Forrest Stegelin & Nathan Smith Agricultural & Applied Economics University of Georgia

Forrest Stegelin & Nathan Smith

Agricultural & Applied Economics

University of Georgia

National Farm Business Management Conference

June 10-13, 2013

Overland Park, Kansas

The aging (and retiring) of active farmers.

2007 Census of Agriculture – average age of farmers ~ 60

“You can take the man off the farm, but you can’t take the farmer out of the man.”

Wake up with depression over wanting to stay engaged and productive in earlier career endeavor of farming (at least have something to do), but without physical stress.

May still reside on farmstead and attend local extension meetings out of desperation to hang onto past and maintain networking relationships with rural peers.

“What can I (and my spouse) do for a practical agribusiness venture as an encore to farming?”

USDA’s Agricultural and Resource Management Survey

(ARMS) data – 15% of rural residents ages 50-64 operate nonfarm businesses, and 25% of rural residents with a farming background ages 65 and older operate nonfarm businesses in the rural counties.

These former-farmer operated nonfarm business contribute $55 billion value-added income to local communities’ gross county product – an economic engine, driver, and contributor to the county’s economy.

Half (53%) of the former farm-family owned and operated nonfarm agribusinesses are in service sector , including consulting.

A quarter (26%) of nonfarm businesses owned and operated by former farmers are in either manufacturing or processing, using farming resources to produce farmrelated value-added goods and services (including agritourism).

Balance (21%) are mostly in sales and marketing or distribution.

Task for CES is to take individual’s earlier career endeavor and experience, the knowledge and skills acquired, their maturity, strong finances, and wide network of professional contacts and associates to design, plan and start a small agribusiness venture.

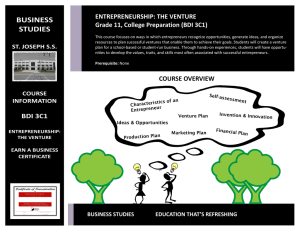

Four components to the encore entrepreneurship program:

Understanding what entrepreneurship is in today’s economic environment;

Discovering how to choose a business idea and turn an entrepreneurial idea into a business reality;

Defining and describing the components to forming a new business , including conducting a feasibility study, developing a flexible business plan, deciding on a business model, and preparing the financial and cash flow budgets;

Acquiring the resources to succeed in the new opportunity.

The extension education activity:

A 2-day (24 hour) workshop from noon to noon, commencing with a lunch to get acquainted.

Each session limited to 6 entrepreneurs (plus spouses or partners) to allow hands-on, one-on-one help from specialist.

Funded by local sponsorships (banks, agribusinesses, and other organizations or agencies).

Self-paced training exercises and self-assessment surveys and questionnaires or reflective inquiries.

An overnight homework assignment, and optional internet and reading resource materials provided.

Be clear about what you want to do and to accomplish.

What is the commitment to the encore entrepreneurship?

Assess readiness to start a business venture;

Identify what is wanted from the business;

Determine how much time can be dedicated to the venture;

Specify what financial resources available to devote to this opportunity.

Self-assessment exercises:

Holland Personality Types

Are You a Risk Taker?

Coping With Stress

Choose your business idea wisely.

Doing something good at and will enjoy is essential.

Must suit lifestyle, family support, and the pocketbook.

Now is not the time to reinvent the wheel, nor chase the latest and greatest craze nor the hottest trend or fad.

Most business ideas succeed because they serve an unfilled need in community or industry, or provide a solution to a problem encountered in earlier endeavor.

A situation of solving problems, satisfying needs, or providing solutions/answers with benefits .

Answer basic questions : What are you interested in? What skills or experiences or knowledge do you have to offer? How do you want your life to look from the outside of the business?

Can you see a gap or opportunity in the market?

Tools and techniques as to how to do positioning , how to conduct a customer demand analysis and a market analysis , how to develop an action plan to accomplish goals and objectives (and how to monitor progress) and contingency plans, and how to develop forecasts and prepare budgets .

Preparation of a multi-year marketing plan ; outline and sample plans provided for guidance.

Social media communications and developing web site as well as a meaningful logo and mission/vision/strategy statements .

Is there income (and profit) potential?

Emotional attachment to their own ideas.

A feasibility study requirement – understanding true and total costs of starting a business plus understanding its income potential plus accurately anticipating operating costs to see a realistic profit.

Doing something the individual likes, is good at, can use a technology or skill to an advantage, and requires low investment or ownership capital and encourages good cash flow management likelihood of success.

If opportunity is not feasible on paper in black and white, it is highly unlikely to be successful in reality.

Minor mental mistakes now lead to major money losses later.

Prepare a flexible business plan that steers the business.

A good business plan is simple, relevant, flexible, and manageable.

A good business plan helps steer or guide the business , but is not a recipe or prescription for success.

Preparation of a draft of a business plan is the overnight homework assignment.

Complete a management audit of the business plan to check on thoroughness and realism of the business plan – purpose, mission/vision, legal structure, goals and objectives, sales and marketing plan, financial plan, human resources or staffing plan (including organizational chart), budgets, and resources/data.

Get the legal and regulatory paperwork in order before the launch of the business.

Get the business registered with the appropriate authorities

Taxes

Permits and licenses

Zoning

Conducting commerce

Work certification and training

Labor or employment records

Legal business structure

Even home-based businesses need permits and licenses.

List of paperwork and costs will vary by location, jurisdiction, and function of business.

NAICS code needed to register with state and US governments.

Decide on a business model.

How to legally structure the business:

Proprietorship or partnership – personal liability

Limited liability company

Consult with tax accountant and an attorney.

Basic financial accounting , to know the effects of their management decisions on the formal financial statements.

Sensitivity analysis to “what-if…?” questions.

Remember: Minor mistakes = major money losses.

Additional resources are made available.

Online internet resources :

IBISWorld; Mintel; RMA; SBA; USDA; DOC; others

Additional reading references (available as paperback and less than 200 pages each):

Winnie-the-Pooh on Management; The Leadership Secrets of

Santa Claus; Be the Elephant; The One Thing You Need to

Know; Growing a Business; The Management Bible; Effective

Decision Making; Think Like a Manager

Marketing Outrageously; What No One Ever Tells You About

Marketing Your Own Business; The 4A’s of Marketing; Why

People Buy Things They Don’t Really Need; Why We Buy;

What Every Manager Needs to Know About Marketing

Social Media Marketing; Planning and Designing Effective

Web Sites

Thank you for your attention and interest.

Any questions or comments?

The Leadership Secrets of Santa Claus.

Build a Wonderful Workshop.

Make the mission the main thing.

Focus on your people as well as your purpose.

Let values be your guide.

Choose Your Reindeer Wisely .

Hire tough so you can manage easy.

Promote the right ones…for the right reasons.

Go for the diversity advantage.

Make a List and Check It Twice.

Plan your work.

Work your plan.

Make the most of what you have.

Listen to the Elves.

Open your ears to participation.

Pay attention to how you’re perceived.

Walk awhile in THEIR shoes.

Get Beyond the Red Wagons.

Help everyone get beyond the reality of change.

Remember: the customer is really in charge.

Teach “the business” of the business.

Share the Milk and Cookies.

Help them see the difference they make.

Do right by those who do right.

Expand the reinforcement possibilities.

Find Out Who’s Naughty and Nice.

Confront performance problems … early.

Coach ‘the majority in the middle.’

Don’t forget ‘the super stars.’

Be Good for Goodness Sake.

Set the example.

Establish guidelines and accountability.

Remember that everything counts.