Capital Inventory Policy Manual

advertisement

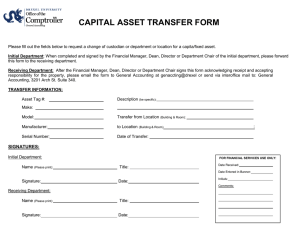

Capital Inventory Policy Manual Facilities Management - Materials Management Office Erik Simonsen simonsee@uwec.edu (715) 836-4283 MCS110b July 17, 2016 Page |2 Index Policy Statement 3 Reason for Policy 4 Accountability 4 Capital Equipment Regulations and Policies 5 Procedures and Forms 6 Definition of Capital Equipment 7 Responsibilities 10 Database / Data Elements 13 Asset Custodians 15 Disposal or Transfer of Capital Equipment 16 Physical Inventory Verification 17 Annual Financial Report 18 Records Management 19 Capital Inventory Contacts 20 Policies and Regulations 21 Appendix 22 Page |3 Policy Statement The University of Wisconsin Eau Claire has a significant investment in capital equipment, representing long-term commitments to fulfill its mission. The University owns and controls all capital equipment purchased with University funds, unless stipulated otherwise by the funding source. Custody and responsibility for use of all capital assets is delegated to the assigned asset custodian. The Facilities Management - Materials Management Office administers capital equipment asset matters and is responsible for the centralized accounting and reporting of University capital equipment assets, but not other personal property items. Asset custodians are responsible for reporting the loss and/or undocumented disposals of capital equipment assets. Page |4 Reason for Policy Accurate capital equipment process and records are important to ensure: the safeguarding of university assets accurate values are included in the annual financial reports, both in statement of asset values and their depreciation adequate insurance coverage and loss settlement that accurate financial information is used for calculating the federal indirect cost rate Asset values are reported on University financial statements, subject to internal and external examinations and provide the means of allocating costs to accounting periods which are used to establish the University’s federal indirect cost rate. This policy helps to assure the accuracy of asset values, defines responsibilities, and helps to assure that ongoing verification is made. Accountability The accuracy and integrity of the Capital Equipment inventory process is reliant on all involved being fully compliant with all capital equipment policies and procedures. To assure the Chancellor and administration that policies and procedures are being followed, the following steps have been taken: At the end of each fiscal year, the Facilities Management - Materials Management Office will provide each division’s administrator and the internal auditor with a summary report of the capital equipment verification outcome. At the end of each fiscal year the Facilities Management - Materials Management Office will provide the Chancellor, each division’s administrator, and the internal auditor with a copy of the financial report. On a daily basis, the Facilities Management - Materials Management Office will run a query report to track when asset custodians leave their UW Eau Claire employment. It is the responsibility of the Facilities Management - Materials Management Office to contact the supervisor of the former asset custodian to obtain the name of the replacement asset custodian(s) and then update the database to reflect the change. Page |5 Capital Equipment Regulations and Policies There are several federal and state regulations applicable to capital equipment, including the Federal Government’s Office of Management and Budget (OMB) Circular A-110 which prescribes standards for the management of property acquired with federal funds. Additionally, UW-System provides guidelines. In April of 2003, the University of Wisconsin System released Financial Administration Policy Paper #33 (FPPP33), Accountability for Capital Equipment. FPPP33 established system-wide policies to ensure the accurate maintenance of property records associated with capital equipment. These policies require each university in the UW System to maintain an accurate inventory system that ensures accountability for capital equipment and accuracy of information regarding that equipment to be used for the purposes of financial reporting and indirect cost calculations. Page |6 Procedures and Forms The following campus procedures and forms support the Capital Inventory policy manual (as of September 12, 2011, forms and procedures are in progress). Procedures Acquiring Capital Equipment Recording and Maintaining University Capital Equipment Disposing of University Capital Equipment Federal Reporting and Compliance for Capital Equipment Verifying Capital Equipment Annual Reconciliation and Financial Report Forms Purchasing Requisition Form Data Collection and Tagging Form Capital Equipment Change Form Capital Equipment Change Form: Component Systems and Fabricated Items Capital Equipment Verification Form Surplus Declaration Form Page |7 Definition of Capital Equipment Capital equipment is defined in FPPP33 as: “any single asset which has an acquisition cost of $5,000 or more and a useful life of more than one year, whether purchased outright, acquired through a capital lease or through donation. It also includes certain constructed or fabricated items and certain component parts. It does not include real property (LAND), software, or library holdings”. Component Part: This can be defined as any item that cannot function alone and is considered to be an integral part or enhancement to an existing piece of equipment. An individual component part qualifies as capital equipment if the cost is $5,000 or greater and it has a useful life of over one year. Replacement parts, however, are only considered capital equipment when the part is not acquired through normal maintenance, the acquisition cost is $5,000 or more, and the item has a useful life of over two years. Component Systems: Component Systems are comprised of individual equipment or material items connected together to operate as a system, such as when individual computers and servers are joined together to create a network. Per FPPP33, component parts which individually cost less than the capitalization level but, when combined, exceed the capitalization level, shall be capitalized when purchased as a functional unit. For example, when purchasing a monitor, keyboard, printer, and CPU and each part costs less than $5,000, but the functional unit exceeds $5,000, the purchase shall be capitalized. Conversely, when purchasing a keyboard and printer only, the purchase need not be capitalized unless each component exceeded $5,000. Page |8 Fabricated Items: Fabricated items differ from component systems in that they generally require extensive construction or assemblage provided by an internal or external shop. Items that are fabricated or constructed from component parts with a completed aggregate value of $5,000 and a life of over one year qualify as capital equipment, whether fabricated internally within the university or externally by an outside vendor. The completed value is inclusive of both materials and labor. Documentation of labor costs (i.e., a requisition) must be used to determine the cost of labor. When the completed value of a fabricated item is $5,000 or more, all parts for the fabrication of the item are deemed capital equipment. Donated Equipment: Donated equipment shall be capitalized if the fair market value on the date of the gift is $5,000 or more and its useful life is one or more years. Capital Lease: A lease is defined as an agreement conveying the right to use property or equipment for a specified period of time. Actual title to the property is not transferred to the lessee. A lease agreement must be evaluated to determine whether the transaction should be treated as a capital lease, an operating lease, or a rental expense. If, at its inception, a non cancellable lease meets one or more of the following four criteria, the lease must be classified as and accounted for, as a capital lease: 1) The lease transfers ownership to the lessee by the end of the lease term 2) The lease contains a bargain purchase option (a provision allowing the University, at its option, to purchase the leased property for a price which is sufficiently lower than the expected fair value of the property at the date the option becomes exercisable). 3) The lease term is equal to 75% or more of the estimated economic life of the leased property. However, if the beginning of the lease term falls within the last 25% of the total estimated economic life of the leased property, including earlier years of use, this criterion shall not be used for purposes of classifying the lease. Page |9 4) At the inception of the lease, the present value of the minimum lease payments, excluding executor costs, to be paid by the lessor, including any profit, equals or exceeds 90% of the excess of the fair value of the leased property to the lessor at the inception of the lease over any related investment tax credit retained by the lessor and expected to be realized by him. However, if the beginning of the lease falls within the last 25% of the total estimated economic life of the leased property, including earlier years of use, this criterion shall not be used for purposes of classifying the lease. Non-Capital Items: Software, real property (land), and library holdings do not qualify as capital equipment. P a g e | 10 Responsibilities Facilities Management - Materials Management Office Responsible for the accurate reporting of all capital assets for the University’s financial statement Assists asset custodians in establishing proper methods for accounting for inventories. Manages the centralized accounting and reporting of University capital equipment in the SFS Asset Management module. Reviews capitally-coded expenses to assure all such equipment meets the capitalization criteria and establishes and executes a periodic inspection to meet Federal and external audit requirements Makes a timely initial inspection and performs tagging of capital equipment assets that meet the capitalization criteria. Purchasing Office Develops, then provides a means of: o Notifying the Facilities Management - Materials Management Office and Accounts Payable whenever new capital equipment is purchased. o Notifies Facilities Management - Materials Management Office whenever capital equipment is declared surplus property. Accounts Payable Assigns capital equipment account codes to items on purchase order. Internal Audit Executes a periodic inspection to meet federal and external audit requirements. Executes a full audit of the capital equipment program to assure policies and procedures meet all federal and state requirements. P a g e | 11 Provides expert guidance to Facilities Management - Materials Management office on capital equipment matters. Asset Custodians Properly use and protect all University property in their custody. Develop clear, consistent internal policies and procedures for dealing with capital equipment. (Include acceptable use, disposal, transfer, and recording of property location, inventory counts, and physical security measures in departmental policies and procedures. May fine-tune policies and procedures to meet own unique operating guidelines, but this document should provide baseline or minimum requirement in regard to assets.) Review Facilities Management - Materials Management Office reports for accuracy and completeness. Report theft, loss, or disappearance to University Police and the Facilities Management - Materials Management Office. Keep a current record of property located off-campus in the form of descriptions, capital equipment asset tag numbers, period of time and location of property offcampus, and person(s) in charge of the property. Notify the Surplus Office and Facilities Management - Materials Management Office when disposing of unwanted or unserviceable property, observing agency funding guidelines, if appropriate. Turn unused or underused capital equipment over to University Surplus so that others within the University may use it. Notify the Facilities Management - Materials Management Office when capital equipment is declared surplus property. Report capital equipment assets donated to the University for capitalization. Notify the Facilities Management - Materials Management Office when capital equipment assets are donated to an organization outside the University. Equipment assets to be donated must be fully depreciated to be considered for approval. P a g e | 12 Department Chairs, Deans, Directors and Administrators Support all responsibilities outlined in this document. Ultimately responsible for reporting the loss and/or undocumented disposal of capital equipment assets. Supervisors of faculty/staff member who is an asset custodian of capital equipment, should review the annual capital equipment summary report generated by the Facilities Management - Materials Management Office. Take corrective action if an Asset Custodian is not complying with the policies outlined in this manual. Delegate duty as Asset Custodian Facilities Management Asst. Dir. For Administrative Services Support all responsibilities outlined in this document. Monitor all responsibilities outlined in this document. Take corrective action when policies and procedures are not being followed. P a g e | 13 Database/Data Elements In accordance with FPPP33, UW- Eau Claire seeks to maintain an accurate inventory of capital equipment. Capital equipment records are currently maintained in a mainframebased data system (Mainframe page /176). Capital equipment records are in the process of being transferred to and will be continually updated in the UW System-supported PeopleSoft Asset Management database. Capital Equipment Acquisitions For any item that qualifies as capital equipment, there are data elements that must be collected by Purchasing, Facilities Management - Materials Management, and Accounts Payable. The new eform purchasing requisition is set up to collect most of the data elements. If the data elements are incomplete the Purchasing Office will contact the originator of the requisition. Per FPPP33, the following data elements must be collected and entered into the database: Equipment description and manufacturer’s name Model number Location Asset custodian Purchase order number Fiscal year Account number (if applicable) Source(s) of funding The Facilities Management - Materials Management Office will collect and assign the following information when locating and tagging each item: Serial number Inventory number Location P a g e | 14 Because component systems and fabricated items consist of multiple parts, it is necessary for Purchasing, Facilities Management - Materials Management, and Accounts Payable to obtain the data elements for every major component part used to complete the item or system. This is especially true when parts are ordered on different requisitions. When writing a requisition to order parts for a fabricated item or component system presumed to be capital, assets custodians, assisted by the Facilities Management - Materials Management Office, need to indicate: A brief description of what is being fabricated or assembled Purchase Order (P.O.) numbers for any previously ordered parts The capital equipment tag number, if already assigned to the item or system After the purchase order (P.O.) is complete, electronic copies of it are forwarded from Purchasing to Accounts Payable (for the coding of payments) and to the Facilities Management - Materials Management Office (for entering capital equipment data elements into the inventory database). Communication between these departments ensures that all three have the information they need for their individual purposes and that all departments have classified the item in the same regard with accurate cost information. Capital equipment is assigned an account code in the 4000 - 4999 range. Once the Facilities Management - Materials Management Office receives a P.O. that includes a capital equipment item, all data elements are collected then entered into the database. The capital inventory item is physically located and tagged to indicate its classification as capital equipment. A digital photo of the capital equipment item is added to the database. Printed records are maintained by the Facilities Management - Materials Management Office. When tagging component systems or fabricated items, the tag is affixed to the component part that either has the highest value or, if necessary, is the most visible. The number on the capital equipment tag is used by Facilities Management - Materials Management to represent the entire item or system for inventory purposes. P a g e | 15 Asset Custodians To increase the level of accountability, capital equipment will no longer be assigned to departments. Rather, existing pieces of capital equipment will be re-assigned to an asset custodian. Newly purchased capital equipment will be assigned an asset custodian. It is the responsibility of the asset custodian to maintain accurate records regarding the location and status of all items for which he or she is responsible. Asset custodians are expected to comply with the Facilities Management - Materials Management Office throughout all aspects of the inventory process, including the physical inventory verification process. The name of the asset custodian will be recorded and maintained in the new PeopleSoft Asset Management system, increasing the level of accountability. Asset custodians must promptly report any change in the status of capital equipment to the Facilities Management - Materials Management Office. Changes in status may include: change in location; change in asset custodian, transfer of an item to another department or location, exchanges or repairs to an item resulting in serial number and/or model number changes, or the disposal of an item through declaration of surplus. Asset custodians must report changes in capital equipment status by completing one of the Capital Equipment Change Forms. Examples of completed change forms for a typical capital asset and for a component system or fabricated item are available to assist asset custodians in completing the form. The Facilities Management – Materials Management Office suggests assigning the asset custodianship to someone in the department who works most with each piece of equipment and knows its location at all times. P a g e | 16 Disposal or Transfer of Capital Equipment Per FPPP33, “Any piece of capital equipment which has ceased to function with respect to its regular operation and which is highly unlikely to be used in its present form in the future, must be disposed of and removed from the inventory records. Disposal of capital equipment must comply with Department of Administration (DOA), State Procurement Manual chapters PRO-F-1 & 3. Records regarding capital equipment items which have been removed from the inventory records should be maintained for one subsequent year. Ultimate disposition data shall include date of disposal and method of disposal. Method of disposal includes trade-in, sale price, loss, theft or salvage. OMB Circular A-110 requires that records for equipment acquired with federal funds be retained for three years after final disposition. Fully depreciated assets which are still being utilized should remain on the inventory records.” Disposal of all capital assets must occur via Campus Surplus. To dispose of a capital item, asset custodians must complete a Surplus Declaration Form and a Capital Equipment Change Form must be completed for the asset, attached to the Surplus Declaration Form, and sent to the Facilities Management - Materials Management Office. The original surplus declaration form is sent to the Purchasing Office. A copy of the surplus declaration form is attached to the original capital equipment change form then sent to the Facilities Management - Materials Management Office. For more information on Campus Surplus policies and procedures, contact Steve Slind, Purchasing, at 715.836.4643, email slindsd@uwec.edu, or visit http://www.uwec.edu/surplus/. P a g e | 17 Physical Inventory Verification Every year, the Facilities Management - Materials Management Office performs an audit to verify that the information on file is accurate. The audit begins by generating asset reports from the database by asset custodian. The reports are sent with a cover letter from the Chancellor’s Office to every asset custodian. The asset report includes the data elements for each capital equipment item the asset custodian is responsible for. It is the responsibility of each asset custodian to verify the accuracy of all information on the report then return the report to the Facilities Management - Materials Management Office with changes noted and completed surplus/change forms attached. In the event that an asset custodian is unresponsive to the requests of the Facilities Management - Materials Management Office, the individual the asset custodian organizationally reports to will be contacted to correct the action. Any items deemed to be missing after the audit will become the concern and responsibility of the asset custodian and his or her supervisor. Asset custodians are responsible for reporting the loss and/or undocumented disposal of capital equipment assets. The Internal Auditor will also perform a physical audit, independent of the Facilities Management - Materials Management Office, to verify that the information on file is accurate. P a g e | 18 Annual Financial Report Accounting Services is responsible for presenting fairly the assets of the UW System in its Annual Financial Report. Each institution must report by August 15th the cost of its capital equipment, the accumulated depreciation and the net book value. Federally titled equipment should not be included in the report. The end-of-fiscal year report must reconcile the current year’s capital equipment value with the previous year’s value by delineating additions, deletions, depreciation, write-offs, and other factors that contribute toward overall value. The Facilities Management - Materials Management office must submit to Accounting Services a report of UW Eau Claire’s total value of its capital equipment, accumulated depreciation, and its net book value. A copy of this report is sent to the Chancellor, each division’s administrator, and the internal auditor. P a g e | 19 Records Management It is the responsibility of the Facilities Management - Materials Management Office to maintain adequate records assuring capital equipment files are retained throughout the life of the asset. It is the responsibility of the Facilities Management - Materials Management Office to maintain adequate records based on UW System General Retention Schedule for Fiscal Accounting Records, February 2007: UWFA800 CAPITAL AND NON-CAPITAL EQUIPMENT INVENTORIES Records include running inventories of capital equipment such as motor vehicles, audio-visual equipment, computers, printing and mailing equipment, production copiers, tools, lab equipment, furniture, etc., that describe each piece of property, denote its location, and provide totals of each type of institution- or equipment owned by University of Wisconsin System institutions. Also included are the same types of inventories for non-capital equipment such as office supplies, computers, commodities, parts, and materials. Retention Time Period Original: Fiscal year of creation + additional 4 years, and thereafter destroy. Duplicates: Destroy when no longer needed. Do not retain duplicates longer than the original record. UWFA801 SURPLUS PROPERTY DISPOSITION RECORDS Records include documentation that identifies surplus property and tracks its disposition. Included are requests for disposal of property, receipts, Duplicates of reporting forms and supporting documentation that describes the property and the proposed method of disposition. Records may also include acquisition information and depreciation schedules. Retention Time Period Original: Date of disposition + additional 3 years, and thereafter destroy. Duplicates: Destroy when no longer needed. Do not retain duplicates longer than the original record. P a g e | 20 Capital Inventory Contacts Facilities Management - Materials Management Office For questions regarding capital inventory, please call Erik Simonsen in the Facilities Management - Materials Management Office at 715.836.4283. Email simonsee@uwec.edu. 2010 – 2011 Capital Equipment Work Group A work group of representatives from campus departments directly involved in the purchasing of, management of, and accountability of capital equipment was delegated the task of developing new capital equipment policies and procedures that would elevate the accountability issue and assure compliance with FPPP33. The Internal Auditor provided input and guidance throughout the writing process. The following representatives served on the work group: Chris Buckley, University Centers Douglas Dunham, Material Science Center Vickie Gardner, Accounts Payable John Lee, Learning and Technology Services Penny Odell, Purchasing Charles Probst, Learning and Technology Services P a g e | 21 Policies and Regulations OMB Circular A-21, Cost Principles for Educational Institutions OMB Circular A-110, Attachment N, Grants and Agreements with Institutions of Higher Education, Hospitals, and Other Nonprofit Organizations Federal Acquisition Guidelines U.S. Department of Health and Human Services Grant Administration Regulations (45 CFR Part 74, Subpart O) NACUBO Financial Accounting and Reporting Manual, Chapter 400 Financial Administration Policy Paper #33 (FPPP33), Accountability for Capital Equipment P a g e | 22 Appendix Audit of Capital Equipment, Office of Internal Audit, February 2010