N R M S

advertisement

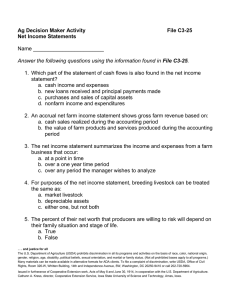

New Risk Management Materials for the Smaller Enterprise Manager John P. Hewlett – University of Wyoming Extension Jeffery E. Tranel – Colorado State University Extension Rodney Sharp – Colorado State University Extension 1 2 http://RightRisk.org Ag Survivor Five Scenarios • EWS Farms • Public Lands • The King Family Ranch • The Lazy U Ranch • The Wheatfields 3 Strategic Risk Management Process 10 Steps to Manage Risk 1. Determine Financial Health 2. Determine Risk Preference 3. Establish Risk Goals 4. Determine Risk Sources 5. Identify Management Alternatives 6. Estimate Likelihoods 7. Rank Management Alternatives 8. Implement Plans 9. Monitor & Adjust 10. Replan What is Good Management? Inertia (Inaction) Random Action Doing the Right Things Inadequate Doing the Right Things Right Management Continuum Excellent 5 Other Projects • Additional risk management CD modules – A Lasting Legacy Values and Life Lessons & Personal Possession and Sentimental Value Wishes To Be Fulfilled & Financial Assets and Real Estate • Insuring Success for Wyoming Agriculture • 10-step process for managing risk for smaller-agricultural operators 6 Taxes for Agricultural Enterprises Course Feasibility of Alternative Rural Enterprises Course 7 9 Section 1: Definition of a Farm Your Goals • To make money? • To pay no taxes? Minimize taxes? Pay more taxes every year? • To maintain equity (net worth)? Increase equity? “A farmer will never go broke paying taxes” - Anonymous Farmer 11 For Profit Farming • It is a business if there is net income or profit in three of last five years • Activities consisting of breeding, showing or raising horses, it is a business if there is a profit in two of last seven years for horses 12 Intent to Profit • Farming for profit – – – – – – – – – Operate in business like manner Time and effort Depend on farming for livelihood Losses due to circumstances beyond your control Change operation in attempt to increase profitability Have necessary knowledge Past success Profits earned in some years Expect profits in future years 13 Hobby Farming • Definition – Profit is not primary motive – Farm income not primary source of income • Tax Implications – Limit on deductions – Cannot use loss to offset income from other activities – Report income on Form 1040 and deduct expenses on Schedule A (Form 1040) 14 Qualified Farmer? • 2/3 of Gross Income must come from farming/ranching in current or prior year • Gross Income = All Income 15 Material Participation 16 Gross Farm Income Farm Income = Income from Farming/Ranching (Schedule F) + Gross Farm Rental Income (Form 4835) + Gross Farm Income (Schedule E, Parts II & III) + Gains from Sale of Breeding Animals (Form 4797) 17 Income Flows 18 Section 2: Importance of Records Cash Method of Accounting • Income is generally recorded in the year received • Expenses are generally recorded in year paid • Income and expenses in a single year may not match causing fluctuations in tax liabilities • Used by most farmers 20 Cash Method of Accounting Exceptions: • The purchase costs of items purchased for resale (yearling cattle for example) are carried forward to the year in which the items are sold • Certain conservation expenses must be capitalized 21 Accrual Method of Accounting • Income is recorded in the year earned, even if not received • Expenses are generally reported in the same year as the associated income • Income and expenses of an event or activity match, resulting in less fluctuation in profit or loss • Used by non-farm businesses 22 Accrual Method of Accounting Exceptions: • Certain conservation expenses must be capitalized • Business expenses and interest owed to a related person who uses the cash method of accounting are not deductible until actual payment is made and the income is included in the related person’s gross income 23 Reasons for Keeping Records • Determining profits • Planning the future • Measuring progress towards goals • Communicating • Reporting taxes 24 Record Keeping Methods • Hand kept • Computerized • Commercial 25 Inflow / Income Categories • • • • • • • • • Grain Hay Cattle Custom work Government payments Insurance Breeding animals Feeder animals Other 26 Outflow / Expense Categories • • • • • • • • • Auto Chemicals Custom hire Feed purchased Fertilizer Freight and trucking Fuel Insurance Interest • • • • • • • • • Labor Rents and leases Repairs Seed and transplants Supplies Taxes Utilities Veterinary Other 27 Section 3: Farm Income Section 3: Farm Income • • • • • • Sales of livestock and other items purchased for resale Sales of livestock, produce, grains and other products Commodity Credit Corporation (CCC) loans Agricultural program payments Conservation Reserve Program (CRP) payments Other income 29 Form 1040 Schedule F Income 30 Farm Income Categories 31 Farm Income Categories 32 Hedging as Risk Management • Hedging transactions entered into in normal course of business • For risk management purposes • As forward contracts, futures contracts, options • Commodity is produced on the farm or directly affects the business • Generally an ordinary gain or loss • Reported on Schedule F 33 Hedging as Speculation • Hedging transactions entered into which are not part of the ordinary business of farm • Has specific record keeping requirements • Reported on Form 1040 34 Hedging vs. Speculation • Hedging Transactions • Speculation Transactions 35 Activity: Farm Income or Not Farm Income 36 Section 4: Farm Expenses Section 4: Farm Expenses • Car and light truck expenses • Conservation expenses • PrePaid livestock feed • Labor • Business use of the home • Depreciation 38 Form 1040 Schedule F Expenses 39 Car and Light Truck Expenses • Up to 75% – Directly in connection with farming – In first year the vehicle is placed in service – Cannot change to another method at later time • 100% – Must have records of proof – Must be used for business the percentage that is claimed 40 Car and Light Truck Mileage • Standard mileage rate (only for business miles): • Cannot be used if operating 5+ cars and light trucks at the same time • Not deductible for commuting miles 41 Depreciation • Annual deduction recognizing that assets wear out or become obsolete • Types of tangible property • To be depreciable, property must meet conditions • Records of depreciation on capital assets must be kept by the taxpayer 42 Depreciation – Breeding Livestock • Raised breeding livestock: – Not typically depreciated – Incurred expenses deducted as ordinary farm expenses – Have no basis when sold Sale price less selling costs equal capital gains 43 Depreciation Limits • Limits – – – – – Passenger automobiles of < 6,000 lbs (GVW) Entertainment and recreational property Computers Cellular telephones Generally, most assets that lend themselves to personal use 44 Depreciation – Section 179 • Allows deducting all or part of qualifying property in the year “placed in service” • Qualifying property • Property must be used more than 50% for qualified business use 45 Prepaid Livestock Feed • Deduct the cost of livestock feed to be consumed in a later year if (meet all tests) • Deductions for prepaid livestock feed may be limited to 50% of other deductible farm expenses 46 Wages for Labor • Deduct reasonable wages • Use fair market value of any assets given to hired labor • Deduct as farm expenses the costs of boarding farm employees • Issue Form W-2 for all employees 47 Contract vs. Employee Labor • Entered as “custom hire” • Cost must be capitalized • See “20 Factors” for determining employee versus custom hire • Individual contractors receiving more than $600 must receive a Form 1099MISC 48 Prepaid Farm Supplies • Amounts paid during the tax year for feed, seed, fertilizer, and similar farm supplies • Must use cash method of accounting • Limited to 50% of other deductible farm expenses 49 Exceptions to 50% Limit • This 50% limit does not apply to farm-related taxpayers under certain circumstances • Definition of a farm-related taxpayer 50 Hired Labor- Family Members • Deduct reasonable wages and other compensation paid your child • Deduct reasonable wages and other compensation paid your spouse 51 Business Use of Home • Can deduct expenses for business use of home if part of the home is used exclusively and regularly • Deduction limit applies • Any depreciation taken reduces the home’s basis 52 Business Use of Home - Telephones • Cannot deduct cost of basic local telephone service for the first telephone line into the home • Can deduct: – Business long-distance changes on the first line – Cost of second telephone line into the home if used exclusively for farm business 53 Activity: Deductible Farm Expense or Not 54 Section 5: Strategies for Managing Tax Liability Section 5: Strategies for Managing Tax Liability • • • • Setting goals Minimize income taxes owed Reducing profits Depreciation Section 179 allowance 56 Tax Management Goals • It may not be best to minimize taxes • Should maximize after tax income across multiple years • Matching depreciation deductions to loan payments 57 Defer Tax Payments • Tax minimizing strategies only defer (delay) income tax payments • Many farmers report crop revenue in one year and expenses on another year’s tax return • Large tax consequences may result at a time when financial hardship already exists 58 Reducing Profits – Gross Income • Postpone receipt of revenues • Reduce revenues from livestock and crop sales • Reduce non-livestock/crop revenues 59 Reducing Profits – Expenses • • • • • Prepay supplies Prepay feed Increase expenses Increase depreciation Pay higher than necessary prices • Use extraordinary amounts of items • Pay consultants 60 Depreciation Calculation • What if you took a section 170 allowance? • Assume you purchase a machine, such as a tractor, for $125,000 61 Depreciation Calculation • What if you took a section 170 allowance? • Assume you purchase a machine, such as a tractor, for $125,000 62 Depreciation Comparison 63 Increase Taxable Income • Here are some reasons why someone might want to increase taxable income: 64 Increase Taxable Income • Here are some reasons why someone might want to increase taxable income: 65 Increase Taxable Income • Here are some reasons why someone might want to increase taxable income: 66 Increase Taxable Income • Here are some reasons why someone might want to increase taxable income: 67 Increase Taxable Income • Here are some reasons why someone might want to increase taxable income: 68 Bob & Betty Workhorse Exercise 1: Bob & Betty Workhorse 69 Bob & Betty Workhorse • Have 100 acres • Livestock – 10 beef cows – Purchased calves in December 2004 – 2005 sales = 8 calves @ 600 lbs @ $115/cwt = $5,520 12 head for $8,190 Sold in 11 head in March 2005 for $8,994 One calf died in January 2005 Sold 1 cull cow (raised) for $536 • Used tractor and backhoe to work for neighbor earning $6,500 70 Bob & Betty Workhorse Sale of items purchased for resale = $8,994 Cost of items purchased for resale = 8,190 Sale of raised livestock Custom work Gross Income from Farming Car and truck (2,345 miles @ $0.405, 840 miles @ $0.485) Depreciation and section 179 ($2,578 + $800) Feed purchased Freight & trucking Fuel Rents – land, other Repairs Supplies Utilities (barn/shop, 50% of internet) Veterinary, breeding, and medicines Other (travel & meals, office supplies/etc.) Total Expenses Net Farm Profit (or Loss) 804 5,520 6,500 $12,824 1,357 3,378 1,123 175 1,200 400 1,123 296 913 297 663 $10,925 $1,899 71 Bob & Betty Workhorse • Income – Farm Profits (schedule F) – Capital Gains (form 4797) – Total 1,899 564 $2,463 • Taxes – Self Employment ($1,899 x 0.9235 x 15.3%) – Income ($2,463 x 10%) – Total 268 246 $514 • After Tax Income From Enterprise – Total Income – Taxes – Net 2,463 514 $1,949 72 More Information • See your tax preparer. • Visit the IRS. – – – • Telephone Website (www.irs.gov) Publications and Forms (Publication 225,farmers tax guide) University. 73 Taxes for Agricultural Enterprises Course Feasibility of Alternative Rural Enterprises Course 74 76 Section One: Agriculture and Rural Enterprises Section 1: Agriculture and Rural Enterprises • • • • Definitions of Agricultural Enterprises Common Traits Alternative Enterprises Factors for Success 78 Enterprise Definition • Enterprise – An activity that generates one or more saleable products 79 Common Traits of an Agricultural Enterprise • Combines limited resources to generate dollars of return • Can be separated from other enterprises by accounting procedures to its receipts and expenses • Has some element of risk and uncertainty 80 Enterprise Relationships: One Relationship Can Impact the Other 81 Enterprises: A Means to Reaching Your Goals • Maximize Profits • Generate Minimum Income Levels (Satisfying Behavior) • Increase Net Worth • Control a Larger Business • Avoid or Reduce Losses • Reduce Borrowing Needs • Increase Family Living 82 Alternative Enterprises • Alternative Livestock Enterprises • Alternative Crop Enterprises • Agritourism/Recreation • Alternative Production Systems • Alternative Marketing Strategies 83 Alternative Livestock Enterprises Listed are the alternative livestock enterprises you might be interested in – jot down any potential enterprises you might have interest in. – – – – – – – – – – Meat Goats Elk/Deer Sheep/Lambs Pastured Poultry Free Range Livestock Exotics Petting Farm Specialty Meats Bison/Buffalo Organic/Natural 84 Alternative Crop Enterprises Listed are the alternative crop enterprises. Take a minute and jot down any potential enterprises you might have interest in: • • • • • • • Fiber Forestry Products Oilseeds Forage Specialty Legumes Fruit/Vegetable Seed 85 Agritourism/Recreation Enterprises Listed are the agritourism/recreation enterprises. Take a minute to list the ones in which you might be interested: • • • • Hunting/Fishing Guiding Farm/Ranch Vacations Hiking/Biking/ Snow Shoeing • Bird Watching • • • • • • Pony Rides Camping/Picnics/Parties Wildlife Viewing Rock Climbing Native Photography Bed and Breakfast 86 Alternative Production Systems • • • • • • Organic Natural No/Reduced Tillage Grass Fed Low/No Input Value Added Processing 87 Alternative Marketing Strategies • Alliances/Partnerships/Cooperatives CSA’s (community supported agriculture) – Direct Sales – E-Commerce – Farmers Markets – U-Pick 88 Non-Farm Alternative Enterprises • • • • • • • • Storage Units Animal Boarding Insect Production Outdoor Classrooms Entertainment Crafts/Decorations/Furniture Horse/Dog Training Historic/Heritage 89 Reasons for Alternative Enterprises • Increase Profits • Reduce Risk • Better Utilization of Resources 90 SWOT Analysis 91 Strengths 92 Weaknesses 93 Opportunities 94 Threats 95 Section Two: Selecting and Planning for Alternative Enterprises Section 2: Selecting and Planning for Alternative Enterprises • Assessing Feasibility • Competitive Analysis • Business Planning 97 Assessing the Feasibility of Alternative Enterprises • • • • Personal Assessment Production Assessment Market Assessment Economic Assessment 98 Personal Assessment • Personal and Family Goals • Important Personal Characteristics • General Business Skills and Knowledge 99 Production Assessment • Physical Resources – – – – – Land Water Equipment Buildings Skills • Production Requirements – Climate and Growing Season • Production Risks – Disease – Pests – Weeds 100 Market Assessment • Who are your customers? • Market Potential • Marketing Strategies 101 Economic Assessment • • • • Start-up Costs Financial Resources Investments Analysis Cash Flow Projections – Sales projections – Estimated operating costs – Debt repayment • Financial Analysis – Budgets – Financial statements – Financial ratios 102 Competitive Advantage • Better Able to Meet Your Customers Wants and Needs – Valued Product Characteristics – Preferred Market Outlets or Product Distribution – Pricing Advantage (lower cost of production) 103 Activity: List your Competitors Take a minute to jot down your three main competitors: 1) Product/Service_______________ 2) Target Audience ______________ 3) Primary Competitors: Competitor # 1 _____________ Competitor # 2 _____________ Competitor # 3 _____________ 104 Activity: Competitor Worksheet Products and Services Customer Needs & Preferences Customer Importance (1-5) Your Farm Competitor 1 Competitor 2 Competitor 3 Product Quality Product Availability Selection/Variety Product Characteristics Product Appearance 105 Activity: Competitor Worksheet Products and Services Customer Importance (1-5) Your Farm Competitor Bob Competitor Sally Competitor Henry Product Quality 5 4 3 1 5 Product Availability 3 3 1 5 2 Selection/Variety 2 2 2 5 2 Product Characteristics 5 5 3 1 4 Product Appearance 3 4 5 3 3 52 44 64 Customer Needs & Preferences 70 106 Competitive Analysis Price • • • • Cost Based Pricing Discount Pricing Luxury Pricing Competitive Pricing 107 Activity: Competitor Worksheet Pricing Customer Needs & Preferences Customer Importance (1-5) Your Farm Competitor 1 Competitor 2 Competitor 3 Competitive Pricing Discount Pricing Luxury/Premium Pricing Cost Oriented Pricing Different Payment Options 108 Competitive Analysis Promotion • Packaging and Labeling • Brand Recognition • Guarantees and Return Policies • Coupons • Advertising 109 Activity: Competitor Worksheet Promotion Customer Needs & Preferences Customer Importance (1-5) Your Farm Competitor 1 Competitor 2 Competitor 3 Packaging and Labeling Brand Recognition Guarantees and Return Policies Coupons Advertising 110 Competitive Analysis Product Distribution • Product Distribution – – – – – – Easier Access More Convenient Location Available Parking Mail Order E-Commerce Etc. 111 Activity: Competitive Analysis Worksheet Market Outlets Customer Needs & Preferences Customer Importance (1-5) Your Farm Competitor 1 Competitor 2 Competitor 3 Location Convenience Accessibility Business Facilities Internet Sales 112 Activity: Competitive Analysis Worksheet Management and Personnel Customer Needs & Preferences Customer Importance (1-5) Your Farm Competitor 1 Competitor 2 Competitor 3 Management Skills Reputation/Image Luxury/Premium Pricing Business Stability Customer Service 113 Marketing Plan • Current Situation – Your business description – Description of target market • • • • • Competitive Analysis Market Objectives Market Strategies Action Plans Marketing Budget 114 Business Plan 115 Business Plan Components • • • • • • • • Business Description Mission or Vision Statements Business Goals Marketing Plan Management and Key Personnel Financial Plan 116 Section Three: Assessing Risks Section 3: Assessing Risks • • • • Risk Preferences Sources of Risk Risk Management Strategies RightRisk Example 118 Alternative Enterprises: Assess the Risks Involved • RISK: The probability of an event occurring that can impact your: – Current profit level – Financial situation (equity position) – Satisfaction and well-being 119 Relationship Between Risk and Profit High Risk = High Potential Profit Low Risk = Low Potential Profit 120 Risk Preferences • Risk Averse or Risk Avoiders – Cautious individuals – Prefer less risky sources of income/investments – Willing to accept some probability of lower income or losses for the opportunity of higher income 121 Risk Preferences • Risk Neutral – Individuals between risk adverse and risk preferring – They choose the decision with the highest expected return 122 Risk Preferences • Risk Preferrers or Risk Takers – More adventuresome individuals – Prefers more risky business alternatives – Willing to accept some probability of lower income or losses for the opportunity of higher income 123 Activity: Risk Preference Game • You flip a coin • For every heads tossed, you win $140 • For every tails tossed, you lose $100 • Would you play this game? If so, what is the maximum amount you would pay to play this game? – – – – Would you pay $5? Would you pay $10? Would you pay $20? Would you pay $40? 124 Sources of Risk • • • • • Production Marketing Financial Legal Human 125 Production Risk Anything that can affect crop yields or livestock performance is referred to as production risk. This includes such things as weather, pests, and diseases 126 Marketing Risk • Marketing is that part of your business that transforms production activities into financial success • Unanticipated market forces can lead to dramatic changes in market prices. • These market forces are referred to as marketing risk 127 Financial Risk Financial risk has three basic components: 1. The cost and availability of debt capital 2. The ability to meet cash flow needs in a timely manner 3. The ability to maintain and grow equity 128 Legal Risk The legal risks commonly associated with agriculture fall into four broad categories: 1. Appropriate legal business structure and tax and estate planning 2. Contractual arrangements 3. Tort liability 4. Statutory compliance, including environmental issues 129 Human Risk • Human risk includes: – – – – – – – – Inadequate management Inadequate labor resources Divorce Illness Death Orientation and training Management succession Other human risks 130 Risk Management • The objective of enterprise diversification and risk management is NOT to eliminate risk • Risk management is taking the RIGHT risks to maximize profit while REDUCING income variability and MEETING strategic goals 131 RightRisk Example • King Family Ranch – 500 cows 94% - weaning percent $350 cow costs – 350 acres of hay $60 per acre costs Normal yield 2.5 ton per acre or 875 ton – Expected income - $51,996.50 per year Revenues - $247,996.50 Expenses - $196,000.00 132 Buy or Sell Hay? 133 Buy or Sell Hay? 134 Buy or Sell Hay? 135 Risk-Return Frontier 136 Risk-Return Frontier 137 Risk-Return Frontier 138 http://RightRisk.org