Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

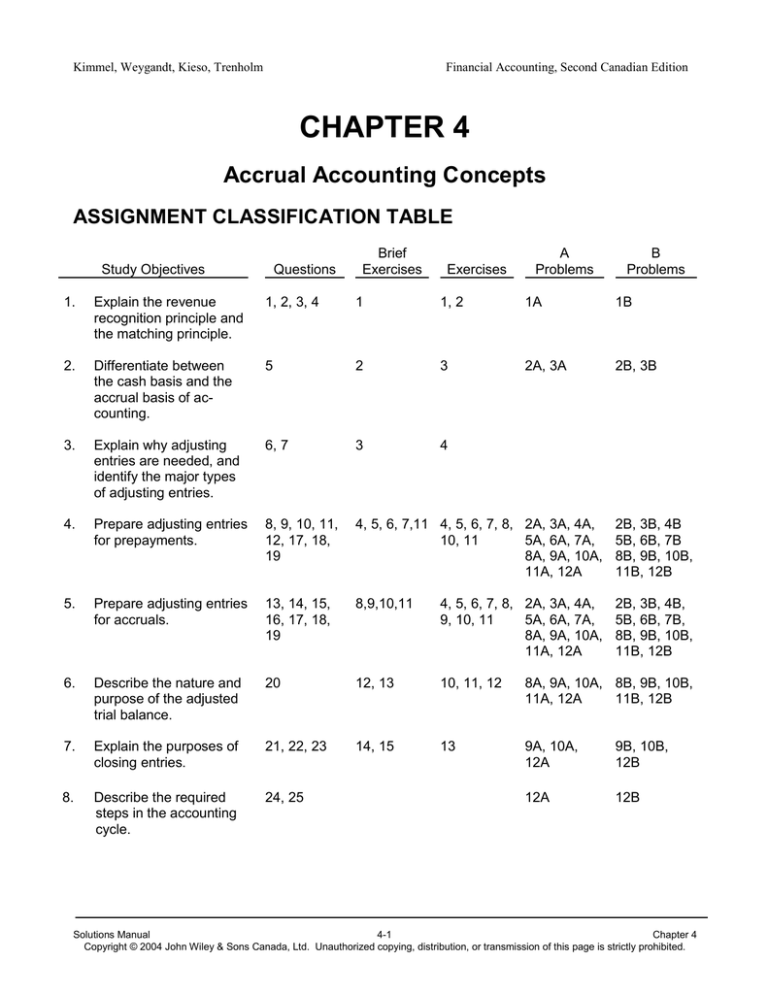

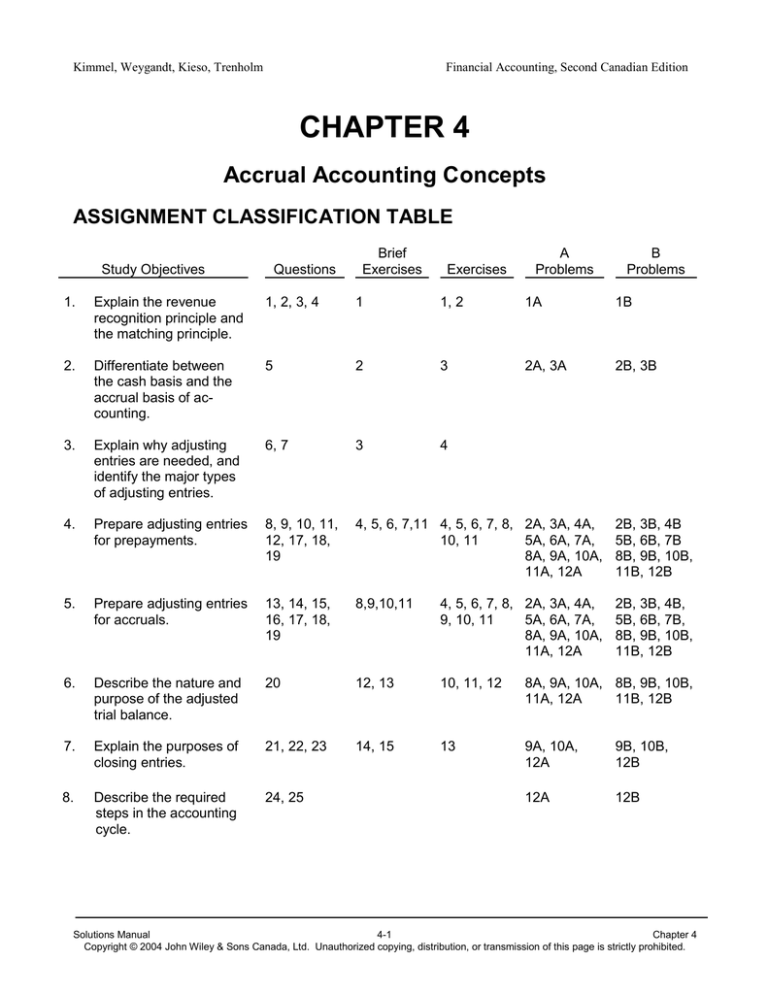

CHAPTER 4

Accrual Accounting Concepts

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Questions

Brief

Exercises

Exercises

A

Problems

B

Problems

*1.

Explain the revenue

recognition principle and

the matching principle.

1, 2, 3, 4

1

1, 2

1A

1B

*2.

Differentiate between

the cash basis and the

accrual basis of accounting.

5

2

3

2A, 3A

2B, 3B

*3.

Explain why adjusting

entries are needed, and

identify the major types

of adjusting entries.

6, 7

3

4

*4.

Prepare adjusting entries

for prepayments.

8, 9, 10, 11,

12, 17, 18,

19

4, 5, 6, 7,11 4, 5, 6, 7, 8, 2A, 3A, 4A,

10, 11

5A, 6A, 7A,

8A, 9A, 10A,

11A, 12A

2B, 3B, 4B

5B, 6B, 7B

8B, 9B, 10B,

11B, 12B

*5.

Prepare adjusting entries

for accruals.

13, 14, 15,

16, 17, 18,

19

8,9,10,11

4, 5, 6, 7, 8, 2A, 3A, 4A,

9, 10, 11

5A, 6A, 7A,

8A, 9A, 10A,

11A, 12A

2B, 3B, 4B,

5B, 6B, 7B,

8B, 9B, 10B,

11B, 12B

*6.

Describe the nature and

purpose of the adjusted

trial balance.

20

12, 13

10, 11, 12

8A, 9A, 10A, 8B, 9B, 10B,

11A, 12A

11B, 12B

*7.

Explain the purposes of

closing entries.

21, 22, 23

14, 15

13

9A, 10A,

12A

9B, 10B,

12B

8.

Describe the required

steps in the accounting

cycle.

24, 25

12A

12B

Solutions Manual

4-1

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

Simple

10-15

1A

Identify accounting assumptions, principles, and

constraints.

2A

Convert earnings from cash to accrual basis.

Complex

30-40

3A

Convert earnings from cash to accrual basis; prepare

accrual-based financial statements.

Complex

40-50

4A

Prepare original and adjusting entries.

Simple

20-30

5A

Prepare adjusting entries.

Simple

20-30

6A

Prepare original and adjusting entries.

Simple

20-30

7A

Prepare adjusting entries and corrected statement of

earnings.

Moderate

40-50

8A

Prepare adjusting entries, post, and prepare adjusted

trial balance.

Moderate

30-40

9A

Prepare adjusting entries, post, prepare adjusted trial

balance, financial statements, and closing entries.

Moderate

50-60

10A

Prepare adjusting entries and financial statements;

identify accounts to be closed.

Moderate

40-50

11A

Complete accounting cycle through to preparation of

financial statements.

Moderate

70

12A

Complete all steps in accounting cycle.

Moderate

70

1B

Identify accounting assumptions, principles, and

constraints.

Simple

10-15

2B

Convert earnings from cash to accrual basis.

Complex

30-40

3B

Convert earnings from cash to accrual basis; prepare

accrual-based financial statements.

Complex

40-50

4B

Prepare original and adjusting entries.

Simple

20-30

Solutions Manual

4-2

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Problem

Number

5B

Financial Accounting, Second Canadian Edition

Description

Prepare adjusting entries.

Difficulty

Level

Simple

Time

Allotted (min.)

20-30

Simple

20-30

6B

Prepare original and adjusting entries.

7B

Prepare adjusting entries and corrected statement of

earnings.

Moderate

40-50

8B

Prepare adjusting entries, post, and prepare adjusted

trial balance.

Moderate

30-40

9B

Prepare adjusting entries, post, prepare adjusted trial

balance, financial statements, and closing entries.

Moderate

50-60

10B

Prepare adjusting entries and financial statements;

identify accounts to be closed.

Moderate

40-50

11B

Complete accounting cycle through to preparation of

financial statements.

Moderate

70

12B

Complete all steps in accounting cycle.

Moderate

70

Solutions Manual

4-3

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ANSWERS TO QUESTIONS

1.

(a)

(b)

Under the time period assumption, an accountant is required to determine the

relevance of each accounting transaction to specific accounting periods.

An accounting time period of one year in length is referred to as a fiscal year.

2.

The two generally accepted accounting principles that pertain to adjusting the accounts

are (1) the revenue recognition principle, which states that revenue should be recognized

in the time period in which it is earned, and (2) the matching principle, which states that

efforts (expenses) must be matched with accomplishments (revenues).

3.

The law firm should recognize the revenue in April. The revenue recognition principle

states that revenue should be recognized in the accounting period in which it is earned. In

this case, the revenue was earned in April when the work was performed.

4.

Expenses of $4,500 should be deducted from the revenues in April. Under the matching

principle efforts (expenses) should be matched in the same period as accomplishments

(revenues). The $2,000 of expense incurred in March would be recorded as a prepaid expense until April.

5.

(a)

(b)

Information presented on an accrual basis is useful because it reveals important information about the relationship between efforts and results. This information is

useful in predicting future results. Trends in revenues and expenses are thus more

meaningful.

Information presented on a cash basis is useful for predicting the future availability

of cash. Cash basis financial statements provide useful information about a company's sources and uses of cash.

6.

The financial information in a trial balance may not be up-to-date because:

(1)

Some events are not journalized daily because it is unnecessary and inexpedient

to do so.

(2)

The expiration of some costs occurs with the passage of time rather than as a result of recurring daily transactions.

(3)

Some items may be unrecorded because the transaction data are not known.

7.

The two categories of adjusting entries are prepayments and accruals. Prepayments consist of revenues and expenses paid before they are earned or incurred such as prepaid

expenses and unearned revenues. Accruals consist of revenues and expenses earned or

incurred prior to payment.

8.

In a prepaid expense adjusting entry, expenses are debited and assets are credited.

9.

No. Amortization is the process of allocating the cost of an asset to expense over its useful life. Amortization results in the presentation of the book value of the asset, not its market value.

Solutions Manual

4-4

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

10.

Amortization expense is an expense account whose normal balance is a debit. This account shows the cost of a long-lived asset that has expired during the current accounting

period. Accumulated amortization is a contra asset account whose normal balance is a

credit. The balance in this account is the amortization that has been recognized from the

date of acquisition to the balance sheet date.

11.

1st Fiscal Year-end

Equipment ……………………………………………………… $12,000

Less: Accumulated Amortization……………………………...

4,000

$8,000

2nd Fiscal Year-end

Equipment ……………………………………………………… $12,000

Less: Accumulated Amortization……………………………...

8,000

$4,000

12.

In an unearned revenue adjusting entry, liabilities are debited and revenues are credited.

13.

Accrued revenues affect asset and revenue accounts. An asset is debited and revenue is

credited.

14.

Accrued liabilities affect liability and expense accounts. An expense is debited and a liability is credited.

15.

Net earnings was understated $300 because prior to adjustment revenues are understated by $900 and expenses are understated by $600. The difference in this case is $300

($900 – $600).

16.

The entries are:

Dec. 31

Jan. 9

Salaries Expense………………………………..

Salaries Payable………………………… ....

1,700

Salaries Payable………………………………..

Salaries Expense…………………………… .....

Cash…………………………………….. ......

1,700

3,300

Salaries Payable

Accumulated Amortization

Interest Expense

(d)

(e)

(f)

1,700

5,000

17.

(a)

(b)

(c)

Supplies Expense

Service Revenue

Service Revenue

18.

Disagree. An adjusting entry affects only one balance sheet account and one statement of

earnings account.

Solutions Manual

4-5

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

19.

Adjusting entries never involve the Cash account. In making adjusting entries for prepayments the cash has already been paid or received and recorded. The adjusting journal entry must be prepared to reflect the fact that the related revenue or expense has not yet

been earned or incurred. An accrual entry reflects the fact that although the cash has not

been paid or received, either revenue has been earned or an expense has been incurred.

Again there is no impact on the Cash account because cash has not yet been received or

paid.

20.

Financial statements can be prepared from an adjusted trial balance because the balances of all accounts have been adjusted to show the effects of all financial events that have

occurred during the accounting period.

21.

(1)

(2)

(3)

(4)

(Dr) Individual revenue accounts and (Cr.) Income Summary

(Dr) Income Summary and (Cr.) Individual expense accounts

(Dr) Income Summary and (Cr.) Retained Earnings (for net earnings)

(Dr) Retained earnings and (Cr) Income Summary (for net loss)

(Dr) Retained Earnings and (Cr.) Dividends

22.

The post-closing trial balance contains only balance sheet accounts. Its purpose is to

prove the equality of the permanent account balances that are carried forward into the

next accounting period.

23.

The accounts that will not appear in the post-closing trial balance are Amortization Expense, Dividends, and Service Revenue.

24.

The steps that involve journalizing are (1) journalize the transactions, (2) journalize the adjusting entries, and (3) journalize the closing entries.

25.

The three trial balances are the (1) trial balance, (2) adjusted trial balance, and (3) postclosing trial balance.

Solutions Manual

4-6

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 4-1

The revenue recognition principle dictates that revenue must be recognized in the period in

which it is earned. In a service environment, such as a university, revenue is considered earned

at the time the service is performed. Once the term starts, ¼ of the tuition should be recognized

each month and matched against the cost of providing this service (e.g., salaries, utilities, etc.).

BRIEF EXERCISE 4-2

(a)

(b)

(c)

(d)

(e)

(f)

Cash

-$100

0

0

+800

–2,500

0

Net Earnings

$0

–50

+1,000

0

0

–500

BRIEF EXERCISE 4-3

Item

(1)

Type of Adjustment

(2)

Accounts Before Adjustment

(a)

Prepaid Expenses

Assets Overstated

Expenses Understated

(b)

Accrued Revenues

Assets Understated

Revenues Understated

(c)

Accrued Revenues

Assets Understated

Revenues Understated

(d)

Unearned Revenues

Liabilities Overstated

Revenues Understated

(e)

Prepaid Expenses

Assets Overstated

Expenses Understated

(f)

Accrued Expenses

Expenses Understated

Liabilities Understated

Solutions Manual

4-7

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 4-4

Dec. 31

Advertising Supplies Expense ........................................

Advertising Supplies ..............................................

Advertising Supplies

Dec. 31

8,800 Dec. 31

Dec. 31 Bal. 1,500

7,300

7,300

Advertising Supplies Expense

Dec. 31

7,300

7,300

BRIEF EXERCISE 4-5

Dec. 31

Amortization Expense—Equipment ................................

Accumulated Amortization—Equipment.................

Amortization Expense—

Equipment

Dec. 31

4,400

4,400

4,400

Accumulated Amortization—

Equipment

Dec. 31

4,400

SHAH CORPORATION

Balance Sheet (partial)

December 31

Assets

Property, plant, and equipment

Equipment ...........................................................................

Less: Accumulated amortization.........................................

$22,000

4,400

$17,600

BRIEF EXERCISE 4-6

June

1

Dec. 31

Prepaid Insurance ...........................................................

Cash ......................................................................

12,000

Insurance Expense ($12,000 x 7/12) ..............................

Prepaid Insurance ..................................................

7,000

Prepaid Insurance

June 1

12,000 Dec. 31

Dec. 31 Bal. 5,000

7,000

Dec. 31

12,000

7,000

Insurance Expense

7,000

Solutions Manual

4-8

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 4-7

June

1

Dec. 31

Cash ...............................................................................

Unearned Insurance Revenue ...............................

12,000

Unearned Insurance Revenue ........................................

Insurance Revenue ................................................

7,000

Unearned Insurance Revenue

Dec. 31

7,000 June 1

12,000

Dec. 31 Bal. 5,000

12,000

7,000

Insurance Revenue

Dec. 31

7,000

BRIEF EXERCISE 4-8

(a)

(b)

(c)

Dec. 28

Dec. 31

Jan.

4

Salaries Expense ...................................................

Cash .............................................................

5,000

Salaries Expense ...................................................

Salaries Payable ...........................................

1,000

Salaries Expense ...................................................

Salaries Payable ....................................................

Cash .............................................................

4,000

1,000

5,000

1,000

5,000

BRIEF EXERCISE 4-9

(a)

(b)

(c)

July 1, 2004

Dec. 31, 2004

Dec. 31, 2005

Vehicle – Truck .............................................

Note Payable .........................................

Cash .....................................................

40,000

Interest Expense ($22,000 X 6% X 6/12) ......

Interest Payable .....................................

660

Note Payable ................................................

Interest Payable ............................................

Interest Expense ($22,000 X 6%) .................

Cash ......................................................

22,000

660

1,320

22,000

18,000

660

23,980

Solutions Manual

4-9

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 4-10

(a)

$2,500 ($2,500 - $0)

(b)

$4,500 ($2,500 + $3,500 - $1,500)

(c)

$3,000 ($1,500 - $2,000 – X = $2,500)

Income Tax Payable

0

0 Expense

2,500

2004 Bal. (a) 2,500

Payment (b) 4,500 Expense

3,500

2005 Bal.

1,500

Payment

2,000 Expense (c) 3,000

2006 Bal.

2,500

Payment

BRIEF EXERCISE 4-11

Account

(1)

Type of Adjustment

(2)

Related Account

(a)

Accounts Receivable

Accrued Revenues

Service Revenue

(b)

Prepaid Insurance

Prepaid Expenses

Insurance Expense

(c)

Equipment

No adjustment required

N/A

(d)

Accum. Amortization—

Equipment

Prepaid Expenses

Amortization Expense

(e)

Notes Payable

No adjustment required

N/A

(f)

Interest Payable

Accrued Expenses

Interest Expense

(g)

Unearned Service Revenue

Unearned Revenues

Service Revenue

Solutions Manual

4-10

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 4-12

LUMAS CORPORATION

Statement of Earnings

Year Ended December 31, 2004

Revenues

Service revenue ...................................................................

Expenses

Salaries expense ..................................................................

Rent expense .......................................................................

Insurance expense ...............................................................

Supplies expense .................................................................

Amortization expense ...........................................................

Total expenses ............................................................

Earnings before income taxes .......................................................

Income tax expense ......................................................................

Net earnings ..................................................................................

$37,000

$13,000

3,500

2,000

1,500

1,000

21,000

16,000

6,400

$ 9,600

BRIEF EXERCISE 4-13

LUMAS CORPORATION

Statement of Retained Earnings

Year Ended December 31, 2004

Retained earnings, January 1 ..............................................................................

Add: Net earnings...............................................................................................

Less: Dividends ...................................................................................................

Retained earnings, December 31 .........................................................................

$15,600

9,600

25,200

6,000

$19,200

BRIEF EXERCISE 4-14

The accounts that will appear in the post-closing trial balance are:

Accumulated Amortization

Retained Earnings

Supplies

Accounts Payable

Solutions Manual

4-11

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 4-15

July 31 Green Fees....................................................

Income Summary ....................................

26,000

July 31 Income Summary ..........................................

Salaries Expense ....................................

Maintenance Expense ............................

Income tax Expense ...............................

16,700

July 31 Income Summary ..........................................

Retained Earnings ..................................

9,300

Green Fees

July 31

26,000 July 31 Bal.

July 31 Bal.

0

8,200

Maintenance Expense

July 31 Bal. 2,500 July 31

July 31 Bal.

0

2,500

Income Tax Expense

July 31 Bal. 6,000 July 31

July 31 Bal.

0

6,000

July 31

July 31

Retained Earnings

July 1

July 31

July 31 Bal.

8,200

2,500

6,000

9,300

26,000

Salaries Expense

July 31 Bal. 8,200 July 31

July 31 Bal.

0

Income Summary

16,700 July 31

9,300

July 31 Bal.

26,000

26,000

0

50,000

9,300

59,300

Solutions Manual

4-12

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 4-1

(a)

Since the sales effort is not complete until the flight actually occurs, revenue should not be

recognized until December. Air Canada should recognize the revenue in December when

the customer has been provided with the flight.

(b)

If Leon’s is reasonably certain of collection, revenue should be recognized at the time

of sale. If the company has concerns over the collectibility of the accounts receivable,

revenue should not be recognized until the time that collection is reasonably assured.

(c)

Revenue should be recognized on a per game basis over the season from April to October.

(d)

Interest revenue should be accrued and recognized by RBC evenly over the term of

the loan.

(e)

Revenue should be recognized when the sweater is shipped to the customer in September provided there is reasonable assurance of collectibility.

EXERCISE 4-2

(a)

(b)

(c)

(d)

(e)

Revenue recognition principle

Going concern assumption

Time period assumption

Cost principle

Economic entity assumption

EXERCISE 4-3

(a) and (b)

Service revenue

Less:

Operating expenses

Insurance expense

Earnings before income taxes

Less: Income tax expense

Net earnings

Cash Basis

$22,000

Accrual Basis

$26,000

013,500

2,500

16,000

—

$ 6,000

015,000

—

011,000

4,400

$ 6,600

Solutions Manual

4-13

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 4-3 (Continued)

(c)

The accrual basis of accounting provides more useful information for decision makers because it recognizes revenues when earned and expenses when incurred. By recognizing

revenue when it is earned and properly matching revenue and expenses, the accrual basis

provides a better measurement of performance.

EXERCISE 4-4

Item

(1)

Type of Adjustment

(2)

Accounts Before Adjustment

1.

Accrued Revenues

Assets: Accounts Receivable understated by $600

Revenues: Service Revenue understated by $600

2.

Prepaid Expenses

Assets: Supplies overstated by $1,700

Expenses: Supplies Expense understated by

$1,700

3.

Accrued Expenses

Expenses: Income Tax Expense understated by

$225

Liabilities: Income Tax Payable understated by

$225

4.

Unearned Revenues

Liabilities: Unearned Revenue overstated by $260

Revenues: Service Revenue understated by $260

5.

Accrued Expenses

Expenses: Salaries Expense understated by $800

Liabilities: Salaries Payable understated by $800

6.

Prepaid Expenses

Assets: Prepaid Insurance overstated $350

Expenses: Insurance Expense understated by

$350

Solutions Manual

4-14

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 4-5

1.

2.

3.

4.

5.

6.

Mar. 031

31

31

31

31

31

Amortization Expense ($500 X 3)................................

Accumulated Amortization—Equipment .............

1,500

Unearned Rent Revenue ............................................

Rent Revenue ($10,200 X 1/3)...........................

3,400

Interest Expense .........................................................

Interest Payable .................................................

600

Supplies Expense .......................................................

Supplies ($4,000 – $850) ...................................

3,150

Insurance Expense ($200 X 3) ....................................

Prepaid Insurance ..............................................

600

Income Tax Expense ..................................................

Income Tax Payable ..........................................

15,000

Accounts Receivable...................................................

Service Revenue ................................................

900

Utilities Expense..........................................................

Utilities Payable ..................................................

5,200

Amortization Expense .................................................

Accumulated Amortization—Dental Equipment..

600

Interest Expense ($60,000 X 8% X 1/12) ....................

Interest Payable .................................................

400

Insurance Expense ($5,000 ÷ 12) ...............................

Prepaid Insurance ..............................................

417

Supplies Expense ($1,800 – $500) .............................

Supplies .............................................................

1,300

1,500

3,400

600

3,150

600

15,000

EXERCISE 4-6

1.

2.

3.

Jan. 31

31

31

31

4.

5.

31

31

900

5,200

600

400

417

1,300

Solutions Manual

4-15

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 4-7

WELLER CORP.

Statement of Earnings

Month Ended July 31, 2005

Revenues

Service revenue ($5,500 + $750) .............................................

Expenses

Wages expense ($2,300 + $300) .............................................

Supplies expense ($1,000 – $400) ...........................................

Utilities expense .......................................................................

Insurance expense ...................................................................

Amortization expense ...............................................................

Total expenses ................................................................

Earnings before income taxes ...........................................................

Income tax expense ..........................................................................

Net earnings ......................................................................................

$6,250

$2,600

600

800

300

150

4,450

1,800

600

$1,200

EXERCISE 4-8

(a)

July

10

14

15

20

31

(b)

July

31

31

31

31

Supplies ......................................................................

Cash ...................................................................

300

Cash ...........................................................................

Service Revenue ................................................

3,000

Salaries Expense ........................................................

Cash ...................................................................

1,200

Cash ...........................................................................

Unearned Service Revenue ...............................

700

Cash ...........................................................................

Service Revenue ................................................

800

Supplies Expense .......................................................

Supplies .............................................................

700

Accounts Receivable...................................................

Service Revenue ................................................

500

Salaries Expense ........................................................

Salaries Payable ................................................

1,200

Unearned Service Revenue ........................................

Service Revenue ................................................

1,200

300

3,000

1,200

700

800

700

500

1,200

1,200

Solutions Manual

4-16

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 4-9

(a)

(b)

Income Tax Expense ([$750 X 12] – $12,000) ...............................

Income Tax Payable ...........................................................

3,000

Utilities Expense ...........................................................................

Utilities Payable ..................................................................

900

Salaries Expense ($1,500 X 3/5 days)...........................................

Salaries Payable .................................................................

900

Interest Expense ($10,000 X 6% X 1/12).......................................

Interest Payable ..................................................................

50

3,000

900

900

50

Arsenault’s accrued expenses reported on its year-end classified balance sheet would

be ($3,000 +$900 + $900 + $50) $4,850. They would be classified as current liabilities.

EXERCISE 4-10

Answer

Calculation

(a)

Supplies balance = $900

Supplies expense

Add: Supplies (Jan. 31)

Less: Supplies purchased

Supplies (Jan. 1)

(b)

Total premium = $7,200

Total premium = Monthly premium X 12; $600

X 12 = $7,200

Purchase date = June 1, 2003

Purchase date: On Jan. 31, there are 4

months coverage remaining ($600

X 4). Thus, the purchase date was 8 months

earlier on June 1, 2003.

Salaries payable = $1,900

Cash paid

Salaries payable (Jan. 31, 2004)

(c)

Less: Salaries expense

Salaries payable (Dec. 31, 2003)

(d)

Service revenue = $1,650

Service revenue

Unearned revenue (Jan. 31, 2004)

Cash received in Jan.

Unearned revenue (Dec. 31, 2003)

$950)

800)

(850)

$900)

$2,500

1,200

3,700

1,800

$1,900

$2,500

750

3,250

1,600

$1,650

Solutions Manual

4-17

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 4-11

Aug.

31

31

31

31

31

31

31

Accounts Receivable ...........................................................

Service Revenue ........................................................

700

Office Supplies Expense .....................................................

Office Supplies ...........................................................

1,600

Insurance Expense ..............................................................

Prepaid Insurance ......................................................

1,500

Amortization Expense..........................................................

Accumulated Amortization—Office Equipment ...........

1,200

Salaries Expense.................................................................

Salaries Payable .........................................................

1,000

Income Tax Expense ...........................................................

Income Tax Payable ...................................................

3,500

Unearned Rent Revenue .....................................................

Rent Revenue.............................................................

800

700

1,600

1,500

1,200

1,000

3,500

800

Solutions Manual

4-18

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 4-12

INUIT INC.

Statement of Earnings

Year Ended August 31, 2004

Revenues

Service revenue ...................................................................

Rent revenue ........................................................................

Total revenues .............................................................

Expenses

Salaries expense ..................................................................

Rent expense .......................................................................

Office supplies expense .......................................................

Insurance expense ...............................................................

Amortization expense ...........................................................

Total expenses ............................................................

Earnings before income taxes .......................................................

Income tax expense ......................................................................

Net earnings ..................................................................................

$34,700

11,800

46,500

$18,000

15,000

1,600

1,500

1,200

37,300

9,200

3,500

$ 5,700

INUIT INC.

Statement of Retained Earnings

Year Ended August 31, 2004

Retained earnings, September 1, 2003 ................................................................

Add: Net earnings...............................................................................................

Less: Dividends ...................................................................................................

Retained earnings, August 31, 2004 ....................................................................

$ 5,600

5,700

11,300

800

$10,500

Solutions Manual

4-19

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 4-12 (Continued)

INUIT INC.

Balance Sheet

August 31, 2004

Assets

Current assets

Cash .....................................................................................

Accounts receivable .............................................................

Office supplies ......................................................................

Prepaid insurance ................................................................

Total current assets .....................................................

Property, plant, and equipment

Office equipment ..................................................................

Less: Accum. amortization—office equipment.....................

Total assets .................................................................

$ 9,600

9,500

700

2,500

22,300

$14,000

4,800

9,200

$31,500

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable ........................................................................................

Salaries payable ..........................................................................................

Income tax payable .....................................................................................

Unearned rent revenue ...............................................................................

Total current liabilities .........................................................................

Shareholders’ equity

Common shares ..........................................................................................

Retained earnings .......................................................................................

Total shareholders’ equity ..................................................................

Total liabilities and shareholders’ equity .............................................

$ 5,800

1,000

3,500

700

11,000

10,000

10,500

20,500

$31,500

Solutions Manual

4-20

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 4-13

Aug.

31

31

031

31

Service Revenue ............................................................

Rent Revenue.................................................................

Income Summary ..................................................

34,700

11,800

Income Summary ...........................................................

Salaries Expense ...................................................

Office Supplies Expense .......................................

Rent Expense ........................................................

Insurance Expense ................................................

Amortization Expense ............................................

Income Tax Expense .............................................

40,800

Income Summary ...........................................................

Retained Earnings .................................................

5,700

Retained Earnings ..........................................................

Dividends ...............................................................

800

46,500

18,000

1,600

15,000

1,500

1,200

3,500

5,700

800

Solutions Manual

4-21

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 4-1A

(a) 2.

Going concern assumption

(b) 3.

Monetary unit assumption

(c) 9.

Materiality

(d) 4.

Time period assumption

(e) 6.

Revenue recognition principle

(f)

Cost-benefit

10.

(g) 1.

Economic entity assumption

(h) 5.

Full disclosure principle

Solutions Manual

4-22

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-2A

$45,000

-1,400

Cash basis earnings

Accounts receivable arise from sales that have been made, thus

revenue must be recognized for balance outstanding at the end of

the current year

Accounts receivable collected in current year, for sales made in

previous year must be deducted from earnings

Prepaid expenses at year end should be set up as an asset rather

than expensed, this increases earnings

Prepaid expenses at the end of the previous year should be expensed this year, this decreases earnings

Accounts payable owing at the end of the current year should be

accrued, thus reducing earnings

Accounts payable owed at the end of the previous year should not

be deducted from the current year’s earnings, thus increasing

earnings

Unearned revenue at the end of the current year should be accrued, thus reducing earnings.

+1,500

Unearned revenue at the end of the previous year should not be

deducted from the current year’s income, thus increasing earnings

+3,600

-2,700

+1,500

-1,300

-1,500

+2,200

$46,900

Accrual basis earnings.

Solutions Manual

4-23

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-3A

(a)

THE RADICAL EDGE LTD.

Statement of Earnings

Six Months Ended April 30, 2004

Revenues

Repair services ($32,150 + $650) .....................

Expenses

Wage expense ($2,600 + $220) ........................

Rent expense ($1,225 - $175) ...........................

Advertising expense ..........................................

Amortization expense ($9,200 ÷ 5 x 6/12) .........

Utilities expense ................................................

Total expenses ..........................................

Earnings before taxes ...............................................

Income tax expense..................................................

Net earnings .............................................................

$32,800

$2,820

1,050

375

920

970

6,135

26,665

10,000

$16,665

Solutions Manual

4-24

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-3A (Continued)

(b)

THE RADICAL EDGE LTD.

Balance Sheet

April 30, 2004

Assets

Current assets

Cash ............................................................

Rent deposit .................................................

Accounts receivable ....................................

Total current assets ..............................

Property, plant, and equipment

Equipment ....................................................

Less: Accumulated amortization..................

Total assets .........................................................

$27,780

175

650

28,605

$9,200

920

8,280

$36,885

Liabilities and Shareholders’ Equity

Current liabilities

Wages payable ............................................

Shareholders’ equity

Common shares ...........................................

Retained earnings ........................................

Total shareholders’ equity.....................

Total liabilities and shareholders’ equity...............

$

220

$20,000

16,665

36,665

$36,885

Solutions Manual

4-25

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-4A

1.

Jan. 2

Dec. 31

2.

Aug. 1

Dec. 31

3.

4.

Dec. 15

Office Supplies ..................................................

Cash .......................................................

2,800

Supplies Expense ($2,800 – $300) .................

Office Supplies ........................................

2,500

Prepaid Insurance ..........................................

Cash .......................................................

3,600

Insurance Expense ($3,600 x 5/12) ................

Prepaid Insurance ...................................

1,500

Prepaid Rent ..................................................

Cash .......................................................

500

2,800

2,500

3,600

1,500

500

Dec. 31

No entry required

Nov. 15

Cash ...............................................................

Unearned Revenue .................................

1,200

Unearned Revenue ($400 x 2) .......................

Revenue .................................................

800

Dec. 31

1,200

800

Solutions Manual

4-26

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-5A

1.

2.

3.

4.

Dec. 31

31

31

31

Salaries Expense........................................

Salaries Payable .................................

(6 X $800 X 2/5 = $1,920)

(2 X $500 X 2/5 = $400)

2,320

Unearned Rent Revenue ............................

Rent Revenue .....................................

(5 X $4,000 X 2 = $40,000)

(4 X $8,500 X 1 =

34,000)

Total rent earned $74,000)

74,000

Advertising Expense ...................................

Prepaid Advertising .............................

(A650 – $500 per month

for 8 months = $4,000)

(B974 – $300 per month

for 5 months = 1,500)

$5,500

5,500

Interest Expense ........................................

Interest Payable ..................................

($80,000 X 9% X 8/12)

4,800

2,320

74,000

5,500

4,800

Solutions Manual

4-27

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-6A

1. (a)

(b) Dec. 31

2. (a) June 1

(b) Dec. 31

3.

Dec. 31

4. (a) July 1

(b) Dec. 31

5.

Dec. 31

Office Supplies .............................................

Cash .......................................................

1,500

Supplies Expense ($300 + $1,500 – $500) ..

Office Supplies ........................................

1,300

Cash ............................................................

Note Payable ..........................................

4,000

Interest Expense ..........................................

Interest Payable ($4,000 X 8% x 7/12) ....

187

Utilities Expense ..........................................

Accounts Payable ...................................

1,400

Truck ............................................................

Cash .......................................................

38,000

Amortization Expense ($7,600 X 6/12) .........

Accumulated Amortization – Truck..........

3,800

Income Tax Expense ($13,000 - $10,000) ...

Income Tax Payable ...............................

3,000

1,500

1,300

4,000

187

1,400

38,000

3,800

3,000

Solutions Manual

4-28

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-7A

(a)

1.

2.

3.

4.

5.

6.

March 31 Travel Service Fees ...............................

Unearned Fees...............................

28,000

31 Supplies Expense ...................................

Supplies ($3,200 – $800) ...............

2,400

31 Insurance Expense ($1,200 x 3/12) ........

Prepaid Insurance ..........................

300

31 Utilities Expense .....................................

Accounts Payable...........................

180

31 Salaries Expense ($175 x 3 x 2) .............

Salaries Payable ............................

1,050

31 Interest Expense (10,000 x 5% x 1/12) ...

Interest Payable .............................

42

28,000

2,400

300

180

1,050

42

Solutions Manual

4-29

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-7A (Continued)

(b)

TRY- US TRAVEL AGENCY LTD.

Statement of Earnings

Quarter Ended March 31, 2004

Revenues

Travel service fees ($50,000 – $28,000) ...........

Expenses

Advertising expense ..........................................

Amortization expense ........................................

Salaries expense ($6,000 + $1,050)..................

Utilities expense ($400 + $180) .........................

Supplies expense ..............................................

Insurance expense ............................................

Interest expense ...............................................

Total expenses ..........................................

Earnings before income taxes ..................................

Income tax expense..................................................

Net earnings .............................................................

(c)

$22,000

$2,600

400

7,050

580

2,400

300

42

13,372

8,628

1,500

$ 7,128

The generally accepted accounting principles pertaining to the statement of

earnings not recognized by Paul were the revenue recognition principle and

the matching principle.

The revenue recognition principle states that revenue is recognized when it is

earned. The fees of $28,000 for summer rentals have not been earned and,

therefore, should not be reported in earnings for the quarter ended March 31.

The matching principle dictates that efforts (expenses) be matched with accomplishments (revenue) whenever it is reasonable and practicable to do so.

This means that the expenses should include amounts incurred in March but

not paid until April, and any other costs related to the operations of the business during the period January—March.

The difference in reported expenses was $3,972 ($13,372 + $1,500 $10,900). The overstatement of revenues ($28,000) plus the understatement

of expenses ($3,972) equals the difference in reported earnings of $31,972

($39,100 - $7,128).

Solutions Manual

4-30

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-8A

(a)

Date

1.

2.

3.

4.

5.

6.

7.

8.

Account Titles

Dec. 31 Accounts Receivable

Service Revenue

31 Insurance Expense

Prepaid Insurance

($3,600 ÷ 2 years)

31 Amortization Expense

Accumulated Amortization—Auto.

Debit

11,500

11,500

1,800

1,800

11,600

11,600

31 Interest Expense

Interest Payable

2,250

31 Unearned Service Revenue

Service Revenue

1,000

31 Salaries Expense (4 x $900)

Salaries Payable

3,600

31 Repairs Expense

Accounts Payable

31 Income Tax Expense

Income Taxes Payable

Credit

2,250

1,000

3,600

650

650

2,600

2,600

Solutions Manual

4-31

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-8A (Continued)

(b)

Cash

Dec. 31 Bal. 12,400

Unearned Service Revenue

Dec. 31

1,000 Dec. 31 Bal. 2,500

Dec. 31 Bal. 1,500

Accounts Receivable

Dec. 31 Bal. 3,200

Dec. 31

11,500

Dec. 31 Bal. 14,700

Common Shares

Dec. 31 Bal. 18,000

Prepaid Insurance

Dec. 31 Bal. 3,600 Dec. 31

Dec. 31 Bal. 1,800

Service Revenue

Dec. 31 Bal. 96,000

Dec. 31

11,500

Dec. 31

1,000

Dec. 31 Bal.108,500

1,800

Automobiles

Dec. 31 Bal. 58,000

Accumulated Amortization—

Automobiles

Dec. 31

11,600

Dec. 31 Bal. 11,600

Accounts Payable

Dec. 31

Dec. 31 Bal.

650

650

Notes Payable

Dec. 31

045,000

Dec. 31 Bal. 45,000

Salaries Expense

Dec. 31 Bal. 57,000

Dec. 31

3,600

Dec. 31 Bal. 60,600

Repairs Expense

Dec. 31 Bal. 6,000

Dec. 31

650

Dec. 31 Bal. 6,650

Rent Expense

Dec. 31 Bal. 12,000

Gas and Oil Expense

Dec.31 Bal. 09,300

Salaries Payable

Dec. 31

Dec. 31 Bal.

03,600

3,600

Amortization Expense

Dec. 31

11,600

Dec. 31 Bal. 11,600

Interest Payable

Dec. 31

Dec. 31 Bal.

0 2,250

0 2,250

Insurance Expense

Dec. 31

1,800

Dec. 31 Bal. 1,800

Income Taxes Payable

Dec. 31

Dec. 31 Bal.

2,600

2,600

Dec. 31

Dec. 31 Bal.

Interest Expense

2,250

2,250

Income Tax Expense

Dec. 31

2,600

Dec. 31 Bal. 2,600

Solutions Manual

4-32

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-8A (Continued)

(c)

ORTEGA LIMO SERVICE LTD.

Adjusted Trial Balance

December 31, 2004

Cash ....................................................................

Accounts Receivable ...........................................

Prepaid Insurance ................................................

Automobiles .........................................................

Accumulated Amortization—Automobiles ............

Accounts Payable ................................................

Interest Payable ...................................................

Salaries Payable ..................................................

Income Taxes Payable.........................................

Unearned Service Revenue .................................

Notes Payable .....................................................

Common Shares ..................................................

Service Revenue..................................................

Salaries Expense .................................................

Rent Expense ......................................................

Repairs Expense..................................................

Gas and Oil Expense ...........................................

Amortization Expense ..........................................

Insurance Expense ..............................................

Interest Expense ..................................................

Income Tax Expense ...........................................

Totals

Debit

$ 12,400

14,700

1,800

58,000

Credit

$ 11,600

650

2,250

3,600

2,600

1,500

45,000

18,000

108,500

60,600

12,000

6,650

9,300

11,600

1,800

2,250

00

2,600 _____ __

$193,700 $193,700

Solutions Manual

4-33

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-9A

(a) 1. Aug. 31

2.

3.

31

31

31

4.

5.

6.

7.

8.

31

31

31

31

31

Insurance Expense ($300 X 3) .................

Prepaid Insurance ............................

900

Supplies Expense ($4,300 – $1,200) .......

Supplies ...........................................

3,100

Amortization Expense—Cottages ............

($6,000 X 3/12)

Accum. Amort.—Cottages ................

1,500

Amortization Expense—Furniture ............

($5,000 X 3/12)

Accum. Amort.—Furniture ................

1,250

Unearned Rent Revenue .........................

Rent Revenue ..................................

5,000

Salaries Expense .....................................

Salaries Payable ..............................

400

Accounts Receivable................................

Rent Revenue ..................................

1,800

Interest Expense ......................................

Interest Payable ...............................

[($90,000 X 8%) X 1/12]

600

Income Tax Expense ...............................

Income Tax Payable .........................

4,000

900

3,100

1,500

1,250

5,000

400

1,800

600

4,000

Solutions Manual

4-34

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-9A (Continued)

(b)

Cash

Aug. 31 Bal. 15,600

Aug. 31 Bal.

400

Interest Payable

Aug. 31

Aug. 31 Bal.

600

600

Income Tax Payable

Aug. 31 Bal.

Aug. 31

Aug. 31 Bal.

5,000

4,000

9,000

Accounts Receivable

Aug. 31

1,800

Aug. 31 Bal. 1,800

Prepaid Insurance

Aug. 31 Bal. 5,400 Aug. 31

Aug. 31 Bal. 4,500

Aug. 31 Bal.

Aug. 31 Bal.

Supplies

4,300 Aug. 31

1,200

900

3,100

Mortgage Payable

Aug. 31 Bal. 90,000

Common Shares

Aug. 31 Bal. 100,000

Land

Aug. 31 Bal. 50,000

Cottages

Aug. 31 Bal. 125,000

Aug. 31 Bal.

Aug. 31 Bal.

Accumulated Amortization—

Cottages

Aug. 31

1,500

Aug. 31 Bal. 1,500

Furniture

Aug. 31 Bal. 26,000

Accumulated Amortization—

Furniture

Aug. 31

1,250

Aug. 31 Bal. 1,250

Accounts Payable

Aug. 31 Bal.

Unearned Rent Revenue

Aug. 31

5,000 Aug. 31 Bal.

Aug. 31 Bal.

Salaries Payable

Aug. 31

Dividends

5,000

5,000

Rent Revenue

Aug. 31 Bal. 90,000

Aug. 31

5,000

Aug. 31

1,800

Aug. 31 Bal. 96,800

Salaries Expense

Aug. 31 Bal. 51,000

Aug. 31

400

Aug. 31 Bal. 51,400

Aug. 31 Bal.

Utilities Expense

9,400

Aug. 31 Bal.

Repair Expense

3,600

6,500

6,800

1,800

Insurance Expense

Aug. 31

900

Aug. 31 Bal.

900

400

Solutions Manual

4-35

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

PROBLEM 4-9A (Continued)

(b)

(Continued)

Financial Accounting, Second Canadian Edition

Amortization Expense—

Cottages

Aug. 31

1,500

Aug. 31 Bal. 1,500

Supplies Expense

Aug. 31

3,100

Aug. 31 Bal. 3,100

Amortization Expense—

Furniture

Aug. 31

1,250

Aug. 31 Bal. 1,250

Income Tax Expense

Aug. 31 Bal. 3,000

Aug. 31

00 4,000

Aug. 31 Bal. 7,000

Interest Expense

Aug. 31

600

Aug. 31 Bal.

600

PROBLEM 4-9A (Continued)

(c)

HIGHLAND COVE RESORT INC.

Adjusted Trial Balance

August 31, 2005

Cash .................................................................

Accounts Receivable ...........................................

Prepaid Insurance ................................................

Supplies ...............................................................

Land.....................................................................

Cottages ..............................................................

Accumulated Amortization—Cottages ..................

Furniture ..............................................................

Accumulated Amortization—Furniture ..................

Accounts Payable ................................................

Unearned Rent Revenue .....................................

Salaries Payable ..................................................

Interest Payable ...................................................

Income Tax Payable ............................................

Mortgage Payable ................................................

Common Shares ..................................................

Debit

$ 15,600

1,800

4,500

1,200

50,000

125,000

Credit

$

1,500

26,000

1,250

6,500

1,800

400

600

9,000

90,000

100,000

Solutions Manual

4-36

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Dividends .............................................................

Rent Revenue ......................................................

Salaries Expense .................................................

Utilities Expense ..................................................

Repair Expense ...................................................

Insurance Expense ..............................................

Income Tax Expense ...........................................

Supplies Expense ................................................

Amortization Expense—Cottages ........................

Amortization Expense—Furniture ........................

Interest Expense ..................................................

Totals

5,000

96,800

51,400

9,400

3,600

900

7,000

3,100

1,500

1,250

600

$307,850

0000,

_____ __

$307,850

Solutions Manual

4-37

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-9A (Continued)

(d)

HIGHLAND COVE RESORT INC.

Statement of Earnings

Three Months Ended August 31, 2005

Revenues

Rent revenue ..................................................

Expenses

Salaries expense.............................................

Utilities expense ..............................................

Repair expense ...............................................

Supplies expense ............................................

Amortization expense—cottages .....................

Insurance expense ..........................................

Interest expense..............................................

Amortization expense—furniture .....................

Total expenses ........................................

Earnings before income tax ....................................

Income tax expense ................................................

Net earnings ...........................................................

$96,800

$51,400

9,400

3,600

3,100

1,500

900

600

1,250

71,750

25,050

7,000

$18,050

HIGHLAND COVE RESORT INC.

Statement of Retained Earnings

Three Months Ended August 31, 2005

Retained earnings, June 1 .........................................................

Add: Net earnings ....................................................................

Less: Dividends ........................................................................

Retained earnings, August 31 ....................................................

$

0

18,050

18,050

5,000

$13,050

Solutions Manual

4-38

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-9A (Continued)

(d)

(Continued)

HIGHLAND COVE RESORT INC.

Balance Sheet

August 31, 2005

Assets

Current assets

Cash ..........................................................

Accounts receivable ...................................

Prepaid insurance ......................................

Supplies .....................................................

Total current assets ..............................

Property, plant and equipment

Land ...........................................................

Cottages.....................................................

Less: Accum. amortization—cottages .......

Furniture.....................................................

Less: Accum. amortization—furniture ........

Total property, plant, and equipment .....

Total assets .......................................................

$15,600

1,800

4,500

1,200

$23,100

$ 50,000

$125,000

1,500

123,500

$ 26,000

1,250

24,750

198,250

$221,350

Solutions Manual

4-39

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-9A (Continued)

(d)

(Continued)

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable .........................................

Salaries payable...........................................

Interest payable............................................

Unearned rent revenue ................................

Income tax payable ......................................

Total current liabilities...................................

Mortgage payable ................................................

Total liabilities .......................................

Shareholders’ equity

Common shares ...........................................

Retained earnings ........................................

Total shareholders’ equity .....................

Total liabilities and shareholders’ equity

(e)

Aug. 31

31

031

31

$6,500

400

600

1,800

9,000

$ 18,300

90,000

108,300

100,000

13,050

113,050

$221,350

Rent Revenue....................................................

Income Summary .......................................

96,800

Income Summary...............................................

Salaries Expense .......................................

Utilities Expense.........................................

Repair Expense .........................................

Insurance Expense ....................................

Interest Expense ........................................

Supplies Expense ......................................

Amortization Expense - Cottages ...............

Amortization Expense - Furniture ...............

Income Tax Expense .................................

78,750

Income Summary...............................................

Retained Earnings......................................

18,050

Retained Earnings .............................................

Dividends ...................................................

5,000

96,800

51,400

9,400

3,600

900

600

3,100

1,500

1,250

7,000

18,050

5,000

Solutions Manual

4-40

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-10A

(a) Dec. 31

31

31

31

31

31

31

31

Accounts Receivable ......................................

Advertising Revenue ...............................

3,500

Art Supplies Expense .....................................

Art Supplies ............................................

2,400

Insurance Expense.........................................

Prepaid Insurance...................................

850

Amortization Expense ....................................

Accumulated Amortization ......................

7,000

Interest Expense ............................................

Interest Payable ......................................

225

Unearned Advertising Revenue ......................

Advertising Revenue ...............................

400

Salaries Expense ...........................................

Salaries Payable .....................................

1,300

Income Tax Expense ......................................

Income tax Payable ................................

2,500

3,500

2,400

850

7,000

225

400

1,300

2,500

Solutions Manual

4-41

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-10A (Continued)

(b)

GRANT ADVERTISING AGENCY LIMITED

Statement of Earnings

Year Ended December 31, 2004

Revenues

Advertising revenue ..........................................

Expenses

Salaries expense...............................................

Amortization expense ........................................

Rent expense ....................................................

Art supplies expense .........................................

Insurance expense ............................................

Interest expense................................................

Total expenses ..........................................

Earnings before income tax expense ........................

Income tax expense ..................................................

Net earnings .............................................................

$62,500

$11,300

7,000

14,000

2,400

850

225

35,775

26,725

10,000

$16,725

GRANT ADVERTISING AGENCY LIMITED

Statement of Retained Earnings

Year Ended December 31, 2004

Retained earnings, January 1 ....................................................

Add: Net earnings ....................................................................

Less: Dividends ........................................................................

Retained earnings, December 31 ..............................................

$11,650

16,725

28,375

12,000

$16,375

Solutions Manual

4-42

Chapter 4

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 4-10A (Continued)

(b)

(Continued)

GRANT ADVERTISING AGENCY LIMITED

Balance Sheet

December 31, 2004

Assets