Bank of Jamaica Quarterly Press Briefing Derick Latibeaudiere

advertisement

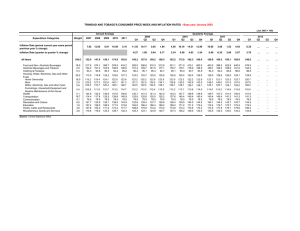

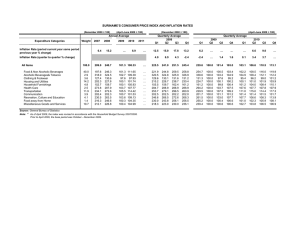

News Release 13 May 2004 Bank of Jamaica Quarterly Press Briefing Statement by Derick Latibeaudiere Governor Good Morning Ladies and Gentlemen: Inflation One of the greatest challenges to the economy, which was of concern to the central bank in the last fiscal year, was the interruption of seven consecutive fiscal years of single digit inflation, due largely to a bout of instability in the foreign exchange market plus increases in taxation, bus fares, and the minimum wage. Unfortunately, and even with a relatively speedy return to stability, it is always much harder to bring inflation back down once it has gone up. But the control of inflation is what a central bank is all about - it is our core mandate, it is what we are here for, and I am here to assure you that we are on the job. Inflation for the quarter ending June 2002 was 1.65 percent, and the figure for the same period in June 2003 climbed to 6.9 percent. I am now pleased to report that the expectation for inflation at the quarter ending June 2004 is 2.6 percent. On a monthly basis, inflation in June 2003 was 2.5 percent, relative to 0.86 percent for June 2002. The expectation for June 2004 is 1.1 percent. Against the background of sustained stability in the foreign exchange market, boosted by increased inflows as well as increased investor confidence, the return to lower levels of inflation is a trend that is expected to continue for the rest of the fiscal year. 1 While it is not expected to interrupt the overall downward trend in inflation, the present trend in global oil prices is a possible obstacle in terms of exactly how low we are able to push inflation during the course of this fiscal year. We continue to monitor this development, and as always, the central bank remains committed to fostering and sustaining a low inflation environment as much as existing circumstances will allow. Interest rates I turn to the matter of interest rates. The central bank has always maintained that it is committed to a low interest rate environment, in so far as prevailing economic conditions will allow. In recent months, those “prevailing economic conditions” have been characterized by increasing levels of investor confidence, boosted by improvements in the fiscal position and strong foreign exchange inflows. This confidence has been manifested in sustained stability in the foreign exchange market despite the presence of high levels of Jamaica Dollar liquidity. The increase in investor confidence has also expressed itself in a willingness to hold Jamaica Dollar assets at lower interest rates, by some appreciation of the local currency, and by increased activity in the stock market. The stability in the foreign exchange market has been reinforced by the healthy state of the Net International Reserves, which, at current levels in the region of US$1.7 billion, is the highest it has been since March 2002. In this context, and in keeping with its expressed commitment to lower interest rates, the central bank has already cut interest rates nine times since the start of this calendar year, and fifteen times since March 2003. Further rate adjustments will be forthcoming as prevailing market conditions dictate. Review of Economic Developments in the March 2004 Quarter I will now review some of the major developments of the previous quarter. The quarter just ended was characterized by a general improvement in the macroeconomic environment. This improvement included growth in the economy, a reduction in the quarterly inflation to less than 2.0 per cent, stability in the financial markets and the attainment of the fiscal target. 2 Core inflation for the quarter was estimated at 1.1 per cent, representing a decrease relative to the 2.2 per cent recorded in the previous quarter. The level of core inflation in the review quarter is consistent with the Central Bank’s medium-term objective of underlying inflation of approximately 4.0 per cent per year. The economy is estimated to have grown in the range of 2.1 per cent to 2.3 per cent for the fiscal year 2003/04, with growth in all sectors except agriculture, and boosted largely by significant growth in mining and tourism. Recent Developments and Outlook Looking forward, challenges remain, and the fact that the Jamaican economy is small and open means that there is always the need to be prudent in how we manage our affairs, and to be mindful of trends in the international economy that can affect us. However with all this in mind, the Bank remains cautiously optimistic that the positive macroeconomic performance in the March quarter will continue into Financial Year 2004/05. As long as the fiscal position continues to improve and stability persists in the financial markets, the economic outlook for the fiscal year is for lower inflation, lower interest rates, and a continuation of economic growth. Continued stability in the financial markets is predicated on expectations of adequate foreign exchange flows and the continued efficient management of liquidity in the domestic market. Growth in the domestic economy is being projected in the context of stronger growth in the world economy, which is expected to stimulate demand for exports such as tourism and bauxite/alumina. In addition, the present level of investor confidence augers well for the continuation of investment flows. Growth in the mining sector is predicated on the increasing demand for aluminium in a context of the expansion in capacity in the industry, while growth in tourist arrivals in the quarter could be in excess of 10.0 per cent. In fact, data from the Jamaica Tourist Board indicates that airport arrivals in April were approximately 18.0 per cent above those for April 2003. With the positive developments in the economy, the focus of monetary policy at this time will continue to be the lowering of interest rates and moderation of inflationary expectations. Thank you. 3