Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

CHAPTER 3

The Accounting Information System

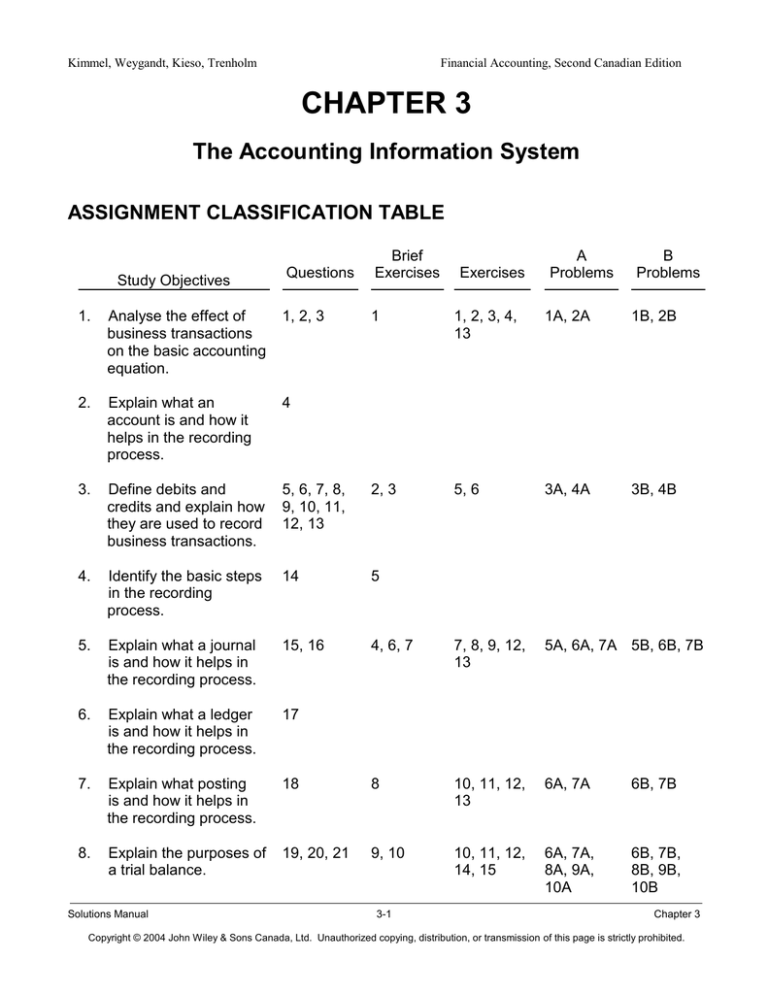

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Questions

Brief

Exercises

1

1, 2, 3, 4,

13

1A, 2A

1B, 2B

5, 6

3A, 4A

3B, 4B

Exercises

A

Problems

B

Problems

1.

Analyse the effect of

business transactions

on the basic accounting

equation.

1, 2, 3

2.

Explain what an

account is and how it

helps in the recording

process.

4

3.

Define debits and

credits and explain how

they are used to record

business transactions.

5, 6, 7, 8,

9, 10, 11,

12, 13

2, 3

4.

Identify the basic steps

in the recording

process.

14

5

5.

Explain what a journal

is and how it helps in

the recording process.

15, 16

4, 6, 7

7, 8, 9, 12,

13

5A, 6A, 7A 5B, 6B, 7B

6.

Explain what a ledger

is and how it helps in

the recording process.

17

7.

Explain what posting

is and how it helps in

the recording process.

18

8

10, 11, 12,

13

6A, 7A

6B, 7B

8.

Explain the purposes of

a trial balance.

19, 20, 21

9, 10

10, 11, 12,

14, 15

6A, 7A,

8A, 9A,

10A

6B, 7B,

8B, 9B,

10B

Solutions Manual

3-1

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

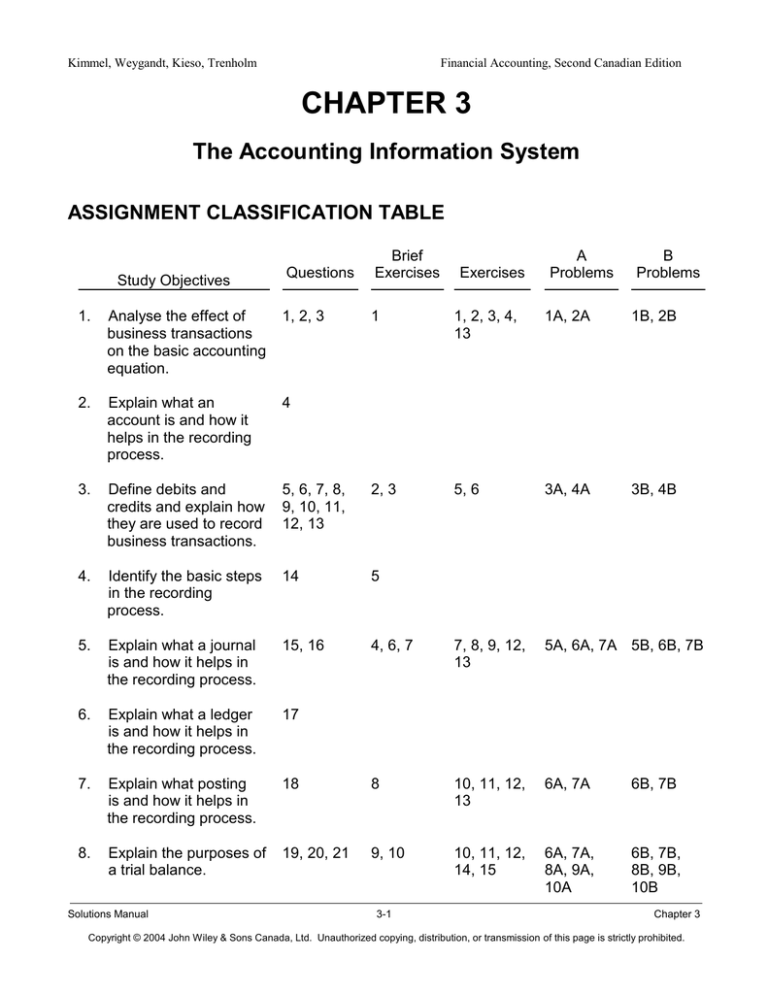

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

1A

Analyse transactions, classify cash flows, and

calculate net earnings.

Moderate

40-50

2A

Analyse transactions and prepare financial

statements.

Moderate

40-50

3A

Identify normal account balance and associated

financial statement.

Simple

20-30

4A

Identify debits, credits, and normal balances;

calculate cash flow and net earnings.

Simple

30-40

5A

Journalize transactions.

Moderate

30-40

6A

Journalize transactions, post, and prepare trial

balance.

Moderate

40-50

7A

Journalize transactions, post, and prepare trial

balance.

Moderate

40-50

8A

Analyse errors and their effects on trial balance.

Moderate

30-40

9A

Prepare corrected trial balance.

Complex

40-50

10A

Prepare trial balance and financial statements.

Moderate

40-50

1B

Analyse transactions, classify cash flows, and

calculate net earnings.

Moderate

40-50

2B

Analyse transactions and prepare financial

statements.

Moderate

40-50

3B

Identify normal account balance and associated

financial statement.

Simple

20-30

4B

Identify debits, credits, and normal balances;

calculate cash flow and net earnings.

Simple

30-40

5B

Journalize transactions.

Moderate

30-40

Solutions Manual

3-2

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Problem

Number

Financial Accounting, Second Canadian Edition

Description

Difficulty

Level

Time

Allotted (min.)

6B

Journalize transactions, post, and prepare trial

balance.

Moderate

40-50

7B

Journalize transactions, post, and prepare trial

balance.

Moderate

40-50

8B

Analyse errors and their effects on trial balance.

Moderate

30-40

9B

Prepare corrected trial balance.

Complex

40-50

10B

Prepare trial balance and financial statements.

Moderate

40-50

Solutions Manual

3-3

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

ANSWERS TO QUESTIONS

1.

Yes, a business can enter into a transaction in which only the left side of the accounting

equation is affected. An example would be a transaction where an increase in one asset is

offset by a decrease in another asset. An increase in the Equipment account which is offset by

a decrease in the Cash account is a specific example.

2.

Accounting transactions are the economic events of the enterprise recorded by accountants

because they affect the basic equation.

(a)

(b)

(c)

(d)

3.

(a)

(b)

(c)

(d)

The death of a major shareholder of the company is not an accounting transaction,

as it does not affect the basic equation.

Supplies purchased on account is an accounting transaction because it affects the

basic equation.

An employee being fired is not an accounting transaction, as it does not affect the

basic equation.

Paying a cash dividend to shareholders is an accounting transaction as it does affect

the basic equation.

Decrease assets and decrease shareholders' equity.

Increase assets and increase liabilities.

Increase assets and increase shareholders' equity.

Decrease assets and decrease liabilities.

4.

An account consists of three parts: (a) the title, (b) the left or debit side, and (c) the right or

credit side. Because the alignment of these parts resembles the letter T, it is referred to as a T

account.

5.

Charles is incorrect. The double-entry system merely records the dual effect of a transaction

on the accounting equation. A transaction is not recorded twice; it is recorded once, with a

dual effect.

6.

Natalie is incorrect. A debit balance only means that debit amounts exceed credit amounts in

an account. Conversely, a credit balance only means that credit amounts are greater than

debit amounts in an account. Thus, a debit or credit balance is neither favourable nor

unfavourable.

7.

(a)

(b)

(c)

Solutions Manual

Asset accounts are increased by debits and decreased by credits.

Liability accounts are decreased by debits and increased by credits.

The Common Shares and revenue accounts are decreased by debits and increased

by credits. The dividend and expense accounts are increased by debits and

decreased by credits.

3-4

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

8. (a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

Accounts Receivable

Cash

Dividends

Accounts Payable

Service Revenue

Income Tax Expense

Common Shares

Unearned Revenue

debit balance

debit balance

debit balance

credit balance

credit balance

debit balance

credit balance

credit balance

9. (a)

(b)

(c)

(d)

(e)

(f)

Accounts Receivable

Accounts Payable

Equipment

Dividends

Supplies

Service Revenue

asset

debit balance

liability

credit balance

asset

debit balance

shareholders' equity

debit balance

asset

debit balance

shareholders’ equity credit balance

10. (a)

(b)

(c)

Debit Supplies and credit Accounts Payable.

Debit Cash and credit Notes Payable.

Debit Salaries Expense and credit Cash.

11. (a)

(b)

(c)

(d)

(e)

(f)

Cash

Accounts Receivable

Dividends

Accounts Payable

Salaries Expense

Service Revenue

both debit and credit entries

both debit and credit entries

debit entries only

both debit and credit entries

debit entries only

credit entries only

12. The balance in total Shareholders’ Equity should not equal the balance in the Cash account.

The balance in Shareholders’ Equity includes Common Shares (investment by shareholders)

and Retained Earnings (net earnings retained in the business). Investment by shareholders

would normally be made in cash. The Retained Earnings component would include earnings

calculated on an accrual basis and therefore would not equal the entries to the Cash account.

13. Two other accounts that the company might have used to record a cash receipt from a

customer are:

(1)

Unearned revenue – where customer paid in advance.

(2)

Accounts Receivable - where the customer was making a payment on a previous

credit purchase.

Solutions Manual

3-5

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

14. The basic steps in the recording process are:

(1)

Analyse each transaction in terms of its effect on the accounts.

(2)

Enter the transaction information in the general journal (book of original entry).

(3)

Transfer the journal information to the appropriate accounts in the general ledger

(book of accounts).

15. This would not be a more efficient process because all transaction would be posted

individually rather than posting summary amounts.

16. (a)

Cash

9,000

Common Shares

9,000

(Invested cash in the business in exchange for common shares)

(b)

(c)

(d)

17. (a)

(b)

Prepaid Insurance

Cash

(Paid one-year insurance policy)

800

Supplies

1,500

Accounts Payable

(Purchased supplies on account)

Cash

7,500

Service Revenue

(Received cash for services rendered)

800

1,500

7,500

The general ledger is the entire group of accounts maintained by a company,

including all the asset, liability, and shareholders' equity accounts.

The chart of accounts is important, particularly for a company that has a large

number of accounts because it helps organize the accounts and identify their

location in the ledger.

18. Posting from the general journal to the general ledger should be performed on a timely basis

to ensure that the general ledger reflects the most up-to-date accounting information. With

the use of computers in the recording process, entries posted to the general journal are

usually simultaneously posted to the general ledger. The more frequently the journal entries

are posted the more accurate the accounting records.

Solutions Manual

3-6

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Questions (Continued)

19. A trial balance is a list of accounts and their balances at a given time. The primary purpose of

a trial balance is to prove the mathematical equality of debits and credits after all journalized

transactions have been posted. A trial balance also facilitates the discovery of errors in

journalizing and posting. In addition, it is useful in preparing financial statements. The main

limitation of the trial balance is that numerous errors may still exist even though the debit and

credit columns of the trial balance agree. For example, provided the debits and credit are

equal, a trial balance will still balance even though a journal entry has been omitted or if an

entry is posted to the wrong account.

20. The proper sequence is as follows:

2.

An accounting transaction occurs.

3.

Information is entered in the general journal.

1.

Debits and credits are posted to the general ledger.

5.

A trial balance is prepared.

4.

Financial statements are prepared.

21. (a)

(b)

Solutions Manual

The trial balance would balance because the debits and credits would still be equal.

The trial balance would not balance because the debit side would be $810 higher

than the credit side

3-7

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 3-1

a.

b.

c.

d.

e.

f.

Assets

Liabilities

Shareholders’

Equity

+

+

+

+/-

+

NE

NE

NE

NE

NE

NE

+

+

NE

BRIEF EXERCISE 3-2

1.

2.

3.

4.

5.

6.

Accounts Payable

Advertising Expense

Service Revenue

Accounts Receivable

Unearned Service Revenue

Dividends

(a)

Debit

Effect

(a)

Credit

Effect

Decrease

Increase

Decrease

Increase

Decrease

Increase

Increase

Decrease

Increase

Decrease

Increase

Decrease

(b)

Normal

Balance

Credit

Debit

Credit

Debit

Credit

Debit

BRIEF EXERCISE 3-3

June

Solutions Manual

1

2

3

12

30

Account Debited

Cash

Equipment

Rent Expense

Accounts Receivable

Income Tax Expense

3-8

Account Credited

Common Shares

Accounts Payable

Cash

Service Revenue

Cash

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 3-4

June 1

Cash

2,500

Common Shares

2

3

12

30

2,500

Equipment

Accounts Payable

900

Rent Expense

Cash

500

Accounts Receivable

Service Revenue

300

Income Tax Expense

Cash

100

900

500

300

100

BRIEF EXERCISE 3-5

The basic steps in the recording process are:

1.

Analyse each transaction. In this step, business documents are examined to determine the

effects of the transaction on the accounts.

2.

Enter each transaction in the general journal. This step is called journalizing and it results in

making a chronological record of the transactions.

3.

Transfer general journal information to general ledger accounts. This step is called posting.

Posting makes it possible to accumulate the effects of journalized transactions on individual

accounts.

Solutions Manual

3-9

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 3-6

Aug. 1

(a)

Basic Analysis

The asset Cash is increased.

(b)

The shareholders' equity

account Common Shares is

increased.

Aug. 4

(a)

Basic Analysis

The asset Prepaid Insurance

is increased.

Credits increase shareholders'

equity: credit Common Shares

$5,000.

(b)

The asset Cash

is decreased.

Aug. 16

(a)

(a)

Basic Analysis

The asset Cash is increased.

Basic Analysis

The expense Salaries

Expense is increased.

(b)

3-10

Debit-Credit Analysis

Debits increase assets:

debit Cash $900

Credits increase revenues:

credit Service Revenue $900.

(b)

The asset Cash is decreased.

Solutions Manual

Debit-Credit Analysis

Debits increase assets:

debit Prepaid Insurance $2,100

Credits decrease assets:

credit Cash $2,100.

The revenue Service Revenue

is increased.

Aug. 27

Debit-Credit Analysis

Debits increase assets:

debit Cash $5,000.

Debit-Credit Analysis

Debits increase expenses:

debit Salaries Expense $500.

Credits decrease assets:

credit Cash $500.

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 3-7

Aug.

1

4

16

27

Cash

Common Shares

5,000

Prepaid Insurance

Cash

2,100

5,000

2,100

Cash

Service Revenue

900

Salaries Expense

Cash

500

900

500

BRIEF EXERCISE 3-8

Accounts Receivable

May 5

3,200

Bal.

1,300

May 12

Service Revenue

1,900

May 5

May 15

Bal.

Cash

May 12

May 15

1,900

2,000

Bal.

3,900

3,200

2,000

5,200

Income Tax Expense

May 15

750

Income Tax Payable

May 15

Solutions Manual

3-11

750

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 3-9

CARLAND INC.

Trial Balance

June 30, 2004

Debit

Cash

Accounts Receivable

Equipment

Accumulated Amortization

Accounts Payable

Unearned Service Revenue

Common Shares

Retained Earnings

Dividends

Service Revenue

Salaries Expense

Rent Expense

Income Tax Expense

Totals

Solutions Manual

Credit

$ 8,400

3,000

17,000

$ 3,400

4,000

150

20,000

1,090

1,200

6,600

4,000

1,000

640

$35,240

3-12

______

$35,240

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

BRIEF EXERCISE 3-10

ING LIMITED

Trial Balance

December 31, 2004

Debit

Cash

Prepaid insurance

Accounts payable

Unearned revenue

Common shares

Retained earnings

Dividends

Service revenue

Salaries expense

Rent expense

Income tax expense

Totals

Solutions Manual

Credit

$17,600

3,500

$ 3,000

2,200

10,000

7,000

4,500

25,600

18,600

2,400

1,200

$47,800

3-13

00 0000

$47,800

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 3-1

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Increase in assets and increase in shareholders' equity.

Decrease in assets and decrease in shareholders' equity.

Increase in assets and increase in liabilities.

Increase in assets and increase in shareholders' equity.

Decrease in assets and decrease in shareholders' equity.

Increase in assets and decrease in assets. No effect overall.

Increase in liabilities and decrease in shareholders' equity.

Increase in assets, decrease in assets and increase in liabilities.

Increase in assets and increase in shareholders' equity.

Decrease in assets and decrease in shareholders’ equity.

EXERCISE 3-2

Transaction

1.

2.

3.

4.

5.

6.

7.

8.

Assets

+19,000

-4,000

+15,000

-15,000

+3,000

-11,000

+32,000

-19,000

+1,000

Solutions Manual

Shareholders’

Equity

+19,000

NE

NE

-4,000

Liabilities

NE

NE

NE

+4,000

Net

Earnings

NE

-4,000

Revenues

Expenses

NE

NE

NE

NE

NE

NE

NE

NE

-19,000

+1,000

+3,000

-11,000

+32,000

NE

NE

+3,000

NE

NE

NE

NE

NE

+11,000

NE

NE

NE

+3,000

-11,000

NE

NE

NE

3-14

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-3

(a)

1. Shareholders invested $15,000 cash in the business.

2. Purchased office equipment for $5,000, paying $1,000 in cash and the balance of $4,000 on

account.

3. Paid $750 cash for supplies.

4. Earned $8,000 in revenue, receiving $4,600 cash and $3,400 on account.

5. Paid $1,500 cash on accounts payable.

6. Paid $2,000 cash dividends to shareholders.

7. Paid $800 cash for rent.

8. Collected $450 cash from customers on account.

9. Paid salaries of $2,900.

10. Incurred $500 of utilities expense on account.

11. Paid $1,500 of income tax expense.

(b) Issued common Shares

Service revenue

Dividends

Rent expense

Salaries expense

Utilities expense

Income tax expense

Increase in shareholders' equity

(c) Service revenue

Rent expense

Salaries expense

Utilities expense

Income tax expense

Net earnings

Solutions Manual

$15,000

8,000

(2,000)

(800)

(2,900)

(500)

(1,500)

$15,300

$8,000

(800)

(2,900)

(500)

(1,500)

$2,300

3-15

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-4

HAGIWARA INC.

Statement of Earnings

Month Ended August 31, 2004

Revenues

Service revenue

Expenses

Salaries expense

Rent expense

Utilities expense

Total expenses

Earnings before income tax

Income tax expense

Net earnings

$8,000

0

2,900

800

500

4,200

3,800

1,500

$2,300

HAGIWARA INC.

Statement of Retained Earnings

Month Ended August 31, 2004

Retained earnings, August 1

Add: Net earnings

$0,000

2,300

2,300

2,000

$ 300

Less: Dividends

Retained earnings, August 31

Solutions Manual

3-16

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-4 (Continued)

HAGIWARA INC.

Balance Sheet

August 31, 2004

Assets

Current assets

Cash

Accounts receivable

Supplies

Total current assets

Property, plant and equipment

Office equipment0

Total assets

$ 9,600

2,950

750

$13,300

5,000

$18,300

Liabilities and Shareholders' Equity

Liabilities

Accounts payable

Shareholders' equity

Common shares

Retained earnings

Total shareholders’ equity

Total liabilities and shareholders’ equity

Solutions Manual

3-17

$ 3,000

$15,000

300

15,300

$18,300

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-5

Account

Normal Balance

Financial Statement

Account Classification

Accounts payable

Accounts receivable

Cash and cash

equivalents

Common stock

Dividends

Credit

Debit

Debit

Balance sheet

Balance sheet

Balance sheet

Current liability

Current asset

Current asset

Credit

Debit

Shareholders’ equity

N/A

Income taxes payable

Interest expense

Interest income

Inventories

Prepaid expenses

Property and

equipment

Revenues

Credit

Debit

Credit

Debit

Debit

Debit

Balance sheet

Statement of retained

earnings

Balance sheet

Statement of earnings

Statement of earnings

Balance sheet

Balance sheet

Balance sheet

Credit

Statement of earnings

Solutions Manual

3-18

Current liability

Expense

Revenue

Current asset

Current asset

Property, plant and

equipment

Revenue

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-6

Account Debited

Transaction

(a)

Basic

Type

(b)

Specific

Account

Account Credited

(c)

(d)

Effect

Dr./Cr.

(a)

Basic

Type

(b)

Specific

Account

(c)

(d)

Effect

Dr./Cr.

1.

Asset

Cash

Increase

Debit

Shareholders’

Equity

Common

Shares

Increase

Credit

2.

Asset

Vehicle

Increase

Debit

Asset

Cash

Decrease

Debit

3.

Asset

Supplies

Increase

Debit

Liability

Accounts

Payable

Increase

Credit

4.

Asset

Accounts

Receivable

Increase

Debit

Shareholders’

Equity

Service

Revenue

Increase

Credit

5.

Shareholders’ Advertising

Equity

Expense

Increase

Debit

Asset

Cash

Decrease

Debit

6.

Asset

Cash

Increase

Debit

Asset

Accounts

Receivable

Decrease

Debit

7.

Liability

Accounts

Payable

Decrease

Credit

Asset

Cash

Decrease

Debit

8.

Shareholders’ Dividends

Equity

Increase

Debit

Asset

Cash

Decrease

Debit

Solutions Manual

3-19

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-7

General Journal

Trans.

1.

2.

3.

4.

5.

6.

7.

8.

Solutions Manual

Account Titles

Cash

Common Shares

Vehicle

Cash

Debit

Credit

10,000

10,000

018,000

018,000

Supplies

Accounts Payable

00,500

Accounts Receivable

Service Revenue

02,600

Advertising Expense

Cash

00,200

Cash

Accounts Receivable

00,700

Accounts Payable

Cash

00,300

Dividends

Cash

00,500

00,500

02,600

00,200

00,700

00,300

00,500

3-20

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-8

Oct.

1

Debits increase assets:

Credits increase shareholders' equity:

2

No accounting transaction.

3

Debits increase assets:

Credits increase liabilities:

Debit Office Furniture $1,900.

Credit Accounts Payable $1,900.

6

Debits increase assets:

Credits increase revenues:

Debit Accounts Receivable $6,200.

Credit Service Revenue $6,200.

10

Debits increase assets:

Credits increase revenues:

Debit Cash $140.

Credit Service Revenue $140.

27

Debits decrease liabilities:

Credits decrease assets:

Debit Accounts Payable $700.

Credit Cash $700.

30

Debits increase expenses:

Credits decrease assets:

Debit Salaries Expense $2,500.

Credit Cash $2,500.

Solutions Manual

3-21

Debit Cash $25,000.

Credit Common Shares $25,000.

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-9

General Journal

Date

Oct. 1

Cash

Common Shares

Debit

25,000

No entry.

3

Office Furniture

Accounts Payable

01,900

Accounts Receivable

Service Revenue

06,200

Cash

Service Revenue

00,140

Accounts Payable

Cash

00,700

Salaries Expense

Cash

00,2,500

10

27

30

Credit

25,000

2

6

Solutions Manual

Account Titles

01,900

06,200

00,140

00,700

00,2,500

3-22

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-10

(a)

Cash

Oct. 1

10

25,000

140

Bal.

Oct. 27

30

Accounts Payable

700

2,500

Oct. 27

700

Oct. 3

1,900

Bal.

1,200

21,940

Common Shares

Accounts Receivable

Oct. 6

6,200

Bal.

6,200

Oct. 1

25,000

Bal.

25,000

Service Revenue

Office Furniture

Oct. 3

1,900

Oct. 6

Oct. 10

Bal.

1,900

Bal.

6,200

140

6,340

Salaries Expense

Oct. 30

2,500

Bal.

2,500

Solutions Manual

3-23

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-10 (Continued)

(b)

AUBUT REAL ESTATE AGENCY CORPORATION

Trial Balance

October 31, 2004

Debit

Cash

Accounts receivable

Office furniture

Accounts payable

Common shares

Service revenue

Salaries expense

Totals

Solutions Manual

Credit

$21,940

006,200

1,900

2,500

9$32,540

3-24

$ 1,200

25,000

0 6,340

______

$32,540

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-11

(a)

Cash

Aug. 1

10

31

1,600

2,900

600

Bal.

4,100

Aug. 12

Common Shares

1,000

Aug. 1

1,600

Bal.

1,600

Service Revenue

Accounts Receivable

Aug. 25

1,800

Bal.

1,200

Aug. 31

600

Aug. 10

25

2,900

1,800

Bal.

4,700

Office Equipment

Aug. 12

4,000

Bal.

4,000

Notes Payable

Solutions Manual

Aug. 12

3,000

Bal.

3,000

3-25

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-11 (Continued)

(b)

KANG, INC.

Trial Balance

August 31, 2004

Debit

Cash

Accounts Receivable

Office Equipment

Notes Payable

Common Shares

Service Revenue

Totals

Solutions Manual

Credit

$4,100

00,1,200

04,000

_____

$9,300

3-26

$3,000

01,600

4,700

$9,300

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-12

(a) Oct. 1

3

4

6

10

10

12

15

20

20

Solutions Manual

Cash

4,000

Common Shares

4,000

(Invested cash in business in exchange for common shares)

Furniture

3,000

Accounts Payable

(Purchased furniture on account)

Supplies

Cash

(Purchased supplies)

3,000

400

400

Accounts Receivable

800

Service Revenue

(Billed clients for services provided)

800

Cash

750

Service Revenue

(Received cash for services rendered)

750

Cash

Notes Payable

(Obtained loan from bank)

8,000

8,000

Accounts Payable

1,500

Cash

(Made payment on accounts payable)

Rent Expense

Cash

(Paid cash for rent)

1,500

250

250

Cash

800

Accounts Receivable

(Received cash in payment of account)

800

Accounts Receivable

740

Service Revenue

(Billed clients for services provided)

740

3-27

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-12 (Continued)

(a) (Continued)

Oct. 25

30

31

31

Cash

2,000

Common Shares

2,000

(Invested cash in business in exchange for common shares)

Dividends

Cash

(Paid cash dividends)

300

Store Wages Expense

Cash

(Paid wages)

500

Supplies Expense

Supplies

(Used supplies for operating)

180

300

500

180

(b)

HOLLY CORP.

Trial Balance

October 31, 2004

Debit

Cash

Accounts Receivable

Supplies

Furniture

Notes Payable

Accounts Payable

Common Shares

Dividends

Service Revenue

Store Wages Expense

Supplies Expense

Rent Expense

Totals

Solutions Manual

Credit

$12,600

00740

000,220

003,000

$08,000

0001,500

006,000

000,300

002,290

000,500

000,180

250

$17,790

3-28

______

$17,790

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-13

(a)

Cash

Sept. 1

Accounts

Shareholders’

+ Equipment = Payable +

Equity

+$15,000

+ 15,000

–5,000

+12,000

+ 10,000 +

12,000

+–3,000

______

+ 7,000 +

12,000

+ -500

______

$ 6,500 + +$12,000

5

25

30

=

=

=

=

+$15,000 Investment

+ 15,000

+7,000

____ _____

7,000 +

+ 15,000

-3,000

______

4,000 +

+ 15,000

_____

-500 Dividends

$4,000 +

$14,500

(b)

General Journal

Date

Sept. 1

5

25

30

Solutions Manual

Account Titles

Debit

Cash

Common Shares

15,000

Equipment

Cash

Accounts Payable

12,000

Accounts Payable

Cash

03,000

Dividends

Cash

00,500

Credit

15,000

05,000

07,000

03,000

00,500

3-29

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-13 (Continued)

(c)

Cash

Sept. 1

Bal.

15,000 Sept. 5

Sept. 25

Sept. 30

Common Shares

5,000

3,000

500

Sept. 1

15,000

Bal.

15,000

6,500

Dividends

Equipment

Sept. 5

12,000

Bal.

12,000

Sept. 30

500

Bal.

500

Accounts Payable

Sept. 25

3,000 Sept. 5

Bal.

Solutions Manual

7,000

4,000

3-30

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-14

Solutions Manual

Error

(a)

In Balance

(b)

Difference

(c)

Larger Column

1.

2.

3.

4.

5.

6.

No

Yes

Yes

No

Yes

No

$400

0

0

$300

0

$9

Debit

n/a

n/a

Credit

n/a

Credit

3-31

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-15

(a)

SPEEDY DELIVERY SERVICE, INC.

Trial Balance

July 31, 2004

Debit

Cash ($111,640 - $83,920 debit total of all accts. without cash)

Accounts Receivable

Prepaid Insurance

Delivery Equipment

Accumulated Amortization

Accounts Payable

Salaries Payable

Notes Payable

Common Shares

Retained Earnings

Dividends

Service Revenue

Amortization Expense

Salaries Expense

Gas and Oil Expense

Repair Expense

Insurance Expense

Income Tax Expense

Totals

Solutions Manual

3-32

Credit

$ 27,720

13,640

1,960

49,360

$ 19,745

7,390

815

18,450

40,000

4,630

700

20,610

9,870

4,420

750

1,200

520

1,500

$111,640

000 0000

$111,640

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-15 (Continued)

(b)

SPEEDY DELIVERY SERVICE, INC.

Statement of Earnings

Year Ended July 31, 2004

Revenues

Service revenue

Expenses

Amortization expense

Salaries expense

Gas and oil expense

Repair expense

Insurance expense

Total expenses

Earnings before income tax

Income tax expense

Net earnings

$ 20,610

0

9,870

4,420

750

1,200

520

16,760

3,850

1,500

$ 2,350

SPEEDY DELIVERY SERVICE, INC.

Statement of Retained Earnings

Year Ended July 31, 2004

Retained earnings, August 1, 2003

Add: Net earnings

Less: Dividends

Retained earnings, July 31, 2004

Solutions Manual

3-33

$4,630

2,350

6,980

700

$6,280

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

EXERCISE 3-15 (Continued)

(b) (Continued)

SPEEDY DELIVERY SERVICE, INC.

Balance Sheet

July 31, 2004

Assets

Current assets

Cash

Accounts receivable

Prepaid insurance

Total current assets

Property, plant and equipment

Delivery equipment0

Less: Accumulated amortization

Total property, plant and equipment

Total assets

$27,720

13,640

1,960

$43,320

$49,360

(19,745)

Liabilities and Shareholders' Equity

Liabilities

Accounts payable

$7,390

Salaries payable

815

Total current liabilities

Notes payable

Total liabilities

Shareholders' equity

Common shares

$40,000

Retained earnings

6,280

Total shareholders’ equity

Total liabilities and shareholders’ equity

Solutions Manual

3-34

29,615

$72,935

$ 8,205

18,450

26,655

46,280

$72,935

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 3-1A

(a) and (b)

TransAction

1.

Cash

Flow

Statement

F

2.

I

- 5,000

3.

O

- 500

4.

O

- 400

5.

O

6.

O

+4,100

+4,100 (c)

7.

F

-500

-500 (d)

8.

O

-1,500

-1,500 (e)

9.

O

-140

-140 (f)

10.

O

11.

O

+120

12.

O

-1,000

Total

Solutions Manual

Accounts

Cash

Receivable Supplies

+$15,000

Equipment

Accounts Payable

Common

Shares

+$15,000

+$5,000

- $500 (a)

+ $400

+ $250

- 250 (b)

+400

$10,180

Retained

Earnings

+400 (g)

-120

-1,000 (h)

$280

3-35

$400

$5,000

$250

$15,000

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

$610

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-1A (Continued)

(a) (Continued)

Key to Retained Earnings column on previous page.

(a)

(b)

(c)

(d)

(e)

(f )

(g)

(h)

Rent expense

Advertising expense

Service revenue

Dividends

Salaries expense

Utilities expense

Service revenue

Income tax expense

(c)

Service revenue

Expenses

Salaries expense

Rent expense

Advertising expense

Utilities expense

Income tax expense

Net earnings

$4,500

$1,500

500

250

140

1,000

3,390

$1,110

OR

Increase in retained earnings

Add: Dividends

Net earnings

Solutions Manual

$ 610

500

$1,110

3-36

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-2A

(a)

CORSO CARE CORP.

Cash

Bal.

1.

2.

3.

4.

5.

6.

7.

8.

9.

$ 9,000

–3,100

+1,600

-1,000

+2,300

–600

–1,700

Accounts

Office

Notes

Accounts

Common

+ Receivable + Supplies + Equipment = Payable + Payable + Shares

$1,700

$600

$ 6,000

$3,600

–3,100

+4,100

+3,100

+

$13,000

+6,600

+8,900

–600

–700

–900

–100

–170

00 000

$6,700

0 0

$600

00 000

$10,100

+$7,000

700 000

$7,000

00 000

$3,770

00 0 00

$13,000

$28,400 = $28,400

Solutions Manual

$ 700

–1,600

+170

+7,000

-2,500

$11,000

Retained

Earnings

3-37

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

(a)

(b)

(c)

(d)

(e)

(f)

-2,500 (g)

$4,630

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-2A (Continued)

Key to Retained Earnings column on previous page.

(a)

(b)

(c)

(d)

(e)

(f )

(g)

Service revenue

Dividends

Salaries expense

Rent expense

Advertising expense

Utility expense

Income tax expense

(b)

CORSO CARE CORP.

Statement of Earnings

Month Ended September 30, 2004

Revenues

Service revenue

Expenses

Rent expense

Salaries expense

Utilities expense

Advertising expense

Total expenses

Earnings before taxes

Income tax expense

Net earnings

$8,900

0

900

700

170

100

1,870

7,030

2,500

$4,530

CORSO CARE CORP.

Statement of Retained Earnings

Month Ended September 30, 2004

Retained earnings, September 1

Add: Net earnings

Less: Dividends

Retained earnings, September 30

Solutions Manual

3-38

$0,700

4,530

5,230

0 600

$4,630

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-2A (Continued)

(b) (Continued)

CORSO CARE CORP.

Balance Sheet

September 30, 2004

Assets

Current assets

Cash

Accounts receivable

Supplies

Total current assets

Office equipment

Total assets

$11,000

6,700

600

$18,300

10,100

$28,400

Liabilities and Shareholders' Equity

Liabilities

Notes payable

$ 7,000

Accounts payable

3,770

Total liabilities

Shareholders' equity

Common shares

$13,000

Retained earnings

3

4,630

Total shareholders’ equity 0

Total liabilities and shareholders' equity

Solutions Manual

3-39

$10,770

17,630

$28,400

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-3A

Normal

Balance

Financial

Statement

Classification

Account

Accounts payable and

accrued items

Credit

Balance Sheet

Current Liabilities

Accounts receivable

Debit

Balance Sheet

Current Assets

Capital assets

Debit

Balance Sheet

Cash and short-term deposits Debit

Balance Sheet

Property, Plant and

Equipment

Current Assets

Cost of goods sold and

selling, general and

administrative expenses

Debit

Statement of Earnings Expense

Depreciation and

amortization expense

Debit

Statement of Earnings Expense

Dividends

Debit

Statement of

Retained Earnings

Income tax expense

Debit

Statement of Earnings Expense

Income tax payable

Credit

Balance Sheet

Investments

Debit

Balance Sheet

Investment income

Credit

Short-term or Longterm investments

Statement of Earnings Revenue

Merchandise inventories

Debit

Balance Sheet

Current Assets

Prepaid expenses

Debit

Balance Sheet

Current Assets

Retained earnings

Credit

Balance Sheet

Shareholders’ Equity

Sales

Credit

Statement of Earnings Revenues

Share capital

Credit

Balance Sheet

Solutions Manual

3-40

N/A

Current Liabilities

Shareholders’ Equity

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-4A

(a)

(1)

TransBasic

action

Type

1.

Asset

Account Debited

(2)

(3)

(4)

Specific

Account Effect Dr./Cr.

Cash

Increase Debit

(1)

Basic

Type

Shareholders’

Equity

Account Credited

(2)

(3)

Specific

Account

Effect

Common

Increase

Shares

(4)

Dr./Cr.

Credit

2.

Asset

Cash

Increase Debit

Shareholders’

Equity

(Revenue)

Service

Revenue

Increase

3.

Asset

Vehicle

Increase Debit

Asset

Cash

Decrease Credit

Liability

Note

Payable

Increase

Credit

Liability

Unearned

Revenue

Increase

Credit

4.

Asset

Cash

5.

Shareholders’

Equity

(Expense)

Wages

Increase Debit

Expense

Asset

Cash

Decrease Credit

6.

Asset

Accounts Increase Debit

Receivable

Shareholders’

Equity

(Revenue)

Service

Revenue

Increase

Credit

7.

Asset

Supplies

Increase Debit

Liability

Accounts

Payable

Increase

Credit

8.

Asset

Cash

Increase Debit

Asset

Accounts

Receivable

Decrease Credit

Solutions Manual

Increase Debit

Credit

3-41

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-4A (Continued)

(a) (Continued)

Transaction

(1)

Basic

Type

Account Debited

(2)

(3)

Specific

Account Effect

(4)

Dr./Cr.

(1)

Basic

Type

Account Credited

(2)

(3)

Specific

Account

Effect

(4)

Dr./Cr.

9.

Shareholders’

Equity

(Expense)

Rent

Increase Debit

Expense

Asset

Cash

Decrease Credit

10.

Shareholders’

Equity

(Expense

Income

Increase Debit

Tax

Expense

Asset

Cash

Decrease Credit

(b)

Cash Flow

Issue shares

Provide services

Payment for truck

Deposit from customers

Payment of wages

Collection from customers

Payment of rent

Payment of income taxes

Ending cash

$10,000

2,500

(10,000)

5,000

(2,000)

20,000

(1,500)

(800)

$23,200

Net Earnings

Provide services

Payment of wages

Bill customers

Payment of rent

Payment of income tax

Net earnings

$ 2,500

(2,000)

20,000

(1,500)

(800)

$18,200

Solutions Manual

3-42

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-5A

Date

Account Titles and Explanation

Apr. 1 Cash

Common Shares

(Issued shares for cash)

Debit

Credit

75,000

75,000

4 Land

Cash

Note Payable

(Purchased land for cash, note)

50,000

8 Advertising Expense

Accounts Payable

(Incurred advertising expense on

account)

01,800

11 Salaries Expense

Cash

(Paid salaries)

10,000

40,000

01,800

01,700

01,700

12 No entry.

13 Prepaid Insurance

Cash

(Paid for one-year insurance policy)

03,000

17 Dividends

Cash

(Payment of cash dividend)

00,600

20 Cash

Admission Revenue

(Received cash for admission fees)

05,700

Solutions Manual

3-43

03,000

00,600

05,700

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-5A (Continued)

Date

Account Titles and Explanation

Apr. 25 Cash

Unearned Admissions Revenue

(Received advance for future

services)

Debit

Credit

07,500

07,500

30 Cash

Admission Revenue

(Received cash for admission fees)

7,875

30 Accounts Payable

Cash

(Paid creditor on account)

0,700

Solutions Manual

7,875

0,700

3-44

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-6A

(a)

Date

Account Titles and Explanation

May 1 Cash

Common Shares

(Issued shares for cash)

Debit

Credit

52,000

52,000

2 No entry. Not an accounting transaction.

3 Supplies

Accounts Payable

(Purchased supplies on account)

7 Rent Expense

Cash

(Paid office rent)

0800

0800

00,900

00,900

11 Accounts Receivable

Service Revenue

(Billed client for services provided)

01,100

12 Cash

Unearned Revenue

(Received an advance for future

services)

04,200

17 Cash

Service Revenue

(Received cash for revenue earned)

04,200

31 Salaries Expense

Cash

(Paid salaries)

01,000

31 Accounts Payable ($800 X 40%)

Cash

(Paid creditor on account)

00,320

31 Income Tax Expense

Cash

(Paid income taxes)

00,100

Solutions Manual

01,100

04,200

04,200

01,000

00,320

00,100

3-45

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-6A (Continued)

(b)

Accounts Payable

Cash

May 1

May 12

May 17

52,000 May 7

4,200 May 31

4,200 May 31

May 31

Bal.

58,080

May 31

900

1,000

320

100

320 May 3

Bal.

800

480

Unearned Revenue

Accounts Receivable

May 11

1,100

Bal.

1,100

May 12

4,200

Bal.

4,200

Common Shares

May 1

52,000

Bal.

52,000

Supplies

May 3

800

Bal.

800

Solutions Manual

3-46

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-6A (Continued)

Rent Expense

Service Revenue

May 11

May 17

1,100

4,200

Bal.

5,300

May 7

900

Bal.

900

Income Tax Expense

Salaries Expense

May 31

1,000

Bal.

1,000

May 31

100

Bal.

100

(c)

ASTROMECH ACCOUNTING SERVICES INC.

Trial Balance

May 31, 2004

Debit

Cash

Accounts Receivable

Supplies

Accounts Payable

Unearned Revenue

Common Shares

Service Revenue

Salaries Expense

Rent Expense

Income Tax Expense

Totals

Solutions Manual

Credit

$58,080

001,100

00800

$00,480

004,200

052,000

005,300

001,000

900

100

$61,980

3-47

_ ___

$61,980

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-7A

(a) and (c)

Cash

6,000 Apr. 2

3,800 Apr. 10

3,000 Apr. 12

85 Apr. 29

Apr. 30

5,885

Apr. 1 Bal.

Apr. 9

Apr. 25

Apr. 30

Bal.

Apr. 30

Bal.

Accounts Receivable

85

85

Apr. 30

Bal.

Prepaid Rentals

1,000

1,000

Apr. 1 Bal.

Bal.

Land

10,000

10,000

Apr. 1 Bal.

Bal.

Buildings

8,000

8,000

Apr. 1 Bal.

Bal.

Equipment

6,000

6,000

Solutions Manual

1,000

3,000

400

1,600

1,000

Apr. 10

Apr. 10

Accounts Payable

1,000 Apr. 1 Bal.

Apr. 20

Bal.

2,000

500

1,500

Mortgage Payable

2,000 Apr. 1 Bal.

Bal.

8,000

6,000

Common Shares

Apr. 1 Bal.

Bal.

20,000

20,000

Admission Revenue

Apr. 9

Apr. 25

Bal.

3,800

3,000

6,800

Concession Revenue

Apr. 30

Bal.

3-48

Apr. 12

Bal.

Advertising Expense

400

400

Apr. 2

Apr. 20

Bal.

Film Rental Expense

1,000

500

1,500

Apr. 29

Bal.

Salaries Expense

1,600

1,600

170

170

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-7A (Continued)

(b)

Date

Account Titles and Explanation

Apr. 2 Film Rental Expense

Cash

(Paid film rental)

Debit

Credit

0,1,000

0,1,000

3 No entry not a transaction.

9 Cash

Admission Revenue

(Received cash for admissions)

10 Mortgage Payable

Accounts Payable

Cash

(Made payments on mortgage and

accounts payable)

3,800

3,800

2,000

1,000

3,000

11 No entry. Not a transaction.

12 Advertising Expense

Cash

(Paid advertising expenses)

0,400

20 Film Rental Expense

Accounts Payable

(Rented film on account)

0,500

25 Cash

Admission Revenue

(Received cash for admissions)

3,000

0,500

29 Salaries Expense

Cash

(Paid salaries expense)

Solutions Manual

0,400

3,000

1,600

1,600

3-49

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-7A (Continued)

(b) (Continued)

Date

Account Titles and Explanation

Debit

Apr. 30 Cash

Accounts Receivable

Concession Revenue (17% X $1,000)

(Received cash and balance on account for

concession revenue)

Credit

0,085

0,085

0,170

30 Prepaid Rentals

Cash

(Paid cash for future film rental)

0,1,000

0,1,000

(d)

LAKE THEATRE, INC.

Trial Balance

April 30, 2004

Debit

Cash

Accounts Receivable

Prepaid Rentals

Land

Buildings

Equipment

Accounts Payable

Mortgage Payable

Common Shares

Admission Revenue

Concession Revenue

Advertising Expense

Film Rental Expense

Salaries Expense

Totals

Solutions Manual

Credit

$05,885

000,085

000,1,000

010,000

008,000

006,000

$01,500

006,000

020,000

006,800

000,170

000,400

001,500

1,600

$34,470

3-50

000 000

$34,470

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-8A

(a) Correct:

8

Incorrect: 1, 2, 3, 4, 5, 6, and 7

(b)

(1)

Error In Balance

1.

No

2.

Yes

3.

No

4.

Yes

5.

Yes

6.

No

7.

Yes

Solutions Manual

(2)

Difference

$90

Nil

$750

Nil

Nil

$500

Nil

(3)

Larger Column

Credit

N/A

Debit

N/A

N/A

Debit

N/A

3-51

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-9A

SAGINAW LTD.

Trial Balance

May 31, 2004

Debit

Cash ($7,490 + $420)

Accounts Receivable ($2,570 – $210)

Prepaid Insurance ($700 + $100)

Supplies

Equipment ($8,000 - $420)

Accumulated Amortization

Accounts Payable ($4,500 - $100 + $420)

Common Shares ($5,700 + $700)

Dividends

Retained Earnings

Service Revenue ($6,960 - $210)

Salaries Expense

Advertising Expense

Amortization Expense

Insurance Expense

Income Tax Expense ($200 + $100)

Totals

Solutions Manual

3-52

Credit

$ 7,910

2,360

040800

420

4207,580

$ 3,200

04,820

0 6,400

700

6,000

006,750

4,200

1,100

1,600

200

300 00 0000

$27,170 $27,170

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-10A

(a)

HUDSON’S BAY COMPANY

Trial Balance

January 31, 2003

(thousands)

Debit

Capital stock

Cash in stores

Credit card receivables

Dividends

Fixed assets

Goodwill

Income tax expense

Interest expense

Long-term debt

Long-term debt due within one year

Long-term receivables

Merchandise inventories

Operating expenses

Other accounts payable and accrued

expenses

Other accounts receivables

Other assets

Other long-term liabilities

Other shareholders’ equity items

Prepaid expenses and other current assets

Retained earnings

Sales and revenue

Short-term borrowings

Short-term deposits

Trade accounts payable

Totals

Solutions Manual

3-53

Credit

$1,454,655

$

7,308

559,151

38,912

1,205,333

152,294

42,421

45,428

388,543

258,870

12,105

1,551,104

7,184,503

541,599

117,412

496,702

230,824

199,231

122,860

668,304

7,383,813

24,744

51,418

0000000000

436,368

$11,586,951 $11,586,951

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

Problem 3-10A (Continued)

(b)

HUDSON’S BAY COMPANY

Statement of Earnings

Year Ended January 31, 2004

(thousands)

Revenues

Sales and revenue

Expenses

Operating expenses

Interest expense

Total expenses

Earnings before income tax

Income tax expense

Net earnings

$7,383,813

0

7,184,503

45,428

7,229,931

153,882

42,421

$ 111,461

HUDSON’S BAY COMPANY

Statement of Retained Earnings

Year Ended January 31, 2004

(thousands)

Retained earnings, February 1, 2003

Add: Net earnings

Less: Dividends

Retained earnings, January 31, 2004

Solutions Manual

3-54

$ 668,304

111,461

779,765

38,912

$ 740,853

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-10A (Continued)

(b) (Continued)

HUDSON’S BAY COMPANY

Balance Sheet

January 31, 2004

(thousands)

Assets

Current assets

Cash in stores

Short-term deposits

Credit card receivables

Other accounts receivable

Merchandise inventories

Prepaid expenses and other current

assets

Total current assets

Long-term receivables

Property, plant and equipment

Goodwill

Other assets

Total assets

Solutions Manual

3-55

$

7,308

51,418

559,151

117,412

1,551,104

122,860

$2,409,253

12,105

1,205,333

152,294

496,702

$4,275,687

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-10A (Continued)

(b)

(Continued)

Liabilities and Shareholders' Equity

Liabilities

Trade accounts payable

$436,368

Other accounts payable and accrued

541,599

liabilities

Short-term borrowings

24,744

Long-term debt due within one year

258,870

Total current liabilities

Long-term liabilities

Long-term debt

$388,543

Other long-term liabilities

230,824

Total long-term liabilities

Total liabilities

Shareholders' equity

Capital stock

$1,454,655

Other shareholders’ equity items

199,231

Retained earnings

740,853

Total shareholders’ equity

Total liabilities and shareholders’ equity

Solutions Manual

3-56

$1,261,581

619,367

1,880,948

2,394,739

$4,275,687

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-1B

(a) and (b)

TransCash Flow

action

Statement

1.

F

Cash

+$20,000

2.

O

- 700

3.

I

- 2,500

Accounts

Receivable Supplies

Equipment

Retained

Earnings

+$2,500

+$300

5.

O

-600

6.

O

+1,000

7.

F

-400

8.

O

-300

9.

O

-1,200

10.

O

+8,000

11.

O

-2,000

Solutions Manual

Common

Shares

+$20,000

-$700 (a)

4.

Total

Accounts

Payable

$21,300

-300 (b)

+$600

+$8,000

+9,000 (c)

-400 (d)

-300

-1,200 (e)

-8,000

-2,000 (f)

$0

3-57

$600

$2,500

$0

$20,000

$4,400

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-1B (Continued)

(a) (Continued)

Key to Retained Earnings column on previous page.

(a)

(b)

(c)

(d)

(e)

(f )

Rent expense

Advertising expense

Service revenue

Dividends

Salaries expense

Income tax expense

(c)

Service revenue

Expenses

Salaries expense

Rent expense

Advertising expense

Income tax expense

Net earnings

$9,000

$1,200

700

300

2,000

4,200

$4,800

OR

Increase in retained earnings

Add: Dividends

Net earnings

Solutions Manual

$4,400

400

$4,800

3-58

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-2B

(a)

IVAN IZO, INC.

Cash

Bal.

1.

2.

3.

4.

5.

$4,000

+2,000

–2,700

+3,000

–400

–2,750

6.

7.

8.

9.

–550

+2,000

0

-1,300

$3,300

Accounts

Office

Notes

Accounts

Common

Retained

+ Receivable + Supplies + Equipment = Payable + Payable + Shares + Earnings

$2,500

–2,000

$500

$5,000

, 00

$4,200

$6,500

–2,700

+3,400

+6,400 (a)

+2,000

+1,600

–1,500

–900

–350

–550

0

00 0

$500

0000 0

$3,900

00

$7,000

+$2,000

+

0000 0

$2,000

+300

00

$3,400

0000 0

$6,500

$14,700 = $14,700

Solutions Manual

$1,300

3-59

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

(b)

(c)

(d)

(e)

–300 (f)

-1,300 (g)

$2,800

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-2B (Continued)

(a) Continued)

Key to Retained Earnings column on previous page.

(a)

(b)

(c)

(d)

Service revenue

Salaries expense

Rent expense

Advertising expense

(e) Dividends

(f) Utilities expense

(g) Income tax expense

(b)

IVAN IZO, LLP.

Statement of Earnings

Month Ended August 31, 2004

Revenues

Service revenue

Expenses

Salaries expense

Rent expense

Utilities expense

Advertising expense

Total expenses

Earnings before income tax

Income tax expense

Net earnings

$6,400

0

1,500

900

300

350

3,050

3,350

1,300

$ 2,050

IVAN IZO, LLP.

Statement of Retained Earnings

Month Ended August 31, 2004

Retained earnings, August 1

Add: Net earnings

Less: Dividends

Retained earnings, August 31

Solutions Manual

3-60

$1,300

0 2,050

3,350

550

$2,800

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-2B (Continued)

(b) (Continued)

IVAN IZO, INC.

Balance Sheet

August 31, 2004

Assets

Current assets

Cash

Accounts receivable

Supplies

Total current assets

Office equipment

Total assets

$3,300

3,900

500

$ 7,700

7,000

$14,700

Liabilities and Shareholders' Equity

Liabilities

Notes payable

$2,000

Accounts payable

3,400

Total liabilities

Shareholders' equity

Common shares

$6,500

Retained earnings

2,800

Total shareholders’ equity

Total liabilities and shareholders' equity

Solutions Manual

3-61

$ 5,400

9,300

$14,700

Chapter 3

Copyright © 2004 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm

Financial Accounting, Second Canadian Edition

PROBLEM 3-3B

Account

Normal

Balance

Financial

Statement

Classification

Accounts receivable

Debit

Balance Sheet

Amortization expense

Debit

Statement of Earnings Expense

Common shares

Credit

Balance Sheet

Cost of goods sold

Debit

Statement of Earnings Expense

Equipment

Debit

Balance Sheet

Income tax expense

Debit

Property, Plant and

Equipment

Statement of Earnings Expense

Income tax payable

Credit

Balance Sheet

Insurance expense

Debit

Statement of Earnings Expense

Interest revenue

Credit

Statement of Earnings Revenue

Inventories

Debit

Balance Sheet

Current Assets

Long-term debt

Credit

Balance Sheet

Long-term Liabilities

Notes payable

Credit

Balance Sheet

Short or Long-term

Liabilities

Prepaid insurance

Debit

Balance Sheet

Current Assets

Retained earnings

Credit

Balance Sheet

Shareholders’ Equity

Sales revenue

Credit