Case Study - Answer Sheet March 15, 2014

advertisement

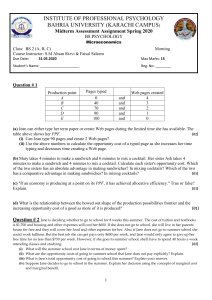

Case Study - Answer Sheet March 15, 2014 Financial Ratios • Equity Position – Before Purchase – After Purchase 40% 31% • Liquidity – Before Purchase – After Purchase 25% 10% • Efficiency Ratio – Before Purchase – After Purchase 70% 63% 2 Management Benchmarks • Knows Cost of Production Green/Yellow (Green if just hay/Yellow after purchase) • Credit Score Green/Yellow • Risk Management Some • Business Plan Red 3 S.W.O.T Strengths Weaknesses Knowledgeable about the industry Money set aside for college? Family’s insurance is paid by Jane’s job Operation may need to support additional family members They have off-farm income Do not have much liquid cash, especially after down payment They use family for labor No business plan Jane’s knowledge of record keeping Seeking 90% financing Good credit scores Open Market sales Budgets May not be knowledgeable about the corn industry Operation is profitable Crop Insurance Corn allows diversity 4 S.W.O.T Opportunities Threats New purchase close to their operation No diversification Children want to return to the operation – new ideas Commodity down turn More owned vs. rented ground Weather related conditions Ability to diversify with more ground Increased input costs Current high cattle market Volatile overseas markets Potential exposure to more markets with more product available to sell Local market competition Environmental contaminants 5 Financial & Management Benchmark Benchmark Measure Green Yellow Red Tom & Jane Before Purchase Tom & Jane After Purchase Equity Position >65% 35-65% <35% 40% 31% Liquidity >50% 20-50% <20% 25% 10% Efficiency Ratio <70% 70-80% >80% 70% 63% Knows cost of Production By Enterprise Overall None Yes Overall Credit Score >700 650-700 <650 690 690 Risk Management All Components Some None Some Some Business Plan Written Verbalized None None None 6