions; prepare intangible assets section.

Moderate

30-40

9A

Calculate and evaluate ratios.

Moderate

30-40

10A

Evaluate ratios.

Moderate

20-30

*11A

Calculate amortization under straight-line and declining balance methods.

Moderate

30-40

*12A

Calculate amortization under straight-line and unitsof- activity methods; calculate total expense over life

of asset.

Moderate

30-40

Simple

20-30

1B

Determine acquisition cost.

2B

Classify expenditures.

Moderate

15-20

3B

Record property, plant and equipment transactions;

prepare partial balance sheet.

Moderate

40-50

4B

Revise amortization.

Moderate

30-40

5B

Classify operating and capital expenditures.

Moderate

10-15

Solutions Manual

9-3

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Problem

Number

6B

Financial Accounting, Second Canadian Edition

Description

Record disposal of equipment.

Difficulty

Level

Simple

Time

Allotted (min.)

15-20

7B

Correct errors in recording and amortizing intangible

assets.

Moderate

30-40

8B

Record intangible asset transactions; prepare intangible assets section.

Moderate

30-40

9B

Calculate and evaluate ratios.

Moderate

30-40

10B

Evaluate ratios.

Moderate

20-30

*11B

Calculate amortization under straight-line and declining balance methods.

Moderate

30-40

*12B

Calculate amortization under straight-line and declining balance methods; calculate total expense over life

of asset.

Moderate

30-40

Solutions Manual

9-4

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ANSWERS TO QUESTIONS

1.

For long-lived assets, the cost principle states that long-lived assets are recorded at cost,

which consists of all expenditures necessary to acquire the asset and make it ready for its intended use. The matching principle requires that the cost of a long-lived asset be amortized

to expense over the asset’s useful life.

2.

The cost principle has persisted because it provides information that is objective and verifiable. Market values are subjective. It is a situation where reliability takes precedence over relevance.

3.

(a)

(b)

4.

An impairment loss is recognized when the value of a long-lived asset is written down to

market value. The impairment loss is only recognized when there has been a permanent decline in value, which is assessed using specific recoverability tests. Once an impairment loss

has been recognized the book value of the asset is not subsequently adjusted for any recovery in value.

5.

The primary advantages of leasing are (1) reduced risk of obsolescence, (2) low down payment, (3) shared tax advantages, (4) reduced recorded assets and liabilities, and (5) asset financing that might not otherwise be available.

6.

You should explain to the president that amortization is a process of allocating the cost of a

long-lived asset to expense over its service (useful) life in a rational and systematic manner.

Recognition of amortization is not intended to result in the accumulation of cash for replacement of the asset.

7.

(a) Useful life is expressed in years under the straight-line and declining-balance methods

and in units of activity under the units-of-activity method.

(b) The pattern of periodic amortization expense over useful life is constant under the

straight-line method, accelerated in the early years of declining-balance method and

variable under the units-of-activity method.

8.

The effects of the three methods on annual amortization expense are: Straight-line—

constant amount–-expense is constant and effect on net earnings is smooth. Units-ofactivity—varying amounts–-the expense increases with an increase in the level of activity

and net earnings decrease. Declining-balance—decreasing amounts–-the expense declines

over time and net earnings increase. In the early years of an asset’s life, declining-balance

and units-of-activity generally lead to higher amortization and lower net earnings than the

straight-line method. Over the total life of the asset, total amortization will be the same regardless of the amortization method chosen.

In a cash transaction, cost is equal to the cash paid.

In a noncash transaction, cost is equal to the cash equivalent price, which is the fair

market value of the asset given up, if determinable. If not, the fair market value of the

asset received is used.

Solutions Manual

9-5

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

9.

Since Morgan uses the straight-line amortization method, its amortization expense will be

lower in the early years of an asset’s useful life as compared to using an accelerated method. Fairchild’s amortization expense in the early years of an asset’s useful life will be higher

as compared to the straight-line method. Morgan’s net earnings will be higher than

Fairchild’s in the first few years of the asset’s useful life. These differences will impact the

amortization expense, accumulated amortization and net earnings of the companies making

comparison of their results and financial position difficult. In reality, the choice of amortization method results in an artificial, timing difference only and should be ignored, if possible,

in comparing financial positions.

10. Yes, income tax regulations allow a company to use a different amortization method on the

tax return than is used in preparing financial statements. Tax regulations require the taxpayer

to use the single-declining-balance method, regardless of which method is used in preparing

financial statements. Lucille Corporation’s motivation for using the straight line method for financial reporting is to ensure that the amortization method selected provides the best matching of revenue to expense.

11. Operating expenditures are ordinary repairs made to maintain the operating efficiency and

expected productive life of the asset. Capital expenditures are additions and improvements

made to increase efficiency, productivity, or expected useful life of the asset. Operating expenditures are recognized as expenses when incurred; capital expenditures are generally

debited to the asset account affected.

12. A revision of amortization is made in current and future years but not retroactively. The rationale is that continual restatement of prior periods for what is merely a change in estimate

would adversely affect the reader’s confidence in the financial statements.

13. In a sale of long-lived assets, the book value of the asset is compared to the proceeds received from the sale. If the proceeds of the sale exceed the book value of the asset, a gain

on disposal occurs. If the proceeds of the sale are less than the book value of the asset sold,

a loss on disposal occurs.

14. The machine and related accumulated amortization should continue to be reported on the

balance sheet without further amortization or adjustment until the asset is retired. Reporting

the asset and related accumulated amortization on the balance sheet informs the reader of

the financial statements that the company is still using the asset. Once an asset is fully amortized, even if it is still being used, no additional amortization should be taken on this asset. In

no situation can the amortization on the asset exceed the cost of the asset.

15. The student is not correct. Only intangible assets with limited lives such as patents and copyrights are amortized. Intangibles with unlimited lives such as trademarks are not amortized

but their book value is assessed annually for impairment and a loss recognized if a decline in

value has occurred.

Solutions Manual

9-6

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

16.

Goodwill is the value of many favourable attributes that are intertwined in the business enterprise. Goodwill can be identified only with the business as a whole and, unlike other assets, cannot be sold separately. Goodwill can only be sold if the entire business is sold.

17. Research and development costs present several accounting problems. It is sometimes difficult to assign the costs to specific projects, and there are uncertainties in identifying the extent and timing of future benefits. As a result, the CICA requires that research costs are always recorded as an expense and development costs are usually recorded as an expense. If

future benefits are identifiable for development costs, then these development costs can be

capitalized.

18. Long-lived assets should be reported on the balance sheet at cost less accumulated amortization. The statement of earnings includes amortization expense and any gain or loss on

disposal of long-lived assets. The cash flow statement will include any cash paid to purchase

long-lived assets and any cash received on their disposal.

19. The notes to financial statements should disclose the balance of the major classes of assets

and the amortization method(s) and rates used.

20. (a)

(b)

Grocery stores usually have a high asset turnover and a low profit margin.

Car dealerships normally have a low asset turnover and a high profit margin.

21. ($ in U.S. millions)

Return on assets:

$132

= 25.3%

$521

22.

Asset turnover:

$572

= 1.10 times

$521

The return on assets ratio measures the return being generated by each dollar invested in

the business (net earnings ÷ average total assets). The return on assets can also be calculated by multiplying the profit margin by the asset turnover ratio. The profit margin

measures how effective the business is at generating earnings from its sales and the asset

turnover measures how well the company can generate sales from a given level of assets.

Together, the two ratios can be combined to measure how effective a company is at generating earnings from a given level of assets (return on assets). Therefore if a company wants

to improve its return on assets, it can do so by either by increasing the margin it generates

from each dollar of sales (profit margin) or by increasing the volume of goods that is sells

(asset turnover).

Solutions Manual

9-7

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

*23. Straight-line and units-of-activity measures apply the amortization criteria to the original cost

of the assets over a fixed period (in years or in units), which must be reduced by salvage

value to get an accurate representation of the amortizable cost of the assets to the company. Because the declining-balance method applies the amortization criteria, not to the original cost, but to a declining book value, the original cost is used instead of the amortizable

cost. Applying a fixed percentage rate to a declining balance will always result in an ending,

residual amount. Salvage value is considered in the declining-balance method in that the

asset is never amortized below its salvage value, so in effect, this residual amount is adjusted to equal salvage value.

Solutions Manual

9-8

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 9-1

All of the expenditures should be included in the cost of the land. Therefore, the cost of the land is

$56,000 ($50,000 + $2,500 + $3,500).

BRIEF EXERCISE 9-2

The cost of the truck is $18,400 (cash price $18,000 + painting and lettering $400). The expenditures for insurance and motor vehicle licence should be expensed, not added to the cost of the

truck.

BRIEF EXERCISE 9-3

Amortizable cost of $40,000 ($42,000 – $2,000). With a 4-year useful life, annual amortization is

$10,000 ($40,000 ÷ 4). Under the straight-line method, amortization is the same each year. Thus,

amortization is $10,000 for both the first and second years.

BRIEF EXERCISE 9-4

Book value, Jan. 1, 2004 ($32,000 - $15,000) ......................................................

Less: Salvage value .............................................................................................

Amortizable cost ...................................................................................................

Remaining useful life ............................................................................................

Revised annual amortization ($15,000 ÷ 2) ..........................................................

$17,000

2,000

15,000

2 years

$ 7,500

BRIEF EXERCISE 9-5

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

O

C

C

O

C

O

O

C

C

O

Solutions Manual

9-9

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 9-6

(a)

(b)

Accumulated Amortization—Delivery Equipment .....................

Delivery Equipment ..............................................................

41,000

Accumulated Amortization—Delivery Equipment .....................

Loss on Disposal ......................................................................

Delivery Equipment ..............................................................

38,000

3,000

Cost of delivery equipment

Less: Accumulated amortization

Book value at date of disposal

Proceeds from sale

Loss on disposal

41,000

41,000

$41,000

38,000

3,000

0

$ 3,000

BRIEF EXERCISE 9-7

(a)

(b)

Amortization Expense ($14,000 X 9/12) ...................................

Accumulated Amortization—Office Equipment ...................

10,500

Cash .........................................................................................

Accumulated Amortization—Office Equipment .........................

Gain on Disposal .............................................................

Office Equipment .............................................................

21,000

52,500

Cost of office equipment

Less: Accumulated amortization

Book value at date of disposal

Proceeds from sale

Gain on disposal

*$42,000 + $10,500 = $52,500

10,500

1,500

72,000

$72,000

52,500*

19,500

21,000

$ 1,500

Solutions Manual

9-10

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 9-8

Goodwill is an intangible asset with an indefinite useful life. Intangible assets with indefinite useful

lives are not amortized but their value must be reviewed annually and an impairment loss recorded

if the asset’s market value permanently falls below its book value. If the decline in value of Descartes Systems Group’s goodwill is assessed as being permanent, the goodwill should be reported

at $17.6 million and an impairment loss of $86.7 ($104.3 – $17.6) million recorded on the company’s statement of earnings.

BRIEF EXERCISE 9-9

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

(m)

(n)

PPE

NA

I

I

NA

NA

PPE

NA

I

PPE

PPE

I

PPE

I

Solutions Manual

9-11

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 9-10

CANADIAN TIRE CORPORATION, LIMITED

Balance Sheet (Partial)

December 28, 2002

(in millions)

Property, plant and equipment

Land .....................................................................

Buildings ...............................................................

Less: Accumulated amortization—buildings .........

Computer software ...............................................

Less: Accumulated amortization, computer

software ..............................................

Fixtures and equipment ........................................

Less: Accumulated amortization—

fixtures and equipment ........................

Assets under capital lease....................................

Less: Accumulated amortization –

assets under capital lease ..................

Leasehold improvements .....................................

Less: Accumulated amortization –

leasehold improvements .....................

Less: Assets held for disposal ($87.5 – $37.3) .....

Total property, plant and equipment ..............

Goodwill ......................................................................

$ 613.9

$1,806.3

558.8

$172.4

1,247.5

116.9

$392.9

55.5

270.5

$23.5

122.4

7.2

$179.2

16.3

57.2

122.0

2,177.6

(50.2)

2,127.4

32.8

BRIEF EXERCISE 9-11

($ in millions)

Return on assets

$111.5

= 2.5%

($4,275.7 $4,534.2) 2

Asset turnover

$7,383.8

= 1.7 times

($4,275.7 $4,534.2) 2

Solutions Manual

9-12

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*BRIEF EXERCISE 9-12

The declining-balance rate is 25% (1/4 X 1) and this rate is applied to book value at the beginning of the year. The calculations are:

Book Value

Year 1

Year 2

$42,000

($42,000 – $10,500)

X

Rate

=

Amortization

25%

25%

$10,500

$7,875

*BRIEF EXERCISE 9-13

The amortizable cost per unit is 20 cents per km. calculated as follows:

Amortizable cost ($34,500 – $500) ÷ 125,000 = $0.272

2003

2004

50,000 km X $0.272 = $13,600 amortization expense

40,000 km X $0.272 = $10,880 amortization expense

Solutions Manual

9-13

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 9-1

(a)

Under the cost principle, the acquisition cost for property, plant and equipment includes all

expenditures necessary to acquire the asset and make it ready for its intended use. For

example, the cost of factory machinery includes the purchase price, freight costs paid by

the purchaser, insurance costs during transit, and installation costs.

(b)

1.

2.

3.

4.

Delivery Truck

Delivery Truck

Licence Expense

Maintenance Expense

5.

6.

7.

8.

Prepaid Insurance

Land

Land Improvements

Property Tax Expense

EXERCISE 9-2

(a)

(b)

Cost of land

Cash paid ................................................................................

Net cost of removing warehouse ($6,600 – $1,700) ...............

Legal fee .................................................................................

Total ................................................................................

$100,000

4,900

1,300

$106,200

The architect’s fee ($7,800) should be debited to the building account. The cost of the

driveways and parking lot ($14,000) should be debited to Land Improvements.

EXERCISE 9-3

2004 amortization = $14,000 X 9/12 = $10,500

2005 amortization = $14,000

$96,000 - $12,000

Straight - line method :

= $14,000 per year

6

Solutions Manual

9-14

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 9-4

(a)

Type of Asset

Book value, January 1, 2004

Less: Salvage value

Amortizable cost

Building

$458,0001

62,000

$396,000

153

24

$ 26,400

$ 35,200

Revised remaining useful life in years

Revised annual amortization

Equipment

$74,0002

3,600

$70,400

1 $800,000

- $342,000 = $458,000

- $46,000 = $74,000

3 25 - 10 = 15

44 - 2 = 2

2 $120,000

(b)

Dec. 31

Amortization Expense—Building ..........................

Accumulated Amortization—Building ...........

26,400

Amortization Expense—Equipment .....................

Accumulated Amortization—Equipment .......

35,200

26,400

35,200

EXERCISE 9-5

MEMO

To:

From:

Date:

Client

Financial Advisor

Today

The change in the amortization policy will increase the period in cases where the contracted exhibition period is greater than two years. This will have the effect of spreading the cost over a

longer period and in the short term increasing net earnings. It will be more difficult to compare the

current year’s results with previous years’ because of the change in estimated useful life. In evaluating Alliance’s performance you would want to make an adjustment for this change in estimated life. If the contracted exhibition period is a good measure of the useful life of the broadcast

rights and the revenue potential is consistent over this period, then the policy is reasonable.

Solutions Manual

9-15

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 9-6

Jan.

1

June 30

Dec. 31

31

Accumulated Amortization—Machinery .........................

Machinery ..............................................................

62,000

Amortization Expense ...................................................

Accum. Amortization—Computer ..........................

($33,000 X 1/3 X 6/12)

5,500

Cash ..............................................................................

Accumulated Amortization—Computer .........................

($33,000 X 2/3 = $22,000; $22,000 + $5,500)

Loss on Disposal [$5,000 - ($33,000 - $27,500)] ..........

Computer ......................................................

5,000

27,500

Amortization Expense ...................................................

Accumulated Amortization—Truck ........................

[($27,000 - $3,000) X 1/5]

4,800

Cash ..............................................................................

Accumulated Amortization—Truck ................................

[($27,000 - $3,000) X 4/5]

Gain on Disposal ...........................................

Truck .............................................................

9,000

19,200

62,000

5,500

500

33,000

4,800

1,200

27,000

EXERCISE 9-7

1.

Amortization is the process of allocating the cost of a long-lived asset to expense over the

asset’s useful life. Because the value of land generally does not decline with time and usage, its usefulness and revenue producing ability does not decline. In addition, the useful

life of land is indefinite. Therefore it would be incorrect for the student to amortize the land.

2.

Goodwill is an intangible asset with an indefinite life. According to generally accepted accounting principles, goodwill is not amortized but reviewed annually for impairment. If a

permanent decline in value has occurred the goodwill is written down and an impairment

loss is recorded on the statement of earnings. Therefore the amortization entry should be

reversed and no decline in value recorded until am impairment in value occurs.

4. This is a violation of the cost principle. Because current market values are subjective and

not reliable, they are not used to increase the recorded value of an asset after acquisition.

The appropriate accounting treatment is to leave the building on the books at its zero book

value.

Solutions Manual

9-16

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

5. EXERCISE 9-8

(a)

Jan.

April

July

2

1

1

Sept.

1

30

Patents .......................................................................

Cash .......................................................................

450,000

Goodwill .......................................................................

Cash .......................................................................

360,000

Franchise .......................................................................

Cash .......................................................................

250,000

Research Expense .........................................................

Cash .......................................................................

185,000

Development Expense....................................................

Cash .......................................................................

50,000

450,000

360,000

250,000

185,000

50,000

(b)

Dec. 31

Amortization Expense–Patents

($450,000 ÷ 5) ........................................................

Amortization Expense–Franchise

[($250,000 ÷ 10) X 6/12] .........................................

Patents ...................................................................

Franchise ................................................................

90,000

12,500

90,000

12,500

Ending balances, December 31, 2004:

Patent

Goodwill

Franchise

= $360,000 ($450,000 - $90,000)

= $360,000

= $237,500 ($250,000 - $12,500)

Solutions Manual

9-17

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 9-9

(a)

Account

Financial Statement

Section

Accumulated Amortization –

Buildings

Balance Sheet

Property, Plant and

Equipment

Accumulated Amortization –

Finite-Life Intangible Assets

Balance Sheet

Intangibles

Accumulated Amortization –

Machinery and Equipment

Balance Sheet

Property, Plant and

Equipment

Accumulated Amortization

– Other Property, Plant and Equipment

Balance Sheet

Property, Plant and

Equipment

Accumulated Amortization –

Telecommunication Assets

Balance Sheet

Property, Plant and

Equipment

Amortization Expense

Statement of Earnings

Operating Expenses

Buildings

Balance Sheet

Property, Plant and

Equipment

Cash and Cash Equivalents

Balance Sheet

Current Assets

Cash Paid for Capital Expenditures

Cash Flow Statement

Investing Activities

Common Shares

Balance Sheet

Shareholders’ Equity

Finite-Life Intangible Assets

Balance Sheet

Intangibles

Goodwill

Balance Sheet

Intangibles

Impairment Charge

Statement of Earnings

Other Expenses

Indefinite Life – Intangible Assets

Balance Sheet

Intangibles

Land

Balance Sheet

Property, Plant and

Equipment

Solutions Manual

9-18

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 9-9

(a) (Continued)

Account

Financial Statement

Section

Machinery and Equipment

Balance Sheet

Property, Plant and

Equipment

Other Long-term Assets

Balance Sheet

Long-term Assets

Other Property, Plant and Equipment

Balance Sheet

Property, Plant and

Equipment

Plant Under Construction

Balance Sheet

Property, Plant and

Equipment

Telecommunications Assets

Balance Sheet

Property, Plant and

Equipment

(b)

BCE Inc.

Balance Sheet (Partial)

December 31, 2002

(in millions)

Property, plant and equipment

Land ........................................................................................

Buildings ...................................................................................

Less: Accumulated amortization ...............................................

Plant under construction ...........................................................

Machinery and equipment ........................................................

Less: Accumulated amortization ...............................................

Telecommunications assets .....................................................

Less: Accumulated amortization ...............................................

Other property, plant and equipment ........................................

Less: Accumulated amortization ...............................................

Total property, plant and equipment

Intangible assets

Finite-life intangible assets .......................................................

Less: Accumulated amortization ...............................................

Goodwill ....................................................................................

Indefinite-life intangible assets .................................................

Total intangible assets .....................................................

$

$2,585

1,307

$6,144

3,253

$34,573

21,848

$357

139

$3,021

1,335

99

1,278

1,743

2,891

12,725

218

18,954

1,686

10,103

900

12,689

Solutions Manual

9-19

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 9-10

(a) ($ in millions)

1.

Return on assets

$195.9

= 4.6%

($4,312.6 $4,254.3) 2

2.

Asset turnover

$9,926.5

= 2.3 times

($4,312.6 $4,254.3) 2

3.

(b)

Profit margin

$195.9

$9,926.5

= 2.0%

Profit Margin X Asset Turnover = Return on Assets

= 2.0% X 2.3 times = 4.6%

(c)

Asset turnover and profit margin vary considerably across industries. Therefore, when you

have a diverse group of businesses from several industry types combined into one company, such as in Empire Company, the ability to compare these ratios to other businesses

becomes very difficult. Empire Company would almost need to calculate ratios for each of

the separate industry segments to allow for a meaningful analysis.

Solutions Manual

9-20

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 9-11

(a)

Year

2004

2005

(1)

Straight-Line

$12,833

12,833

Units-of-Activity

$13,090

11,550

Double

Declining-Balance

$29,667

19,775

Straight-Line Method

$89,000 - $12,000 = $12,833 per year

6 years

2004 and 2005 amortization expense = $12,833

(2)

Units-of-Activity Method

$89,000 - $12,000 = $7.70 per hour

10,000 hours

2004 amortization expense = 1,700 hours X $7.70 = $13,090

2005 amortization expense = 1,500 hours X $7.70 = $11,550

(3)

Declining-Balance Method

The declining-balance rate is 1/6 X 2 = 33⅓%

2004 amortization expense = $89,000 X 33⅓% = $29,667

Book value January 1, 2005 = $89,000 – $29,667 = $59,333

2005 amortization expense = $59,333 X 33⅓% = $19,775

(b)

Straight line method results in the highest net earnings in 2004 and units-of-activity results

in the highest net earnings in 2005.

(c)

Cash flow is the same under all three methods. Amortization is an allocation of the cost of

a long-lived asset and not a cash expenditure.

Solutions Manual

9-21

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*EXERCISE 9-12

(a)

(1)

Straight-line method

$10,000 $3,000

$1,750 each year

4

(2)

Double-declining balance method

DDB Rate: ¼ x 2 = 50%

Year 1: $10,000 x 50% = $5,000

Year 2: $10,000 - $5,000 = $5,000 x 50% = $2,500

Year 3: $5,000 - $2,500 x 50% = $1,250

Year 1

Year 2

Year 3

Year 4**

Total

Straight-Line

Amortization

Net Book

Expense

Value

$1,750

$8,250

1,750

6,500

1,750

4,750

1,750

3,000

$7,000

Double-Declining Balance

Amortization

Net Book

Expense

Value

$5,000

$5,000

2,000

3,000

0*

3,000

0

3,000

$7,000

* Do not amortize below salvage value.

** Not required. Included for information only.

(b)

(1)

Straight-line method

Proceeds - book value = Gain (loss)

$2,500 - $4,750 = ($2,250)

(2)

Double-declining balance method

Proceeds - book value = Gain (loss)

$2,500 - $3,000 = ($500)

Solutions Manual

9-22

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*EXERCISE 9-12 (Continued)

(c)

(1)

Straight-line method

Amortization expense: $1,750 + $1,750 + $1,750 + Loss: $2,250 = $7,500

(2)

Double-declining balance method

Amortization expense: $5,000 + $2,000 + $0 + Loss: $500 = $7,500

Note: There is no difference in the total expense over the life of the asset.

Solutions Manual

9-23

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 9-1A

Item

Land

1.

2.

3.

4.

5.

6.

7.

8.

9.

$250,000

4,900

27,000

7,000

10.

(12,700)

$276,200

Building Land Improvements

Other Accounts

$ 20,000

30,000

700,000

$34,000

$15,000 Property Tax

Expense

$750,000

$34,000

$15,000

Solutions Manual

9-24

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-2A

Date

January 10

Expenditure

Land was purchased for $65,000.

Account Title

Land

January 15

Land was surveyed at a cost of $3,000.

Land

February 1

An existing building on the land was razed at a

cost of $5,500 to provide room for the new structure.

Land

February 10

Security fence was built around the land for

$2,500.

Land

Improvements

February 23

$10,500 was paid to an architectural firm for plans

for the new building.

Building

March 15

$3,500 was spent to remove the trees and level the Land

land in preparation for construction of the new

building.

March 17

Building permit acquired for $1,000.

Building

April 10

Paid $5,000 in legal and application costs for a patent on the newly developed product that will be

sold by Cohlmeyer.

Patent

May 1

$460,000 was spent to construct the building.

Building

May 15

$4,000 was spent on landscaping.

May 20

Parking lot constructed for $8,000.

May 25

Company’s domain name, <www.cohlmeyer.ca>,

was registered for $150.

Land

Improvements

Land

Improvements

Miscellaneous

Expense

May 28

Paid $4,000 to lawyer for organizing cost for the

new company.

Organization Cost

Expense

June 1

The building was occupied and the business commenced.

Solutions Manual

9-25

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-3A

(a) April 1

May

1

1

Land ........................................................ 2,630,000

Cash .................................................

630,000

Note Payable ....................................

2,000,000

Amortization Expense ..............................

Accumulated Amortization

—Equipment ($750,000 X 1/10 X 4/12)

25,000

Cash.........................................................

Accumulated Amortization—Equipment

($750,000 X 4/10 + $25,000) ...................

Loss on Disposal ......................................

Equipment ...................................

350,000

Cost

Accum. amort.—equipment

[($750,000 X 1/10) X 4 + $25,000)]

Book value

Cash proceeds

Loss on disposal

25,000

325,000

75,000

750,000

$750,000

325,000

425,000

350,000

$(75,000)

Solutions Manual

9-26

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-3A (Continued)

(a) (Continued)

June 1

Cash......................................................... 1,800,000

Land ..................................................

300,000

Gain on Disposal ...............................

1,500,000

July

Equipment ................................................ 1,000,000

Cash ..................................................

Note Payable .....................................

1

Dec. 31

31

Amortization Expense ..............................

Accumulated Amortization

—Equipment ($470,000 X 1/10) ........

47,000

Accumulated Amortization—Equipment ...

Equipment ...................................

470,000

Cost

Accum. amort.—equipment

($470,000 X 1/10 X 10)

Gain (loss) on disposal

250,000

750,000

47,000

470,000

$470,000

470,000

$

0

Solutions Manual

9-27

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-3A (Continued)

(b) Dec. 31

31

Amortization Expense ............................

Accumulated Amortization

—Buildings ($28,500,000 X 1/40) ....

712,500

712,500

Amortization Expense ............................ 4,728,000

Accumulated Amortization

—Equipment....................................

4,728,000

($46,780,000* X 1/10)

[($1,000,000 X 1/10) X 6/12]

$4,678,000

50,000

$4,728,000

*$48,000,000 - $750,000 - $470,000 = $46,780,000

31

Interest Expense ....................................

Interest Payable...............................

($2,000,000 X 8% X 9/12)

($750,000 X 8% X 6/12)

(c)

150,000

150,000

$120,000

30,000

$150,000

YOUNT CORPORATION

Balance Sheet (Partial)

December 31, 2005

Property, plant and equipment*

Land ......................................................

Buildings ................................................

Less: Accumulated amortization

—buildings .............................................

Equipment .............................................

Less: Accumulated amortization

—equipment ..........................................

Total property, plant and equipment .

$ 6,330,000

$28,500,000

11,400,000

$47,780,000

17,100,000

39,005,000

8,775,000

$32,205,000

*See T accounts on the following page.

Solutions Manual

9-28

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-3A (Continued)

(c) (Continued)

Land

Dec. 31, 2004

April 1, 2005

4,000,000

2,630,000

Dec. 31, 2005

Bal. 6,330,000

June 1, 2005

300,000

Buildings

Dec. 31, 2004

28,500,000

Dec. 31, 2005

Bal. 28,500,000

Equipment

Dec. 31, 2004

July 1, 2005

48,000,000

1,000,000

Dec. 31, 2005

Bal. 47,780,000

May 1, 2005

Dec. 31, 2005

750,000

470,000

Accumulated Amortization—Buildings

Dec. 31, 2004

Dec. 31, 2005

10,687,500

712,500

Dec. 31, 2005

Bal. 11,400,000

Accumulated Amortization—Equipment

May 1, 2005

Dec. 31, 2005

325,000

470,000

Dec. 31, 2004

May 1, 2005

Dec. 31, 2005

Dec. 31, 2005

35,000,000

25,000

47,000

4,728,000

Dec. 31, 2005

Bal. 39,005,000

Solutions Manual

9-29

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-4A

(a)

Cost

Original building

(b)

Book

Value

$69,375

Amortization expense for current year

Total building $69,375 + $29,125 = $98,500 ÷ 15 = $6,567

(c)

Cost

Total building

1

(d)

Accum.

Amortiz.

$185,000 $115,625

Accum.

Amortiz.

$214,125 $148,4601

Book

Value

$65,665

$115,625 + ($6,567 x 5) = $148,460

Proceeds

Book value

Loss on disposal

$50,000

65,665

$15,665

Journal entry (optional)

Cash.......................................................

Accumulated Amortization–Building .......

Loss on Disposal ....................................

Building ..............................................

50,000

148,460

15,665

214,125

Solutions Manual

9-30

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-5A

Account Debited

Explanation

1.

Equipment

2.

Repairs and Maintenance Does not make the equipment more producExpense

tive. Likely benefits only the current period

3.

Equipment

4.

Repairs and Maintenance Does not make the equipment more producExpense

tive

5.

Training Expense

6.

Repairs and Maintenance Does not make the equipment more producExpense

tive. Painting is a recurring expense

Improvement or betterment expenditure, which

makes the equipment more productive

Improvement or betterment expenditure, which

makes the equipment more productive

Does not increase the productivity of the

equipment–and current accounting policies do

not recognize the cost of human capital

Solutions Manual

9-31

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-6A

(a) Accumulated Amortization—Office Furniture .............

Loss on Disposal .......................................................

Office Furniture ..................................................

48,000

32,000

(b) Cash ..........................................................................

Accumulated Amortization—Office Furniture .............

Loss on Disposal ($32,000 - $30,000) .......................

Office Furniture ..................................................

30,000

48,000

2,000

(c) Cash ..........................................................................

Accumulated Amortization—Office Furniture .............

Gain on Disposal ($35,000 - $32,000) ................

Office Furniture ..................................................

35,000

48,000

80,000

80,000

3,000

80,000

Solutions Manual

9-32

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-7A

1.

2.

Research Expense ......................................

Patents ................................................

153,000

Patents .....................................................

Amortization Expense ..........................

[$10,750 - ($62,000 X 1/20)]

7,650

7,650

Because goodwill has an indefinite life it is not amortized. Instead goodwill

should be review annually for any impairment in value. Therefore any amortization expense recorded must be reversed.

Goodwill ....................................................

Amortization Expense..........................

3.

153,000

760

760

The right should be recorded as an intangible asset with a definite-life since it

will provide a benefit for three years.

Taxi Right (intangible asset) ......................

Vehicle ................................................

25,000

25,000

Solutions Manual

9-33

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-8A

(a) Jan. 2 Patent #1 ......................................

Cash ........................................

22,500

22,500

July 1 Research Expense ....................... 220,000

Cash ........................................

1 Patent #2 (Development Costs) ....

Cash ........................................

220,000

60,000

60,000

Sept. 1 Advertising Expense ..................... 110,000

Cash ........................................

110,000

Oct. 1 Copyright ...................................... 160,000

Cash ........................................

160,000

Dec. 31 Impairment Loss

($210,000 – $150,000)...........

Goodwill ...................................

(b) Dec. 31 Amortization Expense ...................

Patent #1 .................................

[($70,000 X 1/10) + ($22,500 X 1/9)]

60,000

60,000

9,500

9,500

31 Amortization Expense ...................

5,600

Copyright..................................

[($48,000 X 1/10) + ($160,000 X 1/50 X 3/12)]

5,600

31 Amortization Expense ...................

1,500

Patent #2 .................................

[($60,000 ÷ 20 years) x 6/12 = $1,500)

1,500

Solutions Manual

9-34

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-8A (Continued)

(c)

Intangible Assets

Patents ($152,500 cost less $18,000 amort.) (1)

Copyright ($208,000 cost less $24,800 amort.) (2)

Goodwill................................................

Total Intangible Assets

$134,500

183,200

150,000

$467,700

(1)

Cost-Patent #1 ($70,000 + $22,500) + Patent #2 $60,000 = $152,500

Amortization-Patent #1 ($7,000 + $9,500) + Patent #2 $1,500 = $18,000

(2)

Cost-Copyright $48,000 + $160,000 = $208,000

Amortization-Copyright $19,200 + $5,600 = $24,800

Solutions Manual

9-35

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-9A

(a)

($ in thousands)

Profit margin

Sleeman Breweries ............ Big Rock Brewery

$12,321

$157,053

= 7.8%

$1,218

$24,909

= 4.9%

Return on assets

$12,321

($220,081 $197,642) 2

= 5.9%

$1,218

($33,061 $31,346) 2

= 3.8%

Asset turnover

$157,053

($220,081 $197,642) 2

= 0.75 times

$24,909

($33,061 $31,346) 2

= 0.77 times

Solutions Manual

9-36

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-9A (Continued)

(b) Based on profit margin we can see that Sleeman is slightly more profitable

than Big Rock. However, both retailers have profit margins below the industry

average of 9.2%, which indicates that both Sleeman and Big Rock are less

profitable than the average brewery.

The return on assets ratio indicates that Sleeman is generating a better return

then Big Rock based on the amount of assets invested in the business. However, again, based on the industry average of 7.4% both companies are generating a lower return on their assets than most other companies in the industry.

The asset turnover ratio measures how efficiently a company uses its assets

to generate sales. It shows the dollars of sales generated by each dollar invested in assets. Sleeman’s asset turnover ratio (0.75) was slightly lower than

Big Rock’s (0.77) in 2002. Therefore, it could be concluded that Big Rock was

more efficient than Sleeman during 2002 in utilizing assets to generate sales.

Both companies are slightly lower than the industry average of 0.8 times.

The ability to compare the two companies is complicated by the fact that

Sleeman Breweries is far larger than Big Rock Brewery. Its size, and resulting

economies of scale, may account for part of Sleeman’s better profitability.

Solutions Manual

9-37

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-10A

(a)

As evidenced by the high profit margin compared to the lower asset turnover (when compared to other companies in the industry), the company is

focusing its efforts on maximizing profits versus having a high volume of

sales. The company could be maximizing profits by either charging a

higher selling price for its products, by focusing on cost control or some

combination of both.

(b)

The company’s strategy appears to be to sell a lower number of high-end

computers with strong profit margins. It appears to be willing to accept a

lower volume of sales (as evidenced by the lower asset turnover ratio) to

achieve this sales objective. Given the company’s high return on asset ratio, this strategy appears to be very successful.

Note to instructors: Students may be interested to learn that the company information produced here was taken from Microsoft Corporation.

Solutions Manual

9-38

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*PROBLEM 9-11A

(a)

STRAIGHT-LINE AMORTIZATION

Calculation

Amortizable

Year

Cost

X

Annual

Amortization

Amortization Accumulated Book

Rate

= Expense

Amortization Value

2005 $231,000a

2006 231,000

2007 231,000

2008 231,000

2009 231,000

a

b

End of Year

20%b

20%

20%

20%

20%

$46,200

46,200

46,200

46,200

46,200

$ 46,200 $196,800

92,400 150,600

138,600 104,400

184,800

58,200

231,000

12,000

$243,000 – $12,000 = $231,000

1/5 = 20%

SINGLE-DECLINING-BALANCE AMORTIZATION

Calculation

Book Value

Beginning

Year

of Year

X

2005

2006

2007

2008

2009

c

d

$243,000

194,400

155,520

124,416

99,533

End of Year

Annual

Amortization

Amortization Accumulated Book

Rate

= Expense

Amortization Value

20%c

20%

20%

20%

20%

$48,600

38,880

31,104

24,883

87,533d

$ 48,600 $194,400

87,480 155,520

118,584 124,416

143,467

99,533

231,000

12,000

1/5 = 20%

Adjusted so ending book value will equal salvage value ($231,000 - $143,467

= $87,533)

Solutions Manual

9-39

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*PROBLEM 9-11A (Continued)

(b) Straight-line amortization provides the lower amount for 2005 amortization expense and, therefore, the higher 2005 earnings. Over the five-year period,

both methods result in the same total amortization expense ($231,000) and,

therefore, the same total earnings.

Note to instructors: You might wish to point out to students that although the

single-declining-balance method is the most often used method, it does result

in large amounts of amortization at the end of the asset’s useful life in order to

adjust to salvage value. Often, this is not done in practice. Instead, the asset

continues to be amortized as long as it is in use.

(c) Amortization is a noncash expense. Therefore cash flow would be the same

regardless of the method chosen.

Solutions Manual

9-40

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*PROBLEM 9-12A

(a)

1.

STRAIGHT-LINE AMORTIZATION

Calculation

Amortizable

Years

Cost

X

1

2

3

End of Year

Amortization

Rate (1/3)

$72,000*

,,72,000

,,20,000

1/3

1/3

1/3

Annual

Amortization Accumulated Book

Expense

Amortization Value

$ 24,000

24,000

24,000

$ 24,000

48,000

72,000

$56,000

32,000

8,000

*$80,000 - $8,000 = $72,000

2.

UNITS-OF-ACTIVITY AMORTIZATION

Calculation

Units of Activity

Year

X

1

2

3

120,000

100,000

80,000

End of Year

Annual

Amortization

Amortization Accumulated Book

1

Cost/Unit

= Expense

Amortization Value

$0.24

0.24

0.24

$28,800

24,000

19,200

$28,800

52,800

72,000

$51,200

27,200

8,000

1

Amortizable cost per unit = ($80,000 - $8,000) ÷ 300,000 km = $0.24 per

kilometre.

Solutions Manual

9-41

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

*PROBLEM 9-12A (Continued)

(b)

1.

Cost ....................................................

Accum. amort. ....................................

Book value..........................................

Cash proceeds ...................................

Gain (loss) on disposal .......................

(i) Straight

Line

$80,000

48,000

32,000

25,000

$ (7,000)

(ii) Units-of

-Activity

$80,000

52,800

27,200

25,000

$ (2,200)

2.

Amortization expense .........................

Add: Loss on disposal .......................

Net expense .......................................

$48,000

7,000

$55,000

$52,800

2,200

$55,000

In total the effect on net earnings is the same under both methods. This is

because the method of amortization selected only affects the timing of the

expense recognition. In total over the life of the asset the expense recognized is the same.

Solutions Manual

9-42

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-1B

Item

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Land

Building

Land Improvements Other Accounts

$260,000

$7,200

19,000

$23,000

$2,000 Insurance expense

12,000

38,000

5,800 Property Tax

Expense

600,000

(5,000)

$274,000

$661,000

$19,200

$7,800

Solutions Manual

9-43

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-2B

Expenditure

Account Title

1.

Architect fees.

1.

Building

2.

Cost to demolish an old building that is on a

piece of land intended for a new building.

Land: it is a cost of getting the land

ready for its intended use.

3.

Lawyer’s fees associated with a successful patent application.

Patent

4.

Lawyer’s fees associated with an unsuccessful

patent application.

5.

Cost of a grease and oil change on the company’s truck

Operating Expense: if the application

was unsuccessful, then there is no asset.

Repairs and Maintenance Expense

6.

Cost of installing a new roof on the company’s

building.

7.

Cost of painting the president’s

office.

8.

Cost of CD’s and toner for the office computer.

Operating Expense

9.

Payment to a celebrity for endorsement of a

product. The celebrity’s endorsement is featured in television advertisements, which have

been airing for the past three months and will

continue to be televised for another six months

after year-end.

Operating Expense. Some companies

would allocate the cost according to

the number of times that the advertisements are to be aired. A current

asset, such as prepaid advertising,

would be established for those costs

related to future advertisements. However, in the real world, all such costs

are generally charged to advertising

expense.

10.

Cost of new tires for the company delivery van. Operating Expense. Depending on the

vehicle usage during a year, an argument could be made for capitalizing

this expenditure. Again, in the real

world, this expenditure is usually

charged to expenses.

Building (it would be rare to find a

separate capital asset set up for a

“roof” account as distinct from the

building).

Operating Expense

Solutions Manual

9-44

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-2B (Continued)

Expenditure

Account Title

11.

Cost to rebuild the engine on the company delivery van.

The benefit should extend beyond one

year; therefore, the amount would be

capitalized as part of the cost of the

delivery van.

12.

Cost to pave the company parking lot.

Land Improvements

13.

Cost of painting the corporate logo on the

sides of the company delivery van.

Delivery Van

Solutions Manual

9-45

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-3B

(a) April 1

May

1

1

Land ........................................................ 2,200,000

Cash .................................................

200,000

Note Payable ....................................

2,000,000

Amortization Expense ..............................

Accumulated Amortization

—Equipment ($600,000 X 1/10 X 4/12)

Cash.........................................................

Accumulated Amortization—Equipment ...

Loss on Disposal ......................................

Equipment ...................................

Cost

Accum. amort.—equipment

[($600,000 X 1/10) X 2 + $20,000)]

Book value

Cash proceeds

Loss on disposal

20,000

20,000

450,000

140,000

10,000

600,000

$600,000

140,000

460,000

450,000

$ (10,000)

Solutions Manual

9-46

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-3B (Continued)

(a) (Continued)

June 1

Cash......................................................... 1,800,000

Land ..................................................

500,000

Gain on Disposal ...............................

1,300,000

July

Equipment ................................................ 1,200,000

Cash ..................................................

200,000

Note Payable .....................................

1,000,000

1

Dec. 31

31

Amortization Expense ..............................

Accumulated Amortization

—Equipment ($500,000 X 1/10) ........

50,000

Accumulated Amortization—Equipment ...

Cash.........................................................

Equipment ...................................

Gain on disposal ..........................

500,000

4,000

Cost

Accum. amort.—equipment

($500,000 X 1/10 X 10)

Book value

Cash proceeds

Gain (loss) on disposal

50,000

500,000

4,000

$500,000

500,000

0

4,000

$ 4,000

Solutions Manual

9-47

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-3B (Continued)

(b) Dec. 31

31

Amortization Expense ............................

Accumulated Amortization

—Buildings ($26,500,000 X 1/40) ....

662,500

662,500

Amortization Expense ............................ 3,950,000

Accumulated Amortization—Equipment

3,950,000

($38,900,000* X 1/10)

[($1,200,000 X 1/10) X 6/12]

$3,890,000

60,000

$3,950,000

*$40,000,000 - $600,000 - $500,000 = $38,900,000

31

Interest Expense ....................................

Interest Payable ..............................

($2,000,000 X 6% X 9/12)

($1,000,000 X 6% X 6/12)

(c)

120,000

120,000

$ 90,000

30,000

$120,000

HAMSMITH CORPORATION

Balance Sheet (Partial)

December 31, 2005

Property, plant and equipment*

Land .......................................................

Buildings ................................................. $26,500,000

Less: Accumulated amortization

—buildings .............................................. 13,912,500

Equipment .............................................. $40,100,000

Less: Accumulated amortization .............

—equipment ........................................... 11,380,000

Total property, plant and equipment ..

$ 4,700,000

12,587,500

28,720,000

$46,007,500

*See T accounts on the following page.

Solutions Manual

9-48

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-3B (Continued)

Land

Dec. 31, 2004

April 1, 2005

3,000,000

2,200,000

Dec. 31, 2005

Bal. 4,700,000

June 1, 2005

500,000

Buildings

Dec. 31, 2004

26,500,000

Dec. 31, 2005

Bal. 26,500,000

Equipment

Dec. 31, 2004

July 1, 2005

40,000,000

1,200,000

Dec. 31, 2005

Bal. 40,100,000

May 1, 2005

Dec. 31, 2005

600,000

500,000

Accumulated Amortization—Buildings

Dec. 31, 2004

Dec. 31, 2005

13,250,000

662,500

Dec. 31, 2005

Bal. 13,912,500

Accumulated Amortization—Equipment

May 1, 2005

Dec. 31, 2005

140,000

500,000

Dec. 31, 2004

May 1, 2005

Dec. 31, 2005

Dec. 31, 2005

8,000,000

20,000

50,000

3,950,000

Dec. 31, 2005

Bal. 11,380,000

Solutions Manual

9-49

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-4B

(a)

Year

2002

2003

2004

2005

2006

2007

Amortization Expense

($40,000 - $4,000) ÷ 5 = $7,200

($40,000 - $4,000) ÷ 5 = $7,200

($40,000 - $14,400 = $25,600 - $2,500) ÷ 4 = $5,775

($40,000 - $14,400 = $25,600 - $2,500) ÷ 4 = $5,775

($40,000 - $14,400 = $25,600 - $2,500) ÷ 4 = $5,775

($40,000 - $14,400 = $25,600 - $2,500) ÷ 4 = $5,775

Accumulated

Amortization

$ 7,200

14,400

20,175

25,950

31,725

37,500

(b) If Harrington Corporation had not revised the equipment’s remaining useful life

and salvage value, the total amortization expense and accumulated amortization at December 31, 2006 would have been $36,000. The book value would

have been $4,000.

Solutions Manual

9-50

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-5B

Account Debited

Explanation

1.

Equipment

Cost to prepare the equipment for use.

2.

Land improvements

Non-permanent land expenditure.

3.

Building

Improvement or betterment expenditure, which

makes the factory office more productive.

4.

Repair expense

Does not benefit future periods.

If the loss was considered to be significant, it

would be recorded separately as a loss due to

labour dispute, rather than as repair expense.

5.

Equipment

Cost to prepare the equipment for use.

6.

Repair expense

Does not benefit future periods.

If the damage was covered by insurance, a receivable (from the insurance company) account would be debited.

If the loss was considered to be significant, it

would be recorded separately as a loss due to

damages, rather than as repair expense.

Solutions Manual

9-51

Chapter 9

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 9-6B

(a)

(b)

(c)

Loss on Disposal ....................................

Accumulated Amortization—Equipment .

Equipment ..................................

30,000

20,000